Tired of living paycheck to paycheck? Feeling like you’re constantly struggling to make ends meet? You’re not alone. Millions of people find themselves in a similar situation, but there’s a powerful solution waiting to be unlocked: bi-weekly budgeting.

This comprehensive guide will walk you through the secrets of bi-weekly budgeting, empowering you to take control of your finances and achieve your financial goals. From creating a detailed budget planner to mastering the art of tracking your income and expenses, we’ll cover everything you need to know to transform your relationship with money.

The Power of Bi-Weekly Budgeting

Forget the monthly grind! Bi-weekly budgeting is where it’s at, especially if you want to stay on top of your finances and reach your financial goals. It’s like having a superpower for your money!Think of it as a game of financial control.

By breaking down your budget into two-week chunks, you’re getting a more realistic view of your income and expenses. You can see exactly how much money you have coming in and going out, which gives you a better sense of your financial situation.

Benefits of Bi-Weekly Budgeting

Here’s why bi-weekly budgeting is a game changer:

- More frequent check-ins:You’re checking in with your budget twice a month, which means you’re more likely to catch spending issues before they snowball. It’s like having a personal financial coach whispering in your ear, “Hey, are you sure you need that extra latte?”

- Better control over your spending:You’re not waiting for that monthly paycheck to feel the pinch. You’re seeing the impact of your spending on a smaller scale, which makes it easier to adjust your habits. It’s like having a financial compass that keeps you on track.

- Easier to track your progress:You’re seeing your progress in smaller increments, which makes it more motivating to stick to your budget. It’s like watching your savings grow, one two-week period at a time. You’re more likely to stay on track and see your financial goals become a reality.

How Bi-Weekly Budgeting Can Help You Achieve Your Financial Goals

Ready to unlock your financial dreams? Bi-weekly budgeting can help you achieve them, one paycheck at a time:

- Paying off debt:By breaking down your debt payments into smaller chunks, you’ll feel less overwhelmed and more motivated to pay it off faster. Imagine the feeling of freedom as you watch that debt disappear!

- Saving for a big purchase:Whether it’s a down payment on a house, a dream vacation, or a new car, a bi-weekly budget can help you reach your savings goals faster. Think of it as building a financial safety net that will help you achieve your dreams.

- Investing for the future:With a bi-weekly budget, you can automate regular contributions to your investment accounts, building a solid foundation for your future. Imagine yourself enjoying financial freedom in your golden years, thanks to your smart budgeting habits.

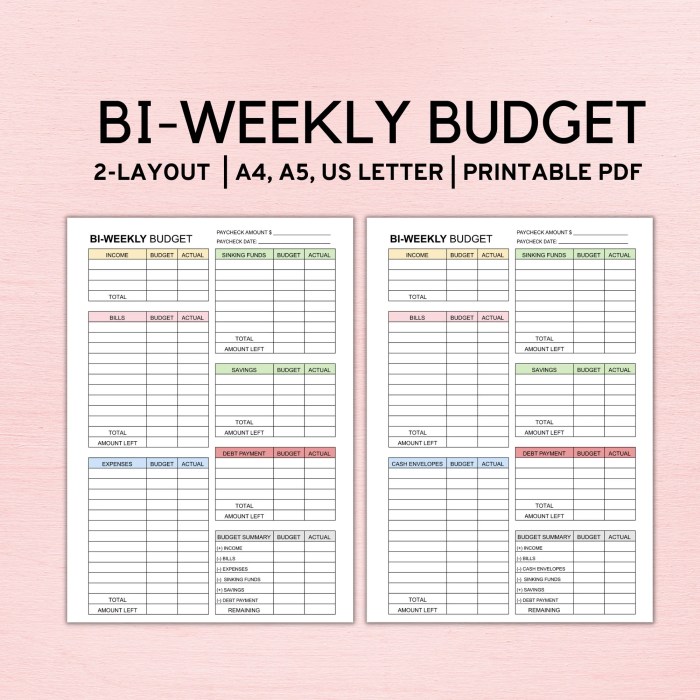

Components of a Bi-Weekly Budget Planner

A bi-weekly budget planner is your personal financial roadmap, helping you navigate your finances and reach your financial goals. It’s like having a personal finance coach in your pocket, guiding you through the process of tracking your income, managing your expenses, and building a brighter financial future.

Income

Income is the foundation of your budget. It’s the money you earn from your job, side hustles, investments, or any other sources.

- Gross Income:This is your total income before taxes and deductions.

- Net Income:This is your take-home pay after taxes and deductions.

- Other Income:This includes any additional income sources like freelance work, interest earned, or rental income.

