Yo, let’s talk about credit scores, mortgages, and building a financial empire! You’re about to learn how to unlock your credit potential, boost those numbers, and finally achieve that homeownership dream faster than you ever thought possible. We’re going to break down everything from the basics of credit to the most effective strategies for crushing debt and getting that sweet, sweet mortgage.

This isn’t your typical boring finance book. We’re keeping it real, using simple language, and sharing practical tips that actually work. Ready to ditch the debt, build a solid credit foundation, and achieve your financial goals? Let’s dive in!

Building a Strong Credit Foundation

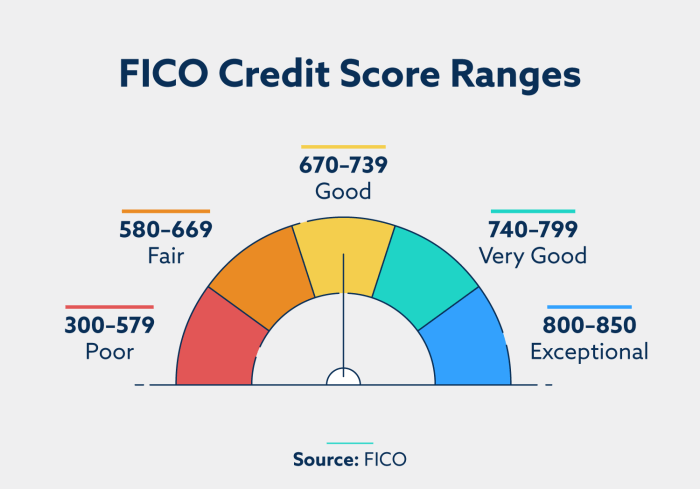

A good credit score is like a golden ticket to financial freedom. It opens doors to better interest rates on loans, lower insurance premiums, and even better job opportunities. It’s a measure of your financial responsibility and trustworthiness, and it’s crucial for achieving your financial goals.

Factors Influencing Credit Score

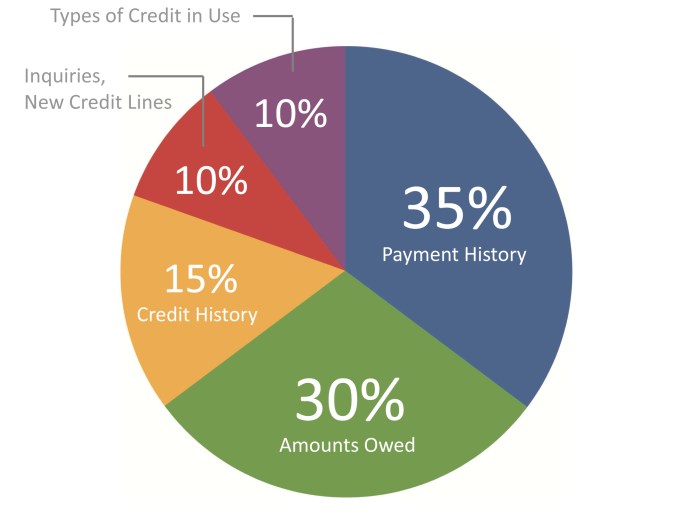

Your credit score is calculated based on several key factors, each playing a significant role in determining your overall creditworthiness.

| Factor | Description | Impact on Score | Tips for Improvement |

|---|---|---|---|

| Payment History | This is the most important factor, accounting for 35% of your score. It reflects your track record of paying bills on time, including credit cards, loans, and utilities. | Late payments, missed payments, and defaults can significantly damage your score. On-time payments contribute positively. | Set up automatic payments, use reminders, and consider a budgeting app to stay on top of your bills. |

| Credit Utilization | This refers to the amount of credit you’re using compared to your total available credit. It accounts for 30% of your score. | A high credit utilization ratio (over 30%) can negatively impact your score. A lower ratio (under 10%) is generally considered good. | Pay down balances, avoid maxing out credit cards, and consider requesting a credit limit increase. |

| Length of Credit History | This factor represents the average age of your credit accounts and accounts for 15% of your score. | A longer credit history generally indicates financial stability and can improve your score. | Avoid closing old accounts, as this can shorten your credit history. |

| Credit Mix | This factor considers the types of credit accounts you have, such as credit cards, installment loans, and mortgages. It accounts for 10% of your score. | Having a mix of credit accounts demonstrates responsible credit management. | Consider applying for different types of credit, such as a personal loan or a mortgage, to diversify your credit mix. |

| Hard Inquiries | These are inquiries made by lenders when you apply for credit. They account for 10% of your score. | Too many hard inquiries in a short period can lower your score, as it suggests you’re actively seeking credit, which can be a red flag for lenders. | Shop around for loans or credit cards within a short timeframe (usually 14-45 days) to avoid multiple hard inquiries. |

