Ever wondered how the big dogs on Wall Street make their moves? They’re not just throwing darts at a board. They’re using a secret weapon: The Power of Three (PO3) concept. It’s a strategy so powerful, it’s practically a secret handshake in the world of institutional trading.

This method, developed by the legendary trader, ICT, is a game-changer, and it’s time you learned how to use it.

This strategy is all about understanding the market’s rhythm and using specific patterns to identify opportunities. Think of it like the ultimate cheat code for navigating the stock market. Forget about chasing the latest hype; the PO3 concept is about making calculated, informed decisions.

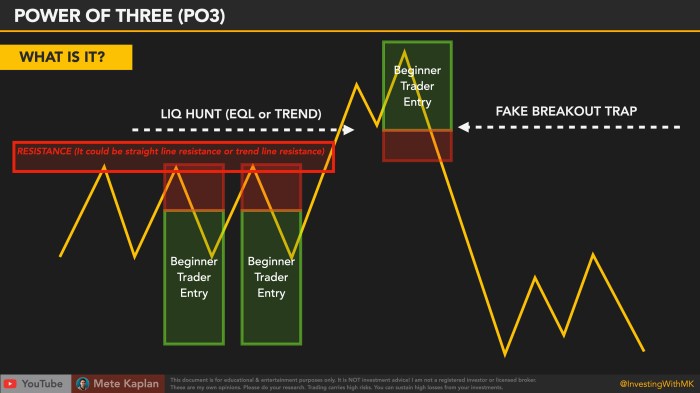

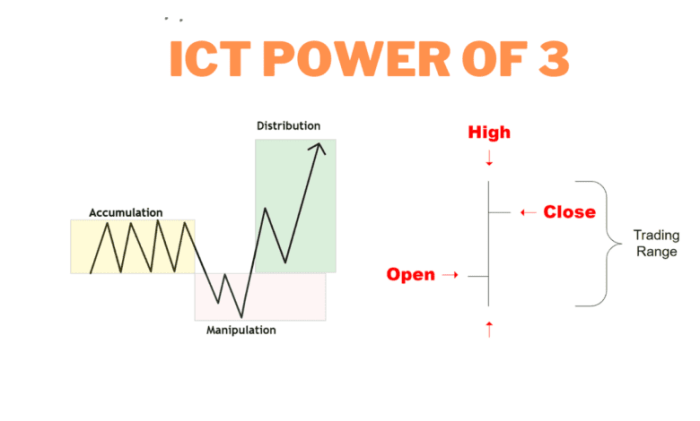

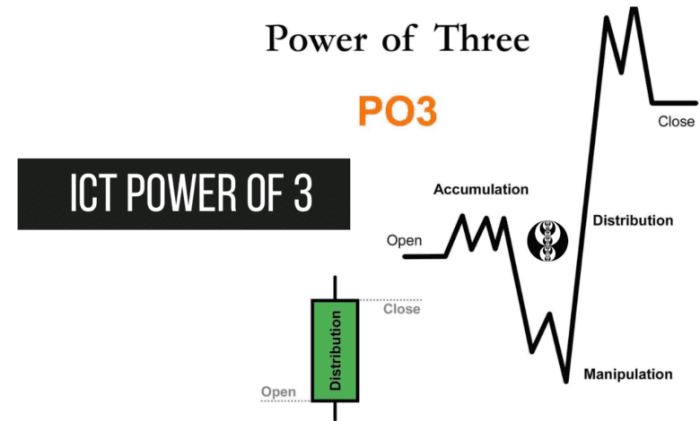

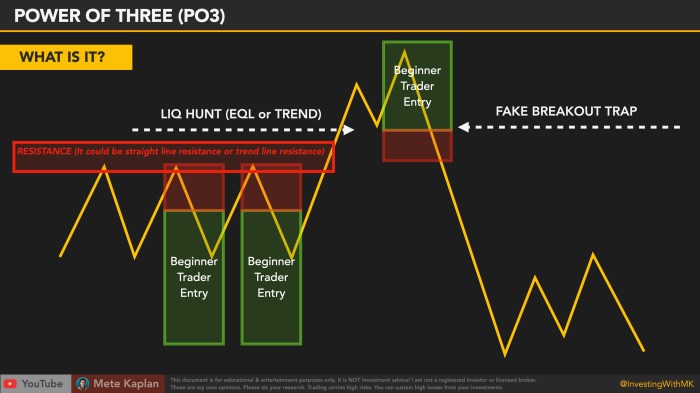

The Power of Three (PO3) Concept

The Power of Three (PO3) concept, a cornerstone of ICT trading, is a strategic approach that has been adopted by institutional traders and banks to gain an edge in the financial markets. It’s like having a secret decoder ring for understanding market movements and making informed trading decisions.