Expenses

Expenses are the money you spend on everything from groceries and rent to entertainment and subscriptions.

- Fixed Expenses:These are expenses that stay the same each month, like rent, mortgage payments, car payments, and insurance premiums.

- Variable Expenses:These are expenses that can change from month to month, like groceries, utilities, entertainment, and dining out.

Savings

Saving money is crucial for achieving your financial goals, whether it’s buying a house, paying off debt, or investing for retirement.

- Emergency Fund:This is a safety net for unexpected expenses, like medical bills or car repairs. It’s generally recommended to have 3-6 months of living expenses saved.

- Retirement Savings:This is money you save for your future, allowing you to enjoy your golden years without financial stress.

- Other Savings Goals:This could include saving for a down payment on a house, a vacation, or a new car.

Debt Repayment

Managing debt is an essential part of financial health. It’s important to create a plan for paying down debt as quickly and efficiently as possible.

Tired of living paycheck to paycheck? Get your finances in check with a Bi Weekly Budget Planner Paycheck Budget Planner Income & Expense Budgeting Workbook and Balance Tracker. You can Download And Listen Here to learn more about these handy tools and start crushing your financial goals.

These planners are your secret weapon for taking control of your money and achieving financial freedom.

- Debt Snowball Method:This method involves paying off your smallest debt first, then using the money you were paying on that debt to pay down the next smallest debt, and so on. This can be a motivating strategy as you see your debts shrink one by one.

- Debt Avalanche Method:This method focuses on paying down your highest-interest debt first, then moving on to the next highest-interest debt. This method can save you more money in the long run due to lower interest charges.

