Retirement. It’s the golden ticket, the dream vacation, the time to finally kick back and relax after years of hustling. But before you start picturing yourself sipping margaritas on a beach, you need to make sure your retirement plan is actually cooked to perfection.

Think of it like a recipe: you need the right ingredients (savings, investments, income strategies), the proper cooking techniques (planning, budgeting, diversifying), and a little sprinkle of “chill” (lifestyle choices, hobbies, and social connections). This guide will help you whip up a retirement plan that’s both delicious and fulfilling.

We’ll dive into the nitty-gritty of retirement planning, covering everything from figuring out your financial needs to choosing the best investment strategies. We’ll also explore the importance of living your best life in retirement, whether that means traveling the world, pursuing your passions, or simply enjoying quality time with loved ones.

So, grab your apron and let’s get cookin’!

Planning for a Comfortable Retirement

Retirement planning is like prepping for a long road trip: the earlier you start, the smoother the ride. Don’t wait until the last minute to figure out your retirement plan. Starting early gives you time to build a solid financial foundation and adjust your strategy as needed.

Estimating Retirement Expenses

Understanding how much money you’ll need in retirement is the first step. This involves estimating your expenses, factoring in inflation, and considering any potential changes in your lifestyle. Here are some tips to help you estimate your retirement expenses:* Track your current spending:Keep a detailed record of your monthly expenses for a year or two.

This will give you a clear picture of where your money goes.

Consider your future needs

Think about how your spending habits might change in retirement. For example, you might spend less on commuting, but more on travel or healthcare.

Factor in inflation

Inflation can erode the purchasing power of your savings over time. Use an inflation calculator to estimate how much your expenses will increase in the future.

Consult a financial advisor

A professional can help you create a personalized retirement plan based on your individual circumstances.

Benefits of Diversifying Retirement Investments

Diversification is like spreading your bets in a casino: it reduces your risk by investing in a variety of assets. Diversifying your retirement investments can help you:* Minimize risk:By investing in a mix of stocks, bonds, and other assets, you can reduce your exposure to any one particular investment.

Maximize returns

Cookin’ up your retirement plan is all about getting your financial house in order, but it’s also about making sure you’re mentally ready for the next chapter. Think of it like growing your own garden – you need the right tools, the right soil, and a whole lot of courage to make it bloom.

Check out “Of Dirt and Wildflowers A Memoir on Growing the Courage to Bloom” here for some inspiration on how to cultivate your inner strength. Just like a garden, your retirement plan needs to be nurtured and tended to, and with the right mindset, you’ll be able to harvest the fruits of your labor for years to come.

A diversified portfolio has the potential to generate higher returns over the long term.

Weather market fluctuations

Retirement planning is all about making smart choices for your future, just like the author of 11 Years A Biography of a Cancer Survivor with a Two-Month Prognosis made the choice to fight for their life. This inspiring story reminds us that even when faced with a tough diagnosis, we can choose to make the most of every day and plan for a brighter future.

So, whether you’re thinking about your financial future or just looking for some inspiration, take a page from this survivor’s playbook and get cookin’ on your retirement plan!

When one asset class performs poorly, others may perform well, helping to offset losses.

Planning for retirement is like a recipe: you need the right ingredients, the right timing, and the right amount of heat. But sometimes, it feels like the whole world is changing around us. You remember it being one way, but then BAM! It’s different, like the Mandela Effect.

Check out The Mandela Effect Mind-Bending Reality (Bleeding Edge Knowledge) to see if you’re experiencing it. No matter what reality throws at you, sticking to your retirement plan is like adding the finishing touches to your culinary masterpiece.

It’s all about the long game, folks.

Common Retirement Savings Strategies

There are several different retirement savings strategies available, each with its own set of advantages and disadvantages. Here are some common strategies:* 401(k) or 403(b) plans:These employer-sponsored retirement plans allow you to contribute pre-tax dollars to a tax-deferred account.

Traditional IRA

A traditional IRA is a tax-deductible retirement account that allows you to make contributions throughout your working years.

Roth IRA

A Roth IRA is a non-deductible retirement account that allows you to withdraw your earnings tax-free in retirement.

Cookin’ up your retirement plan can feel like a whole lotta pressure, like trying to find the perfect recipe for a five-star meal. But don’t sweat it! Download And Listen Here to some financial tips that’ll help you whip up a retirement plan that’s totally delicious, and get ready to enjoy the fruits of your labor (and maybe even some sweet retirement cocktails!).

Annuities

Annuities are insurance contracts that provide a stream of income during retirement.

Role of Social Security in Retirement Income

Social Security is a vital source of income for many retirees. It provides a safety net that can help you meet your basic needs.* Benefits:Social Security benefits are based on your lifetime earnings. The longer you work and the more you earn, the higher your benefits will be.

