Ever dreamt of turning a few bucks into a fortune? You’re not alone. Options trading is the secret sauce many Wall Street gurus use to score big, and now you can too! This crash course breaks down the basics of options trading, from the ground up, so you can understand the lingo and learn to play the game like a pro.

Forget complicated jargon and confusing formulas – we’re keeping it real, keeping it simple, and keeping it fun. Get ready to unlock the power of options trading and watch your portfolio skyrocket!

From the basics of call and put options to mastering strategies like covered calls and bull call spreads, this guide will walk you through everything you need to know. We’ll explore the risks and rewards of each strategy, so you can make informed decisions and avoid any nasty surprises.

Plus, we’ll throw in some real-world examples and a book review of a top options trading guide to give you a head start. So, buckle up, grab your coffee, and get ready to ride the wave of success!

Understanding Options Trading Fundamentals

Options trading can seem like a foreign language at first, but it’s actually a powerful tool that can be used to make money in the market. Just like learning any new skill, it requires a bit of effort and practice, but the potential rewards are well worth it.

Understanding Options Contracts

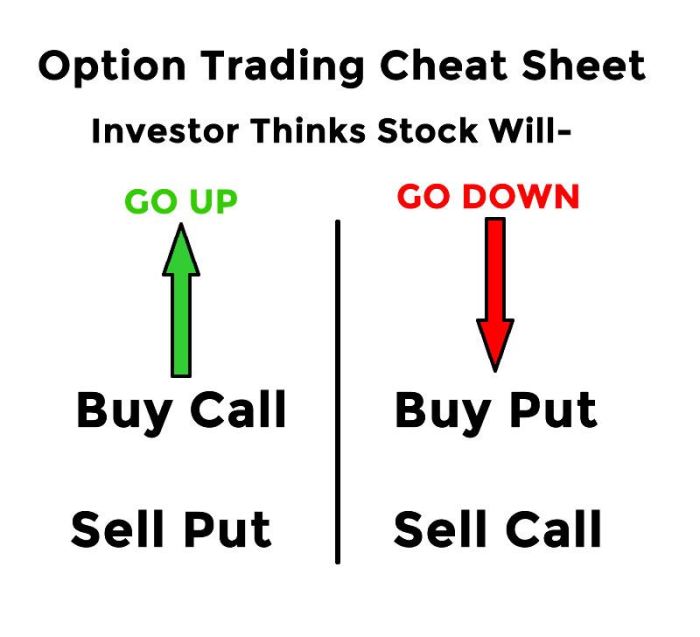

An options contract gives the buyer the right, but not the obligation, to buy or sell an underlying asset (like a stock) at a specific price (the strike price) on or before a certain date (the expiration date). Think of it like a ticket that lets you enter a concert, but you don’t have to go if you don’t want to.There are two main types of options contracts:

- Call optionsgive the buyer the right to buy the underlying asset at the strike price.

- Put optionsgive the buyer the right to sell the underlying asset at the strike price.

The price you pay for an options contract is called the premium. This premium represents the cost of the right to buy or sell the underlying asset.

Intrinsic and Extrinsic Value of Options

The value of an options contract is determined by two factors:

- Intrinsic valueis the difference between the current price of the underlying asset and the strike price. For example, if the stock price is $100 and the strike price is $95, the intrinsic value of a call option would be $5.

Intrinsic value can be positive, negative, or zero.

- Extrinsic valueis the value of the option beyond its intrinsic value. This value is influenced by factors such as time until expiration, volatility of the underlying asset, and interest rates. It represents the potential for the option to increase in value beyond its intrinsic value.

Opening and Closing Options Positions

Opening an options position involves buying or selling an options contract. Closing an options position involves selling or buying back the same contract, effectively reversing the initial transaction.Here’s a step-by-step guide on how to open and close options positions:

- Open a brokerage account: You’ll need an account that allows options trading. Most major online brokerages offer this service.

- Choose an underlying asset: This could be a stock, index, or other asset that you want to trade.

- Select the type of option: Do you want to buy a call or put option?

- Determine the strike price: This is the price at which you want to buy or sell the underlying asset.

