Furniture payment plans have become increasingly popular, offering a convenient way to furnish your home without breaking the bank. These plans allow you to spread the cost of your purchase over time, making high-priced items more accessible. Whether you’re looking for a new sofa, dining set, or bedroom furniture, there’s likely a payment plan option available to fit your budget and needs.

Understanding the different types of payment plans, their terms and conditions, and the factors to consider when choosing one is crucial. This guide will explore the advantages and disadvantages of furniture payment plans, provide tips for selecting the right option, and emphasize responsible usage to avoid debt and financial strain.

Introduction to Furniture Payment Plans

Furniture payment plans have become increasingly popular in recent years, offering a flexible and convenient way to furnish your home without breaking the bank. These plans allow you to spread the cost of your furniture purchase over a period of time, making it more manageable and affordable.

Payment plans offer several benefits for furniture buyers. One of the most significant advantages is the ability to purchase higher-quality furniture that you might not be able to afford outright. By spreading the cost over time, you can access a wider range of options and invest in pieces that will last for years to come.

Types of Furniture Payment Plans

Furniture payment plans come in various forms, each with its own set of terms and conditions. Here are some common types of payment plans:

- Retailer Financing: Many furniture retailers offer their own financing options, allowing you to make monthly payments directly to them. These plans often come with promotional interest rates or no-interest periods, making them attractive to budget-conscious shoppers.

- Third-Party Financing: Some furniture stores partner with third-party financing companies, such as Affirm or Klarna. These companies provide financing options that can be used at multiple retailers, offering flexibility and convenience.

- Rent-to-Own: Rent-to-own programs allow you to rent furniture with the option to purchase it at the end of the rental period. While these plans may have higher overall costs, they can be a good option for those with limited credit or who want to try out furniture before committing to a purchase.

Understanding Furniture Payment Plans

Furniture payment plans can be a great way to get the furniture you need without having to pay for it all at once. There are several different types of payment plans available, each with its own terms and conditions. Understanding the differences between these options will help you choose the plan that’s right for you.

Different Payment Plan Options

There are several different types of furniture payment plans available. Here are a few of the most common:

- Financing: This is a loan that you take out to pay for your furniture. You’ll make regular payments over a set period of time, and you’ll pay interest on the loan. Financing is typically offered by furniture stores or through third-party lenders.

- Rent-to-own: This is a type of lease agreement where you make regular payments for the furniture, and you have the option to purchase it at the end of the lease term. If you don’t purchase the furniture, you’ll have to return it. Rent-to-own agreements typically have higher costs than financing, as they include interest, rental fees, and potentially a purchase option fee.

- Layaway: This is a payment plan where you make regular payments for the furniture until you’ve paid it off in full. You’ll typically be able to take possession of the furniture once you’ve made all the payments. Layaway plans are often offered by furniture stores and may not include interest charges, but they can have a longer payment period than financing.

Comparing Payment Plan Terms and Conditions

When comparing different furniture payment plans, it’s important to consider the following:

- Interest rates: Financing and rent-to-own agreements will typically have interest rates. These rates can vary significantly, so it’s important to compare different options to find the lowest rate possible.

- Payment terms: The payment term is the length of time you have to pay off the furniture. Shorter payment terms will typically have higher monthly payments, but you’ll pay less interest overall.

- Fees: Some payment plans may have additional fees, such as origination fees, late payment fees, or early termination fees.

- Purchase option: If you’re considering a rent-to-own agreement, be sure to read the terms of the purchase option carefully. This will tell you how much you’ll need to pay to purchase the furniture at the end of the lease term.

Factors to Consider When Choosing a Payment Plan

When choosing a furniture payment plan, there are several factors to consider:

- Your budget: Make sure you can afford the monthly payments for the chosen plan.

- Your credit score: Your credit score will affect your interest rate and whether or not you qualify for financing.

- Your financial goals: If you’re looking to build credit, financing may be a good option. If you’re looking to avoid interest charges, layaway may be a better choice.

- The furniture store’s reputation: It’s important to choose a reputable furniture store that offers fair payment plans.

The Pros and Cons of Furniture Payment Plans

Furniture payment plans can be a tempting option when you’re looking to furnish your home, but it’s important to weigh the pros and cons before making a decision. Like any financial decision, there are advantages and disadvantages to consider.

