Tired of feeling overwhelmed by debt? Ready to take control of your finances and finally kiss those bills goodbye? You’re not alone! Millions of people struggle with debt, but there’s a powerful tool that can help you conquer it: a debt payoff planner and tracker.

Think of it as your secret weapon to fight financial stress. It’s like having a personal financial coach in your pocket, guiding you through the process of smashing your debt goals. It’s not just about numbers; it’s about taking charge of your future and achieving financial freedom.

The Power of Debt Management Tools

![]()

Debt can be a heavy burden, both financially and emotionally. But you don’t have to go through it alone. Debt management tools can be your secret weapon to fight back and take control of your finances.

The Psychological Benefits of Debt Management Tools

Using a debt payoff planner and tracker can have a profound impact on your mental well-being. Seeing your progress in black and white can be incredibly motivating. It can help you stay focused and avoid the feeling of being overwhelmed by debt.

Imagine the satisfaction of crossing off each payment as you inch closer to your debt-free goal. It’s like leveling up in a video game, but instead of virtual rewards, you’re winning real financial freedom!

The Financial Benefits of Debt Management Tools

Beyond the mental boost, debt management tools can also save you a ton of money. These tools help you:

- Track your spending:By carefully monitoring your income and expenses, you can identify areas where you can cut back and free up more cash for debt repayment. Think of it like a personal finance detective, uncovering hidden spending habits that could be holding you back.

- Prioritize your debts:Knowing which debts to tackle first can make a huge difference in your overall debt reduction strategy. Debt management tools help you strategize and optimize your payments, maximizing your progress and minimizing interest charges. Think of it like a master plan for your financial freedom, guiding you towards the most efficient path to debt-free living.

- Stay on track:Life gets busy, and it’s easy to lose sight of your debt goals. A debt payoff planner and tracker can help you stay organized and accountable. It’s like having a personal cheerleader reminding you to keep moving forward, one payment at a time.

Real-World Examples of Success

- Sarah, a single mom, was drowning in credit card debt.She used a debt snowball planner to prioritize her debts and create a clear plan. By sticking to her plan, she was able to pay off all her credit card debt in just 18 months. Now, she has a stable financial foundation and is able to save for her daughter’s college education.

So, you’re crushing those debt goals with your trusty Debt Payoff Planner, right? Maybe you’re even thinking about celebrating with a little ink. If so, you might wanna check out Tribal Tattoo Designs Book Over 1100 Ideas Tribal Tattoo Designs for Real Tattoos Professional and Amateur Artists ( Minimal and Big Designs For Women and Men ) for some serious inspiration.

Then, get back to those spreadsheets and conquer that debt! You got this!

It’s a classic “from rags to riches” story, but instead of riches, Sarah found financial freedom and a brighter future for her family.

- John, a young professional, was struggling to manage his student loan debt.He started using a debt tracker to track his payments and visualize his progress. Seeing the balance decrease each month gave him the motivation to keep pushing forward. After a few years of consistent effort, he was finally debt-free.

Now, he can focus on building his savings and achieving his long-term financial goals. It’s a testament to the power of persistence and the importance of having a clear vision for your financial future.

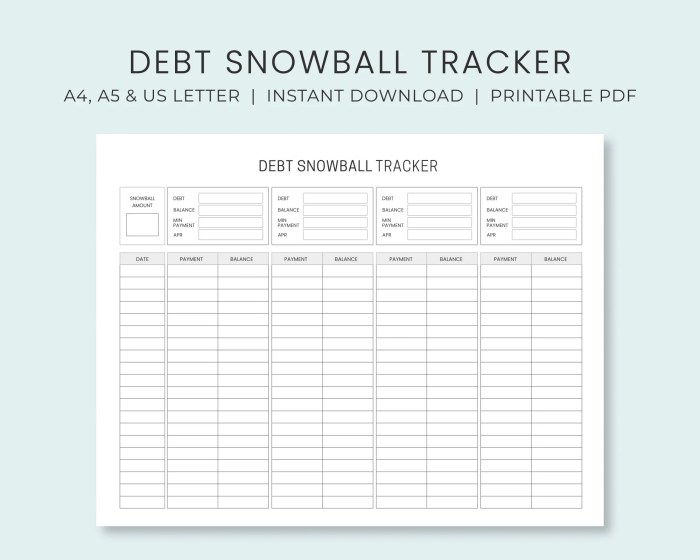

Key Features of a Debt Payoff Planner and Tracker

Debt payoff planners and trackers are essential tools for anyone looking to take control of their finances and achieve financial freedom. These tools provide a structured approach to managing debt, allowing you to visualize your progress and stay motivated throughout the journey.

Debt Listing and Categorization

A key feature of a debt payoff planner is the ability to list and categorize all your debts. This helps you gain a clear understanding of your overall debt situation and identify areas where you might be able to make changes.

By categorizing your debts, you can easily track your progress in each category and see how your overall debt load is shrinking.

