Tired of feeling like you’re stuck in a financial rut? Debt got you feeling like you’re playing a game you can’t win? Well, it’s time to flip the script and turn your money woes into a fun, winning game! This ain’t your grandma’s budgeting – we’re talking about money games that make getting out of debt a total blast.

Think of it as a financial quest where every step you take gets you closer to freedom and achieving your money goals.

Forget boring spreadsheets and complicated formulas. We’re diving into the world of gamification, where strategies become quests, savings become power-ups, and reaching your financial goals becomes a super satisfying victory. Ready to unlock your inner financial champion? Let’s get this game started!

The Power of Play

You know that feeling of getting sucked into a video game and losing track of time? That’s the magic of gamification! It’s the same principle we can use to make managing our money more fun and engaging. Gamification takes the boring stuff, like budgeting and debt repayment, and turns it into a thrilling quest to achieve financial freedom.

Examples of Money Games

Gamification isn’t just a buzzword; it’s a proven strategy for achieving financial goals. Many apps and websites have incorporated game mechanics to motivate users and make saving and debt reduction more enjoyable.

- Mint:This popular budgeting app lets you set financial goals and track your progress with visual charts and graphs. It’s like a real-time scoreboard for your financial journey.

- Ynab:This app focuses on budgeting and helps you allocate your money to different categories. The interface is designed to be intuitive and user-friendly, making it feel like a game you want to play.

- Level Money:This app uses AI to analyze your spending habits and recommends adjustments to reach your goals. It’s like having a personal financial coach guiding you every step of the way.

Unlocking Debt Freedom

Remember those childhood board games that turned financial literacy into a fun, engaging experience? Now, imagine applying those same principles to tackle your debt and achieve your financial goals! Debt freedom can be achieved by transforming your financial journey into a game.

Let’s explore how to make money management fun and effective, transforming your financial struggles into a victory lap.

Popular Money Games for Debt Reduction

Several money games have gained popularity for their effectiveness in tackling debt. These games offer a structured approach to budgeting, saving, and debt reduction, making the process less daunting and more motivating.

- Debt Snowball: This method focuses on paying off the smallest debts first, building momentum and creating a sense of accomplishment. As each smaller debt is eliminated, the payment amount is rolled over to the next smallest debt, creating a snowball effect.

This method can be particularly motivating for individuals who feel overwhelmed by the sheer number of debts they have.

- Debt Avalanche: This method prioritizes paying off the debts with the highest interest rates first, minimizing the total amount of interest paid over time. This strategy is more mathematically efficient, but it can be less motivating initially as the larger debts may take longer to pay off.

The payoff can be significant, though, as you minimize the interest you pay on the most expensive debts.

A Simple Money Game for Financial Literacy

Playing a simple money game with friends or family can be a fun and educational way to learn about financial concepts. Here’s a simple game you can try:

Financial Freedom Race

Objective:The first player to reach the “Financial Freedom” finish line wins.

Materials:

