Ever dreamed of becoming a financial whiz kid? Think you’re too young to start investing? Think again! The stock market is no longer just for Wall Street suits. This guide will break down the stock market in a way that’s easy to understand, even if you’re still rocking those braces.

We’ll cover everything from the basics of buying and selling stocks to developing your own investment strategy. Get ready to learn the secrets of getting rich on autopilot, and yes, it’s possible, even before you can legally drive!

This guide will take you on a journey from stock market newbie to savvy investor, giving you the knowledge and tools to make smart decisions with your money. We’ll cover everything from the basics of the stock market to creating a personalized investment strategy that works for you.

So, buckle up, grab your favorite financial guru, and get ready to ride the wave of success!

Understanding the Stock Market

Think of the stock market as a giant marketplace where people buy and sell tiny pieces of ownership in companies, called stocks. It’s like owning a slice of your favorite pizza place, but instead of getting pepperoni, you get a share of the profits! But just like pizza, sometimes the market is hot and sometimes it’s cold, and you gotta know how to play the game.

Types of Investments

The stock market isn’t just about buying stocks. There are a bunch of different ways to invest, each with its own risks and rewards.

- Stocks:These are the most common type of investment. When you buy a stock, you’re buying a tiny piece of ownership in a company. If the company does well, your stock goes up in value. If it does poorly, your stock goes down.

Yo, wanna be a money-making machine before you even graduate high school? “Stock Market Investing for Teens How to Get Rich on Auto-Pilot in 7 Steps (Learn Everything About Investing)” is your guide to crushing the game. Download the audiobook and get ready to learn the secrets of the stock market, Download And Listen Here.

Once you’ve got the knowledge, you’ll be rolling in dough faster than you can say “bull market.” So, what are you waiting for? Get rich, get lit, and get ready to invest!

Think of it like buying a share of your favorite video game company. If they release a super-hot game, your stock goes up. But if the game flops, you might lose some dough.

- Bonds:Bonds are like loans you give to companies or the government. They pay you interest over time, and you get your money back when the bond matures. It’s like lending money to your friend, but instead of getting a handshake, you get a nice little interest payment.

- Mutual Funds and ETFs:These are baskets of stocks or bonds that are managed by professionals. They’re a great way to diversify your portfolio, which means spreading your money across different investments to reduce risk. It’s like having a bunch of different pizzas, so if one topping isn’t your favorite, you’ve still got plenty of other options.

Risks and Rewards

Investing in the stock market is a bit like playing a game of chance. There’s always the risk of losing money, but there’s also the potential to make a lot of money.

Yo, wanna learn how to make your money work for you? Check out this guide to stock market investing for teens – it’s like a cheat code for getting rich on auto-pilot. But hey, before you start making bank, you gotta have a place to put it, right?

That’s where the Home Repair and Improvement Bible comes in. It’s got all the info you need to make your crib a total baller pad. Once you’re set, you can focus on those sweet, sweet stock market gains!

- Risk:The stock market is volatile, which means prices can go up and down quickly. You could lose money if the market crashes, or if the company you invest in goes bankrupt. Think of it like investing in a new tech startup.

It could become the next big thing, or it could fizzle out. It’s a gamble.

- Reward:The stock market can provide the potential for high returns over time. If you invest wisely and hold on for the long term, you could make a lot of money. Think of it like investing in a hot new band.

If they become superstars, your investment could pay off big time.

Successful and Unsuccessful Investments

There are countless examples of successful and unsuccessful investments in the stock market.

- Successful:One example is investing in Applein the early days. They were a small company back then, but they had a vision for the future. Investors who bought Apple stock early on made a killing. Think of it like investing in a garage band that later becomes a rock legend.

- Unsuccessful:On the other hand, there are companies that have gone bankrupt, leaving investors with nothing. Enronwas a big energy company that was caught in a massive accounting scandal. Investors who bought Enron stock lost everything. Think of it like investing in a band that gets caught in a scandal and breaks up.

Research and Analysis

The key to successful investing is to do your research and analyze stocks before you buy them. You want to make sure the company is solid, has a good track record, and has a bright future.

- Financial Statements:Look at the company’s financial statements to see how much money they’re making and how much debt they have. It’s like looking at the company’s report card. Do they have good grades or are they failing?

- Industry Trends:Consider the industry the company operates in. Is it a growing industry or a dying one? Think about whether people will still be buying their products in the future. Will there be demand for their product, or will it be obsolete?

- Management Team:A strong management team is essential for a company’s success. Do they have experience in the industry? Are they passionate about the company’s mission? Think of it like the band’s manager. Are they good at promoting the band and making sure they’re on the right track?