Interest Rate Tracking

Interest rates play a significant role in the overall cost of debt. A good debt payoff planner will allow you to track the interest rates associated with each of your debts. This information is crucial for making informed decisions about which debts to prioritize.

Payment Scheduling and Tracking

Debt payoff planners help you create a schedule for making payments on your debts. They allow you to track your actual payments and compare them to your planned payments. This feature helps you stay on track with your debt repayment goals and avoid late fees.

Debt Reduction Strategies

There are two main debt reduction strategies: the snowball method and the avalanche method.

Yo, wanna get your finances in tip-top shape? This Debt Payoff Planner and Payment Tracker is like your own personal money guru, helping you crush those bills with a killer strategy. Want to learn more about how to slay your debt?

Download And Listen Here for some serious financial motivation. This Debt Payoff Planner is your ultimate weapon to conquer debt and achieve financial freedom, so you can finally chill out and enjoy life!

- The snowball method involves focusing on paying off the smallest debts first, regardless of their interest rates. This method can be motivating because you get to see quick wins, which can help you stay on track.

- The avalanche method prioritizes paying off debts with the highest interest rates first. This method can save you more money in the long run, but it might be less motivating in the early stages because you might not see as much progress on your largest debts.

Financial Progress Visualization

A debt payoff planner can help you visualize your progress by using charts and graphs. These visual representations can make it easier to see how your debt is shrinking over time and how your financial situation is improving.

Physical Logbook vs. Digital App

There are advantages and disadvantages to using a physical logbook versus a digital app for debt tracking.

- A physical logbook offers a tangible and tactile experience, allowing you to write down your debt information and track your progress manually. This can be a more personal and satisfying approach for some individuals. However, physical logbooks can be prone to loss or damage, and they might not be as easily updated or shared as digital apps.

- Digital apps provide a more convenient and accessible way to track debt. They offer features such as automated calculations, reminders, and data visualization, making it easier to stay organized and motivated. Digital apps can also be easily shared with financial advisors or partners, facilitating collaboration and transparency.

However, digital apps require a smartphone or computer and rely on internet connectivity, which can be a limitation for some individuals.

Popular Debt Payoff Planner and Tracker Apps

| App Name | Key Features | Pricing |

|---|---|---|

| Mint | Budgeting, bill tracking, debt tracking, credit monitoring | Free |

| Personal Capital | Financial planning, investment tracking, debt tracking, net worth tracking | Free |

| EveryDollar | Budgeting, debt tracking, financial coaching | Free with a paid subscription option |

| YNAB (You Need a Budget) | Budgeting, debt tracking, financial planning | Paid subscription |

| Debt.com | Debt consolidation, debt management, credit counseling | Free with a paid subscription option for debt management services |

Using a Debt Payoff Planner and Tracker Effectively

You’ve got the tools, now it’s time to put them to work! A debt payoff planner and tracker isn’t just a pretty notebook, it’s your secret weapon to conquering debt. Think of it like your personal financial coach, guiding you every step of the way.

Tracking Expenses and Income Accurately

The foundation of any successful debt payoff plan is accurate tracking. You can’t fight what you can’t see! It’s like trying to win a game of hide-and-seek without knowing where everyone is hiding. Start by keeping a detailed record of every dollar that comes in and goes out.

This might seem tedious, but trust me, it’s a game-changer. Think of it as a financial diary, documenting your financial journey.

- Use a budgeting app, a spreadsheet, or even a good old-fashioned notebook. The key is to find a method that works for you and that you’ll actually use.

- Be honest with yourself. It’s easy to forget about those little “extra” purchases, like that $5 latte or the impulse buy at the grocery store. But these little expenses can add up quickly.

- Categorize your expenses. This will help you see where your money is going and identify areas where you can cut back.

Allocating Payments to Different Debts

Now that you know where your money is going, it’s time to decide how to allocate it. This is where your debt payoff planner comes in handy. It’s like having a roadmap to financial freedom.

- List out all your debts, including the balance, interest rate, and minimum payment.

- Decide on a debt payoff strategy. There are two popular methods: the debt snowball method and the debt avalanche method.

- The debt snowball method involves paying off the smallest debt first, while making minimum payments on the others. This method provides early wins and can help boost motivation.

- The debt avalanche method focuses on paying off the debt with the highest interest rate first. This method saves you the most money in the long run.

- Once you’ve chosen a strategy, create a payment schedule.

Staying Motivated and Celebrating Milestones

Paying off debt can be a long and challenging journey. But it’s important to stay motivated and celebrate your progress along the way. Think of it like training for a marathonyou don’t just show up on race day and expect to win.

You need to put in the work and celebrate each milestone.

- Set realistic goals. Don’t try to pay off all your debt overnight. Start with small, achievable goals, like paying off one credit card or making an extra payment on your student loan.

- Find a debt payoff buddy. Having someone to share your journey with can make it more fun and motivating.

- Reward yourself for reaching milestones. Treat yourself to a nice dinner, a new book, or a weekend getaway. Just make sure your rewards are within your budget!

