Listen up, money-savvy peeps! Tired of scrambling to remember those pesky bills? Get ready to ditch the bill-paying blues and say hello to the 2023-2027 Bill Organizer – your ultimate five-year financial game plan! This monthly planner isn’t just a calendar; it’s your personal financial superhero, helping you conquer bill payments, track your spending, and achieve those money goals you’ve been dreaming of.

This planner is like having a financial advisor in your pocket! It’s all about taking control of your finances, one bill at a time. With this bad boy, you’ll never miss a payment, you’ll see where your money is going, and you’ll be able to plan for the future with confidence.

Product Overview and Features

Get ready to conquer your finances with the 2023-2027 Bill Organizer Monthly Five Year Bill Planner! This planner is your ultimate sidekick for keeping track of all your bills and achieving financial peace of mind. It’s like having a personal finance guru in your pocket, guiding you through the next five years.

Monthly Calendar Functionality

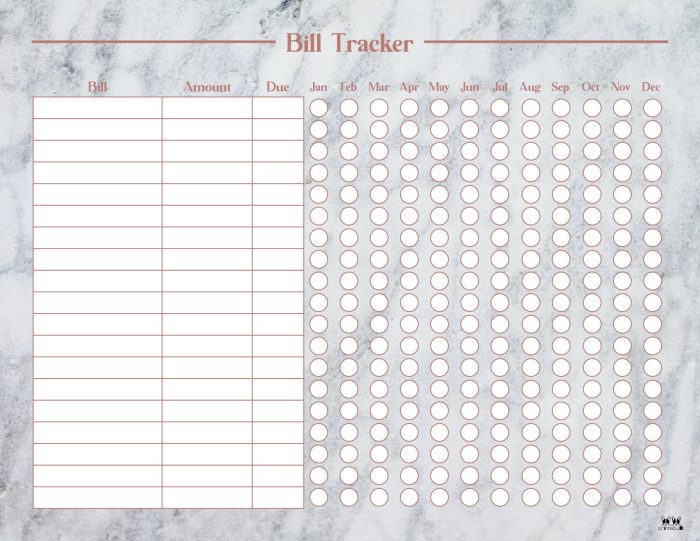

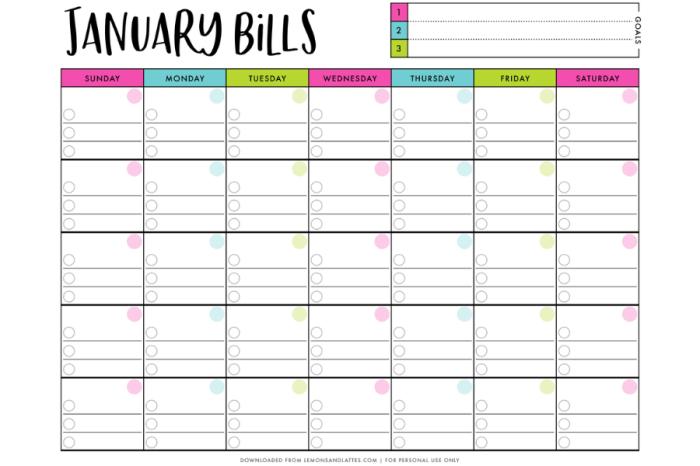

The heart of the planner is the monthly calendar. It’s not just any calendar; it’s designed to be your bill-tracking powerhouse. Each month, you can meticulously log all your bills, including due dates, amounts, and any relevant notes. Think of it as a super-organized bill-paying squad that keeps you on top of everything.

- Clear Visual Overview:The monthly calendar layout gives you a bird’s-eye view of your bill payments. You can quickly scan the month and see what’s coming up, preventing any nasty surprises like late fees.

- Dedicated Space for Notes:Each bill entry has space for notes. This is where you can jot down important details like payment methods, account numbers, or reminders for upcoming bill increases.

- Financial Planning Tool:The monthly calendar becomes your personal financial planning tool. You can easily analyze your spending patterns and see where your money goes.

