Listen up, entrepreneurs and money-minded folks! We’re diving into the world of ledger books, those trusty old-school tools that can help you manage your finances like a boss. Whether you’re running a side hustle or just trying to keep your personal finances in check, a ledger book can be your secret weapon for staying organized and on top of your money game.

Forget those complicated spreadsheets and confusing software programs. A ledger book is all about simplicity and clarity. It’s like having your own personal financial detective, keeping track of every dollar that comes in and goes out. With a ledger book, you can easily see where your money is going, identify areas where you can save, and make smarter financial decisions.

The Importance of Financial Record Keeping for Small Businesses

Running a small business is like juggling chainsaws – it takes skill, focus, and a healthy dose of organization. Just like you wouldn’t try to juggle without knowing where your chainsaws are, you can’t run a successful business without a solid understanding of your finances.

Okay, so you’re thinking about getting your finances in order, maybe starting a side hustle or just trying to keep track of your money better. That’s totally legit! But, you know, sometimes getting your finances in order can feel like a whole healing journey in itself.

It’s like, “Breaking Free The Road To Healing” Breaking Free The Road To Healing but for your bank account! This awesome ledger book, with its 100+ pages, is your chance to get your financial mojo back, one entry at a time.

This is where financial record keeping comes in, and a trusty ledger book is your best friend.

Why Accurate Financial Records Matter

Accurate financial records are the backbone of any successful business, especially for small businesses. They provide a clear picture of your business’s financial health, allowing you to make informed decisions and navigate the often-unpredictable waters of entrepreneurship. Think of it like having a financial GPS – it helps you stay on track, avoid costly detours, and reach your business goals.

The Benefits of Using a Ledger Book

A ledger book is a simple yet powerful tool for tracking your business’s income and expenses. It’s like a financial diary, recording every penny that comes in and goes out. Here’s why it’s a game-changer:

- Organization:A ledger book helps you organize your financial data, making it easy to find specific transactions. No more digging through receipts and scribbled notes!

- Accuracy:By meticulously recording every transaction, you minimize the risk of errors and ensure that your financial data is accurate. This is crucial for making sound decisions.

- Transparency:A ledger book provides a transparent record of your business’s financial activity, which can be helpful for tax purposes, investors, or even just for your own peace of mind.

- Insights:The data in your ledger book can reveal valuable insights about your business’s performance. You can track trends, identify areas for improvement, and make informed decisions based on real data.

How a Ledger Book Can Help with Decision-Making and Financial Planning

Think of your ledger book as a financial crystal ball. It helps you see into the future of your business by providing valuable data for decision-making and financial planning. Here are some examples:

- Budgeting:By analyzing your income and expenses, you can create a realistic budget that helps you manage your cash flow and avoid financial surprises.

- Pricing:Understanding your costs can help you set competitive prices for your products or services. You can use your ledger book to track the cost of materials, labor, and overhead to ensure you’re making a profit.

- Investment Decisions:Your ledger book can help you determine if you have enough cash flow to invest in new equipment, marketing campaigns, or other growth opportunities.

- Tax Preparation:Accurate financial records are essential for tax preparation. Your ledger book can help you organize your expenses and income, making tax filing a breeze.

Features and Benefits of a Ledger Book

A ledger book is a simple but powerful tool for tracking your finances. It’s a physical record of your income and expenses, organized in a way that makes it easy to understand your financial situation.