Advantages of Furniture Payment Plans

Furniture payment plans offer several advantages, making them an appealing choice for some shoppers. Here are some key benefits:

- Affordability: Payment plans allow you to spread the cost of furniture over time, making it more manageable for your budget. This can be especially helpful for larger purchases, like a sofa or dining set, that might otherwise be too expensive to buy outright.

- Flexibility: Payment plans often offer flexible terms, allowing you to choose a payment schedule that fits your financial situation. You can often adjust the length of the plan and the amount of your monthly payments.

- Access to Higher-End Furniture: Payment plans can enable you to purchase higher-quality or more expensive furniture that you might not be able to afford to buy all at once. This can be a good option if you’re looking for durable, long-lasting pieces.

Disadvantages of Furniture Payment Plans

While payment plans can be convenient, they also come with potential drawbacks that you should be aware of:

- Higher Overall Cost: Payment plans typically involve interest charges, which can significantly increase the total cost of the furniture over time. The longer the payment term, the more interest you’ll pay.

- Potential for Debt: If you’re not careful, payment plans can lead to debt. If you fall behind on your payments, you may face late fees and penalties, which can further increase the cost of the furniture.

- Impact on Credit Score: Missing payments on a furniture payment plan can negatively impact your credit score, which can make it harder to get loans or credit cards in the future. This can have a significant impact on your financial well-being.

Risks Associated with Furniture Payment Plans

Furniture payment plans carry certain risks that you should consider before committing:

- Interest Rates: Interest rates on furniture payment plans can vary widely, so it’s important to shop around and compare rates before choosing a plan. Some plans may have very high interest rates, which can make the overall cost of the furniture significantly higher.

- Hidden Fees: Some furniture payment plans may have hidden fees, such as late fees, processing fees, or cancellation fees. Be sure to read the fine print carefully before signing up for a plan.

- Credit Score Impact: As mentioned earlier, missing payments on a furniture payment plan can negatively impact your credit score. This can make it more difficult to obtain loans or credit cards in the future, potentially impacting your financial opportunities.

Tips for Choosing the Right Furniture Payment Plan

Choosing the right furniture payment plan is crucial for ensuring affordability and managing your finances effectively. With various options available, understanding your needs and evaluating different plans is essential.

Factors to Consider, Furniture payment plans

Consider these factors when selecting a furniture payment plan:

- Your Budget: Assess your monthly income and expenses to determine how much you can comfortably allocate towards furniture payments.

- Desired Furniture: Determine the type and cost of the furniture you want to purchase. This will help you narrow down your options and identify plans that fit your budget.

- Credit Score: Your credit score plays a significant role in determining the interest rates and terms you qualify for. A higher credit score generally leads to better financing options.

- Payment Term: Consider the length of the payment plan and the impact on your budget. Longer terms may seem more affordable but often result in higher overall interest costs.

- Interest Rates and Fees: Compare interest rates and fees across different plans to find the most favorable option. Look for plans with low interest rates and minimal hidden fees.

Comparing Payment Plan Options

To compare different payment plan options, utilize the following resources:

- Retailer Websites: Most furniture retailers provide detailed information about their payment plans, including interest rates, terms, and eligibility criteria.

- Credit Bureaus: Check your credit score with credit bureaus like Experian, Equifax, and TransUnion to understand your financing options.

- Financial Websites: Websites like NerdWallet and Bankrate offer comparisons of different financing options, including furniture payment plans.

- Independent Reviews: Read online reviews from other customers to get insights into the pros and cons of specific payment plans.

Negotiating Payment Terms

Negotiating payment terms can help you secure a more favorable plan:

- Shop Around: Compare offers from multiple retailers to leverage competition and potentially negotiate better terms.

- Ask About Discounts: Inquire about discounts or promotions that may be available, such as early payment discounts or financing incentives.

- Consider a Down Payment: A larger down payment can reduce the amount you need to finance, potentially lowering interest costs and monthly payments.

- Be Prepared to Walk Away: If you cannot reach an agreement on satisfactory terms, be prepared to walk away and explore other options.

Understanding Interest Rates

Interest rates are a crucial aspect of furniture payment plans:

- Annual Percentage Rate (APR): The APR represents the annual cost of borrowing money, including interest and fees. A lower APR generally translates to lower overall costs.

