Ready to level up your trading game? Price action is the ultimate key to unlocking the secrets of the market. Forget about those fancy indicators – it’s all about understanding the language of the charts. We’re talking about channels, support, resistance, Fibonacci, trendlines, reversal and continuation patterns, candlestick analysis, multi-timeframe magic, and confluence – all the tools you need to spot those killer trades and ride the waves of profit.

This isn’t just about reading charts – it’s about understanding the psychology of the market and predicting where the price is going to move next. We’ll break down the fundamentals, explore advanced techniques, and even dive into a must-read book that’ll take your trading to the next level.

Understanding Price Action Fundamentals

Price action trading is a technique that focuses on analyzing the movement of price in financial markets to identify trading opportunities. It involves studying the chart patterns, candlestick formations, and other visual indicators to understand the supply and demand dynamics driving price fluctuations.

This approach emphasizes the raw data of price movement, minimizing reliance on external indicators or complex mathematical formulas.

The Importance of Price Action Trading

Price action trading is a valuable skill for traders of all levels because it provides a fundamental understanding of how markets behave. By studying price action, traders can:* Identify potential trading opportunities:Price action patterns can signal potential entry and exit points for trades.

Gain insights into market sentiment

The way price moves can reveal the overall sentiment of the market, whether bullish, bearish, or neutral.

Reduce reliance on indicators

Price action analysis can help traders make trading decisions without relying solely on external indicators that may lag the market.

Yo, wanna master the art of price action trading? We’re talkin’ channels, support & resistance, Fibonacci levels, trendlines, reversal & continuation patterns, candlestick chart patterns, multi-time frame analysis, and confluence – the whole shebang! Get ready to level up your game and learn how to predict market moves like a pro.

Head over to Download And Listen Here to get your hands on the ultimate guide to price action trading. This ain’t no joke – it’s the real deal.

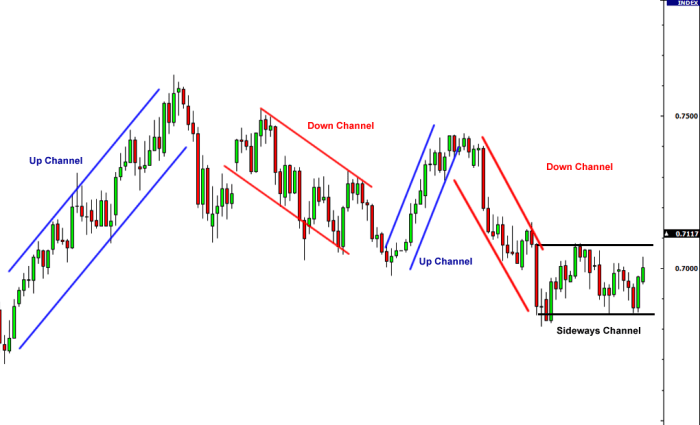

Channels, Support, and Resistance Levels

Channels, support, and resistance levels are essential elements of price action analysis. These concepts help traders identify potential areas where the price might bounce or break through.* Channels:Channels represent the range within which the price has been moving. They can be identified by drawing trendlines connecting recent highs and lows.

The price is expected to stay within the channel, but breakouts can occur.

Support Levels

Support levels are areas where the price has historically found buyers and bounced back. They represent a level of demand for the asset.

Resistance Levels

Resistance levels are areas where the price has historically faced selling pressure and encountered difficulty breaking through. They represent a level of supply for the asset.

Fibonacci Retracement and Extension Levels

Fibonacci retracement and extension levels are based on the Fibonacci sequence, a mathematical sequence that appears in nature. These levels can be used to predict potential price reversal and continuation points.* Fibonacci Retracement:These levels are used to identify potential areas where the price might retrace after a significant move.

They are calculated by dividing the price difference between a high and a low by the Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 100%).

Fibonacci Extension

These levels are used to predict potential price targets after a retracement. They are calculated by extending the price difference between a high and a low by the Fibonacci ratios (1.618, 2.618, 4.236).

Trendlines

Trendlines are lines drawn on a chart connecting a series of highs or lows to identify the direction of the market. They can help traders:* Identify the overall trend:Uptrending trendlines connect a series of rising highs, while downtrending trendlines connect a series of falling lows.

Confirm potential breakouts

Price action trading, with its channels, support, resistance, Fibonacci levels, trendlines, and candlestick patterns, can be a real brain twister. But hey, sometimes you gotta take a break from all that technical analysis and just chill out. Maybe grab a Easy Large Print Color by Number Coloring Book For Adults BLACK BACKGROUND Simple Numbered Designs For Relaxation to de-stress and let your creative side run wild.

Then, you can come back to the charts with a fresh perspective and a clear head, ready to tackle those market fluctuations with confidence.

When the price breaks through a trendline, it can signal a change in trend.

“Price action is the language of the market. Learn to speak it, and you will be able to understand the market’s intentions.”