Strategic Credit Utilization and Debt Management

Your credit utilization ratio is a crucial factor in determining your credit score. It represents the percentage of your available credit that you’re currently using. Lenders use this ratio to assess your creditworthiness, and a high utilization ratio can negatively impact your score.

So, you wanna ditch the debt and live the good life? “How to Take Your Credit Score from 0 to 800 and How to Pay off Your Mortgage in 6 to 8 years 2-Books-in-1” is your jam! It’s all about building that credit, like how Harry Caray built the Cardinals’ fanbase, you know?

Holy Cow St. Louis! Radio’s Best Days Harry Caray’s Best Years – that’s some real dedication to the game, and “Credit Power” is dedicated to helping you win the financial game. Get your copy, and let’s make some moves!

Credit Utilization Ratio: Calculation and Goals

To calculate your credit utilization ratio, divide your total credit card balances by your total credit limits. For example, if you have $1,000 in credit card balances and a total credit limit of $5,000, your credit utilization ratio is 20% ($1,000/$5,000).

The ideal credit utilization ratio is 30% or less.

Aim for a credit utilization ratio below 30% to maintain a healthy credit score. However, strive for a ratio below 10% for optimal credit health.

Strategies for Reducing Credit Utilization

- Pay Down Existing Balances:The most straightforward way to reduce your credit utilization is by paying down your credit card balances. Make more than the minimum payments to accelerate the process.

- Request Credit Limit Increases:If you have a good credit history, consider requesting a credit limit increase from your credit card issuer. This can help lower your credit utilization ratio without reducing your spending.

- Close Unused Credit Accounts:Closing unused credit accounts can sometimes increase your credit utilization ratio if they represent a significant portion of your total available credit. However, if you’re not using them, it’s best to close them to avoid potential security risks.

Managing Debt Effectively

- Create a Budget:A budget helps you track your income and expenses, allowing you to identify areas where you can cut back to free up money for debt repayment.

- Prioritize High-Interest Debt:Focus on paying down debt with the highest interest rates first, such as credit cards or payday loans. This minimizes the amount of interest you pay over time.

- Explore Debt Consolidation Options:Consider debt consolidation options, such as a balance transfer credit card with a lower interest rate or a personal loan. This can streamline your debt payments and potentially lower your overall interest burden.

Flowchart for Strategic Credit Utilization and Debt Management

[Insert flowchart here, providing a visual representation of the process of strategic credit utilization and debt management. The flowchart should include steps such as calculating credit utilization, setting goals, developing strategies for reducing utilization, and managing debt effectively. The flowchart should be easy to understand and follow.]

Unlocking Homeownership: The Mortgage Journey

Owning a home is a major milestone for many Americans, but navigating the mortgage process can feel overwhelming. This section will guide you through the different types of mortgages, the factors lenders consider, how to prepare for a mortgage application, and the steps involved in obtaining a loan.

Yo, listen up! “How to Take Your Credit Score from 0 to 800 and How to Pay off Your Mortgage in 6 to 8 years 2-Books-in-1 How to boost your credit scores use credit … mortgage debt pay off…

(Credit Power)” is all about getting your financial life in order, right? But sometimes, life throws you some curveballs, and you gotta learn to roll with the punches. Check out A Student of Suffering , a story about navigating those tough times.

It’s a real eye-opener, and it might just inspire you to hustle even harder to achieve those financial goals. Once you’ve got your credit score soaring and that mortgage paid off, you’ll be set for anything life throws your way!

Mortgage Types

Mortgages are loans that allow you to purchase a home. There are several types of mortgages available, each with its own features and benefits:

- Fixed-rate mortgages: These mortgages have a fixed interest rate for the entire loan term, which can be 15, 20, or 30 years. This means your monthly payments will remain the same throughout the loan term, providing predictability and financial stability.