- Choose the expiration date: This is the date on which the option expires.

- Place your order: You can place market orders, limit orders, or stop-loss orders.

- Monitor your position: Keep track of the price of the underlying asset and the value of your options contract. If you want to close your position, you can sell your options contract back to the market.

Risks and Rewards of Options Trading

Options trading offers the potential for higher returns than traditional stock trading, but it also comes with greater risks. Here’s a comparison:

| Options Trading | Traditional Stock Trading | |

|---|---|---|

| Potential Returns | Higher | Lower |

| Risks | Higher | Lower |

| Leverage | Higher | Lower |

| Complexity | Higher | Lower |

Options trading can provide a significant advantage in the market, but it’s crucial to understand the risks involved and to have a solid strategy before diving in. Just like anything else in life, the more you practice and learn, the better you’ll become at it.

Mastering Options Strategies for Explosive Income

Options trading offers a world of possibilities beyond just buying and selling stocks. It allows you to leverage your capital and potentially generate significant income. But with great potential comes great responsibility. This section will dive into popular options strategies, breaking down their mechanics, risks, and rewards.

We’ll also explore how to apply these strategies in real-world scenarios to potentially boost your portfolio.

Covered Calls

Covered calls are a popular options strategy for income generation. They involve selling a call option on a stock you already own. By selling a call option, you’re giving the buyer the right, but not the obligation, to purchase your stock at a predetermined price (strike price) on or before the expiration date.In return for selling this right, you receive a premium.

The premium is your profit, and it’s yours to keep regardless of whether the buyer exercises their option.Here’s how it works:* You own 100 shares of XYZ stock at $50 per share.

- You sell one call option contract on XYZ with a strike price of $55 and an expiration date of three months from now.

- You receive a premium of $2 per share, or $200 total.

Now, let’s look at the potential outcomes:* Scenario 1: XYZ stock price stays below $55 at expiration.The call option expires worthless, and you keep the $200 premium.

Scenario 2

XYZ stock price rises above $55 at expiration. The buyer exercises their option, and you are obligated to sell them your 100 shares at the strike price of $55. You still keep the $200 premium, but your profit is capped at $5 per share ($55 strike price

$50 purchase price + $2 premium).

Yo, wanna level up your financial game? “Winning With Options Trading From The Basics To Leveraging The Best Strategies For Explosive Income — A Straightforward Crash Course For Beginners” is your cheat code to making serious cash. Download And Listen Here to unlock the secrets of options trading and start raking in those sweet, sweet profits.

This ain’t your grandma’s investment advice, it’s the real deal, so get ready to win big with options trading!

Risks and Potential Returns

* Limited Profit Potential:Your profit is capped at the premium received plus the difference between the strike price and your purchase price.

Unlimited Loss Potential

If the stock price drops significantly, your losses can exceed the premium received.

Suitability

Covered calls are suitable for investors who believe the underlying stock price will remain relatively stable or even decline slightly. This strategy is also suitable for investors seeking to generate income from their existing stock holdings.

Cash-Secured Puts

Cash-secured puts involve selling a put option and depositing an amount of cash equal to the strike price of the put option into your account. This strategy is also known as a “covered put” because the cash deposited serves as collateral against potential losses.Here’s how it works:* You deposit $5000 into your account.

- You sell one put option contract on XYZ with a strike price of $50 and an expiration date of three months from now.

- You receive a premium of $1 per share, or $100 total.

Now, let’s look at the potential outcomes:* Scenario 1: XYZ stock price stays above $50 at expiration.The put option expires worthless, and you keep the $100 premium.

Scenario 2

XYZ stock price falls below $50 at expiration. The buyer exercises their option, and you are obligated to buy 100 shares of XYZ at the strike price of $50. You still keep the $100 premium, but you’ll need to use the $5000 you deposited to purchase the shares.

Risks and Potential Returns

* Limited Profit Potential:Your profit is capped at the premium received.

Limited Loss Potential

Your maximum loss is limited to the strike price minus the premium received.

