Ready to level up your investing game? Fundamental analysis is your secret weapon for uncovering the hidden gems in the stock market. This powerful approach goes beyond just looking at charts and trends, diving deep into a company’s financial health, competitive landscape, and growth potential.

By mastering the art of reading financial statements, calculating key ratios, and applying valuation methodologies, you’ll gain the confidence to make informed investment decisions that align with your goals.

Think of it like this: you wouldn’t buy a house without inspecting it first, right? The same logic applies to investing. Fundamental analysis is your home inspection toolkit, helping you assess a company’s true worth and identify whether it’s a solid investment or a potential red flag.

This guide will walk you through the essential tools and techniques you need to become a savvy fundamental analyst, empowering you to navigate the market with confidence.

Understanding the Fundamentals of Company Valuation

Think of fundamental analysis as a detective’s toolkit for uncovering a company’s true worth. It’s about digging deep into a company’s financials, operations, and market position to determine if its stock price reflects its real value. You’re not just looking at the surface, but peeling back the layers to see what’s really going on.

Intrinsic Value: The Real Deal

Intrinsic value is like the secret sauce of fundamental analysis. It’s the true worth of a company, independent of its current market price. It’s like knowing the true value of a rare baseball card, even if it’s currently selling for less.

Like Don Juan’s teachings on seeing the world differently, mastering fundamental analysis is about unlocking a deeper understanding of companies. It’s not just about crunching numbers, it’s about gaining a real feel for a company’s health and potential. By reading financial statements and calculating ratios, you can discover hidden insights, just like reading The Teachings of Don Juan A Yaqui Way of Knowledge reveals a different perspective on reality.

With this knowledge, you can set a buy target that’s based on a solid understanding of the company’s value, not just a gut feeling.

This value is based on a company’s future earnings potential, its assets, and its ability to generate cash flow.

Different Valuation Methodologies: Choosing the Right Tool

Just like a detective has different tools for their investigation, fundamental analysts use different methods to estimate a company’s intrinsic value.

Discounted Cash Flow (DCF) Analysis: Predicting the Future

DCF analysis is like a time machine, projecting a company’s future cash flows and discounting them back to the present value. It’s a popular method because it focuses on the company’s future earnings potential. Imagine you’re investing in a lemonade stand.

You’d want to know how much lemonade they’ll sell in the future, right? DCF helps you figure that out.

You know, diving into the nitty-gritty of financial statements, crunching numbers, and figuring out a company’s worth can feel like scaling a mountain. It’s all about conquering those peaks of information, just like those hardcore climbers featured in Rites of Passage The Legacy of Adventure Climbing in the Sierra Nevada.

But once you reach the top, you get a whole new perspective on the company’s potential, and that’s where the real gold is.

Comparable Company Analysis: Comparing Apples to Apples

This method compares a company to its peers in the same industry. It’s like comparing the price of a burger at different restaurants. You’re looking for companies with similar characteristics and then using their market multiples (like price-to-earnings ratio) to estimate the target company’s value.

Precedent Transactions: Looking Backwards for Insights

This method analyzes past acquisitions of similar companies to determine what price they were bought for. It’s like looking at past real estate transactions to get an idea of what your house is worth. This approach can provide insights into how the market values similar companies.

You know, crunching numbers and dissecting financial statements isn’t just for Wall Street suits. It’s about digging into the truth, uncovering the story behind the numbers. Kinda like reading about Robert F. Kennedy Jr.’s journey in the Robert F. Kennedy Jr.

Biography Book The Untold Saga of Robert Francis Kennedy Jr. (Quest for Truth and Change) , you’re looking for the hidden truths, the motives behind the actions. And just like those financial ratios can paint a picture of a company’s health, understanding the underlying narrative helps you make informed decisions, whether it’s about investing or just navigating the world around you.

Assessing a Company’s Competitive Advantage: Finding the Edge

A company’s competitive advantage is its ability to outperform its competitors. It’s like having a secret weapon that gives you an edge in the market. This advantage could be a strong brand, a unique product or service, a cost advantage, or a strong management team.