Yo, wanna ditch that debt and finally own your dream home? “How to Take Your Credit Score from 0 to 800 and How to Pay off Your Mortgage in 6 to 8 years 2-Books-in-1” is your guide to crushing it.

Get the inside scoop on how to boost your credit score, use credit wisely, and pay off that mortgage debt like a boss. Download And Listen Here to unlock the secrets to financial freedom and get ready to live your best life!

- Adjustable-rate mortgages (ARMs): These mortgages have an interest rate that adjusts periodically based on a benchmark index, such as the London Interbank Offered Rate (LIBOR). ARMs typically have a fixed rate for an initial period (e.g., 5 or 7 years), after which the rate can fluctuate.

ARMs can offer lower initial interest rates compared to fixed-rate mortgages, but they come with the risk of higher payments if interest rates rise.

- Government-backed loans: These mortgages are insured or guaranteed by government agencies, such as the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), or the U.S. Department of Agriculture (USDA). These programs typically have more lenient eligibility requirements and offer lower down payment options compared to conventional loans.

Mortgage Eligibility Factors

Lenders use a variety of factors to determine your eligibility for a mortgage and the interest rate you qualify for. These factors include:

- Credit score: A higher credit score demonstrates your creditworthiness and can result in a lower interest rate. Aim for a credit score of at least 620 for a conventional loan and at least 580 for an FHA loan.

- Income: Lenders want to ensure you have enough income to afford your monthly mortgage payments. They typically calculate your debt-to-income ratio (DTI), which is the percentage of your gross monthly income that goes towards debt payments. A lower DTI is generally more favorable.

Okay, so you’re crushing those financial goals, right? You’re reading “How to Take Your Credit Score from 0 to 800 and How to Pay off Your Mortgage in 6 to 8 years 2-Books-in-1 How to boost your credit scores use credit …

mortgage debt pay off… (Credit Power).” That’s awesome! But sometimes, even with a solid plan, life throws you a curveball. Take a look at Wrecked By Grace A journey through addiction and prison and into God’s presence and grace – a story about overcoming challenges.

It’s a reminder that even when things get tough, there’s always hope. And once you’ve got your head on straight, you can get back to crushing those financial goals with “How to Take Your Credit Score from 0 to 800 and How to Pay off Your Mortgage in 6 to 8 years 2-Books-in-1 How to boost your credit scores use credit …

mortgage debt pay off… (Credit Power).” You got this!

- Debt-to-income ratio (DTI): A lower DTI is generally more favorable. A DTI of 43% or less is typically considered acceptable for conventional loans, while FHA loans may allow for a higher DTI.

- Down payment: The amount of money you put down as a down payment influences the amount you need to borrow and your monthly payments. Conventional loans typically require a down payment of 20%, but FHA loans offer lower down payment options, as low as 3.5%.

- Assets: Lenders may also consider your assets, such as savings, investments, and retirement accounts, to assess your financial stability and ability to repay the loan.

Preparing for a Mortgage Application

Before you apply for a mortgage, it’s important to take steps to improve your creditworthiness and financial stability. These steps include:

- Improve your credit score: Pay your bills on time, reduce your credit utilization ratio (the amount of credit you use compared to your available credit), and avoid opening too many new credit accounts.

- Save for a down payment: Aim to save for a down payment of at least 20% to avoid paying private mortgage insurance (PMI). PMI is an additional insurance premium that lenders require if you put down less than 20%.

- Understand the mortgage process: Research different mortgage options, compare interest rates from multiple lenders, and understand the terms and conditions of the loan. Consult with a mortgage broker or financial advisor for personalized guidance.

The Mortgage Application Process

The mortgage application process typically involves the following steps:

| Step | Description | Timeline | Key Documents |

|---|---|---|---|

| Pre-approval | Get pre-approved for a mortgage from a lender. This process involves providing your financial information and receiving a pre-approval letter that indicates the amount you qualify for. | 1-2 weeks | Credit report, income verification, debt-to-income ratio calculation |

| Home search | Begin searching for a home that meets your needs and budget. Work with a real estate agent to find properties that fit your criteria. | Variable | Real estate agent contract, property disclosures |

| Offer and negotiation | Make an offer on a property and negotiate the purchase price and closing terms with the seller. | 1-2 weeks | Offer to purchase, counteroffers |