You wanna level up your game and make some serious cash with options trading? It’s all about knowing the right moves, and that’s where a crash course comes in handy. Think of it like learning how to use the latest AI tech, like the way Jensen Huang’s Nvidia is powering the future with its mind-blowing processors, Jensen Huang’s Nvidia Processing the Mind of Artificial Intelligence.

Once you’ve got the basics down, you can start using advanced strategies to make those profits explode. It’s all about staying ahead of the curve, just like Nvidia is with AI.

Suitability

Cash-secured puts are suitable for investors who believe the underlying stock price will remain relatively stable or even increase slightly. This strategy is also suitable for investors who are looking to acquire shares of a company at a discounted price.

Bull Call Spreads

A bull call spread is a bullish options strategy that involves buying a call option with a lower strike price and selling a call option with a higher strike price. Both options have the same expiration date.Here’s how it works:* You buy one call option contract on XYZ with a strike price of $50 and an expiration date of three months from now.

- You sell one call option contract on XYZ with a strike price of $55 and an expiration date of three months from now.

- The net premium paid is $2 per share.

Now, let’s look at the potential outcomes:* Scenario 1: XYZ stock price stays below $50 at expiration.Both options expire worthless, and you lose the $200 net premium paid.

Scenario 2

XYZ stock price rises above $55 at expiration. Both options are exercised. You buy 100 shares at $50 and sell 100 shares at $55, resulting in a profit of $3 per share, or $300 total, minus the $200 net premium paid.

Scenario 3

XYZ stock price rises between $50 and $55 at expiration. The lower strike price option is exercised, and you buy 100 shares at $50. The higher strike price option expires worthless. Your profit is limited to the difference between the strike prices minus the net premium paid.

Risks and Potential Returns

* Limited Profit Potential:Your maximum profit is limited to the difference between the strike prices minus the net premium paid.

Limited Loss Potential

Your maximum loss is limited to the net premium paid.

Suitability

Bull call spreads are suitable for investors who believe the underlying stock price will rise but are not confident about the magnitude of the increase. This strategy is also suitable for investors who are looking to reduce the risk of a traditional call option purchase.

Listen up, rookie traders! You wanna level up your game and make some serious dough with options? This course is your one-stop shop, teaching you everything from the basics to advanced strategies. But hey, before you dive into the market, maybe take a minute to check out …

He Dicho!!! ‘Reflexiones de Vida’ (Spanish Edition) for some life wisdom – you might need it when the market gets wild! Once you’re feeling zen, come back and dominate the options game. It’s time to make that money, baby!

Comparison of Options Strategies

| Strategy | Profitability | Risk | Suitability |

|---|---|---|---|

| Covered Calls | Limited, capped at premium + difference between strike price and purchase price | Unlimited loss potential if stock price drops significantly | Investors who believe the underlying stock price will remain relatively stable or even decline slightly. |

| Cash-Secured Puts | Limited, capped at premium received | Limited, maximum loss is strike price minus premium received | Investors who believe the underlying stock price will remain relatively stable or even increase slightly. |

| Bull Call Spreads | Limited, maximum profit is difference between strike prices minus net premium paid | Limited, maximum loss is net premium paid | Investors who believe the underlying stock price will rise but are not confident about the magnitude of the increase. |

Real-World Examples

* Covered Calls:You own 100 shares of Apple (AAPL) stock at $150 per share. You sell one call option contract on AAPL with a strike price of $160 and an expiration date of three months from now. You receive a premium of $3 per share, or $300 total.

If AAPL’s stock price stays below $160 at expiration, you keep the $300 premium. If AAPL’s stock price rises above $160, you are obligated to sell your 100 shares at $160. You still keep the $300 premium, but your profit is capped at $13 per share ($160 strike price$150 purchase price + $3 premium).

Cash-Secured Puts

You deposit $5000 into your account. You sell one put option contract on Tesla (TSLA) with a strike price of $500 and an expiration date of three months from now. You receive a premium of $2 per share, or $200 total.

If TSLA’s stock price stays above $500 at expiration, you keep the $200 premium. If TSLA’s stock price falls below $500, you are obligated to buy 100 shares of TSLA at $500. You still keep the $200 premium, but you’ll need to use the $5000 you deposited to purchase the shares.