- Simple Interest: Simple interest is calculated only on the principal amount borrowed.

- Compound Interest: Compound interest is calculated on the principal amount and any accumulated interest, leading to faster growth over time.

Tip: Always read the fine print of payment plan agreements carefully to understand the interest rates, fees, and other terms and conditions.

Responsible Furniture Payment Plan Usage

Furniture payment plans can be a great way to get the furniture you need without having to pay for it all at once. However, it’s important to use them responsibly to avoid getting into debt.

The key to responsible furniture payment plan usage is to budget carefully and manage your finances effectively. This means knowing how much you can afford to pay each month and making sure you can keep up with your payments. If you’re not careful, it’s easy to overextend yourself and end up in a situation where you can’t afford to make your payments. This can lead to late fees, damage to your credit score, and even the possibility of having your furniture repossessed.

Furniture payment plans can be a great way to spread out the cost of new pieces, but sometimes you just want to get your hands dirty and create something yourself. If you’re looking for inspiration, check out these simple woodworking plans for projects that won’t break the bank.

Once you’ve built a few pieces, you’ll be well on your way to filling your home with unique, handcrafted furniture.

Strategies for Avoiding Debt

There are several things you can do to avoid getting into debt when using a furniture payment plan. Here are a few key strategies:

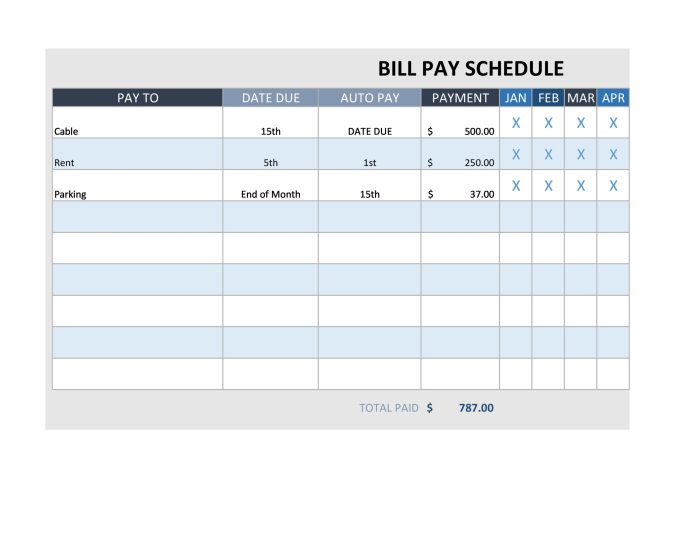

- Create a Budget: Before you sign up for a payment plan, create a budget that includes all of your income and expenses. This will help you determine how much you can afford to pay each month without putting yourself in a difficult financial position. Be sure to factor in all of your expenses, including your regular bills, groceries, transportation, and entertainment.

- Compare Payment Plans: Don’t just go with the first payment plan you find. Shop around and compare different options from different retailers. Look at the interest rates, monthly payments, and any other fees that may apply. Choose a plan that fits your budget and that you feel comfortable with.

- Make Payments on Time: This is crucial. Make sure you understand the payment due date and set up a reminder system to ensure you make your payments on time. Late payments can result in late fees and can negatively impact your credit score.

- Pay More Than the Minimum: If you can afford it, pay more than the minimum payment each month. This will help you pay off your balance faster and save money on interest charges.

- Avoid Using Payment Plans for Non-Essential Items: Furniture payment plans are often used for big-ticket items like sofas, beds, and dining tables. Avoid using them for non-essential items that you can easily afford to pay for outright.

Consequences of Missed Payments

If you miss payments on your furniture payment plan, there are several consequences you should be aware of:

- Late Fees: You will likely be charged late fees for each missed payment. These fees can add up quickly, making it even more difficult to pay off your balance.

- Damaged Credit Score: Missed payments can negatively impact your credit score. This can make it more difficult to get loans, credit cards, and other financial products in the future.

- Repossession: If you continue to miss payments, the retailer may repossess your furniture. This means they will take back the furniture you purchased, and you will lose your money.

Furniture Payment Plans and Consumer Protection

Furniture payment plans can be a great way to get the furniture you need without having to pay for it all at once. However, it’s important to understand your rights and protections as a consumer when using these plans.

