Yo, traders! Ready to take your game to the next level? Think of a trading journal as your secret weapon – a place to track your wins, analyze your losses, and become a master of the market. It’s like having a personal coach in your pocket, guiding you through every trade and helping you make those smart moves that separate the pros from the rookies.

This ain’t just about scribbling down your trades, though. We’re talking about a strategic journal that helps you identify patterns, refine your strategies, and build the confidence to crush your trading goals. Think of it as a blueprint for success, one trade at a time.

The Importance of a Trading Journal

In the fast-paced world of trading, keeping a detailed journal is more than just a good habit—it’s a crucial tool for success. It’s your personal record of every trade, allowing you to analyze your performance, identify patterns, and ultimately, improve your decision-making.

Think of it as your trading diary, where you chronicle your journey to becoming a better trader.

Tracking Performance

A trading journal helps you monitor your progress over time. By meticulously recording your trades, you can track your wins, losses, and overall profitability. This data provides a clear picture of your trading performance, allowing you to identify areas for improvement.

For example, if you consistently underperform on certain days of the week, you can investigate why and adjust your trading strategy accordingly.

Identifying Patterns

One of the most valuable aspects of a trading journal is its ability to help you spot patterns in your trading. By analyzing your entries, you can identify recurring mistakes, successful strategies, and market conditions that favor your approach. This insight allows you to refine your trading strategy, focusing on what works and avoiding what doesn’t.

For example, if you notice that you tend to make impulsive trades when the market is volatile, you can develop strategies to mitigate these risks.

Improving Decision-Making

A trading journal encourages you to analyze your trading decisions, both successful and unsuccessful. By dissecting your thought processes, you can understand what led to your choices and whether they were based on sound reasoning or emotional impulses. This introspective approach helps you develop a more disciplined and logical approach to trading.

For instance, if you discover that you often enter trades without a clear exit strategy, you can incorporate this lesson into your future trades, reducing the risk of unnecessary losses.

Learning from Mistakes

Mistakes are inevitable in trading, but a trading journal provides a valuable tool for learning from them. By reviewing your losing trades, you can identify the underlying causes, such as poor risk management, emotional trading, or a lack of market understanding.

This analysis helps you avoid repeating the same mistakes in the future, transforming your losses into valuable learning experiences. For example, if you consistently lose money on breakout trades, you can research the reasons behind these failures and adjust your strategy accordingly.

Fostering Discipline and Accountability

Keeping a trading journal promotes discipline and accountability in your trading. The act of recording your trades creates a sense of responsibility, forcing you to consider your decisions more carefully. It also serves as a reminder of your trading goals and helps you stay focused on your long-term strategy.