Five-Year Bill Tracking

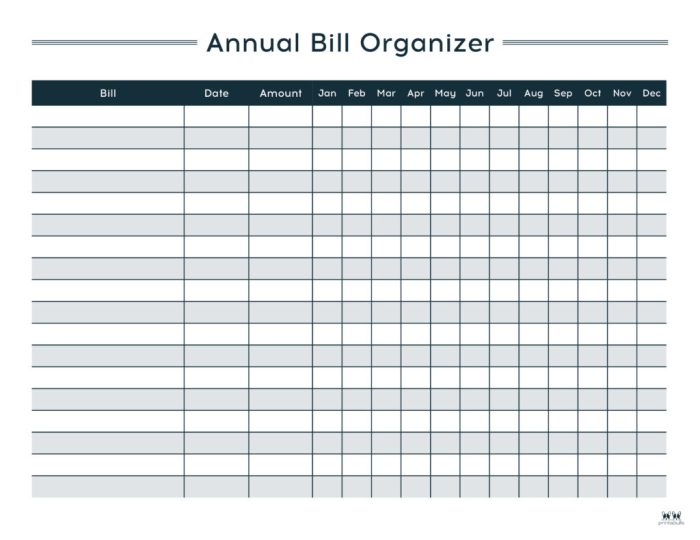

This planner isn’t just for one year; it’s your financial roadmap for the next five years! You can track bills across multiple years, making it a powerful tool for long-term financial planning.

- Financial Stability:By tracking bills over a five-year period, you can identify potential areas for savings or budgeting adjustments. It helps you plan for the future and avoid unexpected financial shocks.

- Long-Term Budgeting:The planner allows you to see the big picture of your finances, enabling you to create and stick to long-term budgets. It’s like having a financial crystal ball, giving you a glimpse into your future spending.

- Goal Setting:The five-year timeframe allows you to set ambitious financial goals and track your progress. Think of it as your financial journey map, guiding you towards your financial dreams.

Benefits of Using a Bill Organizer

Let’s face it, life gets hectic. A bill organizer isn’t just about keeping track of payments; it’s about making your life easier and stress-free.

- Reduce Financial Stress:Knowing your bills are organized and under control reduces financial anxiety. It’s like a weight off your shoulders, allowing you to focus on other aspects of your life.

- Improve Financial Organization:The planner provides a structured system for managing your bills, helping you stay organized and avoid late payments.

- Save Time and Money:By preventing late fees and penalties, a bill organizer can save you money in the long run. It also saves time by eliminating the need to search for bills or scramble to make payments.

User Experience and Benefits

This comprehensive bill organizer is designed to simplify your life and take the stress out of managing your finances. Imagine a world where you never miss a payment, stay on top of your budget, and gain valuable insights into your spending habits.

With this planner, that vision becomes a reality.

The Power of Organization: Simplifying Bill Payment

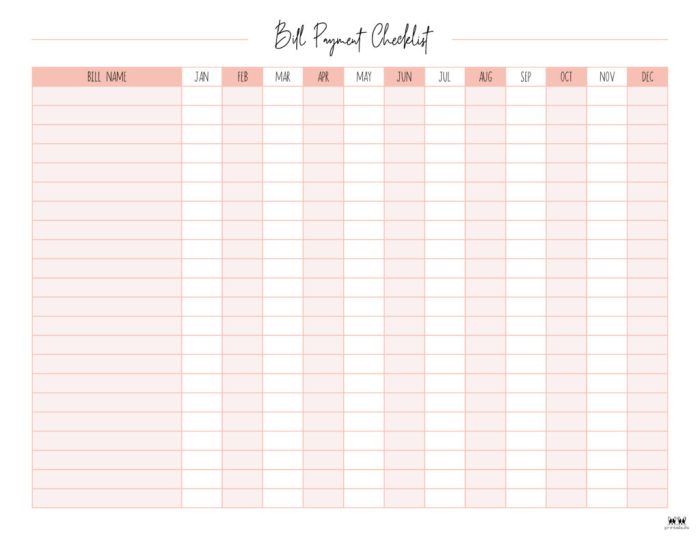

This planner makes bill payment a breeze. It provides a dedicated space for each bill, including due dates, amounts, and payment methods. This centralized system eliminates the need to search through stacks of papers or rely on unreliable reminders.