Consumer Rights and Protections

When you enter into a furniture payment plan, you have certain rights and protections under consumer protection laws. These laws vary by state, but generally include:

- The right to a clear and understandable contract that Artikels the terms of the plan, including the total cost of the furniture, the interest rate, the payment schedule, and any late fees.

- The right to a refund if you cancel the plan within a certain timeframe, usually within 3 days of signing the contract.

- The right to dispute any charges or errors on your account.

- The right to protection from unfair or deceptive practices, such as hidden fees or misleading advertising.

The Role of Regulatory Bodies

Several regulatory bodies oversee the furniture payment plan industry. These bodies ensure that companies comply with consumer protection laws and that consumers are treated fairly. Some of the key regulatory bodies include:

- The Federal Trade Commission (FTC): The FTC enforces federal consumer protection laws, including laws related to credit and lending. The FTC can investigate complaints about furniture payment plan companies and take action against companies that violate the law.

- The Consumer Financial Protection Bureau (CFPB): The CFPB is responsible for overseeing the financial products and services offered by banks, credit unions, and other financial institutions. The CFPB can investigate complaints about furniture payment plans offered by these institutions and take action against companies that violate the law.

- State Attorneys General: Each state has an Attorney General who enforces state consumer protection laws. State Attorneys General can investigate complaints about furniture payment plan companies that operate within their state and take action against companies that violate state law.

Reporting Fraudulent or Unfair Practices

If you believe you have been a victim of fraudulent or unfair practices related to a furniture payment plan, you can report the issue to the appropriate regulatory body. You can also contact your state’s Attorney General or the FTC to file a complaint.

- The FTC: You can file a complaint with the FTC online at https://www.ftc.gov/faq/consumer-protection/complaints or by phone at 1-877-FTC-HELP (1-877-382-4357).

- The CFPB: You can file a complaint with the CFPB online at https://www.consumerfinance.gov/complaint/ or by phone at 1-855-411-CFPB (1-855-411-2372).

- State Attorneys General: You can find contact information for your state’s Attorney General on the National Association of Attorneys General website at https://www.naag.org/attorneys-general/.

The Future of Furniture Payment Plans

The furniture industry is constantly evolving, and furniture payment plans are no exception. The rise of technology, changing consumer preferences, and the growing popularity of digital payments are all influencing how people buy furniture. As a result, the future of furniture payment plans is likely to be characterized by increased flexibility, convenience, and personalization.

The Impact of Technology and Digital Payments

Technology is playing a significant role in shaping the future of furniture payment plans. Online retailers and traditional furniture stores are increasingly embracing digital payment solutions. These solutions offer a more seamless and convenient experience for consumers, allowing them to make payments from anywhere, anytime.

- Digital wallets, such as Apple Pay and Google Pay, are becoming increasingly popular. These wallets allow consumers to make purchases quickly and securely without having to enter their credit card information each time.

- Buy now, pay later (BNPL) options are gaining traction, offering consumers the ability to pay for their furniture in installments over a period of time. These services are often integrated into online checkout processes, making it easier for consumers to access financing.

- Artificial intelligence (AI) is also being used to personalize payment options. AI-powered algorithms can analyze customer data to recommend payment plans that are tailored to their individual needs and preferences.

Closing Summary

Furniture payment plans offer a valuable solution for individuals seeking to upgrade their living spaces without immediate financial burden. By carefully considering the pros and cons, choosing the right plan, and managing finances responsibly, you can enjoy the benefits of owning new furniture while staying in control of your budget. Remember to research different options, compare terms, and prioritize responsible financial practices to ensure a positive experience with furniture payment plans.

Q&A

What are the common types of furniture payment plans?

The most common types include financing, rent-to-own, and layaway. Financing allows you to borrow money to purchase furniture, while rent-to-own involves paying a monthly fee for a set period until you own the item. Layaway lets you pay for the furniture in installments over time, and you receive the item once it’s fully paid off.

What should I consider when choosing a furniture payment plan?

Factors to consider include the total cost, interest rates, payment terms, and any hidden fees. It’s also important to assess your budget and ability to make timely payments.

How can I avoid debt with furniture payment plans?

Create a budget, prioritize essential expenses, and avoid overextending yourself. Make sure you understand the terms and conditions of the plan, including interest rates and late fees.