Remember that time your favorite bank went belly up and everyone went running to get their cash? Or that crazy stock market crash that made headlines for weeks? Those are just a couple of examples of the wild world of bank failures, bank runs, and financial system collapses.

These events, like a plot twist in a financial thriller, can send shockwaves through the economy, leaving individuals and institutions reeling.

We’ll dive into the history of these financial meltdowns, explore the psychology behind bank runs, and uncover the interconnectedness of financial institutions that can lead to a full-blown crisis. It’s a story of panic, risk, and the delicate balance of trust that keeps the financial system afloat.

Bank Failures and Their Impact

Bank failures, like a domino effect, can have devastating consequences for economies and individuals alike. These failures are not new, and their impact has been felt throughout history. From the Great Depression to the recent global financial crisis, understanding the historical context of bank failures is crucial to comprehending their potential for disruption.

Significant Bank Failures and Their Impact on Economies

The history of banking is riddled with instances of bank failures, each leaving its mark on the economic landscape. These failures often stem from a combination of factors, including poor lending practices, economic downturns, and regulatory shortcomings.

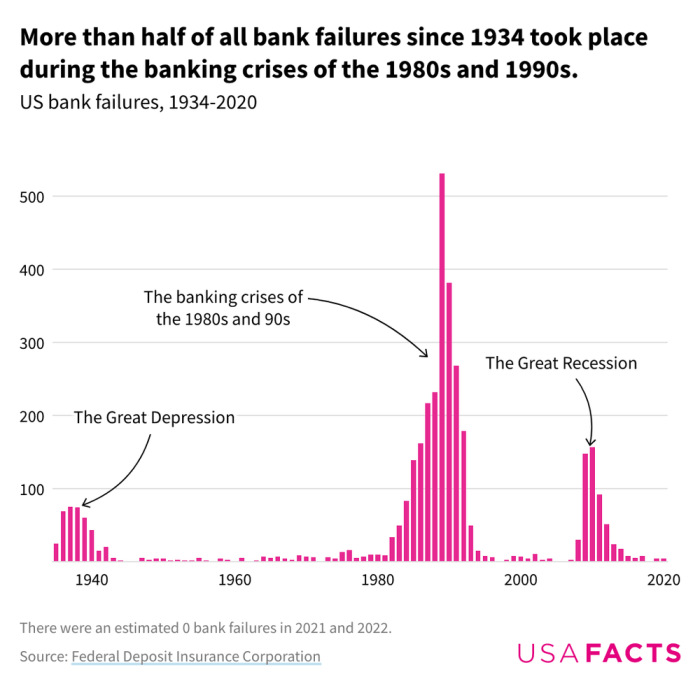

- The Great Depression (1929-1939): The most severe economic downturn in modern history, the Great Depression saw a wave of bank failures across the United States. These failures were largely attributed to risky lending practices during the Roaring Twenties, leading to widespread panic and a loss of confidence in the banking system.

The resulting economic devastation led to widespread unemployment, homelessness, and social unrest.

- The Savings and Loan Crisis (1980s): This crisis involved the failure of hundreds of savings and loan associations (S&Ls) in the United States. The crisis was fueled by deregulation, risky investments in real estate, and fraud. The collapse of these institutions led to a significant loss of taxpayer funds and contributed to the recession of the early 1990s.

- The Global Financial Crisis (2008-2009): This crisis was triggered by the collapse of the subprime mortgage market in the United States. The crisis spread rapidly, leading to the failures of major financial institutions, such as Lehman Brothers and Bear Stearns.

The resulting recession had a profound impact on the global economy, leading to widespread job losses, foreclosures, and a decline in global trade.

Contributing Factors to Bank Failures

Bank failures are often a result of a complex interplay of factors. Some of the most common contributing factors include:

- Risky Lending Practices: Banks can become vulnerable when they engage in risky lending practices, such as extending loans to borrowers with poor credit histories or making loans based on inflated asset valuations.

- Economic Downturns: Recessions and economic downturns can lead to a rise in loan defaults, which can strain a bank’s financial resources and increase the risk of failure.

- Regulatory Shortcomings: Weak or ineffective regulations can allow banks to engage in risky behavior and increase the likelihood of failures.

- Fraud and Mismanagement: Fraudulent activities and poor management practices can also lead to bank failures.