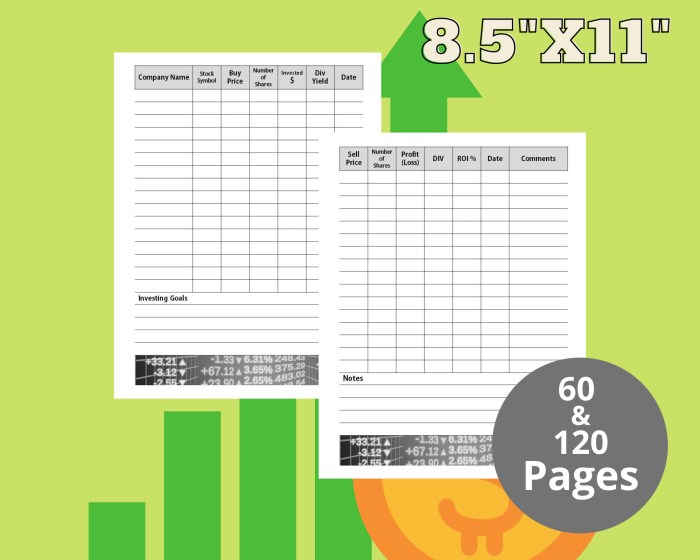

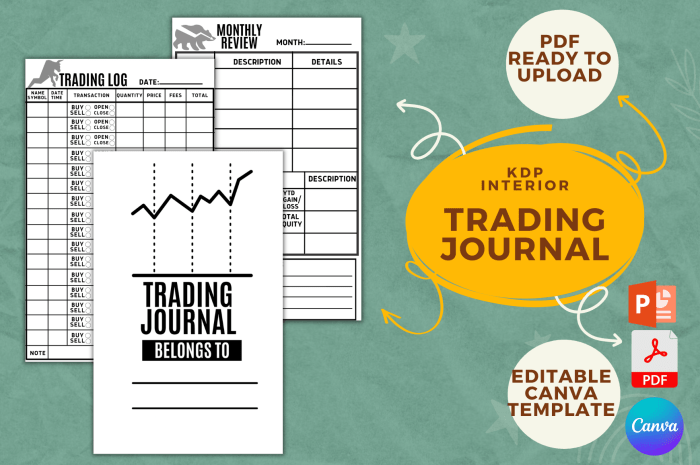

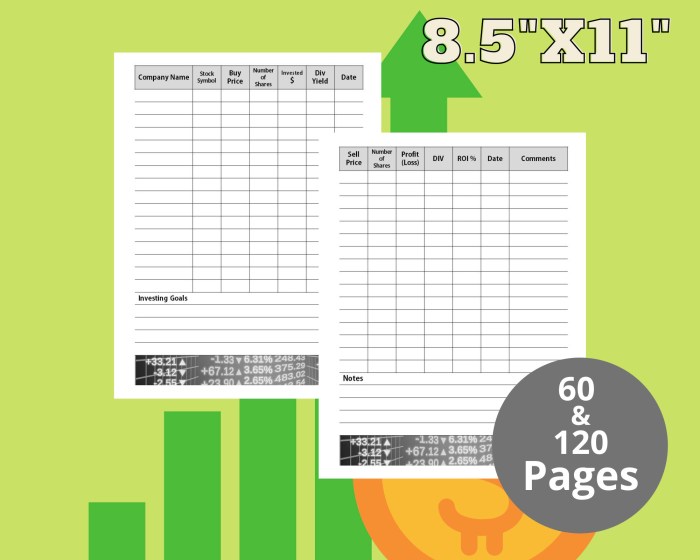

Yo, wanna level up your trading game? This Trading Journal & Log Book is your secret weapon, keeping your trades organized like a boss. Track your wins, learn from your losses, and see how those small changes can have a huge impact, like a Domino Effect.

It’s all about building a solid foundation for success, and this journal is your roadmap to becoming a trading legend.

The journal becomes a testament to your trading journey, encouraging you to stay committed and strive for continuous improvement.

Key Components of a Trading Journal

A trading journal is like a personal trainer for your trading. It helps you identify your strengths and weaknesses, track your progress, and ultimately become a better trader. Think of it as a roadmap to your financial freedom.

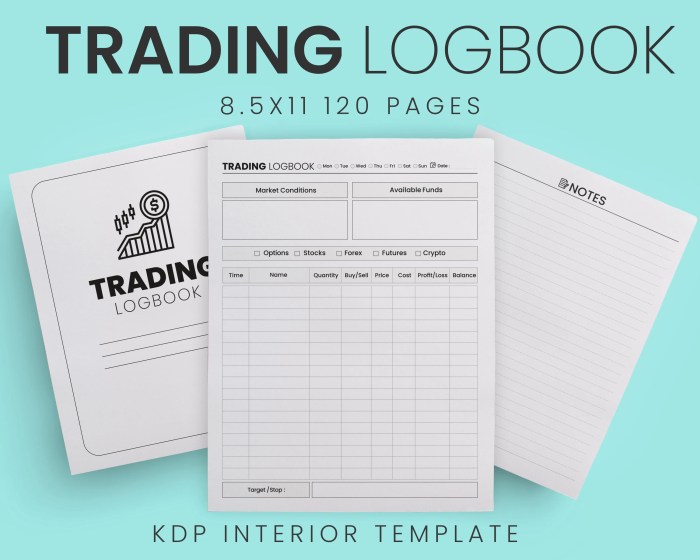

Trade Entries

Recording your trades is crucial. It allows you to see patterns in your trading behavior and learn from past mistakes. Every trade should be meticulously documented, including the entry price, date, and time.

Market Analysis

It’s not enough to just record your trades; you need to understand why you made those trades. Document your market analysis, including technical indicators, fundamental news, and any other factors that influenced your decision.

Trade Setups

Your trade setups are your game plan. Recording your trade setups, such as chart patterns, support and resistance levels, and entry and exit points, helps you understand the logic behind your trading decisions.

Okay, so you’re all about that trading life, tracking your moves like a pro. But hey, maybe you’re also a parent or have a little one in your life. If you’re looking for something fun and educational, check out this Creative Color by Number Coloring Book for Kids & Girls Ages 8-12.

It’s a great way to help them unleash their inner artist while boosting their fine motor skills and concentration. And who knows, maybe they’ll even pick up a love for finance too! Back to your trading journal though, gotta keep those charts lookin’ sharp!

Exit Strategies

Having a clear exit strategy is essential. Document your exit strategies, including your profit targets and stop-loss levels. This helps you manage risk and ensure you don’t hold on to losing trades for too long.

Recording Emotions

Trading is an emotional game. Recording your emotions during trades helps you identify biases and emotional triggers that may be affecting your trading decisions.

Psychological Factors

Understanding your psychology is crucial for trading success. Document your psychological state before, during, and after trades, including factors like stress, fear, greed, and confidence.

Sample Table Layout

Here’s a sample table layout for a trading journal:| Date | Time | Symbol | Entry Price | Exit Price | Stop Loss | Profit/Loss | Trade Rationale | Emotions | Psychological Factors ||—|—|—|—|—|—|—|—|—|—|| 2023-08-23 | 10:00 AM | AAPL | $175.00 | $178.00 | $173.00 | $3.00 | Bullish breakout above resistance level | Excited | Confident || 2023-08-24 | 11:00 AM | TSLA | $250.00 | $245.00 | $247.00 |

$5.00 | Bearish pullback from overbought conditions | Disappointed | Fearful |

Trading Journal Examples and Strategies

A trading journal is a powerful tool for any trader, regardless of experience level or trading style. It provides a structured way to track your trades, analyze your performance, and identify areas for improvement. By keeping a detailed record of your trading decisions, you can gain valuable insights into your strengths and weaknesses, ultimately helping you to become a more consistent and profitable trader.

