Yo, let’s talk about money. Not the boring, spreadsheet kind. We’re talking about real, tangible wealth, the kind that lets you live life on your own terms. You know, the kind where you’re not stressing over bills, you’re actually crushing your goals, and you’ve got the freedom to do what you love.

That’s what we’re about to unlock, and it all starts with 25 seriously smart strategies to cut costs, boost your cash flow, and build your financial empire. Think of it as your ultimate guide to winning the money game, because let’s be real, financial freedom is the ultimate power move.

This isn’t just some generic “save money” advice. We’re diving deep into the nitty-gritty, from analyzing your spending habits to finding those hidden cash flow leaks. We’ll cover everything from scoring killer deals on groceries to side hustles that actually make you money.

Get ready to unleash your inner financial guru, because you’re about to learn how to turn your cash flow into a money-making machine.

Understanding Your Spending Habits

You can’t manage what you don’t measure, right? That’s why understanding your spending habits is the first step to taking control of your finances. By tracking your expenses, you can identify areas where you’re overspending and find opportunities to cut back.

Tracking Your Expenses

Tracking your expenses can seem daunting, but it’s actually pretty straightforward. You can use a budgeting app, a spreadsheet, or even a simple notebook to record every dollar you spend. The key is to be consistent and thorough.

Yo, “25 Strategies to Cut Costs and Unlock Your Cashflow Your Way to Wealth and Prosperity” sounds like the ultimate hustle guide, right? But remember, just like Dorian Gray traded his soul for eternal youth, sometimes the shortcuts to success can come with a hefty price.

Check out The Picture of Dorian Gray for a cautionary tale about the dark side of chasing your dreams. In the end, it’s about finding that sweet spot between ambition and integrity, and “25 Strategies” might just be the roadmap to get you there.

- Categorize Your Spending:Once you’ve tracked your expenses for a few weeks or months, you can start to categorize them. This will help you see where your money is going. Common expense categories include housing, transportation, food, entertainment, and personal care.

- Analyze Your Spending Patterns:After categorizing your spending, you can analyze your spending patterns to identify areas for improvement. For example, you might find that you’re spending too much on eating out or that you’re not taking advantage of discounts on groceries.

Creating a Detailed Budget

A budget is a plan for how you’re going to spend your money. It helps you stay on track with your financial goals and avoid overspending.

- Start with Your Income:The first step to creating a budget is to determine your income. This includes your salary, any other income sources, and any regular payments you receive.

- List Your Expenses:Next, list all of your expenses, including fixed expenses like rent or mortgage payments and variable expenses like groceries or entertainment.

- Track Your Spending:Once you have a budget, it’s important to track your spending to make sure you’re sticking to it. You can use the same methods you used to track your expenses before.

Monitoring Spending Patterns

Monitoring your spending patterns over time can help you identify trends and areas where you can make adjustments.

- Use Budgeting Apps:Budgeting apps can make it easier to track your spending and identify areas where you can cut back. They can also help you set financial goals and monitor your progress.

- Review Your Budget Regularly:It’s important to review your budget regularly, at least once a month, to make sure you’re still on track. You may need to adjust your budget as your income or expenses change.

Cutting Costs in Everyday Life

Now that you’ve got a handle on your spending habits, it’s time to dive into the nitty-gritty of cutting costs. Think of it like this: you’re on a mission to become a master of your money, and that means getting the most out of every dollar.

We’re talking about finding ways to trim the fat without sacrificing your quality of life. We’ll cover strategies for housing, utilities, transportation, and groceries, and show you how to become a pro at negotiating, finding discounts, and maximizing savings on everyday purchases.

Yo, wanna know how to level up your finances and get that sweet, sweet cash flowing? “25 Strategies to Cut Costs and Unlock Your Cashflow Your Way to Wealth and Prosperity” is like the ultimate cheat code for your money game.

And, if you’re looking to manage your resources like a boss, check out the Domain 6 Management MARKENDIUM SMPS Body of Knowledge. It’s like the playbook for maximizing your potential, whether you’re running a business or just trying to make ends meet.

So, get your game face on and let’s unlock that financial freedom!

Negotiating Bills

Don’t just accept the first bill you get! Many companies are willing to negotiate lower rates, especially if you’re a loyal customer or willing to switch providers. Here’s how to become a bill-negotiating ninja:

- Call and ask for a lower rate.Be polite and explain that you’re looking for a better deal. Many companies have retention departments specifically for this purpose. You might be surprised at what they’re willing to offer.

