Tax season is upon us, and it’s time to get your game face on. This year, don’t just file your taxes – dominate them! This guide is your secret weapon to unlock a world of tax-saving strategies and tips, helping you keep more of your hard-earned cash.

We’ll break down the tax landscape, reveal the secrets of maximizing deductions, and show you how to make Uncle Sam work for you.

Whether you’re a seasoned tax pro or a newbie to the game, we’ve got you covered. From understanding your tax situation to mastering the art of maximizing your refund, we’ll equip you with the knowledge and confidence to conquer tax season like a boss.

So buckle up, it’s time to level up your tax game!

Understanding Your Tax Situation

Navigating the world of taxes can feel like trying to decipher a secret code, but fear not! This guide will break down the essential components of your tax situation, empowering you to make informed decisions and maximize your tax savings.

Types of Taxes

Taxes are a fact of life, but knowing what types you’re dealing with is key to managing them effectively. Here’s a rundown of common taxes that individuals and families encounter:

- Federal Income Tax:This is the largest tax most Americans pay. It’s based on your income, with different tax brackets determining the percentage you owe.

- State Income Tax:Most states also impose an income tax, though some states have no income tax. The rates and deductions vary from state to state.

- Property Tax:If you own a home, you’ll pay property taxes based on the assessed value of your property. This revenue typically goes to fund local schools and other public services.

- Sales Tax:You pay sales tax on most purchases, and the rate varies by state and locality. This tax helps fund state and local government programs.

- Payroll Taxes:These taxes are withheld from your paycheck to fund Social Security and Medicare, which provide retirement benefits and healthcare for the elderly and disabled.

Tax Deductions and Credits

Think of tax deductions and credits as your personal tax superheroes, helping you lower your tax bill. Let’s break them down:

- Tax Deductions:These reduce your taxable income, leading to a lower tax bill. Popular deductions include:

- Standard Deduction or Itemized Deductions:You can choose to take the standard deduction or itemize your deductions if it results in a lower tax bill. Itemized deductions include deductions for mortgage interest, charitable contributions, and medical expenses.

- Homeownership Deductions:These include deductions for mortgage interest and property taxes, which can significantly reduce your tax liability if you own a home.

- Education Deductions:These help offset the cost of higher education, including tuition, fees, and interest on student loans.

- Tax Credits:These are direct reductions to your tax liability, offering even more savings. Common tax credits include:

- Child Tax Credit:This credit provides a significant tax break for families with children, with a potential refund even if you owe no taxes.

- Earned Income Tax Credit (EITC):This credit helps low-to-moderate income workers, offering a sizable tax refund.

- Premium Tax Credit:This credit helps individuals and families afford health insurance through the Affordable Care Act (ACA) marketplaces.

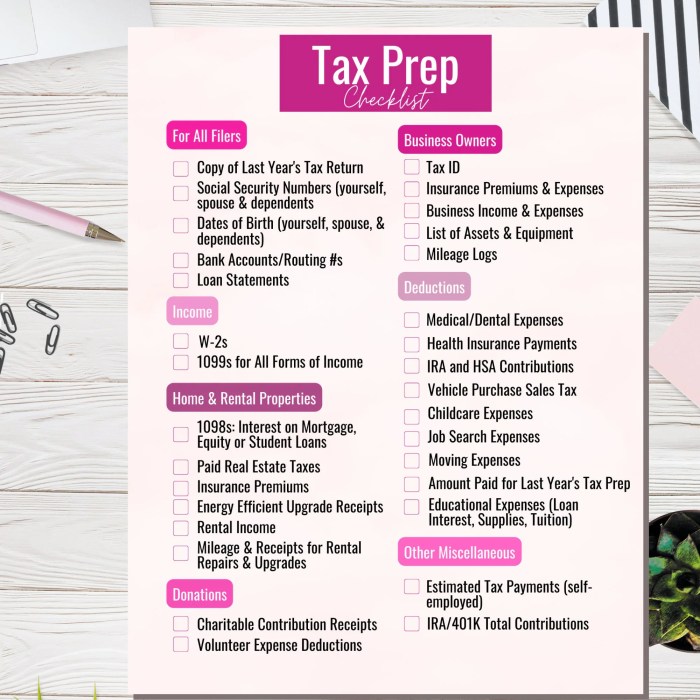

Organizing Your Tax Documents

Staying organized is crucial for accurate tax filing. Here are some tips to ensure a smooth tax season:

- Gather All Essential Documents:This includes your W-2 form (from your employer), 1099 forms (for income from sources like freelance work or investments), and any other relevant documentation.

- Create a Filing System:Develop a system for storing your tax documents, such as folders or a digital file system. This makes it easy to locate them when you need them.

- Keep Track of Receipts:If you plan to itemize your deductions, keep receipts for all expenses related to deductible items. This includes medical expenses, charitable donations, and home improvement costs.

