Forget about those confusing spreadsheets and complicated accounting software! The Accounting Ledger Book is your secret weapon to crushing your financial goals, whether you’re running a side hustle or managing your personal finances. This simple, easy-to-use guide will have you feeling like a financial pro in no time.

Think of the Accounting Ledger Book as your personal financial coach, helping you track every penny, manage your expenses, and stay on top of your budget. It’s all about getting organized and taking control of your money.

With the Accounting Ledger Book, you’ll be able to visualize your financial journey, make informed decisions, and achieve those big dreams you’ve been dreaming about.

The Importance of Accounting Ledgers for Small Businesses

![]()

Think of an accounting ledger as the financial backbone of your small business. It’s like a detailed diary of every single penny that comes in and goes out, helping you keep track of your financial health. It’s more than just a list of numbers – it’s a powerful tool for understanding your business’s performance and making smart decisions.

So, you’re all about keeping your finances in check with an Accounting Ledger Book, huh? That’s totally rad, like, budgeting is the ultimate power move. But maybe you also have a creative side that needs some TLC. If you’re looking to unleash your inner artist on your iPad, you gotta check out PROCREATE ALL-IN-ONE MASTERY GUIDE Beginner to Expert Guide to Master the Art of Digital Painting Calligraphy Drawing and Designing on iPad Devices.

It’s like, the ultimate guide to mastering digital art on your iPad. Once you’ve got your finances on point, you can unleash your creativity and turn your artistic vision into a reality. And who knows, maybe you’ll even start making some extra cash from your amazing art!

Financial Visibility and Organization

An accounting ledger provides a clear and organized picture of your business’s financial position. It helps you see where your money is coming from, where it’s going, and how much you have left. This clarity is essential for making informed decisions about your business, whether it’s investing in new equipment, hiring new staff, or simply managing your cash flow.

Yo, keeping your finances straight is like, totally the key to bossing up your business. This ledger book, it’s like your personal financial guru, helping you track income and expenses. And if you’re feeling a little stressed about the whole money thing, you might wanna check out I Too Cry Purple Tears for some relatable vibes.

It’s like, the perfect combo for a little financial zen and a dose of literary inspiration, ya know? Get organized, get inspired, and get your business to the next level!

Imagine trying to navigate a busy city without a map – it’s chaos! An accounting ledger is your map, guiding you through the complex world of your business finances.

Yo, wanna keep your business finances tight? This “Accounting Ledger Book Simple Accounting Ledger for Bookkeeping Small Business and Personnel Financial Planning Monthly Income and Expense Log Book 8.5 X 11” is the real deal, like a financial guru in book form.

You can download and listen to some financial tips Download And Listen Here to level up your game. Then, get back to that ledger and track every penny, ’cause your business deserves the best, right?

Budgeting and Expense Management

An accounting ledger is your personal financial guru, helping you stick to your budget and control your expenses. By tracking your income and expenses, you can easily identify areas where you’re overspending and find opportunities to save. For example, you might notice that your marketing costs are higher than expected, prompting you to explore more cost-effective strategies.

Yo, wanna keep your small biz on track? Get yourself an Accounting Ledger Book, it’s like the ultimate cheat sheet for your cash flow. Need a little inspiration? Check out The Copper Trail A Journey of Survival from Ireland to Montana , a tale of grit and determination that’ll fuel your entrepreneurial fire.

Then, get back to your ledger, and make sure your numbers are as solid as the pioneers on the Copper Trail. It’s all about building a foundation, one entry at a time, right?

It’s like having a personal finance coach in your pocket, always there to guide you towards better financial habits.

Tax Preparation

Tax time can be stressful, but an accounting ledger can make it a whole lot easier. With all your financial transactions neatly organized, you’ll have all the information you need to prepare your tax returns accurately and efficiently. It’s like having a cheat sheet for your taxes, making sure you don’t miss any deductions or credits you’re entitled to.

Setting Up a Simple Accounting Ledger

Setting up a simple accounting ledger is like laying the foundation for your business’s financial health. It’s the backbone of your bookkeeping system, helping you track every dollar coming in and going out.