- Threaten to switch providers.If you’re not getting the deal you want, let them know you’re considering switching. This can be a powerful motivator for them to give you a better rate.

- Bundle your services.Many companies offer discounts when you bundle multiple services, such as internet, phone, and cable. This can save you a significant amount of money in the long run.

Finding Discounts

Who doesn’t love a good deal? The world of discounts is your oyster, and there are tons of ways to score amazing savings on everyday purchases. Here are some tips to help you become a discount-hunting champion:

- Sign up for loyalty programs.Many stores and brands offer loyalty programs that give you points, discounts, and exclusive offers. It’s like getting paid to shop!

- Use coupon apps.Apps like Ibotta and Checkout 51 let you earn cash back on groceries and other purchases. Just scan your receipts and boom – instant savings!

- Look for clearance sales.Stores often mark down items that are about to expire or go out of season. This is a great way to score amazing deals on everything from clothes to home goods.

- Shop online for deals.Websites like Groupon and LivingSocial offer deep discounts on everything from restaurants to activities. It’s like having a personal deal finder at your fingertips.

Maximizing Savings on Everyday Purchases

Even the smallest changes can add up to big savings over time. Here are some tips to help you maximize your savings on everyday purchases:

- Buy generic brands.Generic brands often offer the same quality as name brands at a fraction of the price. You’ll be surprised how much you can save by making this simple switch.

- Cook at home more often.Eating out can be expensive, so try to cook at home more often. This is a great way to save money and control your portion sizes.

- Bring your own lunch.Pack your own lunch instead of buying it every day. This can save you hundreds of dollars per year.

- Shop around for the best deals.Don’t just settle for the first price you see. Take the time to compare prices and find the best deals. You might be surprised at the savings you can find.

Cutting Costs on Housing

Your housing costs are probably one of your biggest expenses, so it’s important to find ways to save money in this area. Here are some tips for reducing your housing costs:

- Downsize your living space.If you’re living in a large home that you don’t need, consider downsizing to a smaller, more affordable space. This can free up cash flow and allow you to invest in other areas of your life.

- Become a roommate.If you’re living alone, consider finding a roommate to share the cost of rent and utilities. This can be a great way to save money and make new friends.

- Negotiate your rent.Just like you can negotiate your bills, you can also negotiate your rent. If you’re a good tenant with a good payment history, your landlord might be willing to work with you on a lower rate.

- Shop around for insurance.Compare insurance quotes from different providers to see if you can get a better rate. You might be surprised at the savings you can find.

Cutting Costs on Utilities

Utilities can be a major expense, but there are plenty of ways to cut back. Here are some tips for saving money on your utility bills:

- Turn off lights when you leave a room.This simple habit can make a big difference in your energy consumption and your electric bill.

- Unplug electronics when not in use.Even when electronics are turned off, they can still draw power. Unplugging them when you’re not using them can save you money on your electricity bill.

- Lower your thermostat in the winter and raise it in the summer.This can save you money on your heating and cooling costs. Try to set your thermostat a few degrees lower in the winter and a few degrees higher in the summer.

- Install a programmable thermostat.Programmable thermostats can automatically adjust your temperature settings to save energy and money.

- Take shorter showers.Showers account for a significant portion of your water usage. Try to take shorter showers to save water and money on your water bill.

- Wash clothes in cold water.Most clothes can be washed in cold water, which saves energy and money on your water bill.

- Air dry your clothes.If you have a clothesline or drying rack, air drying your clothes can save you money on your electricity bill.

Cutting Costs on Transportation

Transportation costs can add up quickly, but there are ways to save money in this area. Here are some tips for reducing your transportation costs:

- Walk or bike more often.If you live close to work or school, consider walking or biking instead of driving. This is a great way to get exercise and save money on gas and parking.

- Use public transportation.Public transportation can be a cheaper alternative to driving, especially if you live in a city with a good public transportation system.

- Carpool.If you have to drive, consider carpooling with coworkers or friends. This can save you money on gas and parking.

- Shop around for car insurance.Compare quotes from different car insurance providers to see if you can get a better rate.

- Get regular car maintenance.Keeping your car in good condition can help you save money on gas and repairs in the long run.