| Loan application | Submit a formal mortgage application to your chosen lender. This involves providing detailed financial information, including income, assets, and debts. | 1-2 weeks | Mortgage application, bank statements, tax returns, pay stubs |

| Loan approval | The lender reviews your application and approves or denies your loan. If approved, you will receive a loan commitment letter outlining the terms and conditions of the loan. | 1-2 weeks | Loan commitment letter |

| Home inspection and appraisal | A home inspector examines the property for any defects or issues, and an appraiser assesses the fair market value of the home. | 1-2 weeks | Home inspection report, appraisal report |

| Closing | You sign all the necessary documents and finalize the purchase of the home. This includes transferring the title to your name and paying closing costs. | 1-2 weeks | Closing disclosure, deed of trust, mortgage note |

Accelerated Mortgage Payoff Strategies

Imagine finally being debt-free from your mortgage, enjoying the freedom of owning your home outright. Accelerating your mortgage payoff can be a game-changer, saving you thousands in interest and putting you on a path to financial freedom faster.

Understanding Amortization

Amortization is the process of gradually paying off a loan over time, with each payment covering both principal and interest. The initial payments are heavily weighted towards interest, while the principal balance decreases slowly. Over time, the interest portion decreases, and the principal portion increases.

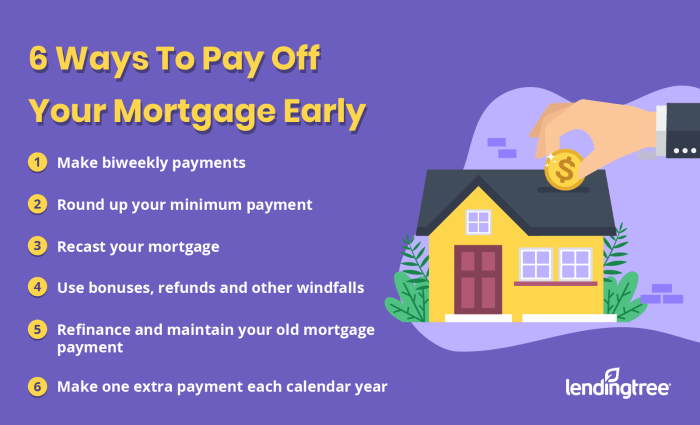

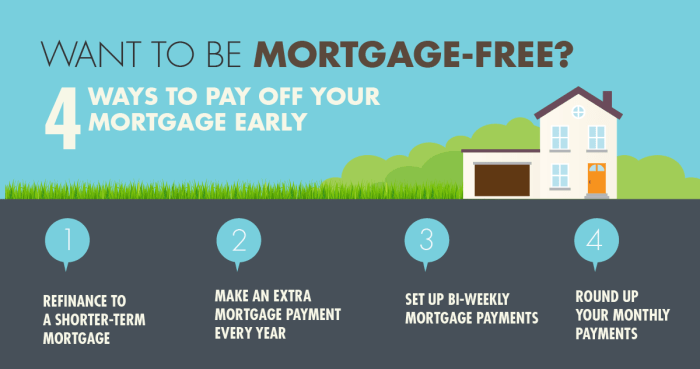

Strategies for Accelerated Payoff

Accelerating your mortgage payoff involves making additional payments beyond your regular monthly payment, aiming to reduce the principal balance more quickly. Here are some common strategies:

Extra Principal Payments

Making extra principal payments on your mortgage can significantly reduce the loan term and the total interest paid. This strategy involves paying a little extra each month, or making lump-sum payments whenever possible. For example, if your monthly payment is $1,500, you could make an extra $100 payment each month, or a lump-sum payment of $1,000 twice a year.

Bi-weekly Payments

Instead of making one monthly payment, you can make half your monthly payment every two weeks. This strategy effectively makes an extra payment each year, as there are 52 weeks in a year, but only 12 months.

Lump-Sum Payments

Receiving a bonus, tax refund, or inheritance? Consider using this windfall to make a significant lump-sum payment on your mortgage. This can dramatically reduce the remaining principal balance and accelerate the payoff timeline.

