Tired of juggling spreadsheets and losing track of your small business finances? Get ready to ditch the chaos and embrace the streamlined world of QuickBooks Online! This guide will take you from zero to hero, guiding you through the ins and outs of this powerful tool, so you can finally gain control of your finances and focus on what matters most: growing your business.

We’ll dive into the basics, from setting up your account to tracking income and expenses. Then, we’ll explore advanced features like payroll and bank reconciliation, unlocking the full potential of QuickBooks Online to manage your business with ease. Whether you’re a solopreneur or running a team, this guide has everything you need to streamline your financial operations and achieve your business goals.

Getting Started with QuickBooks Online

QuickBooks Online is a cloud-based accounting software designed to help small businesses manage their finances. It’s like having a virtual accountant at your fingertips, streamlining your bookkeeping, and providing valuable insights into your business’s financial health.

Signing Up for QuickBooks Online

Signing up for QuickBooks Online is quick and easy. Here’s a step-by-step guide:

- Visit the QuickBooks Online website (https://quickbooks.intuit.com/).

- Click on the “Start Free Trial” button. You’ll be prompted to create an account.

- Provide your email address and create a password.

- Choose a plan that suits your business needs. QuickBooks Online offers different plans based on your business size and complexity.

- Enter your company information, including your business name, industry, and contact details.

- You’ll be asked to connect your bank accounts. This allows QuickBooks Online to automatically import transactions, saving you time and reducing the risk of errors.

Once you’ve completed these steps, you’ll be ready to start using QuickBooks Online to manage your finances.

Setting Up Your Company Profile

Your company profile is the foundation of your QuickBooks Online experience. Here’s how to set it up:

- Go to the “Company” tab and click on “Company Settings”.

- Provide detailed information about your business, including your company name, address, phone number, and website. This ensures your invoices and other documents have accurate information.

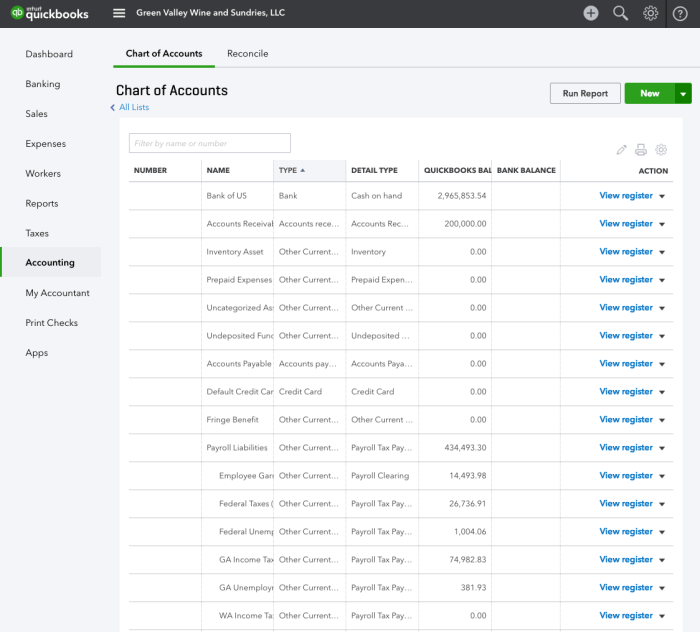

- Set up your chart of accounts. This is a list of all the accounts you use to track your finances, such as income, expenses, and assets. Think of it like a financial filing system.

- Customize your company preferences, such as your currency, date format, and email settings. This makes sure everything aligns with your business needs and preferences.

Customizing Your Dashboard

Your QuickBooks Online dashboard is your central hub for managing your finances. Here’s how to customize it:

- Go to the “Dashboard” tab. You’ll see a default dashboard with various financial widgets.

- Customize the dashboard to focus on the information that matters most to you. You can add, remove, or rearrange widgets to track key metrics like cash flow, sales, and expenses.

- Set up alerts and notifications. This keeps you informed about important financial events, such as upcoming bills or low account balances.

Mastering the Basics of QuickBooks Online

Once you’ve set up your QuickBooks Online account, it’s time to get down to business – literally! Let’s dive into the fundamental operations that will make your financial management smooth and efficient.

Recording Income and Expenses

Keeping track of your income and expenses is the bread and butter of any business. QuickBooks Online makes this process a breeze with its intuitive features.

Yo, wanna ditch the spreadsheet chaos and level up your small biz finances? “MANUAL QUICKBOOKS ONLINE FOR BEGINNERS 2023 The Step-by-Step Guide to Streamlining Finances for Small Business Owners From Zero to Expert” is your ultimate cheat sheet.

Download and listen to the audiobook Download And Listen Here and get ready to dominate your finances like a boss! “MANUAL QUICKBOOKS ONLINE FOR BEGINNERS 2023 The Step-by-Step Guide to Streamlining Finances for Small Business Owners From Zero to Expert” will have you saying “bye Felicia” to financial headaches for good.