Cutting Costs on Groceries

Groceries are a major expense, but there are ways to save money on your food bill. Here are some tips for reducing your grocery costs:

- Plan your meals.Planning your meals ahead of time can help you avoid impulse purchases and make sure you’re only buying what you need.

- Make a grocery list.Sticking to a grocery list can help you avoid buying unnecessary items and save money.

- Shop around for the best deals.Compare prices at different grocery stores to find the best deals on the items you need.

- Buy in bulk.If you have the space to store it, buying in bulk can often save you money per unit. Just make sure you’ll use everything before it expires.

- Use coupons.Many grocery stores offer coupons, both online and in print. Take advantage of these coupons to save money on your groceries.

- Cook at home more often.Eating out can be expensive, so try to cook at home more often. This is a great way to save money and control your portion sizes.

- Grow your own food.If you have a garden, consider growing your own fruits and vegetables. This can be a great way to save money on groceries and get fresh, healthy produce.

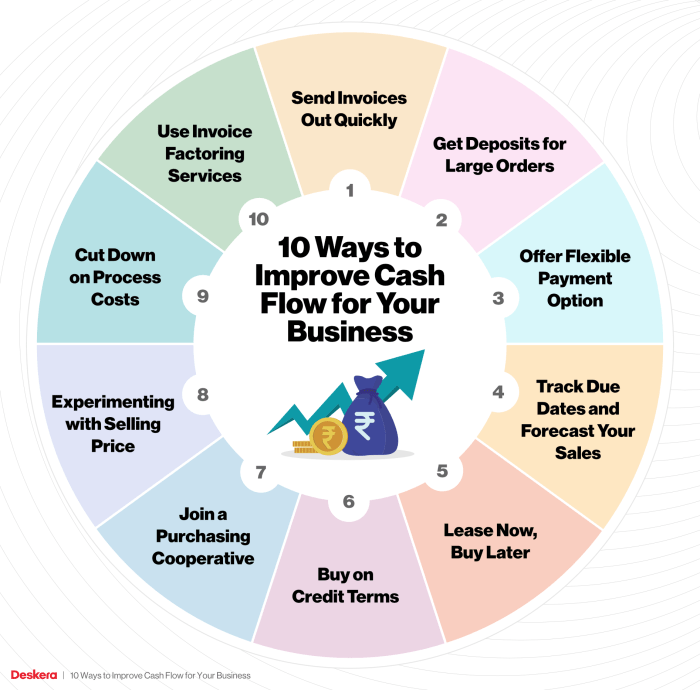

Unlocking Your Cash Flow for Growth

Imagine a financial river flowing freely, bringing in more than it takes out. That’s the power of positive cash flow. It’s the lifeblood of financial well-being, allowing you to achieve your financial goals and live a life of abundance.

Understanding Cash Flow

Cash flow is the movement of money into and out of your accounts. It’s the difference between your income and expenses. Positive cash flow means you have more money coming in than going out, allowing you to save, invest, and build wealth.

Negative cash flow means you’re spending more than you earn, leading to debt and financial stress.

Yo, wanna unlock your inner money guru and level up your financial game? “25 Strategies to Cut Costs and Unlock Your Cashflow Your Way to Wealth and Prosperity” is your ultimate guide to becoming a financial boss. But hey, sometimes the best way to make a big change is to start small, like with a daily writing habit.

Check out this awesome article, ” 100-Word Writing Habit A Small Action With Big Results (Short Read) “, it’s all about how a little bit of writing can make a big difference in your life. Once you’ve mastered your money moves and your writing game, you’ll be unstoppable!

Increasing Your Income

Boosting your income is a key strategy for improving your cash flow. Here are some effective ways to do so:

- Explore Side Hustles:Turn your passions or skills into a side income. Think about offering services like freelance writing, graphic design, or virtual assistance. You can also explore opportunities in online marketplaces, delivery services, or teaching.

- Freelancing:Offer your expertise to businesses or individuals on platforms like Upwork, Fiverr, or Guru. This can be a flexible way to earn extra income on your own terms.

- Investing:Investing your money can generate passive income. Consider options like stocks, bonds, real estate, or peer-to-peer lending. It’s important to research and understand the risks involved before investing.

Automating Savings and Investing

Automating your savings and investments is a powerful way to build wealth over time.