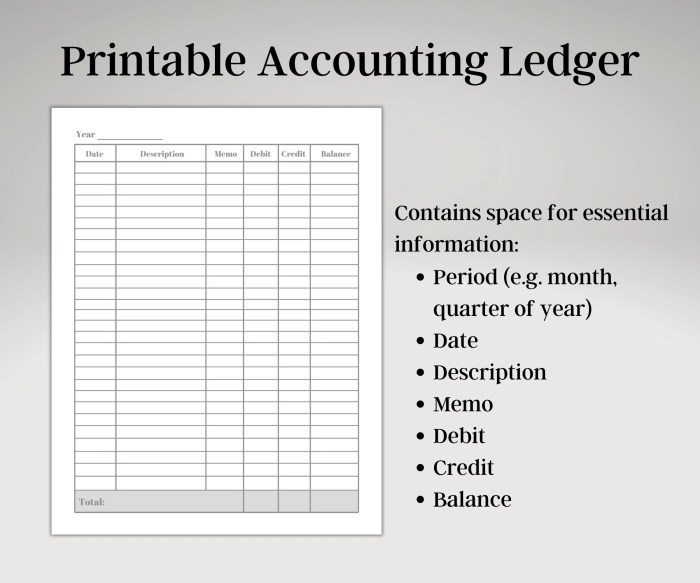

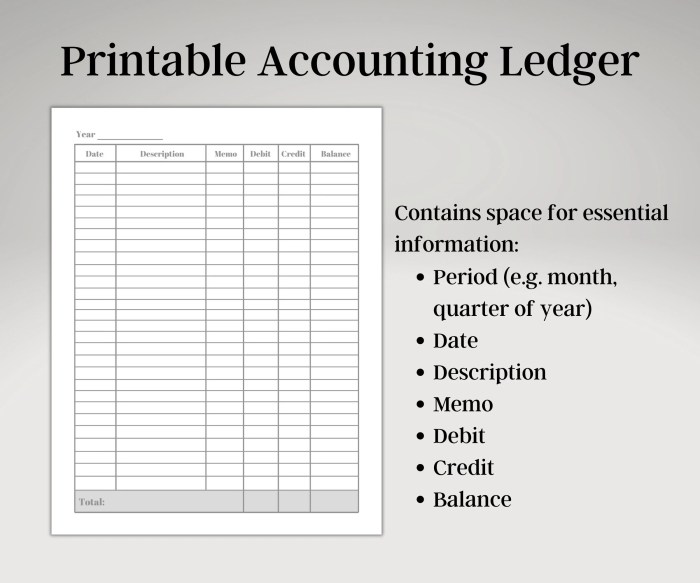

The Essential Components of an Accounting Ledger

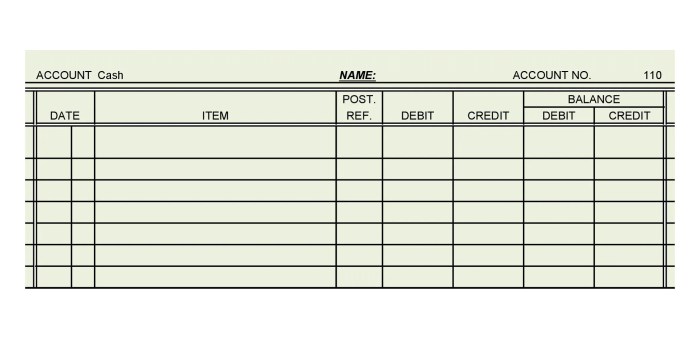

A basic accounting ledger has four essential columns:

- Date:This column records the date of each transaction.

- Description:This column provides a brief but clear explanation of the transaction. For example, “Sales of widgets,” “Rent payment,” or “Utilities bill.”

- Debit:This column records the amount of money going out of your business. This includes expenses, payments, and purchases.

- Credit:This column records the amount of money coming into your business. This includes income, sales, and deposits.

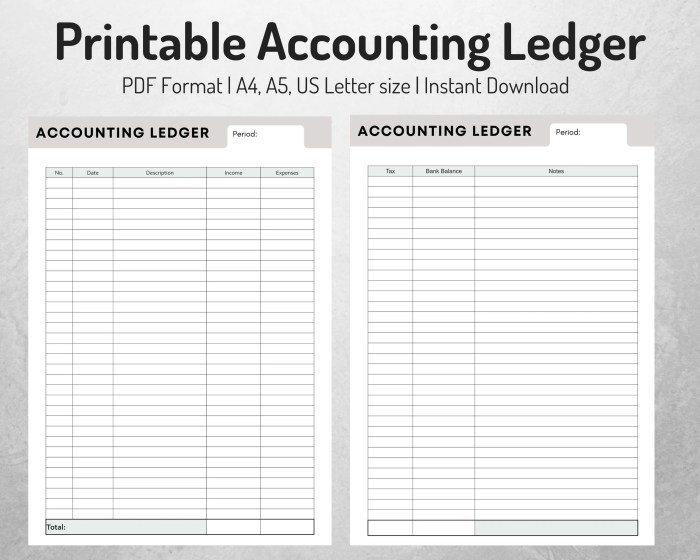

Methods for Setting Up an Accounting Ledger

There are several ways to set up an accounting ledger:

- Spreadsheet Program:Programs like Microsoft Excel or Google Sheets offer a flexible and customizable option. You can create your own ledger template with the necessary columns and formulas to automate calculations.