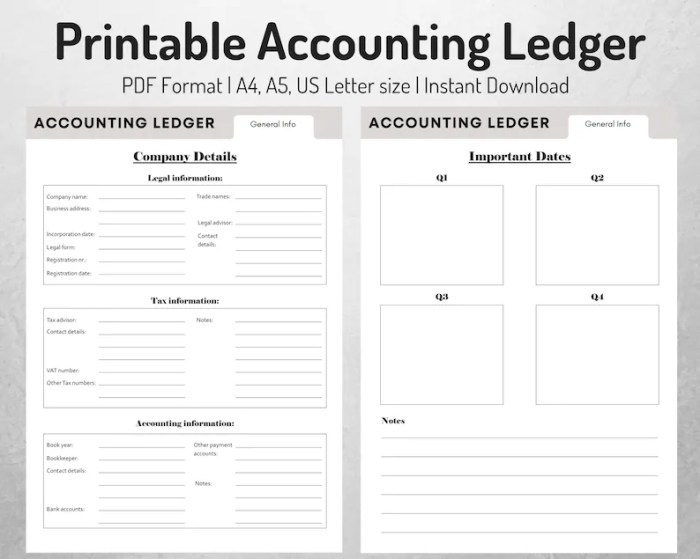

Key Features of a Ledger Book

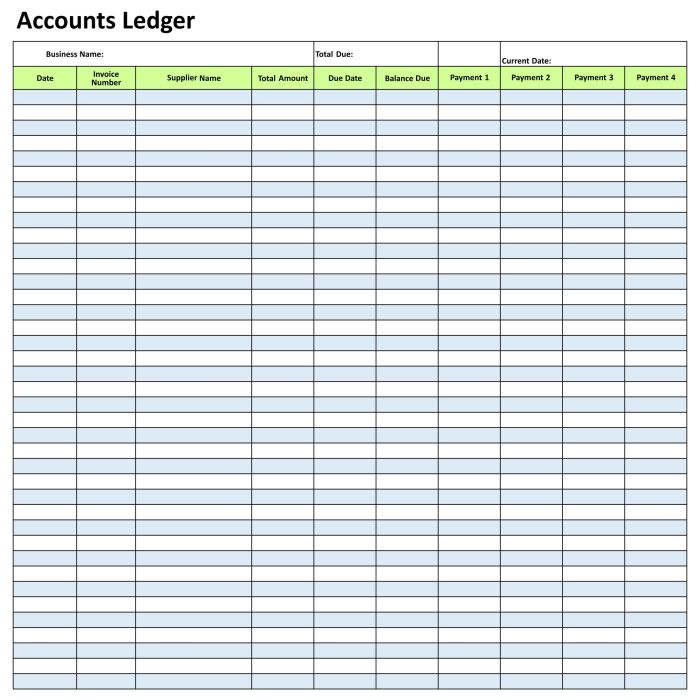

A typical ledger book includes columns for:

- Date:The date of the transaction.

- Transaction Type:Whether the transaction is income or expense.

- Description:A brief description of the transaction.

- Amount:The amount of money involved in the transaction.

These columns allow you to easily track your financial activity and analyze your spending patterns.

Advantages of Using a Physical Ledger Book

While digital accounting software is becoming increasingly popular, there are still several advantages to using a physical ledger book:

- No internet required:You can use a ledger book anywhere, anytime, without needing an internet connection. This is especially useful for small businesses or individuals who work in remote areas or have limited access to technology.

- Security and privacy:A physical ledger book is less susceptible to hacking or data breaches than digital software. Your financial information is safe and secure in your own hands.

- Tangible record:Having a physical record of your finances can provide a sense of security and control. It’s also easier to refer to and audit a physical ledger book than a digital file.

- Improved focus and mindfulness:Writing down your transactions in a ledger book can help you be more mindful of your spending and encourage you to make more deliberate financial decisions.

Benefits of a Simple Ledger Book for Bookkeeping

A simple ledger book is an excellent tool for bookkeeping, especially for small businesses and individuals:

- Easy to use:Even if you’re not a financial expert, you can easily learn to use a ledger book. It’s a straightforward system that requires minimal training.

- Accessible:A ledger book is affordable and readily available. You can purchase one at most office supply stores or online retailers.

- Organization and clarity:A ledger book helps you stay organized and keep track of your finances. It provides a clear and concise overview of your income and expenses.

- Transparency and accountability:A physical ledger book promotes transparency and accountability. It allows you to easily see where your money is going and helps you stay on track with your financial goals.

Using a Ledger Book for Personal Finance

In today’s world, it’s easy to lose track of your finances, especially with all the online shopping, subscriptions, and automated payments. That’s where a trusty ledger book comes in. It’s like your personal financial sidekick, helping you stay on top of your money and make smart decisions.Think of a ledger book as a personalized financial journal, a place to document every penny that comes in and goes out.

