Furniture layaway plans offer a flexible way to acquire the furniture you desire without immediate full payment. These plans allow you to make regular payments over a set period, gradually owning your chosen furniture piece. This approach can be particularly beneficial for larger furniture items, such as sofas, dining tables, or bedroom sets, which can often strain a budget.

Layaway plans typically involve a down payment, followed by scheduled installments. The terms and conditions can vary depending on the retailer, so it’s essential to carefully review the details before committing. Understanding the benefits, potential drawbacks, and alternative options will help you make an informed decision.

What is Furniture Layaway?

Furniture layaway is a payment plan that allows you to purchase furniture and pay for it over time. It’s a great option for those who want to spread out the cost of a big furniture purchase or need time to save up for a particular piece.

Benefits of Furniture Layaway

Layaway plans offer several benefits for furniture shoppers:

- Affordable Payments: Layaway plans allow you to break down the cost of furniture into smaller, more manageable payments, making it easier to budget for your purchase.

- Avoid Interest Charges: Unlike financing options, layaway plans typically don’t come with interest charges, saving you money in the long run.

- Secure Your Purchase: Once you put down a deposit, the furniture is reserved for you, ensuring you get the piece you want even if it goes out of stock.

- Time to Save: Layaway plans give you time to save up for the full purchase price, ensuring you can afford the furniture without overextending your budget.

Types of Furniture Layaway Plans

There are different types of furniture layaway plans available, each with its own terms and conditions:

- Traditional Layaway: This is the most common type of layaway, where you make regular payments until the full purchase price is paid, and then you take home your furniture.

- Interest-Free Layaway: Some retailers offer interest-free layaway plans, allowing you to pay off the furniture over time without accruing interest charges. These plans typically have a set time frame for payment.

- Deferred Payment Layaway: With this type of layaway, you make a small down payment, and the rest of the balance is due at a later date. This option is often used for larger furniture purchases.

How Furniture Layaway Works

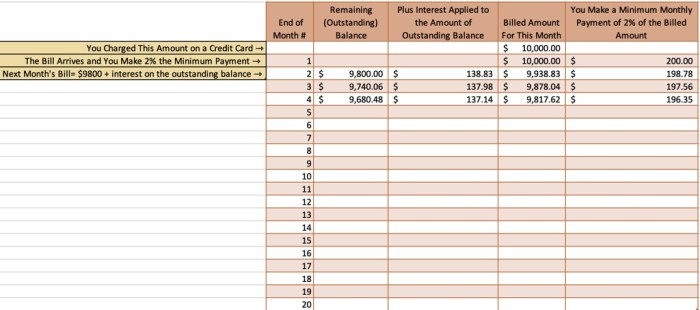

Layaway plans provide a way to purchase furniture gradually over time, allowing you to budget and manage your expenses more effectively. Let’s explore the typical steps involved in a furniture layaway plan and understand how it works.

Payment Schedule and Down Payment, Furniture layaway plans

The payment schedule for a furniture layaway plan typically involves making regular payments over a set period. These payments can be weekly, bi-weekly, or monthly, depending on the retailer’s policy. The down payment, usually a percentage of the total purchase price, is required upfront.

- Down Payment: The initial payment, usually a percentage of the total purchase price. This can range from 10% to 25% depending on the retailer’s policy. For example, a retailer might require a 20% down payment on a $1,000 sofa, which would be $200.

- Payment Schedule: A set schedule for making regular payments. This can be weekly, bi-weekly, or monthly. For example, you might pay $50 every week for a total of 20 weeks to pay off a $1,000 sofa.

- Payment Period: The length of time you have to make payments. This can vary depending on the retailer, but it’s usually between 30 and 90 days. For example, you might have 60 days to pay off a $1,000 sofa.

Terms and Conditions

Layaway plans often have terms and conditions that Artikel the responsibilities of both the buyer and the seller. These terms may include:

- Cancellation Policy: This Artikels the process and potential fees for canceling the layaway agreement. For example, a retailer might charge a cancellation fee of 10% of the total purchase price if you cancel your layaway agreement before the agreed-upon time.

- Non-Payment Penalties: This Artikels the consequences of missing payments, such as late fees or the cancellation of the layaway agreement. For example, a retailer might charge a late fee of $10 for each missed payment.

- Price Protection: This may protect you from price increases during the layaway period. For example, if the price of the furniture you’re buying increases, you may still be able to purchase it at the original price.

It’s essential to read and understand the terms and conditions of a layaway plan before you agree to it.

Advantages of Furniture Layaway: Furniture Layaway Plans

Layaway plans offer a flexible and convenient way to purchase furniture, especially for larger items, without the immediate financial burden. They provide several advantages for consumers, helping them budget effectively and achieve their furniture goals.

Financial Planning and Budgeting

Layaway plans can be beneficial for managing your finances and achieving your furniture goals. By spreading the cost over time, you can avoid taking on debt, which can help you maintain a healthy financial position.