Creating a Personalized Debt Reduction Plan

Ready to get started? Here’s a step-by-step guide to creating a personalized debt reduction plan using your planner or tracker:

- Gather your financial information. This includes your income, expenses, and debt balances.

- Calculate your net income. This is your income minus your expenses.

- List out all your debts, including the balance, interest rate, and minimum payment.

- Choose a debt payoff strategy (debt snowball or debt avalanche).

- Create a payment schedule. This will Artikel how much you’ll pay towards each debt each month.

- Track your progress. Use your planner or tracker to monitor your payments and see how much debt you’re paying off each month.

- Adjust your plan as needed. Life happens, and sometimes you may need to make adjustments to your plan. That’s okay! Just be sure to review your plan regularly and make any necessary changes.

Book Review

In the vast sea of personal finance books, “The Total Money Makeover” by Dave Ramsey stands out as a beacon of hope for those drowning in debt. Ramsey’s no-nonsense approach and practical advice have helped millions of people achieve financial freedom.

Listen, if you’re trying to conquer your debt, a good planner is like your secret weapon. You need a system, right? Think of it like the way a parent needs to be organized when raising kids, especially if they’re on the autism spectrum, like in Lessons From My Ausome Life 10 Things I’ve Learned From Raising Two Boys On The Autism Spectrum.

You’ve gotta track those payments, strategize, and keep your eye on the prize. A planner is like your own personal cheerleader, helping you reach that debt-free finish line.

This book review delves into the core principles of “The Total Money Makeover,” examining its strengths and weaknesses, and ultimately assessing its suitability for different types of readers.

Key Takeaways and Insights

Ramsey’s “The Total Money Makeover” advocates for a debt snowball method, prioritizing the repayment of the smallest debts first, regardless of interest rates. This approach is designed to provide early wins and build momentum, keeping you motivated on your debt-free journey.

The book emphasizes the importance of a written budget, a crucial tool for tracking income and expenses, and identifying areas where you can cut back. Ramsey also stresses the need for an emergency fund, a safety net that protects you from unexpected financial setbacks.

Strengths and Weaknesses

One of the book’s greatest strengths lies in its simplicity. Ramsey’s clear and concise language makes the complex world of personal finance accessible to everyone. The debt snowball method, though not always the most mathematically efficient, provides psychological benefits, offering a sense of accomplishment with each debt paid off.

However, the book’s weaknesses include its lack of emphasis on credit score management and its focus on a strict cash-only approach, which may not be suitable for everyone.

Suitability for Different Types of Readers

“The Total Money Makeover” is a valuable resource for individuals who are overwhelmed by debt and lack a clear plan to tackle it. Its straightforward approach and practical advice can empower those who are new to personal finance. However, for readers who are already familiar with budgeting and debt management strategies, the book may not offer much new information.

Personal Experience Using the Book’s Strategies and Techniques

I personally found the debt snowball method to be highly effective. Seeing the smaller debts disappear quickly provided a much-needed boost of motivation. The book’s emphasis on budgeting also helped me gain control over my finances and identify areas where I could save.

However, I found the cash-only approach to be somewhat restrictive, and I prefer to use a combination of cash and credit cards to maximize rewards and build my credit score.

Okay, so you’re all about getting your finances in order with that debt payoff planner, right? That’s totally boss! But let’s be real, sometimes you need a little something to make your space feel like a grown-up, like a Modern Luxury Decorative Coffee Table Book.

It’s like the adult version of a unicorn sticker, but way more chic. And you know what? When you’re feeling on top of your game financially, your space should reflect that! So grab that planner and get to work, then add some serious style with a faux book for that Instagram-worthy vibe.

Summary of Main Points

- Debt Snowball Method:Pay off the smallest debts first, regardless of interest rates, to build momentum and motivation.

- Written Budget:Track income and expenses to identify areas for savings and prioritize spending.

- Emergency Fund:Build a safety net to protect yourself from unexpected financial setbacks.

- Cash-Only Approach:Minimize the use of credit cards and rely on cash for most transactions.

- Baby Steps:Follow a structured plan to achieve financial freedom, starting with building an emergency fund and then tackling debt.

Conclusive Thoughts

Debt payoff planners and trackers are more than just tools; they’re your partners in achieving financial freedom. They’re like having a cheerleader in your corner, pushing you to stay motivated and celebrating every milestone along the way. So, grab your planner, track your progress, and get ready to celebrate your debt-free future! You got this!

FAQ Section

Is a debt payoff planner right for everyone?

Absolutely! Whether you’re dealing with student loans, credit card debt, or just want to get a handle on your finances, a planner can be a game-changer.

How do I choose the right debt payoff method?

There are two main methods: the snowball method (paying off the smallest debts first) and the avalanche method (paying off the debts with the highest interest rates first). The best method for you depends on your individual situation and preferences.

Can I use a debt payoff planner even if I don’t have a lot of debt?

Absolutely! A planner can help you stay on track with your budget, monitor your spending, and achieve your financial goals, even if you don’t have a lot of debt to pay off.