Okay, so you’re trying to level up your business game with this awesome accounting ledger book. You want to keep track of every dime, right? Well, you know what they say, “Know your enemy and know yourself, and you will not be imperiled in a hundred battles.” That’s why you should check out The Art of War (Annotated) to understand the strategies behind business success.

Think of it as a guide to conquering your financial goals. Once you’ve got your finances in order, you’ll be unstoppable.

You can track your income from your job, side hustles, or even gifts, and list all your expenses, from groceries and rent to that new pair of sneakers you couldn’t resist.

Yo, if you’re running a side hustle or just want to stay on top of your finances, an accounting ledger book is your new best friend. It’s like having your own personal accountant in a notebook, helping you track every penny coming in and going out.

You can download a super-useful template and listen to some awesome tips on using it right Download And Listen Here. Once you get the hang of it, you’ll be a budgeting boss in no time!

Tracking Income and Expenses

A ledger book provides a structured way to keep tabs on your finances. It allows you to record every transaction, from the smallest coffee purchase to the biggest bills. By meticulously logging your income and expenses, you gain a clear picture of your financial health.

This knowledge empowers you to make informed decisions about your spending habits, identify areas where you can save, and work towards achieving your financial goals.

Okay, so you’re all about keeping your finances in check, right? You’ve got your trusty Accounting Ledger Book, ready to track every penny. But hey, life’s not all about spreadsheets and numbers, right? Sometimes you need to unwind and tap into your creative side.

That’s where Super Easy Kalimba Sheet Music for Beginners comes in. Learn to play some sweet tunes, and when you’re done, you can go back to balancing your books. You’re a total boss, handling both your finances and your musical side!

Organizing and Maintaining a Personal Ledger Book

Organizing your ledger book can make all the difference in how effectively you use it. Here are some tips for keeping your financial records in tip-top shape:

- Choose a format that works for you:There are various ledger book templates available online or you can create your own. Some prefer a simple table format with columns for date, description, income, and expenses, while others opt for more detailed categories.

- Use clear and concise language:When describing your transactions, be specific and use language that you’ll easily understand later. For example, instead of “groceries,” write “groceries at Safeway.”

- Review your entries regularly:Set aside time each week or month to review your ledger book. This allows you to spot any errors, track your progress, and make adjustments as needed.

- Use a system for categorizing expenses:Categorizing your expenses helps you identify areas where you might be overspending. Common categories include housing, food, transportation, entertainment, and personal care.

- Keep your ledger book in a safe place:Your ledger book contains sensitive financial information, so it’s important to keep it secure. Store it in a locked drawer or safe.

Managing Finances and Achieving Financial Goals

A ledger book can be your secret weapon for achieving financial goals. By tracking your income and expenses, you gain a clear understanding of your financial situation. This allows you to:

- Create a budget:By analyzing your spending patterns, you can create a budget that aligns with your financial goals.

- Identify areas for savings:Your ledger book can reveal hidden areas where you can cut back on expenses, freeing up money for savings or debt repayment.

- Track progress towards financial goals:Whether you’re saving for a down payment on a house, paying off debt, or investing for retirement, your ledger book can help you monitor your progress and stay motivated.

- Make informed financial decisions:A ledger book provides a historical record of your finances, allowing you to make informed decisions about big purchases, investments, and other financial commitments.

Ultimate Conclusion

![]()

So, ditch the stress and embrace the simplicity of a ledger book. It’s a time-tested method that can empower you to take control of your finances and achieve your financial goals. Whether you’re a seasoned entrepreneur or just starting out, a ledger book is a valuable tool that can help you build a brighter financial future.

Questions Often Asked

Is a ledger book really necessary in today’s digital age?

While digital tools are great, a ledger book offers a tangible and organized way to track finances. It can be especially helpful for small businesses and individuals who prefer a hands-on approach.

How do I choose the right ledger book for my needs?

Consider the size and format that best suits your preferences. Look for a book with enough pages to accommodate your needs, and consider features like pre-printed columns or sections for specific categories.

What are some tips for keeping a ledger book organized?

Use a consistent format for recording transactions, date entries clearly, and consider using different colored pens or highlighters to categorize income and expenses. Regularly review and update your ledger to ensure accuracy.