Developing a Stock Market Investing Strategy

Alright, you’ve got the basics of the stock market down. Now it’s time to get real and craft a strategy that’s gonna help you build your wealth. Think of it like a game plan for your financial future, and we’re gonna break it down step-by-step, just like your favorite video game walkthrough.

Setting Financial Goals

Before you even think about picking stocks, you gotta know what you’re aiming for. What are your financial goals? Do you want to buy a sweet car in a few years? Maybe a house? Or maybe you’re saving for a trip around the world?

Once you know what you’re working towards, you can set realistic goals and timelines.

Determining Risk Tolerance

Okay, here’s the deal: investing involves risk. You could make a killing, or you could lose some cash. That’s why figuring out your risk tolerance is crucial. Are you a thrill-seeker who’s cool with big swings in the market?

Yo, wanna learn how to invest like a boss and make that sweet, sweet cash? Check out “Stock Market Investing for Teens: How to Get Rich on Auto-Pilot in 7 Steps (Learn Everything About Investing)” and level up your financial game.

You’ll learn the basics of the stock market, but if you wanna add some spice to your life, you gotta check out this sick chord progression book 1908 The Most Popular Chord Progressions Book For Piano The Ultimate Collection of Chord Progressions for Songwriters and Musicians Major and Minor Chords in All Keys.

Get your musical chops on point while you’re building your financial empire. It’s all about finding your rhythm, right?

Or are you more cautious, preferring steady growth? Knowing your risk tolerance will help you choose the right investments for you.

Choosing Investment Vehicles

Now that you’ve got your goals and risk tolerance sorted, it’s time to choose your weapons, or in this case, your investment vehicles. There are tons of options, but here are a few popular ones:

- Individual Stocks:This is the classic way to invest. You’re buying a piece of a company, hoping its value will increase over time. It can be risky, but it also has the potential for high returns.

- Mutual Funds:These are like baskets of stocks, managed by professionals. They offer diversification, which means you’re spreading your risk across multiple companies.

- Exchange-Traded Funds (ETFs):ETFs are similar to mutual funds, but they trade on stock exchanges like individual stocks. They’re often cheaper and more flexible than mutual funds.

Different Investment Strategies

There are many different approaches to investing, and choosing the right one depends on your goals, risk tolerance, and time horizon. Here are a few popular strategies:

- Value Investing:This strategy focuses on finding undervalued companies that are trading below their intrinsic worth. Value investors look for companies with strong fundamentals, such as low debt, high earnings, and a good track record.

- Growth Investing:This strategy focuses on companies with high growth potential. Growth investors look for companies in rapidly growing industries, with strong management teams, and innovative products or services.

- Dividend Investing:This strategy focuses on companies that pay regular dividends to their shareholders. Dividend investors look for companies with a long history of dividend payments, a stable business model, and a strong balance sheet.

Investment Portfolios for Different Age Groups and Risk Profiles

It’s important to tailor your investment portfolio to your age and risk tolerance. Here are a few examples:

| Age Group | Risk Profile | Sample Portfolio |

|---|---|---|

| Teens and Young Adults (18-30) | High Risk Tolerance | 70% Stocks (Growth, Tech, Emerging Markets), 20% Bonds, 10% Cash |

| Mid-Career (30-50) | Moderate Risk Tolerance | 50% Stocks (Value, Dividend, Large-Cap), 30% Bonds, 20% Cash |

| Retirement (50+) | Low Risk Tolerance | 30% Stocks (Dividend, Large-Cap), 50% Bonds, 20% Cash |

Sample Investment Plan

Alright, let’s put it all together. Here’s a sample investment plan that incorporates diversification, asset allocation, and rebalancing:

- Diversification:Don’t put all your eggs in one basket. Spread your investments across different asset classes, like stocks, bonds, and real estate. This helps to reduce your overall risk.

- Asset Allocation:Determine how much of your portfolio you want to allocate to each asset class. This will depend on your goals, risk tolerance, and time horizon.

- Rebalancing:Over time, the value of your investments will fluctuate. Rebalancing ensures that your portfolio stays aligned with your original asset allocation. You can do this by selling some of your investments that have performed well and buying more of those that have underperformed.

Remember, investing is a long-term game. Don’t panic sell if the market takes a dip. Stay focused on your goals and stick to your plan.

Listen, getting rich quick ain’t a walk in the park. It’s about investing smart and learning the ropes, and yeah, maybe a little bit of luck. But hey, while you’re figuring out the stock market, maybe you wanna chill out and learn a new instrument.

