Ever wondered how those Wall Street giants make their moves? They’re not just flipping coins, they’re using a whole different playbook. Welcome to the world of smart money trading, where institutional investors and big banks dominate the market with strategies that leave retail traders in the dust.

Get ready to dive deep into the secrets of order blocks, liquidity setups, and how the big players manipulate supply and demand to their advantage. This is your chance to level up your trading game and potentially make smarter moves.

This guide will break down the key concepts, strategies, and indicators that smart money uses to gain an edge in the market. We’ll cover everything from identifying hidden order flow to understanding how liquidity pools drive price action. You’ll learn how to spot those telltale signs that the big players are making their move and how to use that information to your advantage.

Understanding Smart Money Concepts

Imagine you’re at a casino, but instead of slots and roulette, you’re playing the stock market. You see a bunch of people betting on the same numbers, but you notice a group of high rollers who seem to know something you don’t.

They’re not just randomly placing bets; they’re strategizing, analyzing, and using their deep pockets to move the market in their favor. That’s the “smart money” in action. These big players are the institutional investors, hedge funds, and large banks who have access to vast resources, sophisticated tools, and insider information.

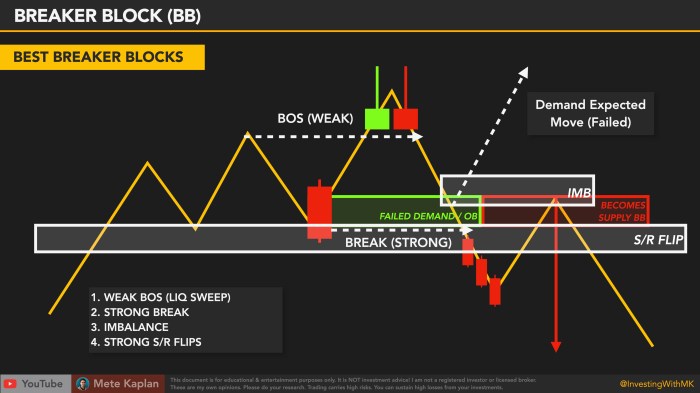

You know that feeling when you’re trying to crack the code of the market, figuring out how the big boys play the game? It’s all about understanding the SMART MONEY CONCEPT, like how institutional orders can break through those pesky block breakers and shift the market structure.

It’s about recognizing liquidity setups, diving into liquidity pools, and anticipating stop hunts. To keep track of it all, you’ll need a solid plan, and that’s where a planner like 2023-2024 Monthly Planner Two Year Monthly Planner (January 2023 to December 2024) Monthly Calendar and Organizer with Federal Holidays & Inspirational Quotes (Cute Flowers Cover) comes in handy.

It’s all about staying ahead of the curve, mitigating risk, and playing the game of supply and demand like a pro.

They don’t just react to market trends; they often drive them.

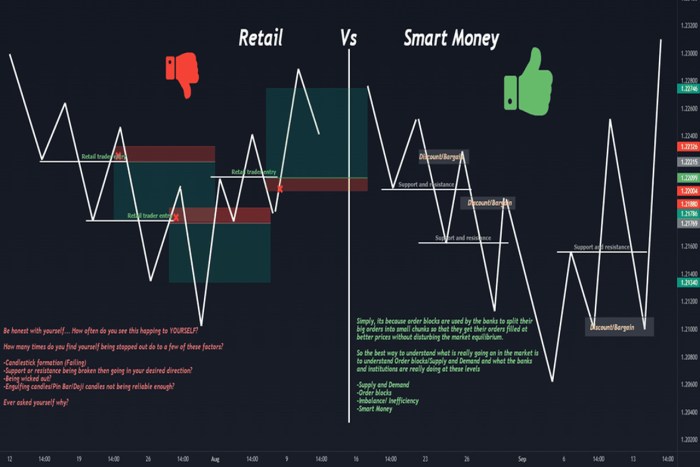

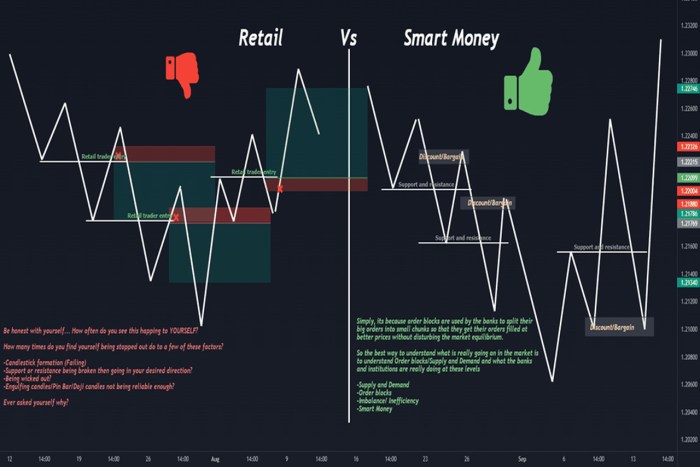

Institutional Investors vs. Retail Traders

The way institutional investors operate is vastly different from how retail traders, like you and me, approach the market. Here’s a breakdown:* Information Advantage:Institutional investors have access to real-time data feeds, advanced analytics, and even private information through their networks. This allows them to anticipate market movements and make informed decisions.

