Ready to unlock the secrets of the market makers? Dive into the world of Order Block Order Flow Trading and learn how to read the market like a pro. This ain’t your average trading guide – it’s a complete blueprint for understanding how the big players move the game, and how you can use their strategies to your advantage.

Get ready to level up your trading game with insights on Order Blocks, SMC, BOS, ICT, and more!

This guide breaks down the complex world of order flow and market structure, making it accessible for traders of all levels. We’ll explore how to identify and analyze order blocks, decode market maker strategies, and discover powerful trading setups that capitalize on real-time market movements.

Whether you’re a seasoned veteran or just starting out, this guide will give you the edge you need to make smarter trading decisions and dominate the market.

Understanding Order Flow and Market Making

Imagine the stock market as a bustling marketplace, where buyers and sellers constantly interact to determine the price of a particular stock. Order flow is the lifeblood of this market, representing the continuous stream of buy and sell orders that drive price fluctuations.

Market makers, like the skilled vendors in this marketplace, play a crucial role in facilitating this exchange. They ensure the smooth functioning of the market by providing liquidity and enabling price discovery.

Market Makers: The Backbone of Liquidity

Market makers are specialized financial institutions that act as intermediaries in the financial markets. They provide liquidity by constantly quoting both buy and sell prices for securities, even when there are no immediate buyers or sellers. Their primary goal is to profit from the difference between the buy and sell prices, known as the bid-ask spread.Market makers contribute significantly to the smooth functioning of the financial markets by:

- Providing Liquidity:They constantly quote buy and sell prices, ensuring that traders can easily enter and exit positions, even in volatile market conditions.

- Facilitating Price Discovery:By matching buyers and sellers, market makers contribute to the formation of fair and accurate prices for securities.

- Reducing Transaction Costs:Their presence in the market helps to minimize the bid-ask spread, lowering the cost of trading for investors.

- Stabilizing Prices:By absorbing buy and sell orders, market makers help to prevent extreme price fluctuations and maintain market stability.

Different Types of Market Orders

Market orders are executed immediately at the best available price. They are typically used by traders who want to execute their trades quickly, without specifying a particular price. However, the price at which a market order is executed can be different from the price at which the order was placed.

- Market Buy Order:A market buy order is placed to buy a security immediately at the best available ask price. This type of order is typically used when a trader believes that the price of a security is likely to rise.

- Market Sell Order:A market sell order is placed to sell a security immediately at the best available bid price. This type of order is typically used when a trader believes that the price of a security is likely to fall.

The Interplay of Order Flow, Price Action, and Market Sentiment

Order flow provides valuable insights into the underlying dynamics of the market. By analyzing the flow of buy and sell orders, traders can gain a better understanding of market sentiment and anticipate potential price movements.

- High Volume of Buy Orders:This suggests strong demand for the security, which could lead to a price increase.

- High Volume of Sell Orders:This indicates a strong supply of the security, which could lead to a price decrease.

- Large Institutional Orders:These orders can have a significant impact on price movements, as they represent a substantial amount of capital.

“Understanding order flow is like reading the market’s language. It gives you a glimpse into the collective thinking of traders, helping you to make more informed decisions.”

Identifying and Analyzing Order Block and Order Flow Patterns

Order blocks and order flow patterns are crucial for understanding market dynamics and predicting price movements. By analyzing these patterns, traders can gain insights into the supply and demand forces at play, enabling them to make informed trading decisions. This section delves into the concepts of order blocks and order flow patterns, providing a comprehensive understanding of their formation, identification, and analysis.