Anonymous

Mastering Reversal and Continuation Patterns

Price action patterns can be incredibly valuable for traders seeking to identify potential trend reversals or continuations. These patterns, often formed by candlestick formations, provide visual clues about market sentiment and potential price movements. By understanding and recognizing these patterns, traders can gain a significant edge in their trading decisions.

Reversal Patterns

Reversal patterns indicate a potential shift in the prevailing trend. They suggest that the current trend is losing momentum and may soon reverse direction. These patterns are often characterized by a distinct change in price action, with the price moving in the opposite direction of the existing trend.

Yo, so you’re into that whole price action trading thing, right? Channels, support, resistance, Fibonacci – you know the drill. But let’s be real, sometimes you just need a break from the charts and get your hands dirty with something more tangible.

Check out Mastering Fusion 360 28 Step-By-Step Projects for Beginners in 3D Printing Prototyping and Making , it’s a killer resource for learning how to design and print your own awesome stuff. Once you’ve got that 3D printing game on lock, you’ll be ready to tackle those charts with a whole new perspective, like a boss!

- Head and Shoulders: This pattern resembles a human head and shoulders, with two peaks (shoulders) on either side of a higher peak (head). The neckline connects the lows of the two troughs. A breakout below the neckline confirms the pattern and suggests a potential downtrend.

- Double Top/Bottom: This pattern consists of two consecutive peaks (double top) or troughs (double bottom) at approximately the same price level. A breakout below the support level for a double top or above the resistance level for a double bottom confirms the pattern.

- Triple Top/Bottom: Similar to the double top/bottom, but with three consecutive peaks or troughs. This pattern is generally considered more reliable than the double top/bottom due to its stronger confirmation. A breakout below the support level for a triple top or above the resistance level for a triple bottom confirms the pattern.

Continuation Patterns

Continuation patterns suggest that the existing trend is likely to continue. These patterns often appear as temporary pauses or consolidations in the price action before the trend resumes.

- Flags: This pattern resembles a flagpole with a rectangular flag attached to it. The flagpole represents the previous trend, while the flag represents a period of consolidation. A breakout above the resistance level for an uptrend or below the support level for a downtrend confirms the pattern.

- Pennants: Similar to flags, but the consolidation period is characterized by a narrowing range of price action, resembling a pennant. A breakout above the resistance level for an uptrend or below the support level for a downtrend confirms the pattern.

- Wedges: This pattern consists of converging trendlines, forming a wedge shape. A breakout above the resistance level for an uptrend or below the support level for a downtrend confirms the pattern.

Candlestick Patterns

Candlestick patterns are a powerful tool for identifying potential reversals or continuations. They provide visual insights into the relationship between buyers and sellers, revealing the dynamics of market sentiment.

- Engulfing Pattern: This pattern consists of two consecutive candlesticks. The second candlestick, which is called the engulfing candlestick, completely engulfs the body of the previous candlestick. A bullish engulfing pattern suggests a potential reversal of a downtrend, while a bearish engulfing pattern suggests a potential reversal of an uptrend.

- Shooting Star: This pattern is characterized by a long upper shadow and a small real body, resembling a shooting star. It often appears at the end of an uptrend and suggests a potential reversal.

- Hammer: This pattern is characterized by a long lower shadow and a small real body, resembling a hammer. It often appears at the end of a downtrend and suggests a potential reversal.

Analyzing Candlestick Patterns in Conjunction with Other Technical Indicators

Candlestick patterns are most effective when used in conjunction with other technical indicators. This approach provides a more comprehensive and reliable analysis of market sentiment and potential price movements.

“Combining candlestick patterns with other technical indicators, such as moving averages, oscillators, and volume, can enhance your trading strategies and improve your risk management.”

Advanced Price Action Techniques

Price action analysis is a powerful tool for traders, but it can be even more effective when combined with other techniques. This section will explore advanced price action techniques that can help you refine your trading strategies and gain a deeper understanding of market movements.

Multi-Timeframe Analysis

Multi-timeframe analysis is a technique that involves looking at price action across different timeframes. This allows traders to identify trends and patterns that may not be visible on a single timeframe. For example, a trader might use a daily timeframe to identify a long-term trend and then switch to a four-hour timeframe to find entry and exit points.

By combining information from different timeframes, traders can gain a more comprehensive view of market dynamics and make more informed trading decisions.

Price action trading is all about deciphering the market’s language, from support and resistance levels to Fibonacci retracements. It’s like learning a whole new vocabulary, but once you get it, you can spot trends and reversals like a pro.

And when the market gets you feeling stressed, take a break with a Kawaii Fantasy Creatures Coloring Book and let your inner artist loose. After a few pages, you’ll be back to analyzing those candlestick patterns and multi-timeframe confluences with a fresh perspective.

Confluence

Confluence is a powerful concept in technical analysis that involves identifying areas where multiple indicators align. This can be a powerful signal that a trend is likely to continue or reverse. For example, if a price is approaching a resistance level, a moving average is crossing below the price, and the RSI is overbought, this could be a confluence of signals indicating that the price is likely to pull back.