Long-Term Growth Potential: Building a Future

A company’s long-term growth potential is its ability to expand its business and generate profits in the future. It’s like knowing if a company can continue to grow and sell more lemonade. This potential can be driven by factors like market growth, new product development, or expanding into new markets.

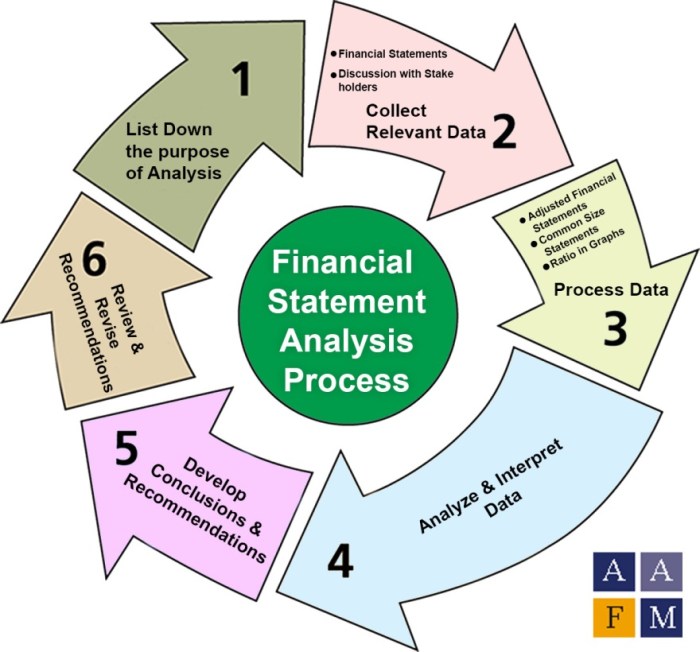

Mastering Financial Statement Analysis

Okay, so you’re ready to dive into the nitty-gritty of a company’s financials. It’s like being a financial detective, looking for clues to understand how a company is doing. Financial statements are the language of business, and learning to read them is essential for making smart investment decisions.

Understanding the Key Components of Financial Statements

Think of financial statements as a company’s report card, giving you a snapshot of its financial health. There are three main statements: the balance sheet, the income statement, and the cash flow statement. Each one tells a different part of the story.

- The Balance Sheet:This statement is like a company’s financial photograph, showing its assets, liabilities, and equity at a specific point in time. It follows the fundamental accounting equation: Assets = Liabilities + Equity.

- Assetsare what a company owns, like cash, inventory, and buildings.

They’re the resources a company uses to generate revenue.

- Liabilitiesare what a company owes to others, such as loans, accounts payable, and deferred revenue.

- Equityrepresents the ownership stake in the company. It’s the difference between assets and liabilities, reflecting the value of the company’s net worth.

- Assetsare what a company owns, like cash, inventory, and buildings.

- The Income Statement:This statement shows a company’s financial performance over a period of time, usually a quarter or a year. It tells you how much revenue a company generated and what its expenses were, ultimately showing its net income (profit) or loss.

The basic formula is: Revenue

Expenses = Net Income.

- Revenueis the money a company earns from selling its products or services.

- Expensesare the costs associated with generating that revenue, including things like salaries, rent, and utilities.

- Net Incomeis the bottom line, showing the company’s profitability.

- The Cash Flow Statement:This statement tracks the movement of cash in and out of a company over a period of time. It helps you understand how a company generates cash, where it spends it, and how much cash it has on hand. It breaks down cash flows into three main categories:

- Operating Activities: Cash flows from the company’s core business operations, like sales and expenses.

- Investing Activities: Cash flows related to buying or selling long-term assets, like property, plant, and equipment (PP&E).

- Financing Activities: Cash flows related to debt, equity, and dividends.