- Avoid High-Interest Debt: Layaway plans eliminate the need for credit cards or loans, which often come with high interest rates. By paying a fixed amount each month, you avoid accruing interest charges and keep your overall debt levels low.

- Control Over Spending: Layaway plans allow you to budget for furniture purchases in advance. You can set a fixed monthly payment that fits comfortably within your budget, ensuring you don’t overspend and maintain financial stability.

- Financial Planning: Layaway plans can help you plan for larger furniture purchases, such as a new sofa or dining set. By making regular payments, you can save up for these items over time, making them more affordable and achievable.

Purchasing Large Furniture Items

Layaway plans are particularly beneficial for purchasing large furniture items that may be expensive. They provide a convenient way to acquire these items without having to pay the full price upfront.

- Affordable Payments: Layaway plans allow you to spread the cost of furniture over a period of time, making it more affordable. By making smaller, regular payments, you can avoid the financial strain of a large upfront purchase.

- Avoid Overspending: Layaway plans can help you avoid overspending on furniture. By setting a fixed monthly payment, you can ensure that you stay within your budget and don’t overextend your finances.

- Flexibility: Layaway plans offer flexibility in payment options. You can choose a payment schedule that works best for your financial situation and adjust it if needed, providing greater control over your spending.

Disadvantages of Furniture Layaway

Layaway plans can be a convenient way to purchase furniture, but they also come with some potential drawbacks. It’s important to weigh the pros and cons carefully before deciding if a layaway plan is right for you.

Cancellation Policies

Layaway plans typically have specific cancellation policies that can impact your finances. Understanding these policies is crucial. For example, some retailers might charge a cancellation fee if you decide to cancel your layaway agreement. Others might retain a portion of your payments as a cancellation fee. This fee could vary depending on the retailer and the terms of the layaway agreement. It’s essential to review the cancellation policy thoroughly before committing to a layaway plan to avoid any unexpected financial consequences.

Impact on Credit Score

Layaway plans don’t directly impact your credit score, but they can indirectly affect it. If you use a credit card to make layaway payments, late payments or missed payments can negatively affect your credit score. It’s crucial to make payments on time to maintain a good credit score. Additionally, if you cancel a layaway agreement, you might lose a portion of your payments, which can strain your budget.

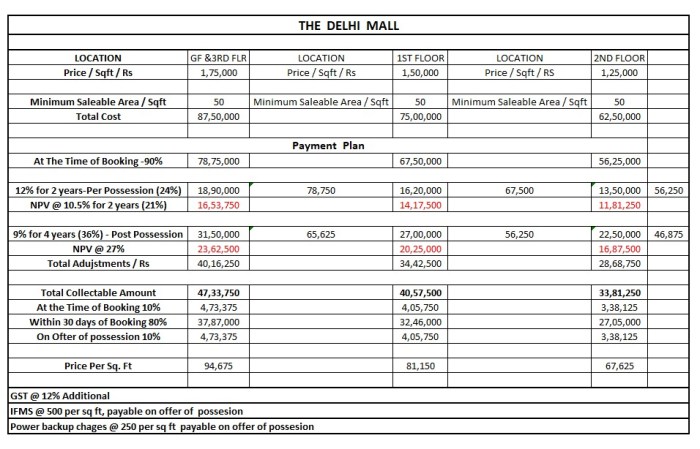

Finding Furniture Layaway Plans

Layaway plans can be a great way to purchase furniture without having to pay the full price upfront. However, not all furniture retailers offer layaway plans, and the terms of the plans can vary widely. To help you find the best layaway plan for your needs, we’ve compiled a list of popular furniture retailers offering layaway plans and some tips for finding the best deals.

Furniture Retailers Offering Layaway Plans

Here’s a table that lists some popular furniture retailers offering layaway plans, along with their layaway terms, minimum down payment, and cancellation policy:

| Retailer | Layaway Terms | Minimum Down Payment | Cancellation Policy |

|---|---|---|---|

| Ashley Furniture HomeStore | Up to 12 months | 10% of the purchase price | Full refund if canceled within 30 days; a restocking fee may apply after 30 days |

| Rooms To Go | Up to 6 months | 20% of the purchase price | Full refund if canceled within 30 days; a restocking fee may apply after 30 days |

| Havertys | Up to 12 months | 10% of the purchase price | Full refund if canceled within 30 days; a restocking fee may apply after 30 days |

| Bob’s Discount Furniture | Up to 6 months | 10% of the purchase price | Full refund if canceled within 30 days; a restocking fee may apply after 30 days |

Tips for Finding the Best Furniture Layaway Plans

Here are some tips for finding the best layaway plans for your needs:

- Compare layaway terms. Look for plans with a longer layaway period, lower minimum down payment, and flexible payment options.

- Read the fine print. Pay attention to the cancellation policy, late payment fees, and any other fees associated with the layaway plan.

- Shop around. Don’t settle for the first layaway plan you find. Compare plans from different retailers to find the best deal.

- Consider the retailer’s reputation. Choose a retailer with a good reputation for customer service and product quality.

- Ask questions. Don’t hesitate to ask the retailer any questions you have about the layaway plan.