Pick up a Kalimba, it’s super easy to learn, and you can play some awesome tunes in no time. Check out this beginner’s guide: Kalimba 100 Songs for the 8 Key I Songbook for Beginners I TAB Lyrics Chords I Easy Sheet Music with Letters Big Book for Kalimba in C (10 and 17 key …

for Kids Teens and Adults I Tablature. And who knows, maybe you’ll even be able to play your own “Money, Money, Money” song while you’re making those sweet, sweet stock market gains.

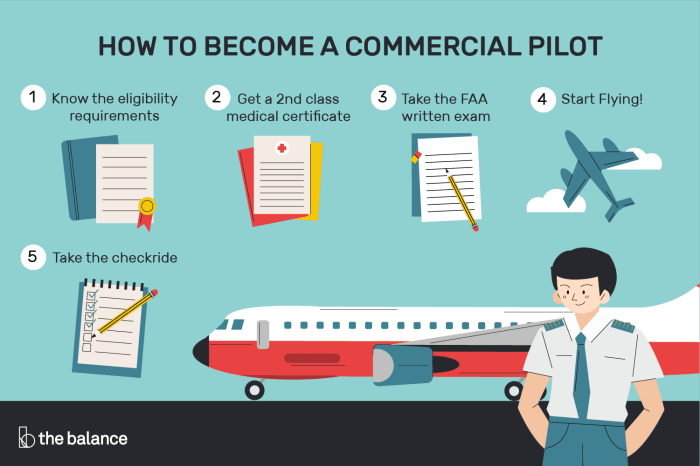

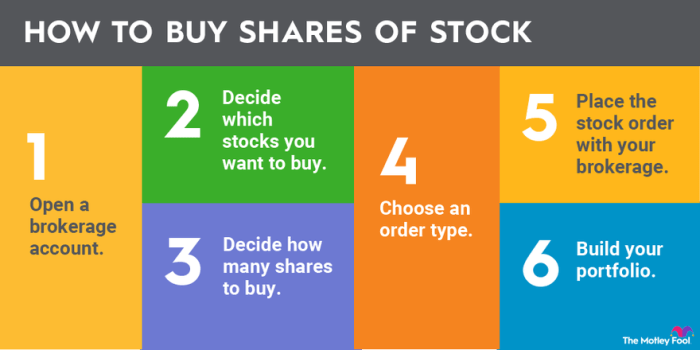

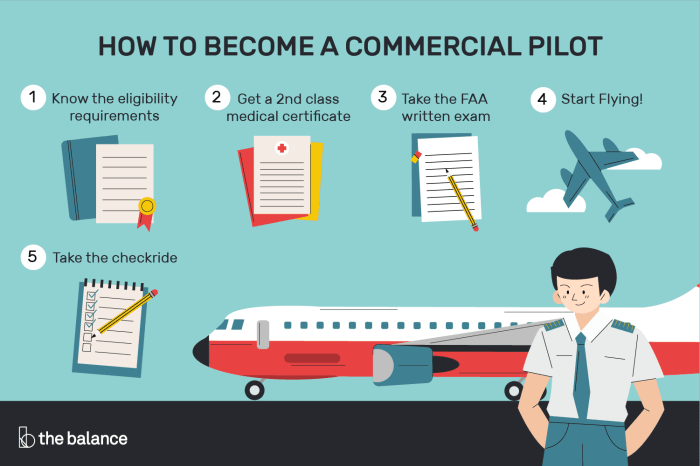

Getting Started with Stock Market Investing

It’s time to take the plunge and actually invest in the stock market! Think of it like starting your own business, but instead of selling lemonade, you’re buying a piece of a company. The first step is to open a brokerage account, which is like a digital wallet for your investments.

Opening a Brokerage Account

You’ll need a brokerage account to buy and sell stocks. This account will hold your money and your investments. Here’s what you need to know:

- Choose a Brokerage Firm:There are many brokerage firms out there, but you want to choose one that fits your needs and budget. Some popular options include Robinhood, Fidelity, and TD Ameritrade.

- Provide Personal Information:You’ll need to provide your personal information, such as your name, address, and Social Security number.

- Fund Your Account:You can fund your account with a bank account, credit card, or debit card.

- Start Investing:Once your account is funded, you can start investing in stocks.

Types of Brokerage Accounts

Different types of brokerage accounts have different tax implications and rules:

- Traditional Brokerage Account:This is the most common type of brokerage account. You can invest in stocks, bonds, mutual funds, and other securities. The gains and losses from your investments are taxed as ordinary income.