Eligibility

You must be at least 62 years old to receive Social Security benefits. However, you can choose to start receiving benefits earlier or later, which will affect the amount you receive.

Limitations

Social Security benefits are not intended to be your sole source of retirement income. You should plan to have other sources of income, such as savings and investments.

Retirement Income Strategies

Retirement income planning is like building a delicious, multi-course meal: you need a variety of ingredients to create a satisfying and fulfilling experience. Just as a chef carefully selects the right ingredients, you need to consider various sources of income to ensure financial security in your golden years.

Retirement Income Sources

A well-rounded retirement income plan should include a mix of income streams, each playing a role in providing financial stability. Here are some key sources to consider:

- Pensions:Traditional pensions are like a steady paycheck you receive after you retire, often based on your years of service and salary. Not all employers offer pensions, but if you’re lucky enough to have one, it can provide a significant source of guaranteed income.

- Investments:Investing your savings is like planting a seed that grows into a tree, providing shade and fruit over time. You can invest in stocks, bonds, mutual funds, and real estate, hoping for long-term growth. Remember, investments carry risk, so diversify your portfolio to spread out that risk.

- Social Security:Think of Social Security as a safety net, providing a base level of income to most Americans after retirement. The amount you receive depends on your earnings history, and it’s often a crucial part of many retirement plans.

Retirement Income Options

Once you’ve built your retirement income foundation, consider additional options to enhance your financial security:

- Annuities:Annuities are like a financial contract that guarantees you a stream of income for a set period, often for life. They can provide peace of mind, knowing you’ll receive a regular payment, regardless of how long you live.

- Reverse Mortgages:A reverse mortgage allows you to tap into your home’s equity, providing a stream of income or a lump sum. It’s a good option if you’re a homeowner with a significant amount of equity, but remember, it can impact your home ownership in the long run.

- Part-Time Work:Staying active and engaged can be a great way to supplement your retirement income. Part-time work can offer flexibility, social interaction, and a sense of purpose.

Managing Retirement Income

Once you’ve established your income streams, it’s crucial to manage them wisely to ensure financial security. Here are some tips:

- Budgeting:Create a realistic budget that Artikels your essential expenses, such as housing, healthcare, and food, and allows for discretionary spending. Track your spending and make adjustments as needed.

- Investing Wisely:Consider your risk tolerance and time horizon when investing. A financial advisor can help you create a portfolio that aligns with your goals and financial situation. Remember, investments carry risk, so diversification is key.

- Tax Planning:Retirement income can be subject to taxes, so it’s important to minimize your tax burden. Consult with a tax professional to explore strategies for reducing your tax liability.

Lifestyle and Retirement

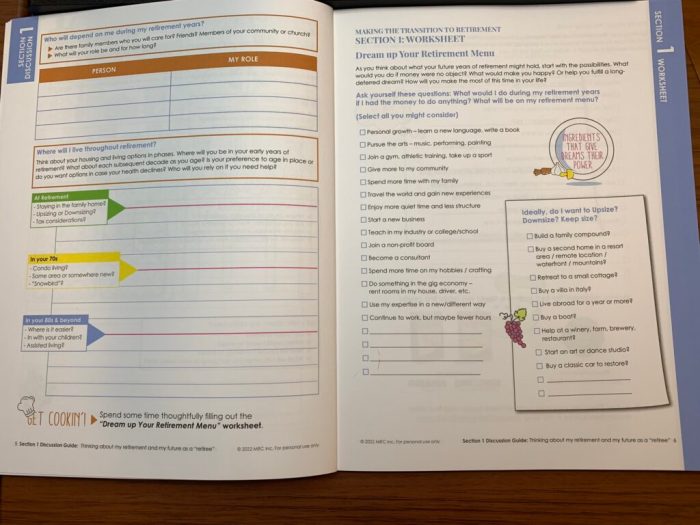

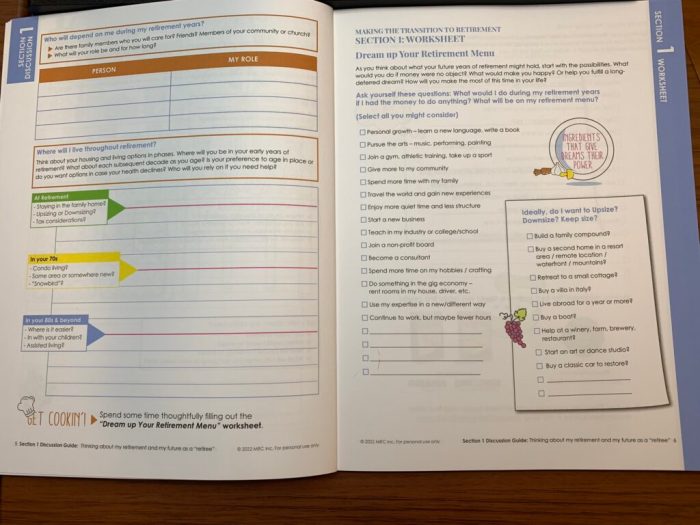

Retirement is a time for many people to finally enjoy the fruits of their labor and pursue their passions. But with so much time on their hands, how do you make the most of your retirement years? The key is to find a lifestyle that fits your interests and keeps you active and engaged.