Capital Resources

They have significantly more capital to deploy, allowing them to influence market prices with large trades.

Trading Strategies

Institutional investors use sophisticated strategies that leverage their information and resources, such as order block trading, liquidity setups, and stop hunts.

Long-Term Perspective

They often have a long-term view of the market, focusing on fundamental analysis and economic trends, rather than chasing short-term gains.

Key Terms in Smart Money Trading

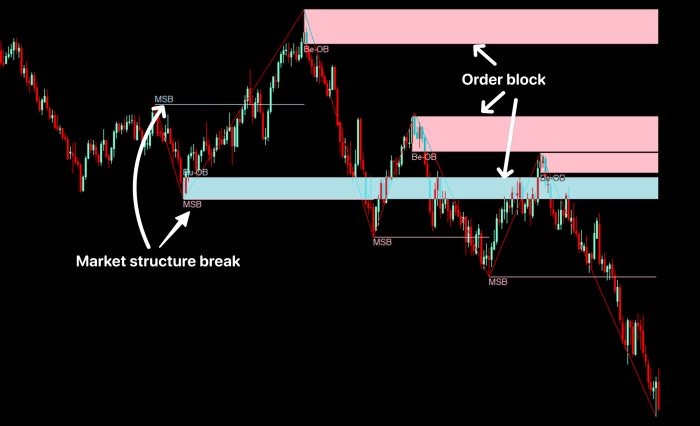

Here’s a closer look at some key terms used in smart money trading:* Order Block:An order block is a price range where a significant number of buy or sell orders are clustered. This indicates a potential area of support or resistance, where the price is likely to bounce or break through.

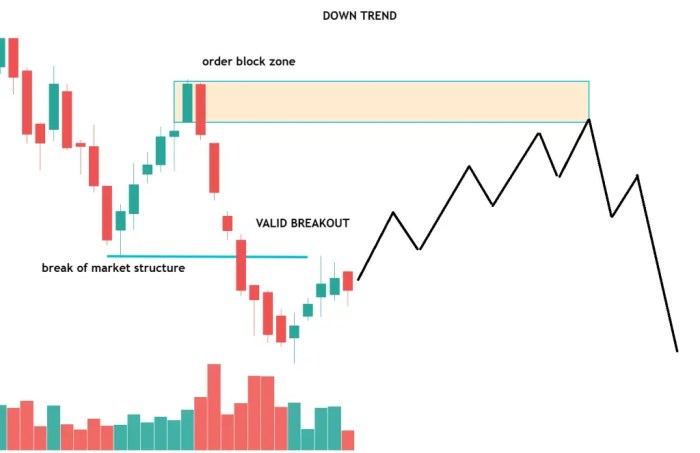

Break of Market Structure

Yo, wanna get in on the game like the big dogs? Learn how to trade like the banks, break the market structure, and snag those sweet liquidity pools. It’s all about understanding the smart money concept, from order block breakers to stop hunt mitigations.

Download And Listen Here to unlock the secrets of supply and demand and dominate the game, bro.

When the price breaks through a significant order block or other key level, it signals a change in market sentiment and a potential trend shift.

Liquidity Setups

These are trading strategies that exploit the availability of liquidity in the market. For example, a “liquidity grab” occurs when a large institutional trader creates a fake breakout to attract retail traders’ stop-loss orders, which they then buy up at a discounted price.

Liquidity Pools and Market Movements

Liquidity pools are essentially large amounts of buy or sell orders waiting to be executed at specific price levels. These pools can be created by institutional investors, and they have a significant impact on market movements.* Large Buy Orders:A large buy order in a liquidity pool will push the price up, attracting more buyers and creating a positive feedback loop.

Large Sell Orders

Conversely, a large sell order in a liquidity pool will drive the price down, attracting more sellers and reinforcing the downward trend.The smart money often uses liquidity pools to their advantage. For example, they might create a “fakeout” by placing a large buy order to attract buyers, only to then sell their holdings at a higher price, taking profits from the unsuspecting retail traders.

Identifying and Utilizing Smart Money Signals

You’re probably wondering, “How do I even know what the smart money is doing?” Well, my friend, that’s where the magic of technical analysis comes in! The smart money, like the big banks and institutional investors, are masters of the game.

They move the market with their massive orders, and leave subtle clues along the way. By learning to read these signals, you can hop on the bandwagon and ride the wave to financial freedom. It’s like being a detective, solving the mystery of the market!