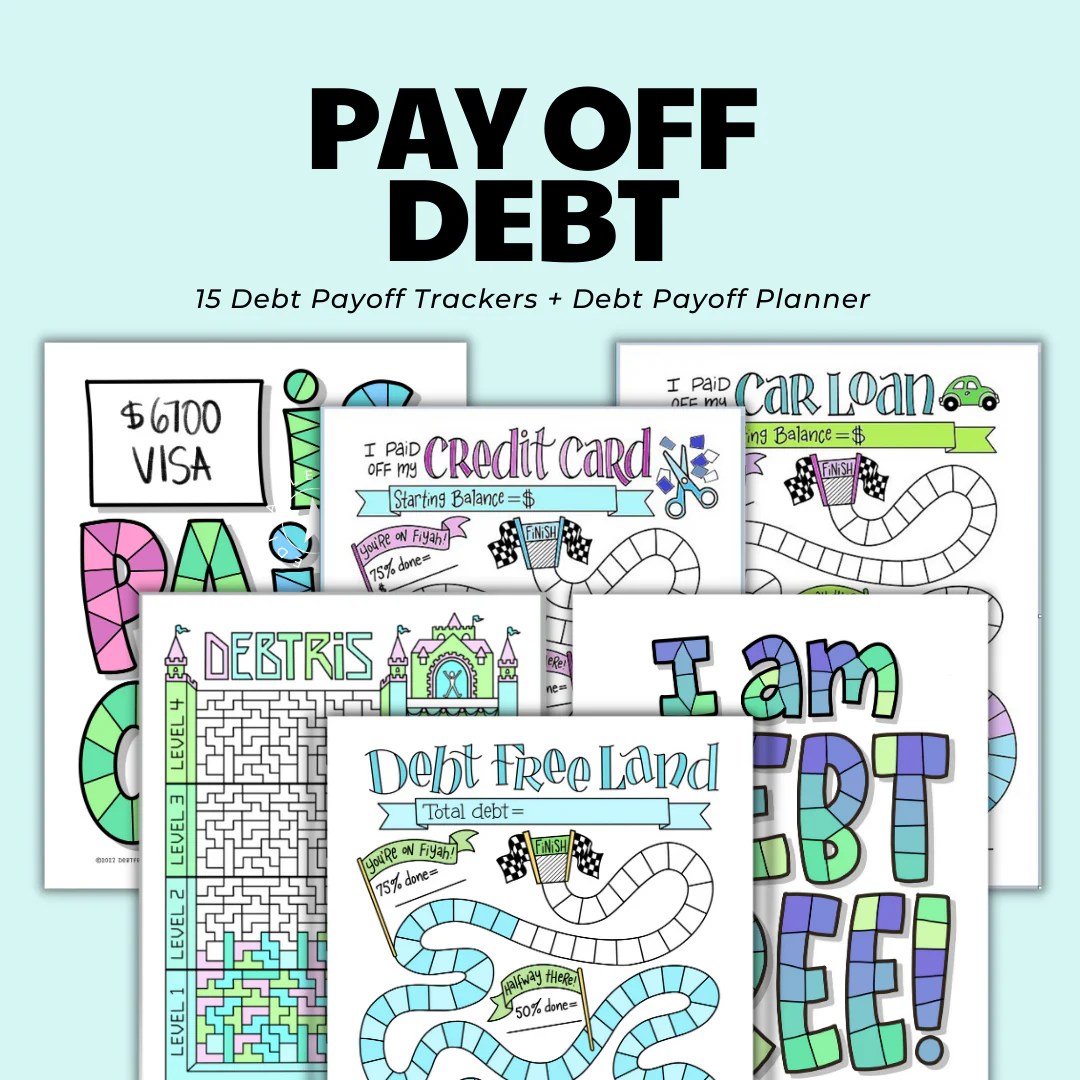

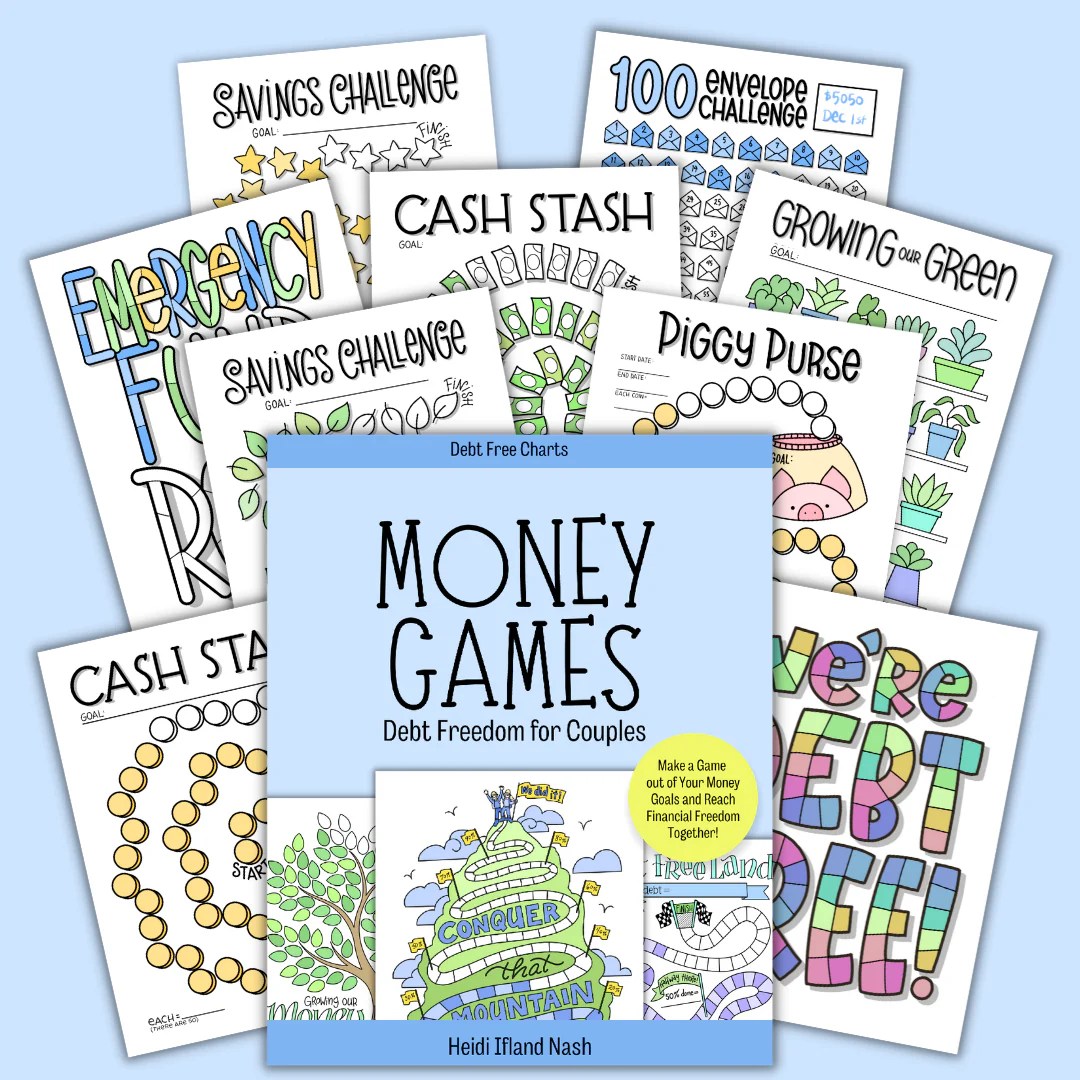

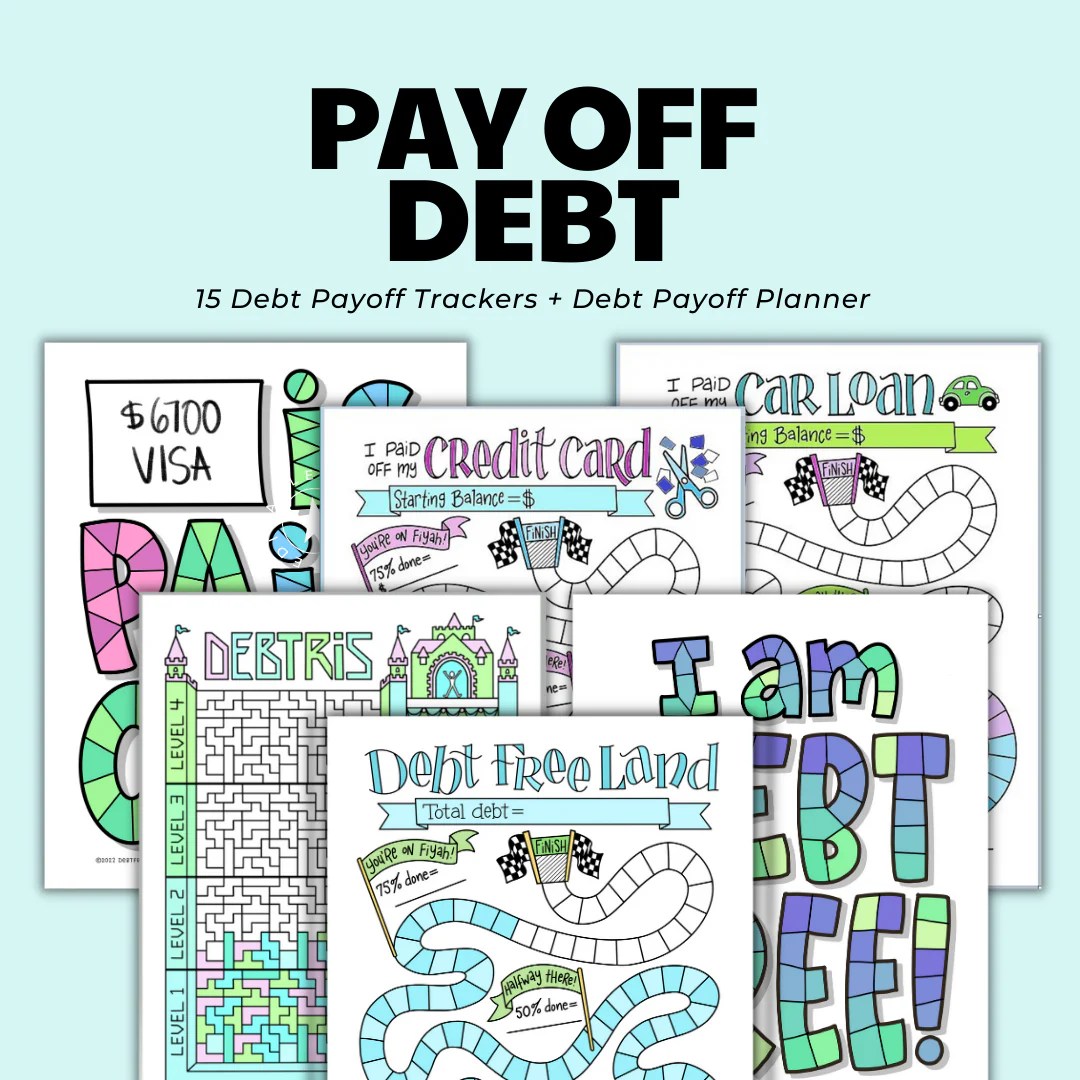

Sick of drowning in debt? “Money Games – Debt Freedom The Fun Way to Get Out of Debt and Reach Your Money Goals” is the game-changer you need! It’s like a financial bootcamp, but way more fun. Want to level up your money game?

Download And Listen Here to learn how to slay those bills and reach your financial goals! “Money Games – Debt Freedom” will have you saying “bye Felicia” to debt in no time!

- A board game with a track representing the journey to financial freedom.

- Playing pieces for each player.

- Cards with different financial scenarios (e.g., unexpected expenses, job loss, salary increase, investment opportunities).

- Dice or a spinner.

Gameplay:

- Players take turns rolling the dice or spinning the spinner to move their playing pieces along the track.

- Each player draws a card and must act according to the scenario described on the card. For example, an unexpected expense card might require a player to pay a certain amount, while a salary increase card might allow a player to save more or pay down debt faster.

- Players can choose to save, invest, pay down debt, or make other financial decisions based on the cards they draw and their current financial situation.

- The first player to reach the “Financial Freedom” finish line wins.

This game can be adapted to different age groups and financial situations. You can create your own scenarios or use real-life financial examples to make the game more relevant and engaging.

Beyond the Game

![]()

Playing Money Games is a fun way to learn about personal finance and get out of debt, but it’s just the beginning. To build a truly sustainable financial future, you need to develop healthy habits that go beyond the game.

This means adopting a long-term mindset and taking proactive steps to manage your money effectively.

Creating a Budget

A budget is a roadmap for your money, helping you track your income and expenses. By understanding where your money is going, you can identify areas where you can save or cut back.