Retirement Lifestyle Options

Retirement is a time for many people to finally enjoy the fruits of their labor and pursue their passions. But with so much time on their hands, how do you make the most of your retirement years? The key is to find a lifestyle that fits your interests and keeps you active and engaged.

Retirement can be a time to travel, spend time with family, pursue hobbies, or volunteer. Some people choose to downsize their homes and move to a warmer climate, while others stay put and enjoy the familiar surroundings of their community.

Staying Active and Engaged

Staying active and engaged is essential for maintaining both physical and mental health in retirement. Regular exercise can help to prevent age-related decline and improve overall well-being. Staying mentally engaged through activities like reading, learning new skills, or playing games can help to keep your mind sharp and prevent cognitive decline.

Engaging in activities that you enjoy can help to reduce stress and improve your mood.

Benefits of Hobbies and Interests

Retirement can be a great time to pursue hobbies and interests that you may not have had time for during your working years. Hobbies can provide a sense of purpose, accomplishment, and satisfaction. They can also be a great way to meet new people and socialize.

Maintaining Social Connections

Maintaining social connections is important for overall well-being at any age, but it’s especially important in retirement. Social interaction can help to reduce stress, improve mood, and prevent loneliness. There are many ways to stay connected in retirement, such as joining clubs, volunteering, attending social events, or staying in touch with friends and family.

Adapting to Lifestyle Changes

Retirement can be a significant life change, and it’s important to be prepared for the adjustments that may come. For example, you may need to adjust your budget, learn new skills, or find new ways to fill your time.

It’s also important to be flexible and adaptable to changes in your health and circumstances.

Book Review

In the realm of retirement planning, a plethora of books offer guidance and strategies for navigating the complexities of this crucial life stage. One such book that caught my eye was “The Total Retirement Makeover: A Proven Plan to Secure Your Future and Live the Retirement You Deserve.” This book, written by renowned financial expert, Tom Lauricella, promises a comprehensive approach to retirement planning, covering everything from budgeting and investment strategies to healthcare and estate planning.

Strengths of the Book

The book’s strengths lie in its clear and concise writing style, its practical advice, and its emphasis on personalized planning. Lauricella breaks down complex financial concepts into easily digestible language, making it accessible to readers of all financial backgrounds. He also provides numerous real-life examples and case studies to illustrate his points, making the book engaging and relatable.

Weaknesses of the Book

While the book offers valuable insights, it does have some limitations. One weakness is its focus on traditional retirement planning strategies, which may not be suitable for everyone. The book also lacks a strong emphasis on alternative retirement income sources, such as side hustles and entrepreneurship.

Key Takeaways and Relevance to Retirement Planning

The book’s key takeaways include the importance of:

- Starting early and saving consistently.

- Diversifying your investment portfolio.

- Developing a comprehensive retirement plan.

- Seeking professional financial advice.

Recommendations for Readers

This book is a great resource for individuals who are new to retirement planning or who are looking for a comprehensive overview of the topic. It is particularly helpful for those who are in their 40s and 50s and are starting to seriously think about their retirement goals.

Impact on Understanding of Retirement Planning

Reading “The Total Retirement Makeover” has enhanced my understanding of the importance of proactive planning and the need to develop a personalized strategy. The book’s emphasis on long-term financial planning and the benefits of seeking professional guidance has been particularly insightful.

Conclusion

Retirement planning isn’t a one-size-fits-all situation. It’s a personal journey that requires a customized approach. By taking the time to understand your financial needs, explore your options, and create a plan that aligns with your goals and lifestyle, you can ensure that your retirement years are filled with peace of mind, financial security, and the freedom to live life on your own terms.

So, ditch the stress, embrace the journey, and start cookin’ up a retirement plan that’s as unique and flavorful as you are!

FAQ

How much should I be saving for retirement?

There’s no one-size-fits-all answer, but a good rule of thumb is to aim for 10-15 times your annual expenses. Use a retirement calculator to get a personalized estimate.

What if I’m starting late with retirement planning?

It’s never too late to start! Even if you’re behind, every dollar you save counts. Focus on maximizing your contributions and making smart investment choices.

What are some common retirement income sources?

Common retirement income sources include Social Security, pensions, retirement savings accounts (401(k), IRA), and investments. You can also consider part-time work or other sources of income.

How can I manage my retirement income?

Create a budget that accounts for your essential expenses and discretionary spending. Consider using a financial advisor to help you develop a comprehensive income management plan.