Order Block Formation and Identification

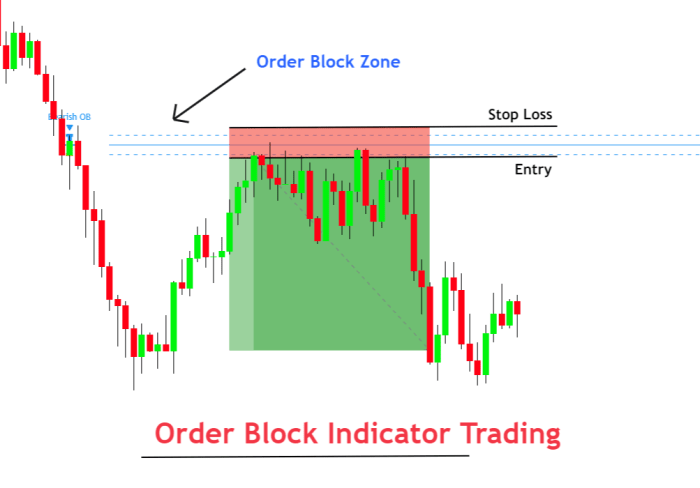

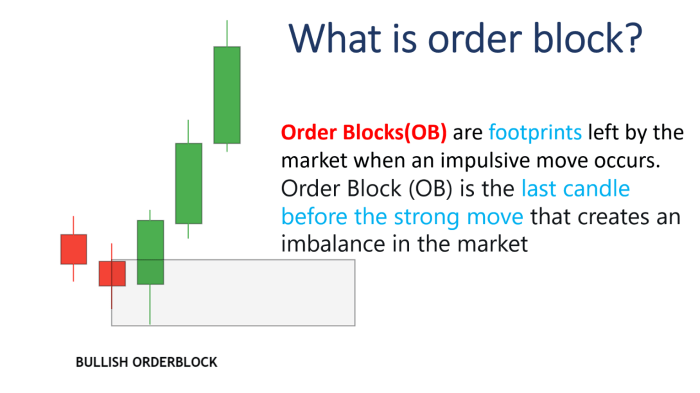

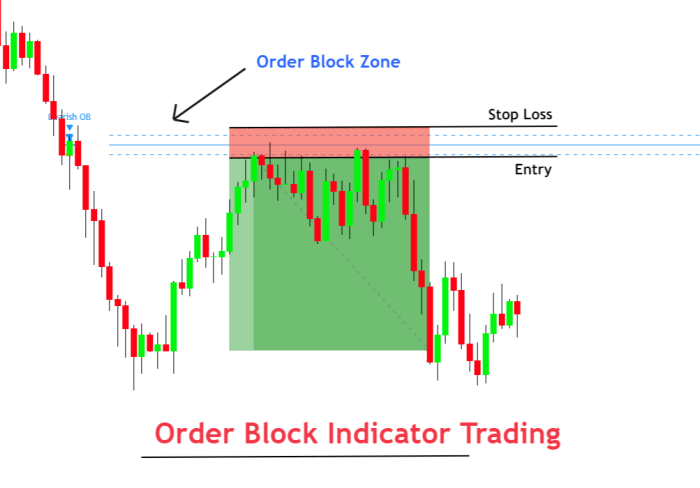

Order blocks represent areas of significant price consolidation, indicating a potential shift in market sentiment. They are formed when price action pauses and consolidates within a defined range, suggesting a potential change in the balance between buyers and sellers.

- Identifying Order Blocks:Order blocks are typically identified on price charts by observing areas of price consolidation, where the price action oscillates within a narrow range. The consolidation period can vary in length, depending on the timeframe being analyzed.

- Types of Order Blocks:There are two main types of order blocks: buy order blocks and sell order blocks.

- Buy Order Blocks:These blocks are formed when the price rallies from a lower level and then consolidates within a defined range. They represent areas where buyers have accumulated a significant amount of liquidity.

- Sell Order Blocks:These blocks are formed when the price drops from a higher level and then consolidates within a defined range. They represent areas where sellers have accumulated a significant amount of liquidity.

Relationship Between Order Blocks and Market Structure

Order blocks are closely tied to market structure, which refers to the overall trend and patterns in price action. Understanding the relationship between order blocks and market structure is crucial for interpreting their significance and making trading decisions.

- Order Blocks as Support and Resistance:Order blocks can act as support and resistance levels, depending on their formation and the surrounding market context.

- Order Blocks in Trending Markets:In trending markets, order blocks can be used to identify potential retracement levels or areas of consolidation before the price resumes its trend.

- Order Blocks in Range-Bound Markets:In range-bound markets, order blocks can be used to identify potential breakout levels or areas of price reversal.

Analyzing Order Flow Patterns

Order flow analysis involves studying the flow of orders in the market, providing insights into the underlying supply and demand dynamics. By understanding order flow patterns, traders can gain a better understanding of the market’s direction and potential price movements.

- Order Flow Indicators:Various indicators can be used to analyze order flow patterns, such as volume, order book depth, and tick data.

- Identifying Order Flow Imbalances:Order flow imbalances occur when there is a significant disparity between buy and sell orders, indicating a potential shift in market sentiment.

- Predicting Price Movements:By analyzing order flow patterns, traders can identify potential price movements, such as breakouts, pullbacks, or reversals.

Trading Strategies Based on Order Flow and Market Structure

Order flow and market structure are powerful tools that can be used to identify potential entry and exit points, and to develop profitable trading strategies. By understanding the dynamics of how orders are placed and executed, traders can gain valuable insights into the market’s direction and momentum.

Identifying Potential Entry and Exit Points

Order flow analysis can be used to identify potential entry and exit points in the market.