Bull Call Spreads

You buy one call option contract on Amazon (AMZN) with a strike price of $2000 and an expiration date of three months from now. You sell one call option contract on AMZN with a strike price of $2100 and an expiration date of three months from now.

The net premium paid is $5 per share. If AMZN’s stock price stays below $2000 at expiration, you lose the $500 net premium paid. If AMZN’s stock price rises above $2100 at expiration, you buy 100 shares at $2000 and sell 100 shares at $2100, resulting in a profit of $95 per share, or $9500 total, minus the $500 net premium paid.

Book Review

Options trading can be a daunting world for beginners. But with the right resources, it can be demystified and made accessible. One book that has gained significant popularity in the options trading community is “The Options Playbook” by Brian Overby.

So, you’re ready to ditch the 9-to-5 grind and become a Wall Street whiz kid? Winning With Options Trading From The Basics To Leveraging The Best Strategies For Explosive Income — A Straightforward Crash Course For Beginners will teach you all the moves.

But hey, even the most hardcore trader needs a break sometimes. Maybe take a breather with some creative fun by checking out Fashion Queen Paper Dolls For Adults Color Cut And Style Paper Dolls Vintage And Modern Also Paper Dolls Made For Girls Ages 8-12.

Once you’ve had your dose of fashion fantasy, it’s back to the charts to learn how to maximize your profits and turn that options trading game into a real money-maker!

Let’s take a deep dive into what makes this book stand out and if it’s the right fit for you.

Strengths and Weaknesses

This book shines in its clear and concise explanations of options trading fundamentals. Overby avoids using overly technical jargon and focuses on breaking down complex concepts into easy-to-understand language. The book is structured in a logical manner, guiding readers through the basics before moving on to more advanced strategies.

- Strengths:

- Clear and concise explanations of options trading fundamentals

- Practical examples and real-world scenarios

- Focus on risk management and minimizing losses

- Well-organized structure and easy-to-follow format

- Weaknesses:

- Limited coverage of advanced options strategies

- May not be comprehensive enough for experienced traders

- Lacks in-depth analysis of market conditions and technical indicators

Target Audience

“The Options Playbook” is an excellent resource for absolute beginners who are new to options trading. It provides a solid foundation for understanding the basics and building a strong base before venturing into more complex strategies.

Comparison to Other Resources

Compared to other options trading books, “The Options Playbook” stands out for its beginner-friendly approach. While some books may delve into advanced strategies and technical analysis, Overby’s book prioritizes simplicity and clarity, making it ideal for those just starting their options trading journey.

Key Takeaways and Actionable Insights

One of the key takeaways from the book is the importance of risk management. Overby emphasizes that options trading can be profitable but also carries inherent risks. He provides practical strategies for managing risk and minimizing potential losses, which is crucial for beginners who are still learning the ropes.

Overall Opinion

“The Options Playbook” is a solid choice for beginners looking to learn the fundamentals of options trading. Its clear explanations, practical examples, and focus on risk management make it a valuable resource for those just starting their journey in the world of options.

However, experienced traders may find the content too basic and lacking in depth.

Concluding Remarks

Options trading can be a wild ride, but with the right knowledge and strategies, it can be a seriously rewarding one. By the time you’re done with this crash course, you’ll have a solid foundation in the basics of options trading and be equipped to explore some of the most powerful strategies out there.

Remember, it’s not about getting rich quick, it’s about building a smart, sustainable, and profitable approach to investing. So, dive in, learn the ropes, and start building your own options trading empire! The future is bright, and it’s yours to conquer!

FAQ Summary

What are the best resources for learning about options trading?

Besides this guide, you can check out online courses, webinars, and books dedicated to options trading. Look for resources that offer real-world examples and practical advice, not just theory.

How much money do I need to start options trading?

You don’t need a ton of money to get started. Start small and gradually increase your investment as you gain experience and confidence. Remember, it’s about building a solid foundation, not making a quick buck.

What are the biggest risks associated with options trading?

Options trading comes with inherent risks, including the potential for losing your entire investment. It’s crucial to understand these risks and manage them effectively. Never invest more than you can afford to lose.