Comparing Strategies

Each accelerated payoff strategy has its pros and cons:

| Strategy | Pros | Cons |

|---|---|---|

| Extra Principal Payments | Flexible, easy to incorporate into budget, consistent impact on principal reduction | Requires discipline, may not be substantial enough for significant impact |

| Bi-weekly Payments | Simple to implement, consistent extra payment, can shorten loan term significantly | May not be suitable for everyone, can lead to cash flow issues if not planned properly |

| Lump-Sum Payments | Can dramatically reduce principal balance, accelerates payoff significantly | Relies on infrequent windfalls, may not be a consistent strategy |

Tips for Incorporating Strategies

Here are some practical tips for incorporating accelerated payoff strategies into your budget:* Automate extra payments:Set up automatic transfers from your checking account to your mortgage account to ensure consistency.

Round up payments

Round up your monthly payment to the nearest $50 or $100.

Use a budgeting app

Track your spending and identify areas where you can cut back to free up funds for extra mortgage payments.

Negotiate a lower interest rate

A lower interest rate can save you thousands in interest over the life of your loan. Consider refinancing if interest rates have dropped.

Illustrative Chart

The following chart illustrates the impact of different payoff strategies on the total interest paid and the length of the mortgage term:[Here, you would describe the chart. You can provide specific examples of mortgage amounts, interest rates, and payoff timelines to illustrate the impact of different strategies.

For example, you could show how making an extra $100 payment per month can reduce the total interest paid by $10,000 and shorten the loan term by 2 years.]

Book Review

“Credit Power: How to Take Your Credit Score from 0 to 800 and How to Pay off Your Mortgage in 6 to 8 Years” is a two-in-one guide that tackles the critical aspects of credit building and mortgage payoff. This book offers a comprehensive approach, providing actionable steps and practical strategies to improve your financial standing.

Strengths and Weaknesses

The book’s strengths lie in its clear and concise language, making it accessible to a wide audience. It provides a step-by-step approach, breaking down complex financial concepts into manageable chunks. The inclusion of real-life examples and case studies adds to the book’s relatability and practicality.

However, the book could benefit from more in-depth coverage of certain topics, such as credit reporting agencies and the intricacies of mortgage refinancing.

Most Valuable Insights

The book offers several valuable insights, including:* Understanding Credit Scores:The book effectively explains the factors that contribute to credit scores, including payment history, credit utilization, and length of credit history. This knowledge empowers readers to make informed decisions about their credit behavior.

Strategic Credit Utilization

The book emphasizes the importance of keeping credit utilization low, which is a key factor in boosting credit scores. It provides practical tips on managing credit cards and maximizing credit limits.

Accelerated Mortgage Payoff Strategies

The book offers various strategies for accelerating mortgage payoff, including making extra principal payments, bi-weekly payments, and utilizing lump sum payments. These strategies can significantly reduce the overall interest paid and shorten the mortgage term.

Comparison with Other Resources

Compared to other resources on credit building and mortgage payoff, “Credit Power” stands out for its holistic approach. It integrates both aspects into a single framework, highlighting the interconnectedness of credit scores and mortgage financing. The book also provides a more practical and action-oriented approach compared to some academic or theoretical resources.

Recommendations

This book is highly recommended for:* Individuals with low credit scores:The book provides a roadmap for improving credit scores and building a strong credit foundation.

Homebuyers seeking to accelerate mortgage payoff

The book offers a comprehensive guide to mortgage financing and provides actionable strategies for reducing mortgage debt.

Individuals seeking to improve their overall financial well-being

The book’s focus on credit building and debt management contributes to a stronger financial position.

Summary

By following the steps in this guide, you can take control of your financial future. Imagine: a killer credit score, a mortgage you’re crushing, and the freedom to pursue your dreams. This isn’t just about numbers; it’s about achieving your financial goals and building a life you love.

So, let’s get to work! You got this!

Questions and Answers

What if my credit score is really bad? Is it still possible to get a mortgage?

Absolutely! Even if your credit score isn’t perfect, there are still options available. You might need to work on improving your score first, or you might need to explore alternative mortgage options. Don’t give up! There are ways to achieve your homeownership goals even with a less-than-stellar credit history.

How much money do I need for a down payment on a house?

The amount of your down payment will depend on several factors, including the type of mortgage you choose and the current market conditions. It’s a good idea to aim for a down payment of at least 20% to avoid paying private mortgage insurance (PMI).

However, there are also options available for smaller down payments, so talk to a mortgage lender to see what works best for you.