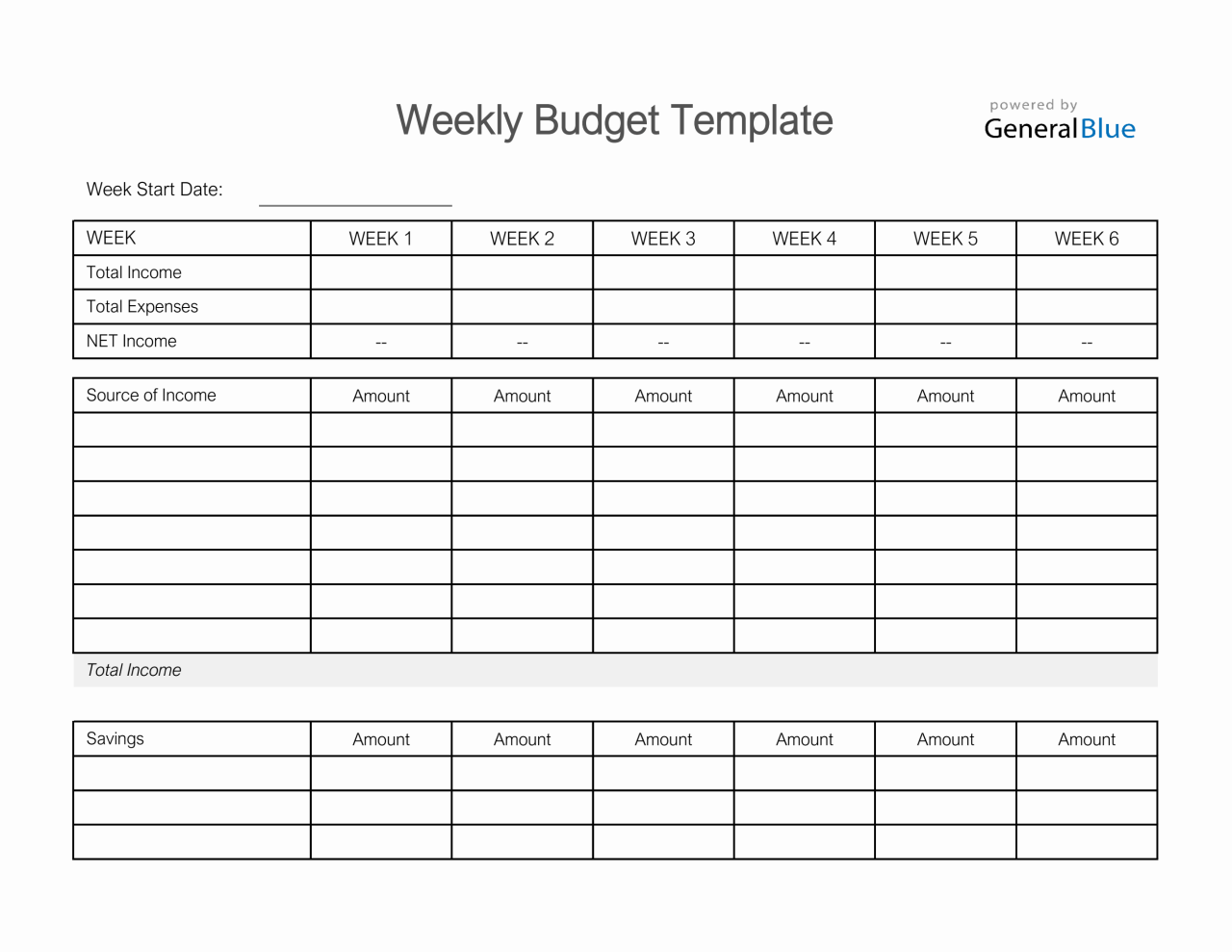

Table: Essential Components of a Bi-Weekly Budget Planner

| Income | Expenses | Savings | Debt Repayment |

|---|---|---|---|

| Gross Income | Fixed Expenses | Emergency Fund | Debt Snowball Method |

| Net Income | Variable Expenses | Retirement Savings | Debt Avalanche Method |

| Other Income | Other Savings Goals |

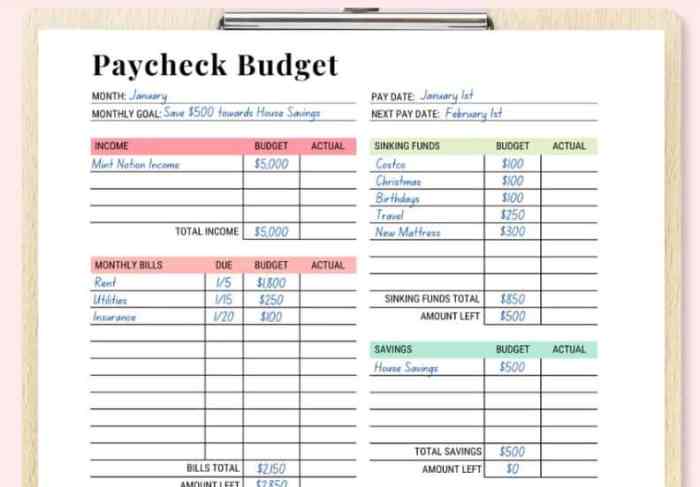

Utilizing a Paycheck Budget Planner

A paycheck budget planner is your trusty sidekick in the world of personal finance. It helps you keep tabs on your income and expenses, ensuring you’re in control of your money.

Tracking Income and Expenses

The first step to conquering your finances is understanding where your money is coming from and where it’s going. A paycheck budget planner provides a structured way to track your income and expenses.

- Income:List all your income sources, including your regular paycheck, side hustles, and any other regular income you receive. This gives you a clear picture of your total monthly income.

- Expenses:Categorize your expenses to see where your money is going. Common categories include housing, transportation, food, entertainment, and debt payments. This breakdown helps you identify areas where you might be overspending.

Allocating Funds from Each Paycheck

Once you know your income and expenses, it’s time to create a budget plan. A paycheck budget planner helps you allocate funds from each paycheck to different categories.

- Needs vs. Wants:Prioritize your needs (housing, utilities, groceries) over wants (entertainment, dining out). Allocate funds accordingly.

- Savings Goals:Set aside a specific amount for savings each paycheck. Whether it’s for an emergency fund, retirement, or a dream vacation, having a savings plan is crucial.

- Debt Payments:Allocate funds to pay down any outstanding debt. The sooner you tackle debt, the less interest you’ll pay in the long run.

Managing Unexpected Expenses

Life throws curveballs, and unexpected expenses can disrupt your budget. A paycheck budget planner helps you prepare for the unexpected.

Yo, managing your dough can be a real struggle, but it’s all about that balance, right? Like, budgeting your cash flow is like hitting the right notes on the viola. You gotta know when to spend and when to save.

And if you’re just starting out, check out Beginner Sheet Music For Viola 60 Easy Viola Scores For Beginner Adults & Kids to get your groove on. Anyway, back to the money game, once you get your financial act together, you’ll be like a pro musician, hitting those financial goals like a boss!

- Emergency Fund:Having an emergency fund (ideally 3-6 months of living expenses) provides a safety net for unexpected car repairs, medical bills, or job loss.

- Flexibility:Build some flexibility into your budget by allocating a small amount for unexpected expenses. This can help you avoid going into debt when unexpected costs arise.

- Adjusting Your Budget:If you face a major unexpected expense, adjust your budget accordingly. Consider cutting back on non-essential spending or finding ways to increase your income to cover the unexpected cost.