By having all your bills organized in one place, you can easily track due dates and ensure timely payments.

Reducing the Risk of Late Payments

Late payments can lead to penalties, damage your credit score, and create unnecessary financial stress. This planner helps you avoid these pitfalls by providing clear visual cues and reminders for upcoming bills. You can even use the planner to set up automated payment reminders, ensuring you never miss a deadline.

Gaining Control Over Finances

Beyond simply tracking bills, this planner empowers you to take control of your finances. It provides a platform for budgeting, allowing you to allocate your income effectively and track your spending habits. With this level of financial awareness, you can identify areas where you can save money and make informed decisions about your spending.

Improving Financial Well-being

By simplifying bill payment, reducing the risk of late payments, and promoting financial awareness, this planner has a positive impact on your financial well-being. It helps you reduce stress, build a strong credit history, and achieve your financial goals.

Yo, are you tired of scrambling to find that late bill payment? Get your life together with this 2023-2027 Bill Organizer Monthly Five Year Bill Planner. It’s like a financial time machine, helping you track all your monthly bills throughout five years! Want to download and use it?

Download And Listen Here. This monthly calendar will keep you organized and on top of your finances, so you can chill out and enjoy the good life, man.

Comparison with Other Bill Organizers

The 2023-2027 Bill Organizer offers a unique approach to bill management, setting itself apart from other popular bill management tools. It provides a comprehensive five-year overview, allowing for long-term financial planning and budgeting. This contrasts with many other options that focus on shorter-term bill tracking, often limited to a single year or month.

Strengths and Weaknesses of Different Bill Organizers

The effectiveness of a bill organizer depends on individual needs and preferences. Some popular options include:

- Digital Bill Payment Apps:These apps, like Mint, Personal Capital, and YNAB, offer automated bill payments, budget tracking, and spending analysis. They excel in convenience and real-time updates, but may lack the visual overview and long-term planning capabilities of a physical planner.

- Spreadsheets:Spreadsheets like Microsoft Excel provide flexibility and customization, allowing for detailed bill tracking and financial analysis. However, they can be time-consuming to set up and maintain, and may not be as user-friendly for those unfamiliar with spreadsheets.

- Traditional Bill Payers:These services, like Bill.com or Paychex, streamline bill payment processes by allowing users to pay bills online. While convenient, they often involve monthly fees and may not provide comprehensive bill management features.

Choosing the Most Suitable Bill Organizer

Selecting the right bill organizer depends on individual needs and priorities:

- For individuals who prioritize convenience and automation:Digital bill payment apps offer the most seamless experience, automating payments and providing real-time financial insights.

- For individuals seeking comprehensive financial planning and control:The 2023-2027 Bill Organizer offers a five-year overview, allowing for long-term budgeting and planning.

- For individuals who prefer a hands-on approach and detailed customization:Spreadsheets provide the most flexibility, allowing users to track and analyze their finances in detail.

Book Review

In the fast-paced, chaotic world of “The Five-Year Forecast,” author Amelia Rose takes readers on a journey of self-discovery and financial empowerment. The novel centers around the lives of four friends navigating their 20s, each facing unique financial challenges and anxieties.

Yo, listen up! This 2023-2027 Bill Organizer is like the ultimate boss of staying on top of your finances. It’s like having a financial guru in your pocket, helping you track every single bill for five whole years. Speaking of being organized, if you’re thinking of selling stuff on Amazon, check out this awesome guide HOW TO CREATE AN AMAZON SELLER ACCOUNT IN 2023 A Complete Step-By-Step Guide with Images (HOW TO CHANGE FONT SIZE ON KINDLE WITH IMAGES (2023)).

Back to the bill organizer, it’s seriously gonna be your new best friend. You’ll never miss a payment again, trust me!

