Tired of feeling like you’re drowning in bills? You’re not alone. We’ve all been there, juggling due dates, trying to remember what we paid and when. But what if there was a way to take back control of your finances, one bill at a time?

Introducing the Monthly Bill Payment Log Book – your ultimate weapon against bill chaos!

This 120-page powerhouse is packed with everything you need to tame those pesky bills. Think of it as your own personal financial superhero, ready to organize, track, and conquer your bills, leaving you feeling empowered and stress-free.

The Importance of Bill Management

Bills are a part of life, but managing them effectively can be a real challenge. It’s easy to get overwhelmed by the sheer number of bills, their due dates, and the different payment methods. This can lead to late fees, missed payments, and even damage to your credit score.

But don’t worry, there’s a solution!

Okay, so you’re all about getting your finances in order with that Monthly Bill Payment Log Book. That’s totally boss! But hey, maybe you need a little chill time after all that budgeting. Check out Tracing Flowers Tracing and Coloring Book With Abstract Floral Designs For Anxiety Relief and Mindfulness to de-stress and get your creative juices flowing.

Then you can jump back into your bill payment game feeling totally zen and ready to conquer those spreadsheets!

Benefits of Using a Bill Payment Log Book

Using a bill payment log book is like having a superhero sidekick for your finances. It helps you stay organized, keep track of due dates, and manage your budget effectively. Here are some of the key benefits:

- Organization: A bill payment log book acts as a central hub for all your bills, providing a clear overview of your financial obligations. You can easily see what’s due, when it’s due, and how much you need to pay.

No more digging through stacks of paper or searching for emails!

- Budgeting: A log book helps you understand your spending patterns. By tracking your bill payments, you can see where your money is going and identify areas where you might be able to save. This knowledge empowers you to make informed financial decisions.

- Avoid Late Fees: One of the biggest benefits of using a log book is avoiding late fees. By tracking due dates, you can ensure you pay your bills on time and avoid unnecessary penalties. This can save you a significant amount of money in the long run.

Setting Up a Successful Bill Payment System

Setting up a bill payment system is like building a house. You need a solid foundation and a well-thought-out plan. Here are some tips to get you started:

- Gather all your bills: Start by collecting all your bills, including utility bills, credit card statements, loan payments, and any other recurring expenses. This will give you a comprehensive picture of your financial obligations.

- Create a log book: Get a dedicated log book or spreadsheet to track your bills. Include columns for bill name, due date, amount due, payment method, and payment date. You can also add a column for notes, such as reminders or special instructions.

- Set up reminders: Use calendar alerts, phone reminders, or even sticky notes to remind yourself of upcoming due dates. This will help you stay on top of your payments and avoid late fees.

- Pay bills on time: Make paying your bills on time a priority. Set aside a specific time each month to review your log book and make payments. Consider setting up automatic payments for recurring bills to ensure they are paid on time.

- Review your log book regularly: Make a habit of reviewing your log book at least once a month. This will help you stay organized, track your spending, and identify any potential problems. It’s also a great opportunity to look for ways to save money.

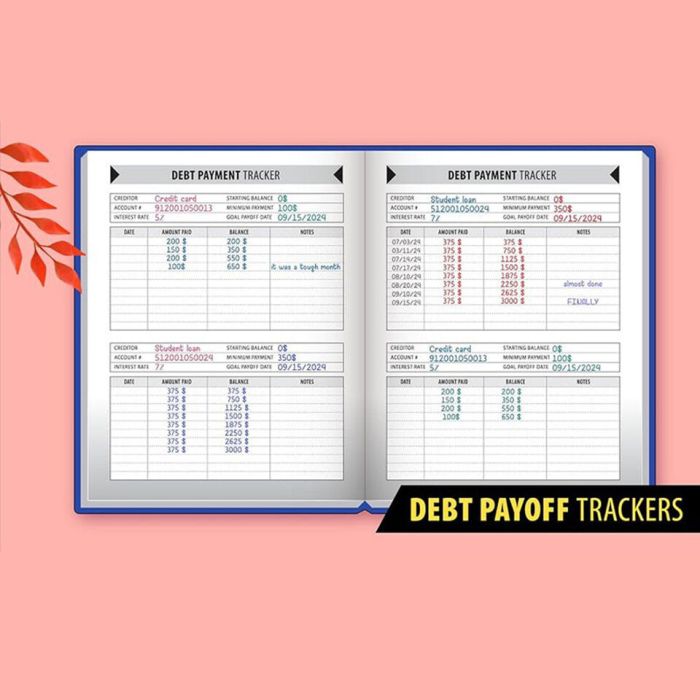

Features of a Bill Payment Log Book

![]()

This bill payment log book is your ultimate weapon against financial chaos! It’s designed to help you stay on top of your bills, avoid late fees, and manage your money like a boss.

Okay, so you’ve got your finances in check with the Monthly Bill Payment Log Book, but let’s be real, sometimes you need a little chill time. That’s where Reverse Coloring for Adults Draw Your Way to Relaxation comes in.

After all, a little coloring can help you unwind before you dive back into your bills and budget!

