Dreaming of building a tax representation empire? You’re not alone. The tax landscape is a goldmine, but navigating it takes more than just a calculator and a good tax code. This guide isn’t just about filing returns, it’s about crafting a practice that’s not only profitable, but also helps clients navigate the complex world of taxes with confidence.

We’ll break down the market, build your foundation, and give you the tools to scale your practice to the next level. Think of it like building a financial empire – you’ll learn how to attract clients, streamline your services, and build a reputation that’s as solid as a tax-free refund.

Understanding the Tax Representation Landscape

The tax representation market is a dynamic and ever-evolving landscape, offering a plethora of opportunities for skilled professionals. This section delves into the current state of the market, identifying key trends, growth areas, and the target audience for a successful tax representation practice.

The Current State of the Tax Representation Market

The tax representation market is experiencing significant growth, driven by a complex and ever-changing tax code, increasing tax compliance requirements, and a growing need for specialized tax expertise. * Increased Tax Complexity:The Internal Revenue Code is constantly evolving, with new laws, regulations, and interpretations emerging frequently.

This complexity creates a growing demand for tax professionals who can navigate the intricacies of the tax system and provide effective representation to individuals and businesses.

Rising Tax Compliance Requirements

The IRS has increased its focus on tax compliance, leading to more audits, investigations, and penalties for non-compliance. This has created a need for tax professionals who can help individuals and businesses comply with tax laws and avoid costly penalties.

Growth of Specialized Tax Services

The tax representation market is also witnessing the rise of specialized tax services, such as tax planning, tax preparation, tax litigation, and tax resolution. These services cater to the specific needs of different client segments, such as high-net-worth individuals, small businesses, and corporations.

The Target Audience for a Tax Representation Practice

The target audience for a tax representation practice varies depending on the specific services offered. However, some common client segments include:* Individuals:Individuals facing tax issues, such as audits, penalties, or back taxes.

Small Businesses

Small businesses struggling with tax compliance, tax planning, or tax disputes.

High-Net-Worth Individuals

High-net-worth individuals requiring specialized tax planning and wealth management services.

Corporations

Corporations facing complex tax issues, such as international taxation, mergers and acquisitions, and tax audits.

Competitive Landscape and Potential Niches

The tax representation market is highly competitive, with numerous tax professionals, accounting firms, and law firms offering similar services. To succeed, tax representation practices need to identify and focus on specific niches within the market. Some potential niches include:* Tax Resolution:Focusing on resolving tax issues, such as audits, penalties, and back taxes.

Tax Planning

Providing tax planning services, such as estate planning, retirement planning, and business succession planning.

Tax Litigation

Representing clients in tax disputes with the IRS or state tax authorities.

Specialized Tax Services

Offering specialized tax services, such as international taxation, tax credits, or tax deductions.

“The key to success in the tax representation market is to identify a niche, build expertise in that area, and develop a strong reputation for providing high-quality services.”

Building a million-dollar tax representation practice is a marathon, not a sprint. You need grit, determination, and a whole lot of hustle. It’s like those crazy folks in the Texas Water Safari who paddle for days on end, battling currents and exhaustion.

You’ve gotta be willing to push your limits and never give up, just like they do. So, if you’re ready to build a powerhouse practice, get your game face on and let’s do this!

Building a Solid Foundation

Building a successful tax representation practice requires more than just expertise in tax law. You need a solid foundation, a roadmap for your practice’s growth and sustainability. Think of it like building a house: you need a strong blueprint, quality materials, and a plan for the future.

This foundation will provide the structure and support your practice needs to thrive.

Creating a Comprehensive Business Plan

A business plan is your roadmap to success. It Artikels your practice’s goals, target market, services, marketing strategy, and financial projections. Think of it as a detailed blueprint for your practice’s growth. A comprehensive business plan should address the following key areas:

- Executive Summary: A concise overview of your practice, including its mission, vision, and key goals.

- Company Description: A detailed description of your practice, including its services, target market, and competitive advantages.

- Market Analysis: A thorough analysis of your target market, including its size, demographics, and needs.

- Services: A detailed description of the services you offer, including their pricing and value proposition.

- Marketing Strategy: A plan for reaching your target market, including your website, social media presence, and other marketing efforts.

- Financial Projections: A detailed forecast of your practice’s financial performance, including revenue, expenses, and profitability.

“A business plan is not just a document; it’s a living, breathing guide that you can use to track your progress and make adjustments as needed.”

Unknown

Developing a Strong Brand Identity

Your brand identity is how you present yourself to the world. It’s the sum of all your visual and verbal communication, including your logo, website, marketing materials, and even the way you interact with clients. A strong brand identity should:

- Be Memorable: Make your practice stand out from the competition.

- Be Consistent: Use the same branding elements across all your marketing materials.

- Be Authentic: Reflect your practice’s values and personality.

- Be Relevant: Appeal to your target market and resonate with their needs.

“A strong brand identity is like a beacon that attracts clients and builds trust.”

Unknown

Establishing a Professional Website and Online Presence

Your website is your online storefront. It’s the first impression you make on potential clients, so it needs to be professional, informative, and easy to navigate. A professional website should:

- Clearly communicate your services: Explain what you offer and how you can help clients.

- Showcase your expertise: Include testimonials, case studies, and articles that demonstrate your knowledge and experience.

- Make it easy for clients to contact you: Include a contact form, phone number, and email address.

- Be mobile-friendly: Ensure your website looks great on all devices.

“Your website is your 24/7 salesperson, so make sure it’s working for you.”