- Consider Using Tax Software:Tax software can simplify the process of organizing your documents and calculating your taxes. Many programs offer features to help you identify potential deductions and credits.

Strategies for Lowering Your Tax Liability

Now that you understand your tax situation, let’s dive into some strategies to help you keep more of your hard-earned cash. There are several ways to lower your tax bill, and many of these strategies are as simple as making smart financial choices.

Maximizing Retirement Contributions

Retirement savings plans like 401(k)s and IRAs offer a fantastic opportunity to save for your future while also reducing your current tax burden. These accounts allow you to contribute pre-tax dollars, meaning you’ll pay taxes on the money only when you withdraw it in retirement.

This can significantly lower your taxable income and potentially reduce your tax bill.

Yo, tax season is coming up, and you know what that means? Time to get your financial game face on! This guide’s gonna break down all the sweet moves you can make to keep more of your hard-earned dough.

And speaking of moves, if you’re a guitar shredder looking to take your blues skills to the next level, check out Beyond Pentatonic Blues Guitar Master Intermediate to Advanced Blues Lead Guitar Concepts Licks Scales & Theory for More Sophisticated Soloing and Improvisation.

But back to taxes, we’re talking about deductions, credits, and all the strategies to keep your tax bill lookin’ like a bargain bin price tag. Let’s make this year your most financially awesome yet!

“Contributing to a 401(k) or IRA can help you save for retirement while also reducing your current tax liability. The more you contribute, the more you can potentially save in taxes.”

Utilizing Tax-Advantaged Accounts for Healthcare Expenses

Healthcare costs can be a major expense, but there are tax-advantaged accounts that can help you manage these costs. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) allow you to set aside pre-tax dollars to pay for eligible medical expenses.

Yo, taxes got you feeling like you’re stuck in a bad rom-com? Don’t sweat it, fam! This Ultimate Guide to Lowering Your Taxes in 2023 is here to help you score some serious savings, like you just won the lottery.

Download And Listen Here and get ready to be a tax-saving superstar, because this guide is about to drop some serious knowledge bombs! With the right strategies and tips, you’ll be laughing all the way to the bank (and not just at your tax bill!).

This can save you money on taxes and help you cover healthcare costs more affordably.

“HSAs and FSAs can help you save on taxes and reduce your out-of-pocket healthcare expenses.”

Claiming Deductions for Homeownership, Charitable Donations, and Education Expenses

The IRS offers various deductions that can lower your tax liability. Some of the most common deductions include those for homeownership, charitable donations, and education expenses. By claiming these deductions, you can potentially reduce your taxable income and save money on your taxes.

Tax season is here, and while you’re probably already feeling the stress of filing, don’t forget about the potential for saving some serious dough! Maybe a little mindfulness can help you through the process. Check out Mindfulness Reverse Coloring Book – Hidden Sea Treasures 50 Colorful Designs to Explore Your Creativity Relieve Stress and Relax for a little creative escape.

After all, a relaxed mind is a more efficient mind when it comes to navigating those tricky tax deductions.

“Claiming deductions can help you reduce your taxable income and lower your tax bill.”

- Homeownership:If you own a home, you can deduct mortgage interest and property taxes on your federal income taxes. This can significantly reduce your tax bill, especially in the early years of your mortgage when you’re paying more interest.

- Charitable Donations:Donating to qualified charities can provide you with a tax deduction. The amount you can deduct depends on the type of donation and the amount you give. For example, if you donate $1,000 to a qualified charity, you can deduct $1,000 from your taxable income, potentially saving you hundreds of dollars in taxes.

- Education Expenses:If you’re paying for education expenses, you may be eligible for certain tax credits or deductions. For example, the American Opportunity Tax Credit can provide a tax credit for qualified education expenses, while the Lifetime Learning Credit can provide a tax credit for courses taken to improve job skills.

These credits can significantly reduce your tax liability and help you pay for education expenses more affordably.

Maximizing Your Tax Refund or Minimizing Your Tax Bill

Alright, so you’ve got your ducks in a row, you’ve learned about all the cool deductions and credits, but now it’s time to get down to the nitty-gritty: actually filing your taxes and making sure you’re getting the most out of your hard-earned cash.

Whether you’re aiming for a fat refund or minimizing your tax bill, we’re gonna break it down so you can feel like a tax pro!

Common Tax Filing Mistakes and Their Consequences

It’s easy to slip up when you’re dealing with all those forms and numbers. But, some mistakes can lead to a bigger tax bill or even an audit, so it’s important to be aware of the most common pitfalls.