- Set Up Automatic Transfers:Schedule regular transfers from your checking account to your savings or investment accounts. This ensures you’re consistently saving and investing, even when you’re busy.

- Invest Regularly:Consider dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals. This helps to reduce the impact of market volatility and can lead to long-term growth.

- Take Advantage of Employer-Sponsored Retirement Plans:If your employer offers a 401(k) or similar plan, contribute as much as you can, especially if your employer offers a matching contribution. This is free money that can significantly boost your retirement savings.

Book Review: “The Total Money Makeover” by Dave Ramsey

Dave Ramsey’s “The Total Money Makeover” is a financial self-help classic that has helped millions of people take control of their finances and achieve financial freedom. Ramsey’s approach is based on a simple but powerful philosophy: get out of debt, build an emergency fund, and then invest for the future.

Yo, wanna ditch the broke life and stack some serious cash? “25 Strategies to Cut Costs and Unlock Your Cashflow Your Way to Wealth and Prosperity” is your ultimate cheat sheet to financial freedom. Download And Listen Here to unlock the secrets of budgeting, saving, and investing like a pro.

This ain’t your grandma’s finance advice – it’s real talk, real strategies for real results.

Dave Ramsey’s Financial Philosophy

The book emphasizes the importance of a disciplined approach to personal finance, focusing on eliminating debt and building a solid financial foundation. Ramsey advocates for a “snowball” method of debt repayment, where you focus on paying off your smallest debts first, regardless of interest rate.

This creates momentum and provides a sense of accomplishment, motivating you to keep going.

Debt Management: The “Baby Steps” Approach

Ramsey’s “Baby Steps” program is a step-by-step plan for achieving financial freedom. The steps are:

- Save $1,000 for an emergency fund.This creates a safety net for unexpected expenses and helps you avoid taking on more debt.

- Pay off all debt (except the house) using the snowball method.This involves listing all your debts from smallest to largest and paying off the smallest debt first, then using the money you were paying on that debt to pay off the next smallest debt, and so on.

- Save 3-6 months of living expenses in an emergency fund.This provides a more substantial buffer for unforeseen circumstances.

- Invest 15% of your household income in retirement.This ensures you’re saving for your future and building wealth over time.

- Save for your children’s college.Ramsey encourages parents to prioritize their own financial well-being before saving for their children’s education.

- Pay off your home mortgage.This eliminates a major financial burden and allows you to enjoy the freedom of being debt-free.

- Build wealth and give generously.Once you’ve achieved financial freedom, you can focus on growing your wealth and giving back to others.

Budgeting and Building Wealth

Ramsey’s budgeting approach is based on the “envelope system,” where you allocate a specific amount of cash to each category of spending each month. This method promotes mindful spending and helps you stay on track with your budget. Ramsey emphasizes the importance of saving and investing, encouraging readers to invest in low-cost index funds or mutual funds for long-term growth.

Effectiveness of Ramsey’s Methods

Ramsey’s methods have been criticized for their emphasis on debt-free living and their avoidance of certain financial instruments, such as credit cards and certain types of investments. However, his approach has been proven effective for many people, especially those who struggle with debt and lack financial discipline.

The “Baby Steps” program provides a clear roadmap for achieving financial freedom, and the focus on debt elimination and saving can help individuals build a solid financial foundation.

Epilogue

So there you have it – 25 strategies that are gonna transform your financial game. You’ve got the power to take control of your money and make it work for you. Don’t just sit there, get out there and start building that wealth! It’s time to level up your financial game, and with these tips, you’re gonna be rocking your own personal financial empire in no time.

Clarifying Questions

What if I’m already good at budgeting? Why should I read this?

Even if you’re a budgeting pro, there’s always something new to learn! This guide is about more than just budgeting – it’s about unlocking your financial potential and creating a life you love. Think of it as a refresh, a boost, and a whole lot of inspiration.

I’m scared to start investing. What if I lose money?

Investing can be a bit scary, but it’s also essential for building long-term wealth. Start small, learn the ropes, and don’t be afraid to seek advice from a financial professional. Remember, Rome wasn’t built in a day, and neither is a financial empire.

How do I know which side hustle is right for me?

That’s where your passions and skills come in! Think about what you enjoy doing and what you’re good at. Could you turn a hobby into a side hustle? Are you a tech wiz? Maybe you’re a creative genius?

Once you know your strengths, the right side hustle will become clear.