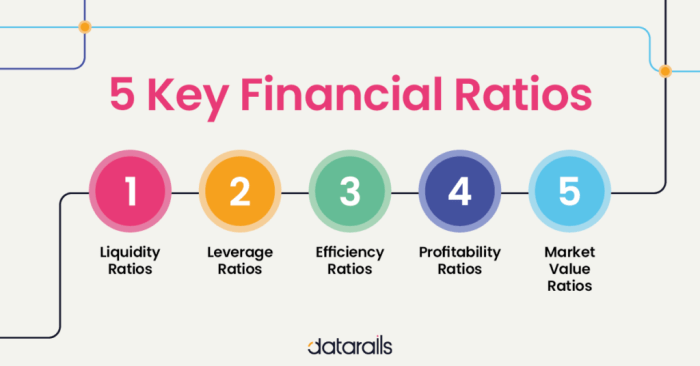

Common Financial Ratios

Financial ratios are like a magnifying glass, allowing you to zoom in on specific aspects of a company’s financial health. They help you compare a company to its competitors or to its own historical performance. Here are some common financial ratios:

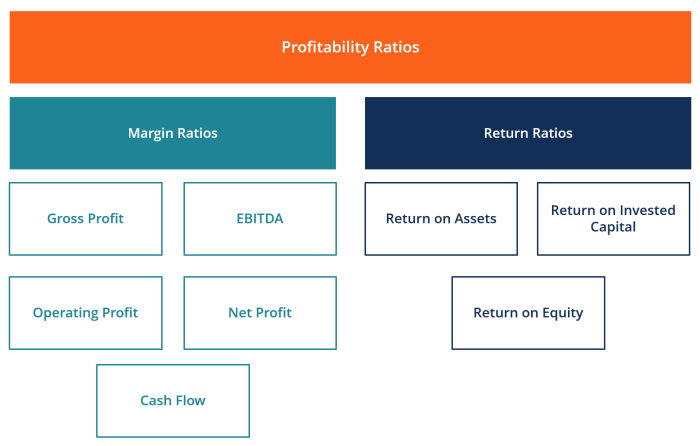

- Profitability Ratios: These ratios measure a company’s ability to generate profits from its operations.

- Gross Profit Margin:(Gross Profit / Revenue) – 100

- Operating Profit Margin:(Operating Income / Revenue) – 100

- Net Profit Margin:(Net Income / Revenue) – 100

- Liquidity Ratios: These ratios measure a company’s ability to meet its short-term obligations.

- Current Ratio:Current Assets / Current Liabilities

- Quick Ratio:(Current Assets – Inventories) / Current Liabilities

- Solvency Ratios: These ratios measure a company’s ability to meet its long-term obligations.

- Debt-to-Equity Ratio:Total Debt / Total Equity

- Times Interest Earned Ratio:Operating Income / Interest Expense

- Efficiency Ratios: These ratios measure how efficiently a company uses its assets to generate revenue.

- Inventory Turnover Ratio:Cost of Goods Sold / Average Inventory

- Days Sales Outstanding (DSO):(Average Accounts Receivable / Revenue) – 365

Interpreting Financial Ratios

Okay, so you’ve got your ratios, but what do they mean? Here’s a table showing some common interpretations:

| Ratio | Interpretation |

|---|---|

| Gross Profit Margin | A higher margin indicates a company is more efficient at managing its costs of goods sold. |

| Operating Profit Margin | A higher margin indicates a company is more efficient at managing its overall operating expenses. |

| Net Profit Margin | A higher margin indicates a company is more profitable overall. |

| Current Ratio | A ratio of 2 or higher is generally considered healthy, indicating a company has enough liquid assets to cover its short-term liabilities. |

| Quick Ratio | A ratio of 1 or higher is generally considered healthy, indicating a company has enough liquid assets to cover its short-term liabilities without relying on inventory. |

| Debt-to-Equity Ratio | A lower ratio indicates a company has less debt relative to its equity, which is generally considered a sign of financial strength. |

| Times Interest Earned Ratio | A higher ratio indicates a company has more than enough earnings to cover its interest expenses. |

| Inventory Turnover Ratio | A higher ratio indicates a company is efficiently managing its inventory, selling it quickly. |

| Days Sales Outstanding (DSO) | A lower DSO indicates a company is collecting its receivables quickly. |

Interpreting Financial Statements and Identifying Potential Red Flags

Alright, let’s break down how to analyze financial statements like a pro:

- Read the Management Discussion and Analysis (MD&A):This section provides insights into the company’s performance and its future outlook. It’s like the CEO’s letter to shareholders, giving you a sense of their priorities and strategies.