- Dedicated Accounting Software:Software like QuickBooks or Xero are designed specifically for bookkeeping. They provide more advanced features like invoicing, inventory management, and reporting. These programs often come with pre-built templates for accounting ledgers.

- Pen and Paper:For small businesses with minimal transactions, a simple pen and paper ledger might be sufficient. This method offers a tangible record of your finances.

Recording Transactions in an Accounting Ledger

Recording transactions in an accounting ledger is a straightforward process:

- Identify the transaction:Determine whether the transaction represents an increase or decrease in your business’s assets (money or possessions). If it increases assets, it’s a debit. If it decreases assets, it’s a credit.

- Record the date:Enter the date of the transaction in the “Date” column.

- Describe the transaction:Write a brief description of the transaction in the “Description” column.

- Enter the amount:Record the amount of the transaction in the appropriate column (debit or credit).

- Balance the ledger:After each transaction, ensure the total of the debit column equals the total of the credit column. This helps maintain accuracy and prevent errors.

Utilizing an Accounting Ledger for Financial Planning

An accounting ledger is more than just a tool for tracking business finances; it can be a powerful tool for personal financial planning. By meticulously recording income and expenses, you gain valuable insights into your spending habits and can effectively manage your money for the future.

Tracking Income and Expenses

Keeping a detailed record of income and expenses provides a clear picture of your financial situation. You can categorize your income sources, such as salary, investments, or side hustles, and track your expenses by category, such as housing, food, transportation, and entertainment.

This allows you to identify areas where you may be overspending and prioritize your financial goals.

Setting Budgets

With a clear understanding of your income and expenses, you can create a realistic budget. By allocating your income to different categories based on your priorities, you can ensure that you are spending within your means and saving for your financial goals.

Monitoring Progress Toward Financial Goals

Regularly reviewing your accounting ledger allows you to track your progress toward your financial goals. This could include saving for a down payment on a house, paying off debt, or investing for retirement. By comparing your actual spending against your budget, you can make adjustments as needed to stay on track.

Debt Management

An accounting ledger can be a valuable tool for managing debt. By tracking your debt payments, interest rates, and minimum payments, you can prioritize paying down high-interest debt and develop a plan to become debt-free.

Saving for Retirement

Retirement planning is crucial for financial security later in life. Using an accounting ledger, you can track your retirement savings contributions, monitor investment growth, and make informed decisions about your retirement plan.

Analyzing Financial Data

Analyzing your accounting ledger data can reveal trends and patterns in your spending. For example, you might notice that you spend more on entertainment during certain months or that your grocery expenses fluctuate based on seasonal factors. This information can help you make informed financial decisions, such as adjusting your budget or reducing discretionary spending.

For example, if you find that you consistently overspend on dining out, you might decide to cook at home more often or reduce the number of times you eat out per month.

Epilogue

Don’t let financial confusion hold you back! The Accounting Ledger Book is your key to financial freedom and achieving your financial goals. Whether you’re a small business owner or just looking to get a handle on your personal finances, this simple tool will help you take charge of your money and build a brighter financial future.

Questions and Answers

What’s the difference between an accounting ledger and a spreadsheet?

An accounting ledger is specifically designed for tracking financial transactions, while a spreadsheet is a more general tool that can be used for various purposes. The Accounting Ledger Book provides a structured format for recording financial data, making it easier to analyze and understand.

Do I need any special software to use an accounting ledger?

Nope! The Accounting Ledger Book is designed to be user-friendly and doesn’t require any special software. You can simply use a pen and paper or a basic spreadsheet program.

Can I use the Accounting Ledger Book for both personal and business finances?

Absolutely! The Accounting Ledger Book is versatile enough to track both your personal and business finances. It’s a great tool for anyone who wants to get a clear picture of their financial situation.

How often should I update my accounting ledger?

It’s best to update your ledger regularly, ideally on a daily or weekly basis. This will help you stay on top of your finances and make informed decisions.

What are some tips for using an accounting ledger effectively?

Keep it consistent! Use the same format and recording methods each time you enter data. Also, don’t be afraid to experiment with different methods to find what works best for you. Remember, the key is to stay organized and track your financial progress.