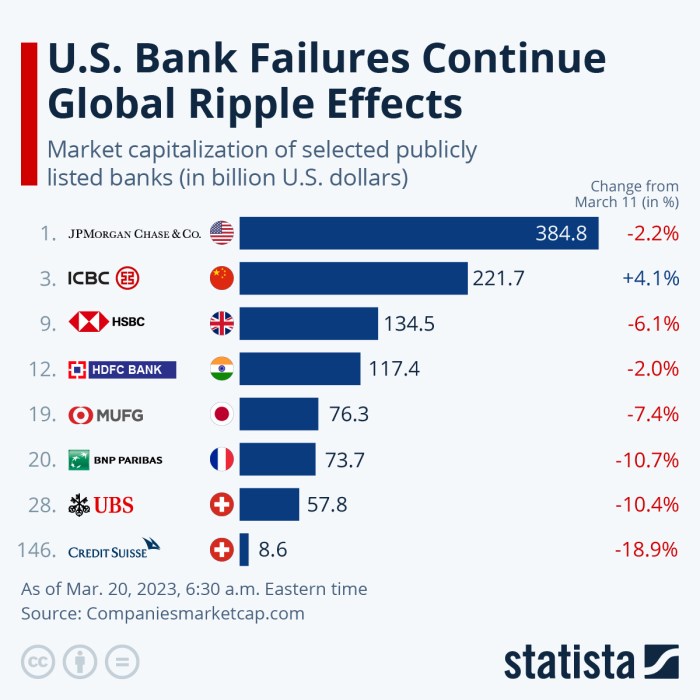

Ripple Effects of Bank Failures

Bank failures can have far-reaching consequences, extending beyond the immediate impact on depositors and shareholders. These ripple effects can include:

- Loss of Confidence in the Financial System: Bank failures can erode public confidence in the financial system, leading to a decrease in deposits and lending.

- Credit Crunch: When banks fail, they may stop lending, leading to a credit crunch that can stifle economic growth.

- Economic Downturn: Bank failures can contribute to economic downturns by reducing investment, slowing consumer spending, and increasing unemployment.

- Systemic Risk: In some cases, the failure of a large bank can trigger a chain reaction of failures throughout the financial system, leading to a systemic crisis.

Bank Runs

A bank run occurs when a large number of depositors withdraw their funds from a bank, often simultaneously, out of fear that the bank may become insolvent. These runs can be triggered by rumors, financial crises, or even just a loss of confidence in the bank’s stability.

The Psychology of Bank Runs

The psychology of bank runs is fascinating. It’s a classic example of a self-fulfilling prophecy. When depositors start to worry about a bank’s solvency, they might begin to withdraw their funds. This withdrawal, in turn, can make the bank appear even more vulnerable, leading to further withdrawals.

Yo, listen up, ’cause this ain’t no joke. ChatGPT’s been spitting some serious fire about bank failures, runs, and the whole financial system going kaput. It’s like watching a wild roller coaster, but instead of screams, you hear whispers of economic doom.

But hold up, there’s a different kind of rollercoaster ride going on in NO EMERGENCY CONTACT An Addict’s Journey to Freedom , where addiction is the main attraction. And just like the financial system, it’s a journey with some serious ups and downs.

But hey, maybe understanding the struggle in “NO EMERGENCY CONTACT” can give us some perspective on the financial chaos ChatGPT’s talking about. After all, both stories are about survival, resilience, and finding a way to climb out of the depths.

This creates a vicious cycle, as more depositors panic and rush to withdraw their money, making the bank’s situation worse. Rumors, even if unfounded, can spread like wildfire, creating a climate of fear and uncertainty.

The Impact of Bank Runs

Bank runs can have devastating consequences, particularly for smaller institutions. Small banks often have a limited pool of depositors, so a significant number of withdrawals can quickly drain their reserves, leading to insolvency. Larger banks, on the other hand, have a more diversified customer base and access to more resources, making them more resilient to bank runs.

However, even large banks can be affected by a widespread panic.

Historical Bank Runs

Throughout history, bank runs have been a recurring phenomenon. One of the most famous examples is the Great Depressionin the 1930s. The stock market crash of 1929 triggered a wave of bank runs across the United States, as depositors feared for the safety of their savings.