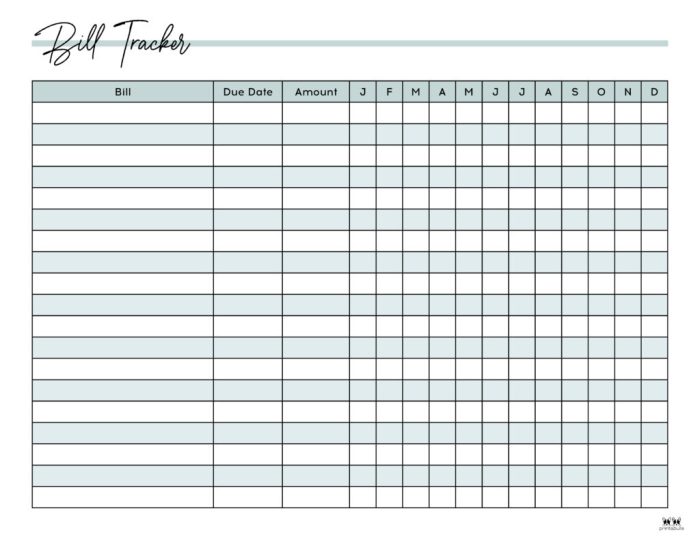

Organization and Structure

This log book provides a clear and organized system for tracking your bills. It’s like having a personal assistant for your finances, keeping everything in one place.

- Each page is dedicated to a specific month, giving you a comprehensive view of your bills for that period.

- The book features a dedicated section for each bill, including the bill name, due date, payment amount, and payment method.

- You can easily track your payment history, making it a breeze to see which bills you’ve paid and which are upcoming.

Sample Table

Here’s a sneak peek at the structure of the log book:| Bill Name | Due Date | Payment Amount | Payment Method | Notes ||—|—|—|—|—|| Rent | 01/15/2024 | $1,500 | Check | || Utilities | 01/20/2024 | $200 | Online Payment | || Credit Card | 01/25/2024 | $100 | Autopay | |

Tracking Bills and Due Dates

This log book is like your personal financial calendar, reminding you when bills are due.

- Simply write down the due date for each bill, and you’ll never miss a payment again.

- You can use the log book to plan your bill payments in advance, ensuring that you have enough money available when they’re due.

Recording Payment Amounts and Methods

This log book keeps your finances organized and transparent.

- Record the exact payment amount for each bill, helping you stay on budget and avoid overspending.

- Document the payment method used, whether it’s online, by check, or through autopay, so you can easily track your payment history.

Additional Features

The log book is packed with features to make bill management a breeze.

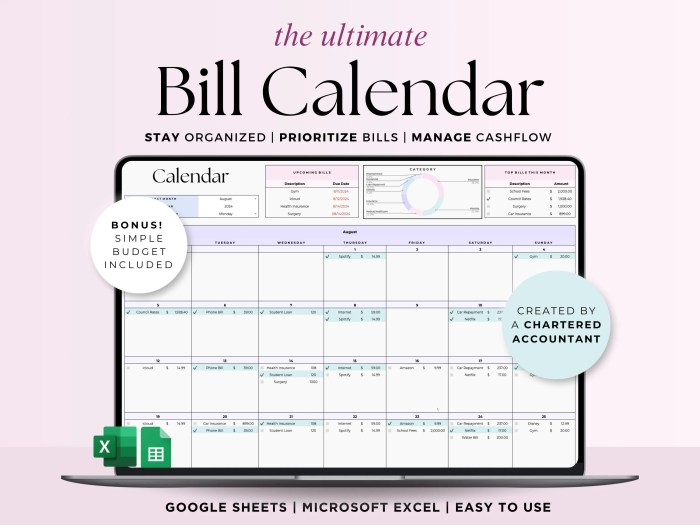

- Budgeting Section:This section allows you to track your monthly income and expenses, giving you a clear picture of your financial situation.

- Goal Setting:Set financial goals and track your progress towards achieving them.

- Notes Section:Use this section to jot down important details about your bills, such as customer service phone numbers or account numbers.

Using the Bill Payment Log Book

This log book is your secret weapon to conquer bill chaos. Think of it as your personal financial sidekick, helping you stay organized, on top of your finances, and avoid those dreaded late fees.

Okay, so you’re trying to get your finances in order, right? You’re looking for a way to keep track of all your bills and make sure you’re not missing any payments. Well, a Monthly Bill Payment Log Book Bill Payment Tracker Bill Planner and Organizer with 120 pages is a great way to do that! You can even download and listen to some financial advice Download And Listen Here to help you get started.

Then, once you’re feeling confident, you can use your new log book to stay on top of your bills and make sure you’re always paying on time.

Setting Up Your Log Book

Start by customizing your log book to fit your unique financial needs.

Okay, so you’re all about staying organized with your bills, right? That’s totally awesome! You’re probably thinking about the “Monthly Bill Payment Log Book Bill Payment Tracker Bill Planner and Organizer 120 Pages” and how it can help you keep your finances on point.