Core Principles of the PO3 Concept

The PO3 concept revolves around identifying and analyzing three key elements: Price, Order Flow, and Time. These three elements are like the holy trinity of trading, working together to paint a comprehensive picture of market dynamics.

- Price:This is the most obvious element, representing the current value of an asset. It’s the foundation of any trading decision, providing insights into market sentiment and potential trends.

- Order Flow:This is the hidden engine of the market, representing the flow of buy and sell orders placed by different market participants. It provides a glimpse into the hidden forces behind price movements, allowing traders to anticipate potential shifts.

- Time:This is the often-overlooked element, providing context to price and order flow. By analyzing the timing of price movements and order flow activity, traders can identify potential patterns and opportunities.

PO3 Concept vs. Traditional Trading Methods

The PO3 concept stands apart from traditional trading methods by emphasizing a holistic view of the market, going beyond just price analysis. It’s like taking a step back and seeing the big picture, rather than focusing on individual pieces of the puzzle.

Okay, so you’re thinking about diving into the world of ICT Trading and mastering the “Secret Power of Three” concept, right? That’s some serious stuff, like figuring out the ultimate cheat code for the stock market. But hey, even the most hardcore traders need a break sometimes.

Maybe you could check out Fantasy Flower Girls A Magical Coloring Book for Adults and Teens for some chill time. After all, a clear head is essential for making those killer trading decisions!

- Traditional methods:Often rely on technical indicators and historical price data, which can be prone to lagging signals and false positives.

- PO3 concept:Integrates order flow analysis, providing real-time insights into market dynamics and helping traders identify market turning points before they happen.

Real-World Applications of the PO3 Concept

The PO3 concept is widely used by institutional traders and banks, enabling them to make informed trading decisions and navigate market volatility.

- Identifying market trends:By analyzing price action, order flow, and time, institutional traders can spot emerging trends and capitalize on them.

- Predicting market reversals:By understanding the flow of buy and sell orders, traders can anticipate potential market reversals before they occur, enabling them to adjust their positions accordingly.

- Managing risk:The PO3 concept helps traders to identify potential risk areas and manage their exposure effectively, reducing the likelihood of significant losses.

Benefits of Utilizing the PO3 Concept

The PO3 concept offers a number of benefits for traders, including:

- Improved trading accuracy:By combining price, order flow, and time analysis, traders can make more informed trading decisions, increasing their chances of success.

- Enhanced risk management:The PO3 concept helps traders to identify potential risk areas and manage their exposure effectively, minimizing losses.

- Greater market understanding:By analyzing the interplay of price, order flow, and time, traders gain a deeper understanding of market dynamics and can anticipate future movements.

Drawbacks of Utilizing the PO3 Concept

While the PO3 concept offers significant benefits, it also comes with some drawbacks:

- Complexity:The PO3 concept requires a significant amount of knowledge and experience to master.

- Time commitment:Analyzing price, order flow, and time requires significant time and effort.

- Subjectivity:There is a degree of subjectivity involved in interpreting order flow data, which can lead to different interpretations.

Inside the Inner Circle

Imagine a world where the stock market isn’t just a game of chance, but a meticulously orchestrated dance, where every move is calculated and every trade is a calculated risk. This is the world of institutional trading, where the “Inner Circle” of traders play by a different set of rules, fueled by a unique mindset and an arsenal of sophisticated tools.

Institutional Trader Mindset

The traders within the inner circle are driven by a relentless pursuit of long-term gains, prioritizing risk management and capital preservation above all else. They are seasoned veterans with a deep understanding of market dynamics, fueled by years of experience and a thirst for knowledge.

Yo, wanna know the secret sauce that the big dogs on Wall Street use to make bank? It’s called ICT Trading, and it’s all about the “Power of Three” concept. Think of it like a super secret code that lets you read the market like a pro.

Want to learn more? Download And Listen Here to get the inside scoop on ICT Trading and level up your game. It’s like having a cheat code for the stock market, trust me.

Their decision-making is grounded in rigorous analysis, relying on complex algorithms and cutting-edge technology to predict market movements and identify opportunities.