Income & Expense Budgeting Workbook

An income and expense budgeting workbook is your personal financial sidekick, helping you track your cash flow and make informed decisions about your money. It’s like a financial diary, where you record every dollar that comes in and goes out, giving you a clear picture of your financial health.

You know how they say, “money makes the world go ’round?” Well, this Bi Weekly Budget Planner Paycheck Budget Planner Income & Expense Budgeting Workbook and Balance Tracker is your ultimate money-making bestie! It’s like having your own personal finance guru, guiding you through the ups and downs of your cash flow.

And speaking of ups and downs, if you’re looking for a heartwarming read about life’s journey, check out My Little Blue Branch A Texas Memoir. It’s a reminder that life’s a wild ride, and just like with your finances, you’ve got to stay on top of things! So, grab your Bi Weekly Budget Planner, get organized, and enjoy the ride!

Understanding the Workbook

A typical income and expense budgeting workbook is structured with columns for date, income source, expense category, amount, and notes. Each row represents a single transaction, whether it’s receiving a paycheck, paying rent, or buying groceries.

Creating a Sample Workbook

Let’s imagine a bi-weekly budget. Here’s a sample table to illustrate how you can track your income and expenses:| Date | Income Source | Expense Category | Amount | Notes ||—|—|—|—|—|| 01/01/2024 | Paycheck | Housing | $1,500 | Rent || 01/01/2024 | Paycheck | Utilities | $200 | Electricity, gas, water || 01/01/2024 | Paycheck | Groceries | $300 | Weekly grocery shopping || 01/01/2024 | Paycheck | Transportation | $100 | Gas, public transportation || 01/08/2024 | Paycheck | Entertainment | $50 | Movie tickets || 01/08/2024 | Paycheck | Savings | $200 | Emergency fund || 01/08/2024 | Paycheck | Dining Out | $75 | Restaurant meal || 01/15/2024 | Paycheck | Clothing | $150 | New shoes || 01/15/2024 | Paycheck | Healthcare | $50 | Doctor’s appointment || 01/15/2024 | Paycheck | Debt Repayment | $100 | Credit card payment || 01/22/2024 | Paycheck | Housing | $1,500 | Rent || 01/22/2024 | Paycheck | Utilities | $200 | Electricity, gas, water || 01/22/2024 | Paycheck | Groceries | $300 | Weekly grocery shopping || 01/22/2024 | Paycheck | Transportation | $100 | Gas, public transportation || 01/29/2024 | Paycheck | Entertainment | $50 | Concert tickets || 01/29/2024 | Paycheck | Savings | $200 | Emergency fund || 01/29/2024 | Paycheck | Dining Out | $75 | Restaurant meal |This table provides a basic framework.

You can customize it to include additional columns or categories as needed. For instance, you might want to add a column for “Budget vs. Actual” to compare your planned spending with your actual expenses.

Yo, so you’re trying to get your finances on point with a Bi Weekly Budget Planner Paycheck Budget Planner, right? That’s the first step to financial freedom, and sometimes you need a little inspiration to stay motivated. Check out Tightrope Over Eden An American Flâneur in Brazil , a book about a dude who just took a leap of faith and went on an adventure.

It’s a reminder that sometimes you gotta shake things up, even if it means tightening the purse strings a little! So, grab that budget planner, get your finances in order, and maybe plan a trip to Brazil, just sayin’.

Balance Tracker

Think of a balance tracker as your financial dashboard, giving you a clear view of your financial health. It’s not just about how much money you have; it’s about understanding the relationship between your assets, liabilities, and net worth.

Tracking Your Financial Position

A balance tracker helps you monitor your financial position by providing a snapshot of your assets, liabilities, and net worth. It’s like a financial checkup that reveals your financial strengths and weaknesses.

Benefits of a Balance Tracker

- Provides a Clear Financial Picture:A balance tracker gives you a comprehensive overview of your financial standing, helping you understand your overall financial health.

- Identifies Spending Patterns:By tracking your income and expenses, you can identify areas where you’re overspending or where you can potentially cut back.

- Highlights Financial Goals:A balance tracker allows you to visualize your progress towards your financial goals, whether it’s saving for a down payment on a house or paying off debt.

- Encourages Financial Discipline:The act of regularly updating your balance tracker can help you stay more mindful of your spending and encourage you to make responsible financial decisions.

Creating a Balance Tracker

To create a balance tracker, you’ll need to list your assets, liabilities, and calculate your net worth.

Assets

Assets are what you own. This can include:

- Checking and Savings Accounts:The balance in your bank accounts.