- Look for Trends:Analyze financial statements over time to identify trends. Is revenue growing?

Are profits increasing? Are expenses under control? Look for any changes or anomalies that might raise questions.

- Compare to Industry Benchmarks:Compare the company’s financial ratios to industry averages. This gives you a sense of how the company stacks up against its peers.

- Identify Potential Red Flags:Watch out for warning signs like:

- Declining Revenue or Profits:This could indicate a struggling business.

- Rising Debt Levels:A high debt-to-equity ratio can indicate a company is taking on too much risk.

- Falling Liquidity:A low current ratio or quick ratio could mean a company is having trouble meeting its short-term obligations.

- Inventory Buildup:A high inventory turnover ratio could indicate unsold inventory or poor demand for the company’s products.

- Slowing Receivables Collection:A high DSO could mean customers are taking longer to pay their bills, which can strain cash flow.

- Don’t Rely on Just One Statement:Analyze all three statements together to get a complete picture of the company’s financial health.

Setting a Buy Target and Making Investment Decisions

Setting a buy target is a crucial step in the investment process, as it helps determine the price at which you’re willing to buy a company’s stock. This target should be based on a thorough fundamental analysis of the company, considering various factors like its financial health, industry trends, and future prospects.

Factors to Consider When Setting a Buy Target

Setting a buy target requires careful consideration of several factors. This involves understanding the company’s intrinsic value, its potential growth trajectory, and the market’s perception of its worth.

- Intrinsic Value:This represents the true value of a company based on its underlying fundamentals. It can be determined using various valuation methodologies, such as discounted cash flow (DCF) analysis, which considers the present value of future cash flows, or comparable company analysis, which compares the company to its peers.

Want to level up your investing game? Mastering fundamental analysis is key, and it’s all about digging into a company’s financials, like reading a financial statement like a boss, calculating ratios that make your head spin, and setting a buy target that’s hotter than a summer blockbuster.

Want to get a jumpstart? Download And Listen Here to some epic insights that will have you analyzing like a pro in no time. Fundamental analysis is your secret weapon to making smart investment decisions that’ll have you saying “cha-ching!” in no time.

- Growth Potential:Assessing the company’s future growth prospects is crucial. Consider factors like market share, new product launches, and expansion plans. A company with a strong growth trajectory is likely to command a higher valuation.

- Market Sentiment:Market sentiment can significantly influence a stock’s price. A positive market outlook or favorable news about the company can boost its stock price, while negative sentiment can have the opposite effect.

- Risk Tolerance:Your own risk tolerance plays a crucial role in setting a buy target. If you’re a risk-averse investor, you might set a lower buy target, while a more aggressive investor might be willing to pay a premium for a company with high growth potential.

Valuation Methodologies

Different valuation methodologies offer unique perspectives on a company’s worth. Each approach has its strengths and weaknesses, and choosing the right method depends on the specific company and investment goals.

- Discounted Cash Flow (DCF) Analysis:This method calculates the present value of a company’s future cash flows. It’s considered a more rigorous approach but requires assumptions about future growth rates and discount rates.

- Comparable Company Analysis:This method compares the company’s valuation metrics, such as price-to-earnings ratio (P/E), to those of similar companies in the same industry. It’s relatively simple to implement but relies on the assumption that comparable companies are truly comparable.

- Precedent Transactions:This method analyzes the prices paid in recent acquisitions of similar companies. It provides a market-based valuation but can be limited by the availability of comparable transactions.

Real-World Investment Scenarios

Fundamental analysis can be applied to real-world investment scenarios to make informed decisions. Let’s consider two examples:

- Example 1: Investing in a Growth Stock:Suppose you’re considering investing in a tech company that’s rapidly growing its market share. You could use DCF analysis to estimate the company’s intrinsic value based on its projected future cash flows. You could also compare its valuation metrics to those of other tech companies to see if it’s trading at a discount.