- Identifying Liquidity:One of the key concepts in order flow trading is the identification of liquidity. Liquidity refers to the ease with which an asset can be bought or sold. Areas of high liquidity are often characterized by large order blocks, which represent a significant number of orders placed at a particular price level.

Yo, wanna level up your trading game? Get the inside scoop on ORDER BLOCK ORDER FLOW TRADING The Complete Market Makers Trading Guide SMC BOS ICT Order Spitting Liquidity Lower TimeFrame Order Flow Refinning Market Structure Cheat Sheet. It’s all about mastering the market like a pro, from understanding order flow to spotting those sweet, sweet liquidity opportunities.

Download And Listen Here to get your hands on this killer guide and start crushing it in the markets!

When the price approaches a large order block, it is likely to encounter resistance or support, providing a potential entry or exit point.

- Order Flow Indicators:Several order flow indicators can be used to identify potential entry and exit points. These indicators provide real-time insights into the flow of buy and sell orders in the market. For example, volume profile analysis can be used to identify areas of high volume, which often coincide with significant price levels.

Yo, so you’re all about that market action, right? ORDER BLOCK ORDER FLOW TRADING, SMC, BOS, ICT, the whole shebang! But hey, sometimes you gotta chill out, and what better way to do that than with some creative coloring?

Check out Magical Tiny Houses – Volume 2 Relax and dream ‒ a coloring book for adults. , and then you can come back to your charts with a fresh perspective and nail those order flow patterns like a pro!

Market depth indicators can show the number of buy and sell orders at different price levels, providing an indication of the strength of supply and demand.

- Order Flow Patterns:Specific order flow patterns can also be used to identify potential entry and exit points. For example, a “buy stop” order flow pattern suggests that buyers are accumulating the asset, potentially indicating a bullish breakout. Conversely, a “sell stop” order flow pattern suggests that sellers are taking control, potentially indicating a bearish breakdown.

Breakout and Breakdown Strategies

Breakout and breakdown strategies are commonly used in order flow trading.

- Breakout Trading:Breakout trading involves entering a trade when the price breaks above a resistance level. Order flow analysis can help identify potential breakout points by looking for areas of high liquidity, such as large order blocks, and observing order flow patterns that suggest a shift in momentum.

For example, a strong volume surge accompanying a price breakout above a resistance level can indicate a strong buying pressure and a potential bullish trend.

- Breakdown Trading:Breakdown trading involves entering a trade when the price breaks below a support level. Similar to breakout trading, order flow analysis can help identify potential breakdown points by looking for areas of high liquidity and observing order flow patterns that suggest a shift in momentum.

For example, a significant decrease in volume accompanying a price breakdown below a support level can indicate a lack of buying interest and a potential bearish trend.

Market Structure Validation

Market structure plays a crucial role in validating trading decisions based on order flow analysis.

- Higher Timeframe Confirmation:Validating trading decisions with higher timeframe market structure helps ensure that the current price action is aligned with the overall trend. For example, if a potential breakout is identified on a lower timeframe chart, but the higher timeframe chart shows a bearish trend, it might be prudent to avoid the trade.

Higher timeframe confirmation provides a broader context for the current price action and reduces the risk of entering a trade against the overall trend.

- Key Levels and Patterns:Market structure analysis helps identify key levels, such as support and resistance, and patterns, such as double tops and bottoms. These levels and patterns can provide further validation for order flow-based trading decisions. For example, if a breakout is identified above a resistance level that has been tested multiple times, it is likely to be more significant than a breakout above a randomly chosen price level.

Real-World Trading Setups

- Example 1: Bullish Breakout:Imagine a scenario where the price of a stock is trading near a resistance level. Order flow analysis reveals a large order block at this level, suggesting a significant amount of selling pressure. However, a sudden surge in volume accompanies a breakout above the resistance level, indicating a strong buying pressure.

This pattern, coupled with a bullish trend on the higher timeframe chart, suggests a strong bullish breakout. A trader might consider entering a long position at the breakout point, targeting the next resistance level.

- Example 2: Bearish Breakdown:Consider a scenario where the price of a stock is trading near a support level. Order flow analysis reveals a large order block at this level, suggesting a significant amount of buying pressure. However, a sharp decline in volume accompanies a breakdown below the support level, indicating a lack of buying interest.

Trading the markets can be a real rollercoaster ride, yo! You’re constantly analyzing charts, deciphering order flow, and trying to predict the next big move. But hey, even the most hardcore traders need a break to chill out, right?