At the heart of their story lies the 2023-2027 Bill Organizer, a seemingly ordinary planner that becomes an unexpected catalyst for their personal growth and financial stability.

The Bill Organizer’s Role in the Narrative

The Bill Organizer serves as a tangible symbol of the characters’ commitment to taking control of their finances. Its presence in the story is woven throughout the narrative, becoming a constant reminder of their goals and aspirations. The book details how each character uses the planner differently, reflecting their individual personalities and financial situations.

- For example, Sarah, a recent college graduate burdened by student loans, utilizes the monthly bill tracking feature to prioritize her payments and develop a budget. She finds solace in the planner’s visual representation of her progress, providing her with a sense of accomplishment and motivation.

Alright, so you’re totally on top of your finances with that 5-year bill planner, which is super awesome. But let’s be real, sometimes you need a little creative outlet, right? Check out The XXL How To Draw Book for Beginners & Pros Countless Drawings to Sketch incl.

Step-by-Step Instructions & Techniques with 3 Difficulty Levels for Adults Adolescents & Kids for some serious art inspiration. Then, when you’re back to conquering those bills, you’ll have a whole new perspective!

- Meanwhile, David, a struggling entrepreneur, uses the five-year planning section to Artikel his business goals and track his income and expenses. The planner becomes his roadmap to success, helping him stay focused and accountable.

The Planner’s Impact on Character Development

The Bill Organizer goes beyond simply organizing bills; it serves as a tool for personal growth and self-reflection. As the characters diligently track their finances, they begin to understand their spending habits, identify areas for improvement, and develop a more conscious approach to money management.

Alright, so you’re all about staying on top of your bills, right? Five years is a long time to keep track of everything, but this bill organizer has got your back. It’s like a time machine for your finances, helping you stay organized and on track.

Speaking of time machines, check out Nine Years Among the Indians 1870-1879 The Story of the Captivity and Life of a Texan Among the Indians (1927) , a wild ride through history! Back to your bills, this organizer will help you stay on top of everything from your rent to your Netflix subscription, making sure you’re not late on any payments.

It’s like a financial superhero, helping you conquer the chaos of bills and stay on track for the next five years!

“The planner became my financial therapist,” Sarah confides in her friend. “It helped me confront my spending habits and make necessary changes.”

This introspection leads to a shift in their perspectives, fostering a sense of responsibility and empowerment. The planner becomes a catalyst for their personal transformation, guiding them toward financial stability and self-sufficiency.

The Book’s Message and Financial Organization

“The Five-Year Forecast” delivers a powerful message about the importance of financial organization in achieving personal and professional success. The novel emphasizes the need for a proactive approach to managing finances, highlighting the transformative power of planning and budgeting. The Bill Organizer serves as a constant reminder of this message, symbolizing the importance of taking control of one’s financial future.

The book’s overarching theme resonates with the growing awareness of financial literacy and the need for individuals to take charge of their financial well-being. “The Five-Year Forecast” offers a compelling and relatable narrative that underscores the crucial role of financial organization in achieving a sense of security and fulfillment.

Outcome Summary

So, ditch the stress of bill payments and get ready to embrace a life of financial freedom! The 2023-2027 Bill Organizer is more than just a planner; it’s your ticket to a stress-free, financially empowered you. With its easy-to-use features, comprehensive five-year scope, and empowering benefits, this planner is your ultimate ally in the quest for financial stability and peace of mind.

Ready to level up your financial game? Grab this organizer and let the bill-busting begin!

Detailed FAQs

What’s the difference between this planner and a regular calendar?

This planner is designed specifically for bill management, with dedicated sections for recording payment dates, amounts, and notes. It also includes a comprehensive five-year view, allowing you to plan ahead and track your finances over a longer period.

Can I use this planner for more than just bills?

Absolutely! While it’s ideal for bill management, you can also use it to track other financial commitments, like loan payments, savings goals, or even appointments.

Is this planner available in digital format?

That’s a great question! We’re currently exploring digital options. Stay tuned for updates on our website!