Money Games – Debt Freedom: It’s like a game of Monopoly, but instead of owning Park Place, you’re conquering your debt! And just like a good board game, it can be a fun way to get your finances in order.

If you’re looking for a way to chill out while you’re strategizing your financial future, check out My Beautiful Coloring Book – Beauties of the 20’s. It’s like a time machine to the roaring twenties, filled with beautiful illustrations that’ll help you unwind and stay focused on your money goals.

A simple budget can be as easy as using a spreadsheet or a budgeting app to track your income and expenses.

Listen, everyone’s got their own hustle, right? Maybe you’re crushing it with your side gig, or maybe you’re just trying to get your finances in order. “Money Games” can help you get on track with budgeting and debt reduction, but it’s also important to remember that sometimes, the best way to learn about money is to hear about how people made it, even in the past.

Check out Mickie’s Diaries 1926-1940 My Career in Vaudeville for a glimpse into the world of vaudeville and how Mickie managed to make a living in a tough business. Whether you’re looking for financial tips or just a good story, there’s something to be learned from the past that can help you reach your money goals today.

There are many different budgeting methods, but the key is to find one that works for you.

Setting Financial Goals

Financial goals give you a target to aim for and motivate you to stay on track. Having goals can help you stay focused and disciplined.

Examples of financial goals include paying off debt, saving for retirement, buying a house, or funding your children’s education.

Setting SMART goals – Specific, Measurable, Achievable, Relevant, and Time-bound – can increase your chances of success.

Investing Wisely

Investing is an essential part of building wealth over the long term. It allows your money to grow through compound interest, which means earning interest on your initial investment and on the accumulated interest.

Think you can’t have fun while getting out of debt? Think again! “Money Games – Debt Freedom The Fun Way to Get Out of Debt and Reach Your Money Goals” shows you how to play the game of money, but if you need a break from all that budgeting, check out “The Long Walk Home with the Ceinture Fléchée The Arrow Sash” The Long Walk Home with the Ceinture Fléchée The Arrow Sash for some historical adventure.

Once you’re back from that mental vacation, you’ll be ready to crush those debt goals and level up your financial life!

For example, if you invest $1,000 at a 10% annual return, you’ll earn $100 in the first year. The next year, you’ll earn 10% on $1,100, which is $110.

There are many different investment options, including stocks, bonds, real estate, and mutual funds. It’s important to do your research and choose investments that align with your risk tolerance and financial goals.

Resources and Tools

Many resources and tools can help you achieve long-term financial stability.

- Financial advisors:A financial advisor can provide personalized guidance and help you create a financial plan that meets your specific needs.

- Online resources:Websites like Investopedia, NerdWallet, and Bankrate offer a wealth of information on personal finance topics.

- Budgeting apps:Apps like Mint, Personal Capital, and YNAB can help you track your expenses, create budgets, and set financial goals.

- Books and podcasts:There are countless books and podcasts available that can teach you about personal finance and investing.

Last Recap

So, are you ready to level up your financial game? It’s time to ditch the debt and embrace the fun! Remember, money games are just one tool in your arsenal. Building healthy financial habits and making smart choices are key to long-term success.

But with a little creativity and a whole lot of fun, you can turn your financial journey into an epic adventure, one win at a time.

FAQ Section

Can I really get out of debt by playing games?

Money games are a fun way to stay motivated and make managing your money more engaging, but they’re not a magic bullet. It’s still important to have a solid budget, track your spending, and make smart financial decisions. Think of money games as a way to add some fun and motivation to your financial journey.

Are these money games only for people with a lot of debt?

Nope! Money games can be beneficial for anyone looking to improve their financial habits, whether you’re trying to get out of debt, save for a dream vacation, or just want to be more mindful of your spending.

What if I’m not a “game person”?

Don’t worry, you don’t have to be a hardcore gamer to benefit from money games. There are tons of different options, from simple savings challenges to more complex budgeting games. Find one that fits your personality and learning style.