Sometimes, it’s good to step away from the screens and unwind with a good old-fashioned coloring book, like Easy Large Print Color by Number Coloring Book For Adults BLACK BACKGROUND Simple Numbered Designs For Relaxation. Once you’ve got your zen on, you can jump back into the game with a fresh perspective and maybe even spot some new patterns in the order flow.

This pattern, coupled with a bearish trend on the higher timeframe chart, suggests a strong bearish breakdown. A trader might consider entering a short position at the breakdown point, targeting the next support level.

Book Review

Yo, traders! Let’s talk about “The Order Flow Bible” by Mike Bellafiore, a book that’s been a game-changer for many in the trading world. It’s like the ultimate guide to understanding how the market moves, and it’s chock-full of insights that can help you level up your trading game.

Strengths of “The Order Flow Bible”

This book is a real powerhouse when it comes to order flow trading. It dives deep into the psychology of market makers, the players who control the flow of orders, and how they influence price action. Bellafiore breaks down the concepts in a clear and engaging way, making it easy to grasp even if you’re a newbie.

Here are some of the key strengths:

- Practical and actionable insights:This book doesn’t just throw theory at you. It provides practical strategies and techniques that you can actually apply to your trading. Bellafiore gives you real-world examples and scenarios to help you understand how order flow patterns play out in different market conditions.

- Focus on market structure:“The Order Flow Bible” emphasizes the importance of understanding market structure, which is crucial for making informed trading decisions. It teaches you how to identify key levels, support and resistance, and how these elements influence price movement.

- Emphasis on risk management:Bellafiore understands that trading is risky, and he doesn’t shy away from that fact. He provides solid advice on risk management strategies, helping you protect your capital and avoid costly mistakes.

Weaknesses of “The Order Flow Bible”

While “The Order Flow Bible” is a valuable resource, it’s not without its flaws.

Yo, if you’re looking to level up your trading game, ORDER BLOCK ORDER FLOW TRADING is the real deal. It’s like having the market makers’ cheat sheet right in your hands, with all the secrets about SMC, BOS, ICT, order spitting, liquidity, and the whole shebang.

It’s all about timing, and that’s where “Borrowed Time” Borrowed Time comes in. Think of it as the ticking clock of the market, and knowing how to read it is crucial for making those winning trades. So, if you want to be a trading ninja, get your hands on this guide and start reading those tea leaves!

- Can be overwhelming for beginners:Some of the concepts in the book can be quite complex, especially for traders who are new to order flow analysis. The sheer amount of information might feel overwhelming at times.

- Focus on institutional trading:The book’s emphasis on market makers and institutional trading might not be as relevant for retail traders who don’t have access to the same level of data and tools.

Comparison to Other Order Flow Trading Methodologies

“The Order Flow Bible” takes a more comprehensive approach to order flow trading compared to other methodologies. It goes beyond just identifying order flow patterns and focuses on understanding the underlying market dynamics that drive price action. This holistic perspective makes it a valuable resource for traders who want to develop a deeper understanding of the market.

Personal Insights and Recommendations

I highly recommend “The Order Flow Bible” to any trader who wants to take their game to the next level. It’s a valuable resource for both beginners and experienced traders. However, it’s important to remember that order flow trading is not a get-rich-quick scheme.

It takes time, effort, and dedication to master the concepts and techniques. Be patient, stay disciplined, and keep learning!

Last Word

By mastering the art of Order Block Order Flow Trading, you’ll be able to spot opportunities that others miss, anticipate price movements, and execute trades with confidence. This guide is your secret weapon for navigating the dynamic world of financial markets, giving you the tools and knowledge to become a more successful and profitable trader.

So buckle up, it’s time to level up your trading game!

Answers to Common Questions

What is the difference between an order block and a support/resistance level?

An order block is a specific area of price action where a significant amount of orders were placed, creating a visible zone of price consolidation. Support/resistance levels are broader areas where price has historically reversed, but they don’t necessarily indicate a specific order block formation.

How can I use order flow to identify potential entry and exit points?

Order flow analysis helps identify areas where market makers are likely to be accumulating or distributing liquidity. Entry points can be found near order blocks, especially when price breaks through them. Exit points can be identified by looking for signs of liquidity depletion or a change in market sentiment.

What are some common order flow patterns to look for?

Some common patterns include:

- Breakouts and breakdowns from order blocks

- Liquidity imbalances, where one side of the market is stronger than the other

- Fakeouts and traps, where market makers manipulate price to lure traders into bad trades

What are some of the best resources for learning more about order flow trading?

Besides this guide, there are many great resources available online and in print. You can find valuable information from traders who specialize in order flow analysis, as well as educational platforms and courses dedicated to this trading style.