This led to the collapse of thousands of banks and exacerbated the economic crisis. Another example is the Savings and Loan Crisisof the 1980s. This crisis was caused by a combination of factors, including deregulation, risky lending practices, and fraud. The crisis led to the failure of hundreds of savings and loan associations and cost taxpayers billions of dollars.

Examples of Bank Runs

The Northern Rock bank run (2007)

The Northern Rock bank run in 2007 was triggered by concerns about the bank’s exposure to the subprime mortgage market. This run was one of the first major bank runs to occur in the aftermath of the 2008 financial crisis.

The Cyprus bank run (2013)

The Cyprus bank run in 2013 was triggered by the country’s economic crisis and the government’s decision to impose a levy on bank deposits. This run led to the collapse of several Cypriot banks and forced the government to accept a bailout from the European Union.

Financial System Collapses

Financial system collapses, or systemic risk, are like a domino effect in the world of money. When one bank falls, it can trigger a chain reaction, bringing down other banks and even the entire financial system. It’s like a game of Jenga, but with real money and real consequences.

Interconnectedness of Financial Institutions

The interconnectedness of financial institutions is like a giant web, where each bank is connected to others through loans, investments, and other financial transactions. When one bank fails, it can affect its creditors, who might also be banks. This ripple effect can spread quickly, leading to a cascade of failures.

Imagine a chain reaction of falling dominoes, with each domino representing a bank. The failure of one domino can cause others to fall, and so on.

- Counterparty Risk:This is the risk that one party in a financial transaction will fail to meet its obligations, leaving the other party holding the bag. When a bank fails, its counterparties may lose money, which can lead to further failures.

For example, if Bank A lends money to Bank B, and Bank B fails, Bank A may lose the money it lent. This loss could cause Bank A to fail as well.

- Contagion Effects:Contagion occurs when the failure of one financial institution leads to the failure of others. This can happen through a variety of mechanisms, such as counterparty risk, liquidity shortages, and loss of confidence. The failure of one bank can lead to a run on other banks, as depositors fear that their money is not safe.

For example, if Bank A fails, depositors may withdraw their money from Bank B, fearing that Bank B will also fail. This can lead to a liquidity shortage at Bank B, which could force it to fail as well.

Role of Regulation and Oversight

Regulation and oversight play a crucial role in mitigating systemic risk. They are like the safety nets that help prevent the dominoes from falling. Governments and regulators have a responsibility to ensure that the financial system is stable and resilient.

This includes setting capital requirements, supervising banks, and managing systemic risk.

- Capital Requirements:Capital requirements are like safety cushions for banks. They require banks to hold a certain amount of capital, which acts as a buffer against losses. This helps to prevent banks from failing due to unexpected losses. For example, if a bank has a capital requirement of 10%, it must hold 10% of its assets in capital.

This capital can be used to absorb losses, such as those incurred from loan defaults.

- Bank Supervision:Bank supervisors act like watchdogs, monitoring banks’ activities and ensuring that they are complying with regulations. They can intervene if they see signs of trouble, such as excessive risk-taking or inadequate capital levels. For example, bank supervisors may require banks to increase their capital levels or to change their lending practices if they are concerned about their financial health.

Yo, ChatGPT’s got some wild theories about bank failures, runs, and how the whole financial system could go kablooey. It’s like a real-life thriller, but with less explosions and more spreadsheets. Wanna dive deeper into the financial drama?

Download And Listen Here and get the lowdown on what ChatGPT’s saying about the potential chaos. It’s gonna be a wild ride, so buckle up, fam.

- Systemic Risk Management:Systemic risk management involves identifying and mitigating risks that could threaten the stability of the financial system as a whole. This includes things like stress testing banks, monitoring interbank lending, and developing contingency plans for dealing with financial crises.

For example, stress testing involves simulating a financial crisis to see how banks would perform under adverse conditions. This information can be used to identify vulnerabilities and to develop strategies for mitigating systemic risk.

Book Review: “This Time Is Different: Eight Centuries of Financial Folly” by Carmen Reinhart and Kenneth Rogoff

This book is a must-read for anyone interested in understanding the history of financial crises and their impact on economies. Reinhart and Rogoff provide a comprehensive and compelling analysis of eight centuries of financial folly, drawing on a vast dataset of historical data.

Their work challenges the notion that financial crises are a modern phenomenon and highlights the recurring patterns of financial instability throughout history.