Identifying Common Indicators and Patterns

Let’s start with the basics. Smart money doesn’t just jump in and out of the market randomly. They have a plan, and they leave their fingerprints all over the charts. Here are some common indicators and patterns that signal smart money activity:

- Large Volume Spikes:When you see a sudden surge in trading volume, it could indicate a big player is making a move. Think of it like a stampede of elephants – it’s hard to miss!

- Price Action Breakouts:If a price breaks through a key resistance level with significant volume, it’s a strong indication that smart money is pushing the price higher. It’s like a door bursting open, signaling a new wave of momentum.

- Order Block Rejections:Order blocks are areas of high volume where the price stalled or reversed. When the price breaks through an order block with significant volume, it shows that the smart money has overcome resistance and is ready to take the price to the next level.

It’s like a wall that has finally crumbled, allowing the price to move forward.

- Liquidity Pool Formations:Smart money often sets up liquidity pools, which are areas where they’ve accumulated a large amount of orders. These pools act like magnets, attracting price towards them, before a sharp reversal or continuation move. It’s like a trap, luring in unsuspecting traders, before the big players make their move.

Analyzing Order Flow and Volume

To really understand the smart money’s moves, you need to analyze the order flow and volume. Think of it like watching a game of chess – every move has a purpose.

- Volume Profile:The volume profile shows you the distribution of volume at different price levels. It can reveal areas of strong support and resistance, as well as where the smart money is accumulating or distributing their positions. It’s like a heat map, showing you where the action is.

- Tick Charts:Tick charts show you every single trade that occurs, giving you a real-time snapshot of the market’s activity. This can be helpful for identifying hidden orders and understanding the flow of liquidity. It’s like watching a live feed of the market, revealing every little detail.

Yo, you know how the big boys play the market? They got their institutional order block breakers, liquidity setups, and stop hunt mitigations. It’s all about supply and demand, but they got the secret sauce. Sometimes, though, even the most seasoned trader needs a break from the stress.

That’s where the Bold And Easy Large Print Coloring Book Beautiful Flowers for Adults Seniors Dementia and Beginners to Stress & Anxiety Relief (Simple & Bold Coloring Book) comes in handy. It’s like a mental vacation for your brain, so you can come back to the charts refreshed and ready to crush those orders.

- Market Depth:Market depth shows you the number of buy and sell orders at different price levels. It can help you identify large institutional orders that are waiting to be filled. It’s like a glimpse into the order book, showing you the hidden forces behind the market.

Identifying Stop Hunts and Choch Mitigations

Smart money often uses stop hunts and choch mitigations to manipulate the market and shake out weak hands. It’s like a game of psychological warfare, where they try to trick you into selling your position.

- Stop Hunts:Stop hunts occur when the price drops sharply to trigger stop-loss orders, creating a cascade of selling pressure that pushes the price even lower. It’s like a domino effect, where one stop loss triggers another, and another, until the price plummets.

- Choch Mitigations:Choch mitigations are similar to stop hunts, but they occur in the opposite direction. The price spikes sharply to trigger stop-loss orders on the short side, creating a surge of buying pressure that pushes the price even higher. It’s like a rocket taking off, fueled by the stop-loss orders of short sellers.

The Role of Supply and Demand in Smart Money Trading Strategies

Smart money understands the fundamental principle of supply and demand. They identify areas where the market is overbought or oversold, and they use this information to their advantage. It’s like knowing where the crowds are going before they get there.

- Buying the Dip:When the price dips below a key support level, it indicates that the market is oversold and that demand is likely to increase. Smart money often buys the dip, hoping to capitalize on the rebound. It’s like buying a stock on sale, knowing that it will eventually go back up.

- Selling the Rally:When the price rallies above a key resistance level, it indicates that the market is overbought and that supply is likely to increase. Smart money often sells the rally, hoping to profit from the inevitable pullback. It’s like selling your shares when they reach their peak, knowing that they will eventually come back down.

Yo, so you’re trying to get that sweet, sweet institutional-level trading game down, right? You know, the whole SMART MONEY CONCEPT, like how big banks manipulate the market with their massive orders? But hey, before you dive into all that crazy liquidity pool action, maybe take a break and chill out with the Mindfulness Reverse Coloring Book – Hidden Sea Treasures 50 Colorful Designs to Explore Your Creativity Relieve Stress and Relax.

Once you’ve got your zen on, you can go back to strategizing about order block breakers, stop hunts, and how to play the supply and demand game like a pro.

Applying Smart Money Concepts to Trading

Okay, so you’ve got the basics down, you know what smart money is, and you can spot their signals like a pro. Now, let’s talk about how to actually use this knowledge to make some sweet, sweet gains in the market.