- Income:When you receive payment for a service or product, you’ll create an invoice in QuickBooks Online. This invoice will detail the items sold, the total amount due, and the payment terms. You can even customize your invoices with your company logo and branding for a professional touch.

Mastering QuickBooks Online can be a game-changer for your business, but it’s not all spreadsheets and numbers! Sometimes, you need a creative outlet, and what better way to unwind than by learning to draw your own anime characters? Check out this awesome guide on how to draw manga and anime – it’s a total blast! After your artistic session, you’ll be ready to tackle those QuickBooks reports with renewed energy and focus.

- Expenses:From office supplies to utilities, QuickBooks Online helps you track all your business expenses. You can create expense entries for individual purchases or import your bank transactions directly into the system. This automated process saves you time and reduces the risk of errors.

Yo, wanna take your small biz from zero to hero? “MANUAL QUICKBOOKS ONLINE FOR BEGINNERS 2023” is your secret weapon to crush those finances. But let’s be real, you gotta get those customers in the door, right? That’s where social media comes in.

Check out this awesome guide on Social Media On Auto Grow Your Business and Revenue In Less Than 2 Hours A Month and get those likes and sales flowing. Once you’ve got those customers hooked, “MANUAL QUICKBOOKS ONLINE FOR BEGINNERS 2023” will help you manage your dough like a pro.

You got this, boss!

Invoices and Estimates

Invoices and estimates are two important documents that help you manage your business transactions.

- Invoices:Invoices are issued after you’ve delivered a service or product and are expecting payment. They are legally binding documents that Artikel the goods or services provided, the price, and the payment terms.

- Estimates:Estimates are used when you’re providing a preliminary quote for a service or product before the actual work begins. They are not legally binding and can be adjusted based on changing requirements or costs. Estimates are essential for setting expectations and ensuring transparency with your clients.

Tracking Inventory and Managing Customer Payments

For businesses that sell physical products, inventory management is a crucial aspect of financial success. QuickBooks Online offers powerful tools to help you track your inventory levels and manage customer payments effectively.

- Inventory Tracking:You can add products to your inventory, set up reorder points, and track the cost of goods sold (COGS). This information helps you make informed decisions about purchasing, pricing, and inventory management.

- Customer Payments:QuickBooks Online simplifies the process of receiving and managing customer payments. You can accept online payments through integrated payment gateways, track outstanding invoices, and reconcile bank transactions. This streamlined process ensures that you get paid on time and keep your finances in order.

Advanced QuickBooks Online Features for Small Businesses

You’ve mastered the basics of QuickBooks Online, but there’s a whole world of powerful features waiting to be unlocked. This section will take you on a deep dive into advanced features that will supercharge your financial management and help you make smarter business decisions.

Reports for In-Depth Financial Insights

Reports are the key to unlocking valuable insights about your business performance. QuickBooks Online offers a variety of reports that can help you analyze your financials, track your progress, and identify areas for improvement.

- Profit and Loss (P&L) Report:This report shows your revenue and expenses over a specific period, giving you a clear picture of your profitability. It’s like a financial snapshot of your business.

- Balance Sheet Report:This report shows your assets, liabilities, and equity at a specific point in time.

Think of it as a financial snapshot of your business’s financial health.

- Cash Flow Statement:This report tracks your cash inflows and outflows, helping you understand how much cash you have available. This report is essential for managing your cash flow and making sure you have enough money to pay your bills.

- Sales by Customer Report:This report provides a detailed breakdown of your sales by customer, helping you identify your top customers and track their spending patterns. This is like a customer loyalty report.

- Sales by Item Report:This report provides a detailed breakdown of your sales by item, helping you identify your best-selling products and track their profitability.

It’s like a product performance report.

Managing Payroll with QuickBooks Online

Paying your employees on time and accurately is crucial for maintaining a happy workforce. QuickBooks Online makes payroll a breeze with its intuitive and efficient payroll features.

- Set Up Payroll:First, you’ll need to set up your payroll by providing information about your company, employees, and payroll tax settings. It’s like setting up your payroll system.

- Enter Employee Information:You’ll need to enter information about each employee, including their name, address, Social Security number, and pay rate.

It’s like creating employee profiles.

- Run Payroll:Once you’ve set up payroll and entered employee information, you can run payroll for each pay period. QuickBooks Online will automatically calculate taxes and deductions, making it super easy. It’s like running your payroll software.

- Direct Deposit:QuickBooks Online allows you to set up direct deposit for your employees, making it easier and faster to get paid. It’s like setting up automatic payments.

- Payroll Taxes:QuickBooks Online can help you track and pay your payroll taxes, ensuring you stay compliant with federal and state regulations.

It’s like a tax compliance system.

Reconciling Your Bank Account with QuickBooks Online

Bank reconciliation is the process of matching your bank statement to your QuickBooks Online records. It’s essential for ensuring that your financial records are accurate and that you haven’t missed any transactions.