Unknown

Scaling Your Practice for Success

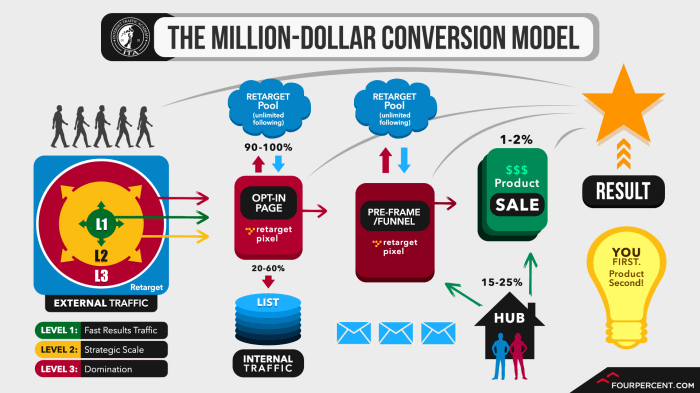

You’ve laid the groundwork, established your credibility, and are ready to attract clients. Now, it’s time to scale your tax representation practice and watch your business thrive. Think of it like a well-oiled machine: you need to implement strategies that optimize your operations, attract new clients, and keep your existing ones coming back for more.

Strategic Marketing Plan

A strategic marketing plan is your roadmap to attracting new clients and building a solid reputation. It’s all about getting your name out there and showcasing your expertise. Here’s how to create a winning marketing plan:* Identify your target audience:Who are your ideal clients?

What are their pain points and needs? Understanding your target audience is key to crafting effective marketing messages that resonate with them.

Develop a unique selling proposition (USP)

What makes your practice stand out from the competition? Highlight your unique skills, expertise, and services to differentiate yourself.

Building a million-dollar tax representation practice isn’t a walk in the park, but it’s definitely achievable with the right strategy and hustle. Think of it like becoming a superstar – you gotta practice your moves, network with the right people, and learn how to handle the pressure.

And remember, sometimes the best things in life take time, so don’t get discouraged if you don’t see results overnight – check out this inspiring story about patience and perseverance, Not My Time , and keep pushing towards your goals.

Building a successful practice takes time, but with dedication and a solid plan, you can make it happen.

Choose the right marketing channels

Wanna know the secret sauce to building a million-dollar tax representation practice? It’s all about strategy, baby! From understanding your target audience to mastering the art of client acquisition, Download And Listen Here to get the lowdown on the ins and outs of building a successful tax representation practice.

You’ll be rolling in the dough before you know it!

Explore a mix of online and offline marketing strategies. Consider:

Social media

LinkedIn, Facebook, Twitter, and Instagram are excellent platforms to engage with potential clients and share valuable content.

Content marketing

Create blog posts, articles, ebooks, and videos that educate and inform your target audience about tax issues.

Networking

Attend industry events, join professional organizations, and build relationships with other professionals who can refer clients.

Email marketing

Build an email list and send regular newsletters with valuable content, promotions, and updates.

Building a million-dollar tax representation practice is no joke, it’s like navigating a maze of tax codes and client needs. But hey, even the most successful tax pros need a way to unwind, and that’s where the Minimalist Boho Coloring Book for Teens & Adults Landscape Designs for Relaxation and Stress Relief comes in.

After a long day of crunching numbers, coloring those intricate designs can help you de-stress and come back to your practice feeling refreshed and ready to tackle those tax challenges head-on.

Referral programs

Incentivize existing clients to refer new business through referral bonuses or discounts.

Track your results

Use analytics tools to measure the effectiveness of your marketing efforts. Adjust your strategies based on what’s working and what’s not.

Streamlining Operations

Efficiency is key to scaling your practice. By implementing systems and processes, you can free up time to focus on high-value activities like client service and business development. Here’s how to streamline your operations:* Invest in technology:Software tools can automate tasks, improve communication, and enhance client experience.

Consider using:

CRM software

Manage client information, track interactions, and automate follow-ups.

Tax preparation software

Streamline tax preparation and filing processes.

Document management systems

Organize and securely store client documents.

Project management tools

Keep track of projects, deadlines, and tasks.

Develop standardized processes

Create clear procedures for handling client inquiries, onboarding new clients, preparing tax returns, and communicating with clients.

Delegate tasks

Outsource tasks like administrative support, bookkeeping, or marketing to free up your time.

Implement a robust quality control system

Ensure accuracy and consistency in your work by establishing clear quality control measures.

Client Retention Strategy

Building long-term relationships with clients is essential for sustainable growth. A strong client retention strategy keeps clients coming back for more and generates valuable referrals.Here’s how to cultivate long-term client relationships:* Provide exceptional service:Go above and beyond to meet client expectations and address their concerns.

Communicate effectively

Keep clients informed about their case progress and proactively address any questions or concerns.

Offer value-added services

Provide additional services that enhance the client experience, such as financial planning or estate planning.

Build relationships

Get to know your clients on a personal level and foster a sense of trust and rapport.

Show appreciation

Recognize client loyalty with thank-you notes, gifts, or special offers.

Last Recap

So, you’ve got the blueprint, the tools, and the drive. Now it’s time to get out there and make your mark on the tax representation landscape. Remember, it’s not just about numbers, it’s about building a practice that helps people and thrives on the power of knowledge and expertise.

Go forth, conquer the tax world, and become the tax titan you were meant to be!

Helpful Answers

What are the most common tax issues clients face?

Clients often struggle with understanding deductions, credits, and complex tax laws. They may also need help with audits, tax planning, and navigating IRS regulations.

How do I find clients for my tax representation practice?

Focus on building relationships with accountants, financial advisors, and other professionals who refer clients. Utilize online marketing, networking events, and community outreach to expand your reach.

What software or tools do I need to run a tax representation practice?

Invest in tax preparation software, accounting software, and client management tools. Consider using CRM software for client communication and relationship management.