Key Themes, Author’s Arguments, Evidence Presented, and Your Critique

The book’s central argument is that financial crises are a recurring feature of economic history, driven by a combination of human behavior and institutional failures. The authors argue that policymakers and investors often fall prey to the “this time is different” syndrome, believing that current conditions are unique and that past crises are irrelevant.

This belief leads to excessive risk-taking and asset bubbles, which eventually burst, triggering financial crises.The book presents a wealth of historical evidence to support its arguments, drawing on data from a wide range of countries and time periods. The authors examine the causes and consequences of financial crises, including bank failures, currency crises, and sovereign debt crises.

ChatGPT can spit out all the facts about bank failures and financial system collapses, but it can’t tell you what it’s like to be in the middle of the storm. That’s where “Falling Off Horses A Memoir” Falling Off Horses A Memoir comes in.

It’s a real-life story about a guy who went through a financial meltdown and how he picked himself up. Maybe reading about his struggles will help you understand what’s at stake when the financial system goes belly up.

They also explore the role of government policies in both exacerbating and mitigating financial instability.Reinhart and Rogoff’s work is highly influential and has been widely cited in both academic and policy circles. However, their analysis has also been subject to criticism.

Yo, so ChatGPT’s been spitting out some serious insights on bank failures, bank runs, and the whole financial system going kablooey. It’s like, “Whoa, dude, that’s some heavy stuff!” But hey, if you’re looking to diversify your portfolio and maybe even hedge against some of that financial chaos, you might wanna check out this OPTIONS TRADING CRASH COURSE.

It’s all about learning the ropes of options trading and becoming a pro in no time. You know, maybe even becoming financially independent? Anyway, back to the bank stuff, ChatGPT’s got some pretty wild predictions about the future of the financial system, so keep your eyes peeled, fam.

Some critics have argued that their data is flawed, while others have questioned their conclusions. The authors have defended their work, but the debate over their findings highlights the complexity of financial crises and the challenges of understanding their causes and consequences.

| Key Themes | Author’s Arguments | Evidence Presented | Your Critique |

|---|---|---|---|

| Financial crises are a recurring feature of economic history. | Financial crises are caused by a combination of human behavior and institutional failures. | The authors present a vast dataset of historical data, including data on bank failures, currency crises, and sovereign debt crises. | The authors’ analysis is comprehensive and compelling, but their data has been subject to criticism. |

| Policymakers and investors often fall prey to the “this time is different” syndrome. | This belief leads to excessive risk-taking and asset bubbles, which eventually burst, triggering financial crises. | The authors provide numerous examples of historical crises, including the South Sea Bubble, the Great Depression, and the Asian financial crisis. | The authors’ arguments are persuasive, but their analysis is focused on large, systemic crises. |

| Government policies can both exacerbate and mitigate financial instability. | Policies that promote financial deregulation and loose monetary policy can lead to excessive risk-taking and asset bubbles. | The authors examine the role of government policies in the lead-up to the 2008 financial crisis. | The authors’ analysis is valuable, but their focus on government policies may neglect the role of other factors, such as technological innovation and globalization. |

Conclusion

From the tulip mania of the 17th century to the 2008 financial crisis, history has shown us that financial disasters are a recurring theme. Understanding the causes and consequences of bank failures and system collapses is crucial for preventing future crises and ensuring a more stable and resilient financial system.

So, buckle up and get ready to learn about the roller coaster ride of finance, because it’s a wild ride.

FAQ Resource

What’s the difference between a bank failure and a bank run?

A bank failure happens when a bank can’t meet its financial obligations and is forced to close. A bank run occurs when a large number of depositors withdraw their money from a bank, fearing that it might fail. Bank runs can trigger bank failures, but not all bank failures are caused by runs.

How can I protect myself from a financial crisis?

It’s tough to predict or fully shield yourself from a financial crisis, but there are steps you can take. Diversify your investments, build an emergency fund, and stay informed about economic conditions. It’s also important to understand your own financial situation and make informed decisions.

What role does regulation play in preventing financial crises?

Regulation plays a crucial role in mitigating systemic risk and preventing financial crises. Strong regulations can help ensure banks are adequately capitalized, limit risky lending practices, and provide oversight of financial institutions. However, finding the right balance between regulation and innovation is a constant challenge.