- Investments:Stocks, bonds, mutual funds, and other investments.

- Real Estate:The value of your home or any other properties you own.

- Vehicles:The value of your cars, trucks, or other vehicles.

- Personal Possessions:Valuable items like jewelry, collectibles, or artwork.

Liabilities

Liabilities are what you owe. This can include:

- Credit Card Debt:The outstanding balance on your credit cards.

- Student Loans:The amount you owe on your student loans.

- Mortgage:The outstanding balance on your home loan.

- Auto Loans:The amount you owe on your car loans.

- Personal Loans:Any other loans you may have taken out.

Net Worth

Your net worth is calculated by subtracting your liabilities from your assets.

Net Worth = Assets

Liabilities

A positive net worth means you have more assets than liabilities, while a negative net worth means you have more liabilities than assets.

Simple Balance Tracker Template

| Assets | Value |

|---|---|

| Checking Account | $ |

| Savings Account | $ |

| Investments | $ |

| Real Estate | $ |

| Vehicles | $ |

| Personal Possessions | $ |

| Total Assets | $ |

| Liabilities | Value |

|---|---|

| Credit Card Debt | $ |

| Student Loans | $ |

| Mortgage | $ |

| Auto Loans | $ |

| Personal Loans | $ |

| Total Liabilities | $ |

| Net Worth | $ |

Book Review: A Bi-Weekly Budgeting Guide

This review explores “The Total Money Makeover: Classic Edition” by Dave Ramsey, a popular guide that emphasizes a debt-free lifestyle and bi-weekly budgeting. The book provides a practical framework for managing finances, focusing on eliminating debt, saving for emergencies, and building wealth.

Key Takeaways

The book’s core message revolves around the “snowball method” for debt repayment. It emphasizes the importance of prioritizing high-interest debt and making consistent payments to achieve faster debt elimination. Ramsey also advocates for living on a cash-flow basis, using a bi-weekly budgeting system to track income and expenses meticulously.

The book encourages readers to save for emergencies and invest in a diversified portfolio for long-term financial security.

Strengths

- Practical and Actionable:“The Total Money Makeover” provides specific steps and strategies for managing finances. The book’s emphasis on eliminating debt, saving, and investing is grounded in real-world scenarios and actionable steps.

- Motivational and Inspiring:Ramsey’s writing style is engaging and motivational. He uses real-life stories and anecdotes to illustrate the power of financial discipline and the potential for achieving financial freedom.

- Comprehensive Coverage:The book addresses various aspects of personal finance, including budgeting, debt management, saving, and investing. It provides a holistic approach to financial well-being, emphasizing the interconnectedness of these elements.

Weaknesses

- Limited Flexibility:The book’s emphasis on the snowball method may not be suitable for everyone, especially those with high-interest debt that could benefit from the “avalanche method” (prioritizing debt with the highest interest rate). The book’s strict adherence to a cash-flow system might also be challenging for individuals who prefer digital banking and online transactions.

- Limited Investment Guidance:While the book emphasizes the importance of investing, it provides limited guidance on specific investment strategies. Readers may need to seek additional resources to develop a comprehensive investment plan.

- Potential for Oversimplification:The book’s focus on debt elimination and saving may oversimplify complex financial concepts such as investing and retirement planning.

Using the Book to Enhance Budgeting Practices

“The Total Money Makeover” can be a valuable resource for individuals looking to improve their budgeting practices. The book’s emphasis on a bi-weekly budgeting system, tracking expenses, and prioritizing debt repayment can help readers gain control over their finances. However, it’s important to consider the book’s limitations and supplement it with other resources for a comprehensive financial strategy.

Final Wrap-Up

By embracing bi-weekly budgeting, you’re not just managing your money, you’re investing in your future. You’re setting yourself up for financial freedom, allowing you to achieve your dreams and live a life of financial security. So, ditch the stress of monthly budgeting and unlock the power of bi-weekly planning.

It’s time to take control of your finances and build a brighter financial future.

Clarifying Questions

What are the key differences between bi-weekly and monthly budgeting?

Bi-weekly budgeting aligns with most paychecks, making it easier to track spending and manage funds. Monthly budgeting can lead to overspending in the early part of the month and potential financial strain later on.

How can I adjust my budget for unexpected expenses?

Create an emergency fund and allocate a portion of your income for unexpected expenses. Review your budget regularly and adjust spending as needed to accommodate unforeseen circumstances.

What are some common mistakes to avoid when budgeting?

Common mistakes include underestimating expenses, not tracking spending accurately, and failing to review and adjust the budget regularly. Avoid these pitfalls to maximize the effectiveness of your budgeting plan.