Furniture Layaway Alternatives

Layaway plans offer a way to purchase furniture without immediate full payment, but they’re not the only option. Exploring other financing methods can help you find the best fit for your needs and budget.

Rent-to-Own Programs

Rent-to-own programs allow you to use furniture immediately while making regular payments. This option can be beneficial for individuals with limited credit or needing immediate access to furniture. However, rent-to-own programs often come with high overall costs, making them less financially advantageous than other options in the long run.

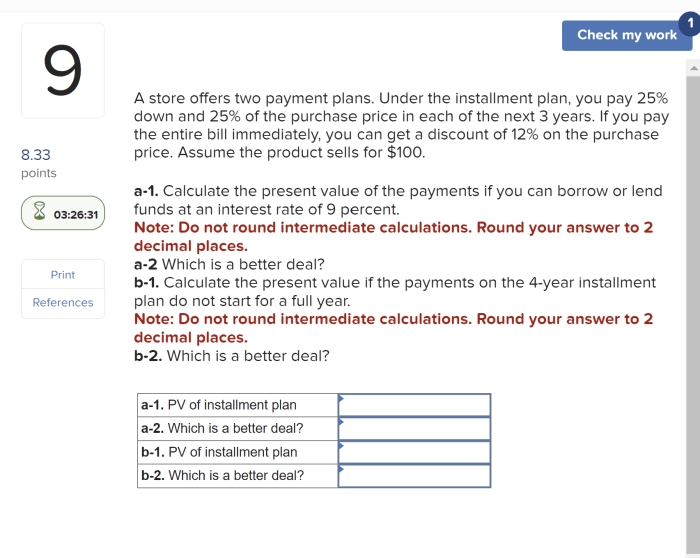

Using Credit Cards for Furniture Purchases

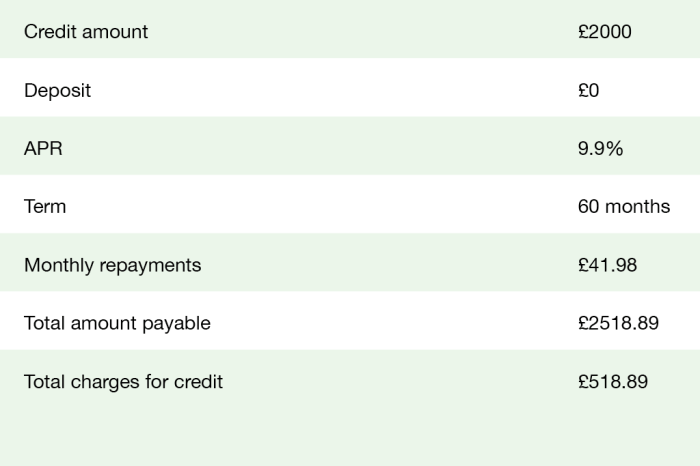

Credit cards offer a convenient way to finance furniture purchases. They provide a temporary line of credit, allowing you to make a purchase and pay it off over time. However, credit cards often come with high-interest rates, so it’s crucial to pay off the balance promptly to avoid accumulating significant debt.

It’s important to compare interest rates and terms across different credit cards to find the most favorable option.

Different Financing Options for Furniture

Various financing options are available for furniture purchases, each with its advantages and disadvantages.

- Personal Loans: These loans provide a fixed amount of money that you can use for any purpose, including furniture. Personal loans often have lower interest rates than credit cards, but you’ll need good credit to qualify.

- Store Financing: Many furniture stores offer their own financing options, sometimes with special promotions or discounts. It’s essential to compare interest rates and terms with other options before committing to store financing.

- Home Equity Loans: If you have equity in your home, you can use a home equity loan or line of credit to finance furniture purchases. These loans generally have lower interest rates than other options, but they put your home at risk if you can’t make payments.

End of Discussion

Furniture layaway plans provide a valuable alternative for consumers seeking to manage their finances and purchase furniture responsibly. By understanding the process, advantages, and potential drawbacks, you can make an informed decision about whether layaway is the right choice for your needs. Remember to carefully review the terms and conditions of any layaway plan, compare options from different retailers, and explore alternative financing methods if necessary.

Helpful Answers

What happens if I can’t make a payment on time?

Most retailers have grace periods for late payments. However, if you consistently miss payments, the layaway plan might be canceled, and you could lose your down payment.

Can I return furniture purchased through layaway?

Return policies vary by retailer. Some may offer a full refund within a specific timeframe, while others might have restrictions or charge a restocking fee.

Is there a limit on how much I can purchase through layaway?

Retailers often have maximum purchase limits for layaway plans. Check with the specific retailer for their policies.

How do layaway plans affect my credit score?

Layaway plans typically don’t directly impact your credit score, as they don’t involve credit lines or loans.

Furniture layaway plans are a great way to get the pieces you need without breaking the bank. While you’re waiting for your new furniture to arrive, why not try some kid’s woodworking projects with the little ones? It’s a fun and creative way to pass the time and maybe even build a few pieces to add to your new furniture setup!