Designing a Smart Money Trading Strategy

Imagine you’re playing poker and you’ve got a hunch that the big players are going to bet big on a specific hand. You’re not going to just blindly follow them, right? You need a strategy to make sure you’re in the best position to capitalize on their moves.

That’s exactly what we’re doing with smart money trading. We’re not just following the crowd; we’re looking for opportunities to ride the wave created by the big boys.

- Identify potential order blocks: These are areas where smart money has previously entered or exited the market, creating a significant imbalance in supply and demand. Think of it like a big “wall” that the price is likely to bounce off of.

- Look for liquidity setups: These are areas where the market is “thin” or “empty,” meaning there’s little resistance to price movement. Smart money often uses these setups to their advantage, either by creating a sudden spike in price or by taking out stop losses.

- Watch for liquidity pools: These are areas where large orders are waiting to be filled. Smart money often uses these pools to manipulate the market, creating fake breakouts or breakdowns to lure in unsuspecting traders.

- Anticipate stop hunts: Stop hunts are a common tactic used by smart money to profit from the pain of retail traders. By driving the price down (or up) quickly, they trigger stop-loss orders, creating more momentum in their direction.

- Implement risk management: Remember, even the best smart money traders get it wrong sometimes. That’s why it’s crucial to have a solid risk management plan in place to protect your profits and minimize potential losses.

Real-World Trading Scenarios

Let’s say you’re watching the chart for a popular stock like Apple. You notice a large order block at $150, and the price has been bouncing off of it for a few days. Then, you see a sudden spike in volume and the price breaks through the order block.

This could be a sign that smart money is taking control and pushing the price higher. You might consider entering a long position with a stop loss below the order block.

Risks and Limitations of Smart Money Strategies

Don’t get too cocky, though. Smart money strategies aren’t foolproof. There are risks and limitations to be aware of.

- False signals: Just because you see a big move doesn’t mean it’s being orchestrated by smart money. There could be other factors at play, like news events or technical indicators.

- Market manipulation: Smart money can use their influence to manipulate the market, making it difficult to predict their true intentions.

- Limited data: It’s hard to get real-time data on the actions of smart money. You’re relying on inferences and patterns, which can be misleading.

Comparing Smart Money Trading with Traditional Technical Analysis

Think of it this way: traditional technical analysis is like reading a map, while smart money trading is like knowing the secrets of the people who made the map. Both can be valuable tools, but understanding the bigger picture can give you a significant edge.

- Focus: Traditional technical analysis focuses on chart patterns and indicators, while smart money trading focuses on the psychology and actions of large players.

- Timeframe: Traditional technical analysis often focuses on short-term trends, while smart money trading can identify long-term trends and opportunities.

- Risk management: Both approaches emphasize risk management, but smart money trading may require a more sophisticated understanding of market dynamics.

Implementing Smart Money Concepts into a Trading Plan

Here’s a step-by-step guide to get you started:

- Educate yourself: Read books, watch videos, and take courses on smart money concepts. Learn about order blocks, liquidity setups, and other key elements.

- Practice on a demo account: Before you risk real money, practice your skills on a demo account. This will help you get comfortable with identifying smart money signals and executing trades.

- Choose your markets: Smart money concepts can be applied to various markets, but some markets may be more suitable than others. For example, stocks with high liquidity are often easier to trade using smart money strategies.

- Develop a trading plan: Artikel your entry and exit points, stop loss orders, and profit targets. This will help you stay disciplined and avoid emotional trading decisions.

- Monitor your results: Keep track of your trades and analyze your performance. This will help you identify areas for improvement and refine your strategy.

Outcome Summary

Mastering smart money concepts is like gaining access to a secret society of traders. It’s about seeing the market from a different perspective, understanding the forces that drive it, and making informed decisions based on the actions of the big players.

By learning to read the language of the market, you can potentially increase your chances of success. But remember, trading is always risky, and even the smartest money strategies can’t guarantee profits. Always do your own research, manage your risk, and trade responsibly.

Now that you’ve got the inside scoop, are you ready to join the game?

Popular Questions

What are some examples of “smart money” trading strategies?

Smart money strategies often involve identifying key levels of support and resistance, using order flow analysis to anticipate institutional orders, and leveraging liquidity pools to profit from price swings. One common example is “liquidity hunting,” where traders target areas of high liquidity to create a sudden price move and capture the stop-loss orders of other traders.

How can I learn more about smart money trading?

There are many resources available online and in print to help you learn about smart money trading. Look for books, courses, and websites that focus on institutional trading strategies, order flow analysis, and price action analysis. Joining online communities and forums dedicated to smart money trading can also be a valuable source of information and insights.

Is smart money trading only for experienced traders?

While smart money trading can be complex, it’s not just for seasoned professionals. With the right education and practice, anyone can learn to identify and utilize smart money signals. However, it’s important to start with a strong understanding of basic trading concepts and to manage your risk carefully.