But let’s be real, sometimes life throws you a curveball, and you need a little escape. Maybe you’re dreaming of a tropical paradise, like the one described in “Lucky to Live Hawai’i From Mundane to Magical – A Life Transformed” Lucky to Live Hawai’i From Mundane to Magical – A Life Transformed.

Then, when you’re back to reality, you can rock those bills like a boss with your new bill payment tracker.

- Create a Table of Contents:List all your recurring bills (rent, utilities, subscriptions, etc.) in the table of contents. This gives you a quick overview of your financial obligations.

- Set Up Your Bill Payment Schedule:For each bill, note the due date, the payment amount, and the method of payment (online, check, autopay, etc.).

- Track Payment History:Record the date you paid each bill and any payment reference numbers. This will help you keep track of payments and avoid duplicates.

Organizing and Categorizing Bills

It’s time to get organized! Think of it like Marie Kondo for your finances.

- Categorize Bills:Group your bills into categories like housing, utilities, transportation, entertainment, and subscriptions. This makes it easier to see where your money is going.

- Use Color Coding:Grab some highlighters and color-code your bills by category. This visual cue will help you quickly identify and prioritize bills.

- Create a “To-Do” List:Use the log book to create a to-do list of bills to pay each month. This ensures you don’t miss any deadlines.

Using the Log Book to Create a Budget and Track Spending

Ready to level up your financial game? This log book is your budget BFF.

- Track Income and Expenses:Use the log book to track your monthly income and expenses. This will give you a clear picture of your financial situation.

- Set Budget Goals:Identify areas where you can cut back on spending. This could be anything from canceling unused subscriptions to finding cheaper alternatives for everyday expenses.

- Monitor Your Progress:Review your budget regularly and make adjustments as needed. This helps you stay on track and achieve your financial goals.

Book Review

This bill payment log book is a great tool for anyone who wants to take control of their finances and get organized. It’s a simple, yet effective way to track your bills, payments, and due dates.

Comparison with Other Tools

This bill payment log book provides a tangible and hands-on approach to bill management, offering a unique experience compared to digital tools. Here’s a comparison:

| Feature | Bill Payment Log Book | Bill Payment Apps | Spreadsheets |

|---|---|---|---|

| Accessibility | Always available offline | Requires internet connection | Requires computer or device |

| Organization | Physical organization, promotes visual overview | Digital organization, may require setup | Highly customizable, requires data entry |

| Security | Physical security, risk of loss or damage | Digital security, potential for data breaches | Security depends on device and software |

| Cost | One-time purchase | Often free with limited features, paid for premium features | Free, but requires time and effort for setup |

| Personalization | Limited customization, focused on basic information | High level of customization, various features and options | Highly customizable, but requires technical knowledge |

Review of the Bill Payment Log Book

This bill payment log book is a simple and effective way to manage your bills. It’s easy to use, and it provides a clear overview of your finances.

Strengths

- Simplicity:The log book is easy to use, with straightforward sections for recording bill information and payments. Even individuals with limited experience in financial management can easily adapt to its layout.

- Visual Organization:The physical format allows for a visual overview of your bills and due dates. You can easily see which bills are coming up and prioritize payments.

- Offline Access:You can access your bill information anytime, anywhere, without relying on internet connectivity. This is especially beneficial for individuals who prefer a hands-on approach or frequently travel.

- Cost-Effective:The log book is a one-time purchase, making it a budget-friendly option compared to subscription-based bill payment apps.

Weaknesses

- Limited Features:The log book primarily focuses on basic bill tracking and doesn’t offer advanced features like budgeting, bill reminders, or automatic payments. Individuals seeking comprehensive financial management tools might find it lacking.

- Potential for Loss or Damage:As a physical product, the log book is susceptible to loss or damage. It’s crucial to store it safely to avoid losing valuable financial information.

- Lack of Customization:The log book offers limited customization options. Individuals with specific financial tracking needs might find it restrictive.

Target Audience

This bill payment log book is ideal for individuals who:

- Prefer a tangible and hands-on approach to bill management.

- Value simplicity and ease of use.

- Are looking for a cost-effective solution to track their bills.

- Don’t require advanced features like budgeting or automated payments.

Impact on Personal Finance

Using this bill payment log book can have a positive impact on personal finance by:

- Improving organization and control over finances.

- Reducing the risk of late payments and associated fees.

- Enhancing awareness of spending habits and financial obligations.

- Facilitating informed decision-making regarding financial priorities.

Closing Notes

![]()

So, are you ready to ditch the bill blues and embrace a life of financial freedom? Grab your Monthly Bill Payment Log Book, get organized, and watch your bills become a thing of the past. You’ll be saying “goodbye” to late fees and hello to a brighter financial future!

FAQ Insights

Is this log book suitable for both digital and physical bills?

Absolutely! This log book works perfectly for both physical and digital bills, allowing you to keep track of everything in one place.

Can I use this log book to track my spending as well?

While the log book focuses primarily on bill payments, you can definitely use it to track your overall spending. Just create a separate section or use a different color ink to distinguish between bills and other expenses.

How long will this log book last me?

With 120 pages, this log book will likely last you for a year or more, depending on how often you pay bills and how detailed your entries are.