- Roth IRA:This is a retirement account where you contribute after-tax dollars.

Your earnings grow tax-free, and you can withdraw your money tax-free in retirement.

- 401(k):This is a retirement savings plan offered by your employer. You can contribute pre-tax dollars, and your earnings grow tax-deferred.

Choosing the Right Brokerage Firm and Investment Platform

Here are some factors to consider when choosing a brokerage firm and investment platform:

- Fees:Some brokerage firms charge fees for trading stocks, while others offer commission-free trading.

- Research Tools:Some brokerage firms offer research tools, such as stock quotes, charts, and analyst reports.

- Investment Options:Make sure the brokerage firm offers the investment options you’re looking for, such as stocks, bonds, mutual funds, and ETFs.

- Customer Service:You want to choose a brokerage firm with good customer service in case you have any questions or problems.

Resources for Learning More About Stock Market Investing

There are many resources available to help you learn more about stock market investing:

- Books:There are many great books on stock market investing, such as “The Intelligent Investor” by Benjamin Graham and “One Up On Wall Street” by Peter Lynch.

- Websites:Websites like Investopedia and The Motley Fool offer articles, videos, and other resources to help you learn about investing.

- Online Courses:There are many online courses available on stock market investing. Some popular options include Coursera and Udemy.

- Financial Advisors:If you’re not sure where to start, you can always talk to a financial advisor.

Book Review: “The Intelligent Investor” by Benjamin Graham

“The Intelligent Investor” by Benjamin Graham is a classic book on value investing that has been a cornerstone of investing for decades. It’s like the “bible” for investors, but instead of preaching about religion, it teaches you how to make money in the stock market.

Key Concepts of “The Intelligent Investor”

“The Intelligent Investor” is a treasure trove of investment wisdom. Graham emphasizes the importance of value investing, which is all about buying stocks that are undervalued by the market. Think of it like finding a diamond in the rough! He also introduces the concept of a “margin of safety,” which is a buffer that protects your investment from potential losses.

It’s like having a safety net in case things go wrong.

Impact on the Investment World

“The Intelligent Investor” has had a profound impact on the investment world. It’s credited with influencing the investment styles of some of the most successful investors of all time, including Warren Buffett. The book’s teachings have been passed down through generations of investors, and its principles are still relevant today.

Comparison with Other Investment Philosophies

Value investing, as championed by Graham, stands in contrast to other investment philosophies like growth investing, which focuses on companies with high growth potential. While growth investing can be exciting, it can also be risky. Value investing, on the other hand, emphasizes a more conservative approach, focusing on companies with strong fundamentals and a history of profitability.

Applying “The Intelligent Investor” to Teen Investing

While “The Intelligent Investor” might seem like a heavy read, its principles can be applied to stock market investing for teens. Here are some key takeaways:

- Focus on Value:Don’t just chase the hottest stocks. Look for companies with solid financials and a history of profitability. Think long-term, not short-term gains.

- Practice Patience:Investing is a marathon, not a sprint. Don’t expect to get rich quick. Be patient and let your investments grow over time.

- Embrace the Margin of Safety:Always buy stocks with a margin of safety. This means buying them at a price that’s significantly below their intrinsic value. This helps to protect your investment from potential losses.

- Do Your Research:Don’t invest in anything you don’t understand. Do your homework and research the companies you’re considering. This will help you make informed decisions.

Final Conclusion

Investing in the stock market can be a game-changer for your future. It’s about taking control of your financial destiny and building wealth over time. Remember, investing isn’t about getting rich quick; it’s about making smart, informed decisions that can help you reach your financial goals.

So, get out there, learn the ropes, and start building your financial empire, one stock at a time!

Essential FAQs

What are some common mistakes that teens make when investing in the stock market?

One common mistake is investing in stocks without doing proper research. Another is getting caught up in hype and buying stocks that are overvalued. Also, teens might be tempted to invest in risky stocks that promise high returns, but can also lead to significant losses.

It’s important to remember that investing is a long-term game and to focus on making smart, informed decisions.

Is it better to invest in individual stocks or mutual funds?

The answer depends on your investment goals and risk tolerance. Individual stocks can offer higher returns, but also carry higher risk. Mutual funds, on the other hand, offer diversification, which can help reduce risk. For beginners, mutual funds are generally a good place to start.

How much money do I need to start investing?

You don’t need a lot of money to start investing. Many brokerage firms allow you to invest with as little as $1. The key is to start small and gradually increase your investment amount as you become more comfortable.