Yo, wanna level up your trading game? This Trading Journal & Log Book is your new best friend. It’s got everything you need to track your trades, from watchlists to log samples for day trading, crypto, and futures strategies.

And the best part? You can Download And Listen Here to some awesome tips and tricks from seasoned traders. Get that journal, get that knowledge, and get ready to crush the market!

Examples of Trading Journals from Successful Traders

Successful traders often have unique approaches to journaling. Here are a few examples of how they use their journals:

- Mark Douglas, Author of “Trading in the Zone”:Douglas emphasizes the importance of emotional awareness in trading. His journal focuses on identifying and managing emotional biases that can negatively impact trading decisions. He uses it to track his emotional state before, during, and after each trade, helping him to become more aware of his triggers and develop strategies to mitigate their influence.

- Van Tharp, Founder of Van Tharp Institute:Tharp believes in the power of analyzing trading performance to identify areas for improvement. His journal is designed to track key metrics such as win rate, average win and loss amounts, and risk-reward ratios. By analyzing these metrics, he can identify patterns in his trading and adjust his strategies accordingly.

- Jesse Livermore, Legendary Trader:Livermore, known for his success in the early 20th century, was a firm believer in the importance of journaling. He used his journal to track his trades, analyze market trends, and develop his trading strategies. He famously said, “The only way to make money in the stock market is to learn from your mistakes.” His journal served as a valuable tool for learning from his experiences and improving his trading.

Yo, wanna level up your trading game? This Trading Journal & Log Book is the ultimate tool for keeping track of your moves, from watchlists to day trading strategies. But hey, sometimes you need to chill out, right?

Check out My Beautiful Coloring Book – Beauties of the 20’s for some vintage vibes and creative relaxation. Then, you can come back to your journal with a fresh mind and crush those trades!

Structuring a Trading Journal for Different Trading Styles

The structure of your trading journal should be tailored to your specific trading style. Here are some examples:

- Day Trading:Day traders focus on short-term price fluctuations and often execute multiple trades within a single day. Their journals should include detailed information about each trade, such as entry and exit points, stop-loss and take-profit levels, and the rationale behind each decision.

They can also use their journals to track their trading performance throughout the day, identifying patterns and areas for improvement.

- Swing Trading:Swing traders hold positions for a few days to a few weeks, aiming to capture price swings in the market. Their journals should focus on identifying potential entry and exit points, analyzing technical indicators, and tracking the performance of their trades over a longer time horizon.

They can use their journals to identify profitable setups and adjust their strategies based on market conditions.

- Long-Term Investing:Long-term investors hold positions for months or even years, focusing on fundamental analysis and company performance. Their journals should track their investment thesis, key financial metrics, and the rationale behind their investment decisions. They can use their journals to monitor the progress of their investments and make adjustments as needed.

Analyzing Trading Journal Data

Analyzing your trading journal data can provide valuable insights into your performance and help you identify areas for improvement. Here are some strategies:

- Identifying Recurring Patterns:By reviewing your trading journal entries, you can identify recurring patterns in your trading decisions. This can help you to understand your strengths and weaknesses and develop strategies to capitalize on your strengths and mitigate your weaknesses.

- Analyzing Risk Management Effectiveness:Your trading journal can be used to assess the effectiveness of your risk management strategies. By tracking your stop-loss levels, win-loss ratios, and risk-reward ratios, you can identify areas where you are taking on too much risk or not managing risk effectively.

- Evaluating the Performance of Different Trading Strategies:Your trading journal can be used to evaluate the performance of different trading strategies. By tracking the results of different strategies, you can identify which strategies are most profitable and which strategies need to be adjusted or abandoned.

Final Thoughts

So, what are you waiting for? Grab your trading journal and start documenting your journey to trading greatness! With every entry, you’re building a roadmap to success, one winning trade after another. Remember, the more you track, the more you learn, and the more you dominate the market.

It’s time to level up your game – your future self will thank you!

FAQ Compilation

What are some examples of trading journal entries?

Think of it like a diary for your trades! You’d record things like the date, time, asset, entry price, exit price, your reasoning for the trade (based on technical indicators, news, or your own analysis), and the outcome (profit or loss).

You can also add notes about your emotions during the trade, any mistakes you made, and what you learned from the experience.

How often should I update my trading journal?

The best practice is to update it after every trade, while the details are still fresh in your mind. It’s like a post-game analysis for your trades – the more immediate the feedback, the better!

What if I don’t have time to write a detailed entry for every trade?

No worries! You can start with a quick summary of the key points and add more details later when you have time. The important thing is to be consistent and build the habit of journaling.