- Import Bank Transactions:QuickBooks Online allows you to import bank transactions directly from your bank, making the reconciliation process faster and more efficient. It’s like a bank statement download.

- Match Transactions:You’ll need to match the transactions on your bank statement to the corresponding transactions in QuickBooks Online.

It’s like a matching game.

- Identify Discrepancies:If there are any discrepancies between your bank statement and QuickBooks Online, you’ll need to investigate and resolve them. It’s like a detective’s work.

Example:Imagine you have a $100 deposit that appears on your bank statement but is not yet recorded in QuickBooks Online. You would need to add this deposit to your QuickBooks Online records to reconcile your bank account.

Book Review: “QuickBooks Online for Dummies”

“QuickBooks Online for Dummies” is a comprehensive guide designed to help individuals and small business owners master the ins and outs of QuickBooks Online. The book is written in a clear and concise style, making it accessible to beginners with no prior accounting experience.

Okay, so you’re totally crushing it with your business, right? You’re a total rockstar, but maybe you’re feeling a little lost when it comes to keeping track of your finances. Don’t sweat it! “MANUAL QUICKBOOKS ONLINE FOR BEGINNERS 2023 The Step-by-Step Guide to Streamlining Finances for Small Business Owners From Zero to Expert” will help you get your money game on point.

And if you need a break from the numbers, check out this amazing guide to mastering your Cricut machine, Cricut The Most Complete Guide to Master Your Cricut Machine with 200+ Projects Ideas – Top Secret Tips and Tricks to Effortlessly Become Your Friends’ & Family’s Favorite Crafter!.

It’s like the ultimate guide to crafting awesome gifts for your friends and fam! Once you’ve got your crafting skills on fire, you can come back to “MANUAL QUICKBOOKS ONLINE FOR BEGINNERS 2023 The Step-by-Step Guide to Streamlining Finances for Small Business Owners From Zero to Expert” and be a total boss with your business!

The Book’s Approach to Learning QuickBooks Online

“QuickBooks Online for Dummies” takes a step-by-step approach to learning QuickBooks Online. The book begins with a basic overview of accounting principles and then gradually introduces users to the various features of the software. The book also includes numerous screenshots and examples to illustrate key concepts.

Key Strengths

- Clear and Concise Writing:The book is written in plain language, making it easy to understand even for those with no accounting background.

- Step-by-Step Instructions:The book provides detailed instructions for each task, making it easy to follow along.

- Numerous Examples:The book includes numerous real-world examples to illustrate key concepts, helping users understand how QuickBooks Online works in practice.

- Focus on Small Business Needs:The book is specifically tailored to the needs of small business owners, covering topics such as invoicing, expense tracking, and payroll.

Key Weaknesses

- Limited Coverage of Advanced Features:While the book covers the basics of QuickBooks Online, it does not delve into more advanced features, such as custom reports and integrations.

- Outdated Information:As QuickBooks Online is constantly updated, some of the information in the book may be outdated.

- Lack of Interactivity:The book is a static resource and does not offer interactive exercises or simulations.

Comparison with Other Resources

“QuickBooks Online for Dummies” is a good starting point for beginners, but it may not be sufficient for those who want to master advanced features or stay up-to-date with the latest updates. Other resources, such as online tutorials, webinars, and the QuickBooks Online Help Center, can provide more in-depth coverage and updated information.

Target Audience and Suitability for Beginners

“QuickBooks Online for Dummies” is an excellent resource for individuals and small business owners who are new to QuickBooks Online. The book’s clear and concise writing style, step-by-step instructions, and numerous examples make it ideal for beginners. However, those seeking a comprehensive guide to advanced features or who need to stay current with the latest updates may want to consider other resources in addition to this book.

Wrap-Up

So, are you ready to level up your financial game? QuickBooks Online can be your secret weapon, providing you with the tools and insights you need to make smarter decisions and achieve greater success. This guide is your roadmap to mastering QuickBooks Online, and with a little dedication, you’ll be well on your way to financial freedom and a thriving business.

It’s time to say goodbye to the spreadsheets and hello to a world of simplified accounting and financial clarity!

FAQ Overview

Is QuickBooks Online right for my small business?

QuickBooks Online is a great fit for businesses of all sizes, from solopreneurs to small teams. It offers a variety of features to meet your specific needs, and its intuitive interface makes it easy to use, even if you’re not an accounting expert.

How much does QuickBooks Online cost?

QuickBooks Online offers different pricing plans based on your business needs. You can check their website for the latest pricing information and choose the plan that best suits your budget.

Do I need any special software to use QuickBooks Online?

No! QuickBooks Online is cloud-based, meaning you can access it from any device with an internet connection. You don’t need to download or install any software.

Can I use QuickBooks Online for my personal finances?

While QuickBooks Online is primarily designed for businesses, you can use it for personal finances as well. However, there are other software options specifically tailored for personal finance management.