Here’s a breakdown of some of the most frequent tax filing mistakes and what they can cost you:

| Mistake | Consequence |

|---|---|

| Failing to file on time | Penalties and interest charges can be hefty, so it’s best to file on time, even if you can’t pay in full. |

| Inaccurate or incomplete information | This can lead to delays in processing your return, and potentially an audit. Double-check your forms before submitting! |

| Claiming incorrect deductions or credits | This can result in a lower refund or a higher tax bill. Make sure you understand the eligibility requirements for each deduction and credit. |

| Not keeping good records | It can be tough to prove your deductions or credits without proper documentation. Keep receipts, invoices, and other relevant paperwork organized. |

| Not understanding the difference between a standard deduction and itemized deductions | Choosing the wrong one can impact your tax liability. Do your research and choose the option that’s best for you. |

Filing Your Taxes Electronically or Using Tax Software

Filing electronically is the way to go! It’s fast, convenient, and usually reduces the risk of errors. Plus, you can get your refund faster than with paper filing. Here’s a step-by-step guide to filing electronically or using tax software:

- Gather your tax documents.This includes your W-2s, 1099s, and any other relevant paperwork. It’s like gathering your weapons before a tax battle!

- Choose a tax preparation software or online service.There are tons of options out there, so compare features and pricing to find the best fit for you. Remember, you want something that’s easy to use and accurate. Think of it as finding your trusty sidekick for tax season.

Yo, listen up, tax season is coming and it’s time to get your game face on. You wanna max out your tax savings, right? It’s all about knowing the rules and playing the game smart. Think of it like a soldier’s journey, except instead of fighting battles, you’re fighting for every dollar you can keep.

Check out Where The Light Enters A Soldier’s Journey for some serious motivation. And once you’re pumped up, hit the ground running with our ultimate guide to tax strategies. You got this!

- Enter your information.This is where the magic happens. The software will guide you through the process, asking for your personal information, income, deductions, and credits. Think of it as a guided tour through your financial jungle.

- Review your return.Take a good look at everything before you hit submit. Make sure all the information is accurate and that you’ve claimed all the deductions and credits you’re eligible for. Think of it as a final pre-battle check-up.

- E-file your return.Once you’re satisfied with everything, click the “e-file” button and send your return to the IRS. Think of it as sending your tax warriors into battle!

Essential Considerations Before Submitting Your Tax Return

Before you hit that “submit” button, take a deep breath and review these key considerations:

- Double-check your information.This is crucial to avoid any errors that could delay your refund or lead to an audit. Think of it as a last-minute check for any rogue tax gremlins.

- Review your deductions and credits.Make sure you’re claiming all the ones you’re eligible for. Think of it as claiming your rightful tax treasures!

- Consider your payment options.If you owe taxes, choose the payment method that works best for you. Think of it as strategizing your tax battle plan.

- Keep copies of your tax return and all supporting documents.You’ll need them for your records and in case you need to make any adjustments or file an amended return. Think of it as keeping your tax battle records safe and sound.

Book Review

It’s tax season, and you’re probably looking for ways to save money. One way to do that is to get your hands on a good tax guide. There are tons of books out there, but which one is right for you?

I recently read “The Total Money Makeover” by Dave Ramsey, and I think it’s a great option for anyone who wants to get their finances in order, including your taxes.

Overview of the Book

“The Total Money Makeover” is a comprehensive guide to personal finance. It covers everything from budgeting and saving to investing and debt management. The book is written in a clear and concise style, and it’s full of practical advice that you can use to improve your financial situation.

Strengths of the Book

One of the biggest strengths of this book is that it’s incredibly practical. Ramsey provides step-by-step instructions for everything, from creating a budget to paying off debt. He also uses real-life examples to illustrate his points, which makes the information more relatable.

Weaknesses of the Book

While the book is incredibly practical, it can be a bit preachy at times. Ramsey has a very specific philosophy about money, and he doesn’t shy away from sharing it. This can be off-putting for some readers, but it’s also part of what makes the book so effective.

Relevance to Tax Savings

While the book doesn’t specifically focus on tax savings, it does provide a lot of information that can help you reduce your tax liability. For example, Ramsey encourages readers to save for retirement and to use tax-advantaged accounts like 401(k)s and IRAs.

He also emphasizes the importance of tracking your expenses, which can help you identify areas where you can save money and potentially reduce your tax burden.

Summary

Don’t just let your taxes happen, take control! By understanding your tax situation, employing smart strategies, and using the resources available to you, you can maximize your tax savings and keep more of your money in your pocket.

Remember, every dollar counts. So go forth, conquer your taxes, and enjoy the sweet taste of financial freedom!

FAQ

What are some common tax deductions that I can claim?

There are many deductions available, including those for homeownership, charitable donations, student loan interest, and medical expenses. The specific deductions you can claim depend on your individual circumstances.

What are some tax-advantaged accounts that can help me save for retirement?

Traditional and Roth IRAs, as well as 401(k) plans, offer tax advantages for retirement savings. The specific benefits vary depending on the account type and your income level.

How do I know if I should file electronically or by mail?

Filing electronically is generally the fastest and most convenient method. However, if you have a complex tax situation or prefer to file by mail, you can do so. The IRS provides detailed instructions on its website.