- Example 2: Investing in a Value Stock:If you’re interested in a company with a low P/E ratio and a strong track record of profitability, you could use comparable company analysis to determine if it’s undervalued relative to its peers. You could also assess the company’s financial health and management team to ensure it’s a sound investment.

Risk Management and Due Diligence

Risk management and due diligence are crucial aspects of any investment decision.

- Risk Management:Diversification is a key risk management strategy. Don’t put all your eggs in one basket. Invest in a range of assets to mitigate the impact of any single investment performing poorly.

- Due Diligence:Before making any investment, conduct thorough due diligence. This involves researching the company’s financials, management team, industry, and competitors. You can also consult with financial advisors or analysts for additional insights.

Book Review: “The Intelligent Investor” by Benjamin Graham

“The Intelligent Investor” by Benjamin Graham is a classic in the world of finance, offering a timeless framework for long-term investing. Graham, often referred to as the “father of value investing,” lays out a disciplined approach to stock market investing, emphasizing a focus on intrinsic value and a healthy dose of skepticism.

Key Principles of Value Investing

Graham’s book emphasizes a methodical approach to investing, urging investors to analyze companies meticulously before making any investment decisions. This involves a deep dive into a company’s financial statements, its industry, and its management.

- Focus on Intrinsic Value:Graham defines intrinsic value as the true worth of a company, independent of market fluctuations. He argues that investors should aim to buy stocks trading below their intrinsic value, creating a margin of safety.

- Margin of Safety:This principle is central to Graham’s philosophy. It emphasizes buying stocks at a price significantly lower than their estimated intrinsic value. This cushion protects investors from potential losses due to market volatility or unexpected events.

- Mr. Market:Graham personifies the market as a fickle and sometimes irrational entity, offering investors opportunities to buy undervalued stocks when Mr. Market is in a pessimistic mood.

- Long-Term Perspective:Graham stresses the importance of investing for the long haul, avoiding short-term market speculation and focusing on the fundamental value of businesses.

Market Psychology and Margin of Safety

Graham recognized that market psychology often drives stock prices, leading to irrational exuberance or excessive pessimism. He emphasizes the importance of maintaining a rational mindset, avoiding the emotional pitfalls of market speculation, and focusing on the long-term value of businesses.

The margin of safety acts as a buffer against these emotional swings, allowing investors to ride out market volatility and capitalize on opportunities.

Real-World Applications

Graham’s principles have been applied by successful investors for decades, including Warren Buffett, who credits Graham as his mentor. For example, Buffett’s investment in Coca-Cola in the 1980s exemplifies Graham’s approach. He recognized the company’s strong brand, dominant market share, and potential for growth, purchasing shares at a significant discount to their intrinsic value.

Strengths and Limitations

“The Intelligent Investor” is lauded for its clarity, practicality, and timeless wisdom. It provides a comprehensive framework for value investing, applicable across various market cycles. However, the book’s focus on fundamental analysis and a conservative approach may not be suitable for all investors.

It also doesn’t delve deeply into modern investment strategies, such as growth investing or quantitative analysis.

Outcome Summary

By mastering the principles of fundamental analysis, you’ll equip yourself with the knowledge and skills to identify undervalued companies, make informed investment decisions, and potentially unlock significant returns. Remember, it’s not just about chasing the next hot stock – it’s about understanding the underlying value of a company and making calculated bets based on solid data.

So, dive into the world of financial statements, ratios, and valuation methodologies – you might be surprised by what you discover.

Commonly Asked Questions

What is the difference between fundamental analysis and technical analysis?

Fundamental analysis focuses on a company’s financial health and intrinsic value, while technical analysis uses charts and patterns to predict future price movements based on past market data. Think of it as comparing a company’s balance sheet to its stock chart.

How can I learn more about fundamental analysis?

There are tons of resources available, including online courses, books, and financial blogs. Start with “The Intelligent Investor” by Benjamin Graham, a classic guide to value investing. You can also find helpful tutorials and articles on websites like Investopedia and Seeking Alpha.

Is fundamental analysis a guaranteed way to make money?

No, investing always involves risk. Even the most thorough fundamental analysis doesn’t guarantee profits. However, it significantly improves your odds of making informed investment decisions and minimizing potential losses.