Price Action Trading Strategy with Technical Indicators

Here’s a trading strategy that combines price action analysis with other technical indicators:

- Identify a trend:Use a moving average or other trend-following indicator to identify the overall direction of the market. For example, a 200-day moving average can be used to identify long-term trends.

- Look for price action signals:Identify price action patterns such as pin bars, engulfing patterns, or inside bars. These patterns can signal potential reversals or continuations of the trend.

- Confirm signals with technical indicators:Use technical indicators such as the RSI, MACD, or Stochastic Oscillator to confirm price action signals. For example, if a price is breaking out of a range, a bullish RSI divergence can confirm the breakout.

- Set stop-loss and take-profit levels:Use price action and technical indicators to set appropriate stop-loss and take-profit levels. For example, you could set a stop-loss at the previous swing low and a take-profit at the next resistance level.

Real-World Examples of Price Action Trading

- The “Double Bottom” Pattern:In 2023, a trader observed a double bottom pattern in the price of Bitcoin, which indicated a potential reversal. The trader combined this price action signal with a bullish RSI divergence and entered a long position. The price subsequently rallied, and the trader was able to exit the trade at a profit.

- The “Engulfing Pattern” in Apple Stock:In 2022, a trader noticed an engulfing pattern in Apple stock, which signaled a potential bullish breakout. The trader also observed that the price was breaking above a resistance level and that the MACD was turning bullish. The trader entered a long position and was able to profit as the price continued to rise.

Book Review

The world of trading is filled with countless books promising the holy grail of profits, but few truly delve into the art of reading price action. One book that stands out as a beacon of insightful wisdom is “Price Action Trading: A Comprehensive Guide to Reading Charts” by Al Brooks.

Brooks, a seasoned trader with decades of experience, offers a unique perspective on understanding the language of the markets.

Key Concepts and Techniques

Brooks’ approach emphasizes the importance of understanding the psychology behind price movements. He argues that by studying how traders react to different market situations, we can gain a deeper understanding of how price action unfolds. The book explores a range of key concepts and techniques, including:

- Understanding the psychology of price action:Brooks emphasizes the importance of recognizing how traders’ emotions and biases influence price movements.

- Identifying key levels of support and resistance:He explains how to identify these crucial levels and how they can be used to predict potential price reversals.

- Mastering candlestick patterns:Brooks provides a comprehensive guide to interpreting candlestick patterns, highlighting their significance in understanding market sentiment and predicting future price movements.

- Utilizing multiple timeframes:He emphasizes the importance of analyzing price action across different timeframes to gain a holistic view of the market.

- Developing a trading plan:Brooks provides practical guidance on developing a trading plan that incorporates risk management, entry and exit strategies, and trade management techniques.

Strengths of the Book

Brooks’ writing style is clear, concise, and engaging. He uses real-life examples and charts to illustrate his concepts, making the information accessible to traders of all levels.

- Practical and actionable insights:The book provides practical advice that can be immediately applied to trading strategies.

- Emphasis on risk management:Brooks consistently emphasizes the importance of risk management, a crucial aspect often overlooked in other trading books.

- Focus on understanding market psychology:The book’s unique focus on the psychology behind price movements provides valuable insights that can help traders make more informed decisions.

- Clear and concise writing style:Brooks’ writing is easy to understand and follow, making the information accessible to traders of all levels.

Weaknesses of the Book

While “Price Action Trading” is a valuable resource, it does have a few limitations.

- Limited focus on technical indicators:Brooks primarily focuses on price action, with limited discussion on technical indicators. While this is a strength for some traders, others may find this approach lacking.

- Lack of specific trading strategies:While the book provides valuable insights into price action, it does not offer specific trading strategies. This may require traders to develop their own strategies based on the concepts presented.

Recommendation

“Price Action Trading: A Comprehensive Guide to Reading Charts” is a must-read for any trader seeking to deepen their understanding of price action. Brooks’ insights into market psychology and his practical approach to trading make this book an invaluable resource for both beginners and experienced traders.

Summary

Mastering price action isn’t a quick fix – it’s a journey of learning, practice, and discipline. But trust me, the rewards are worth it. Once you unlock the secrets of the charts, you’ll be able to spot opportunities that others miss, make smarter decisions, and finally achieve trading success.

So, buckle up and get ready to ride the waves of the market like a pro.

Helpful Answers

What are some common mistakes beginners make when learning price action trading?

One common mistake is focusing too much on the indicators and not enough on the actual price action. Another is overtrading or not having a clear trading plan. Remember, patience is key!

How long does it take to become proficient in price action trading?

It takes time and dedication. Just like any skill, practice makes perfect. Start with the basics, gradually add more complexity, and don’t be afraid to experiment.

Is price action trading suitable for all types of markets?

Absolutely! The principles of price action apply across all markets, including forex, stocks, commodities, and cryptocurrencies.