Institutional Trading Strategies

The inner circle’s approach to trading is fundamentally different from that of retail traders. Instead of chasing quick profits, they focus on building sustainable strategies based on fundamental analysis, technical indicators, and market sentiment. They are masters of hedging, diversifying their portfolios across various asset classes to minimize risk and maximize returns.

“The key to successful institutional trading is not about predicting the future, but about managing risk and capitalizing on opportunities when they arise.”

Anonymous Institutional Trader

Tools and Resources of the Inner Circle

Institutional traders have access to an array of tools and resources unavailable to the average retail investor. These include:

- Advanced Trading Platforms:These platforms offer real-time market data, advanced charting tools, and sophisticated order execution capabilities, allowing traders to execute trades with precision and speed.

- Proprietary Algorithms:Institutional traders often develop their own algorithms to analyze vast amounts of data, identify trends, and generate trading signals. These algorithms are designed to be highly accurate and efficient, giving them a significant edge over retail traders.

- Access to Exclusive Information:Through their connections and resources, institutional traders have access to exclusive information, such as company earnings reports, economic data releases, and industry trends, before they are publicly available. This gives them a crucial advantage in making informed trading decisions.

- Expert Networks:Institutional traders leverage expert networks to connect with industry specialists and subject matter experts, gaining valuable insights and perspectives on specific sectors or companies. These networks provide access to a wealth of knowledge and expertise, enhancing their understanding of the market.

Yo, listen up, ’cause ICT trading’s got this secret weapon called the PO3 concept. It’s like the inner circle of traders and banks have this exclusive playbook, and they’re using it to make bank. It’s all about recognizing those key patterns, and knowing when to jump in or out.

Think of it like figuring out the perfect outfit to drape your shape, Drape Your Shape , but for the stock market. Once you master this PO3 concept, you’ll be seeing those green candles like a boss, just like those big players.

Book Review

This book delves into the captivating world of institutional trading, unveiling the secret sauce that propels these financial behemoths to success. It dissects the Power of Three (PO3) concept, a strategy employed by the elite traders within the “Inner Circle” and the financial institutions themselves.

The PO3 Concept and Its Application in Institutional Trading

The PO3 concept hinges on the idea that by combining three key elements, traders can gain a significant edge in the market. These elements are:

- Fundamental Analysis:This involves dissecting the underlying financial health of a company or asset, considering factors like earnings, debt, and market trends.

- Technical Analysis:This focuses on interpreting price charts and trading patterns to identify potential buy or sell signals.

- Market Sentiment:This involves gauging the overall mood of the market and the prevailing sentiment among traders.

The book argues that by skillfully weaving these three elements together, traders can achieve a more comprehensive and accurate picture of the market. This allows them to make more informed trading decisions, potentially leading to greater profitability.

The Book’s Strengths and Weaknesses

The book provides valuable insights into the world of institutional trading, offering a glimpse into the strategies employed by these sophisticated players. It does an excellent job of explaining the PO3 concept and its practical applications.

Yo, wanna get in on the secret sauce of how the big boys trade? It’s all about the “Power of Three” concept, a slick strategy used by the inner circle traders and the banks. It’s like a symphony, with each move carefully orchestrated.

And speaking of symphonies, check out this killer collection of classical trumpet sheet music 28 Classical Trumpet Sheet Music Collection of Songs By composers Hande Grieg Bach Mozart Tchaikovsky Beethoven — just like the PO3 concept, it’s all about hitting those high notes and knowing when to hold back.

Mastering the Power of Three is like becoming a virtuoso trader, hitting the right notes at the right time to make serious bank.

| Strengths | Weaknesses |

|---|---|

| Provides a clear and concise explanation of the PO3 concept. | May be too technical for novice traders. |

| Offers real-world examples and case studies to illustrate the PO3 concept in action. | Could benefit from more in-depth analysis of specific trading strategies. |

| Emphasizes the importance of risk management and discipline in trading. | Lacks detailed information on specific trading platforms and tools used by institutional traders. |

The Book’s Overall Impact

This book is a valuable resource for traders seeking to understand the intricacies of institutional trading. It offers a compelling and informative exploration of the PO3 concept and its application in real-world scenarios. While it may be a bit technical for beginners, the book’s strengths outweigh its weaknesses, making it a worthwhile read for anyone looking to elevate their trading knowledge and strategies.

Wrap-Up

The Power of Three (PO3) concept is not just a trading method, it’s a whole new way of thinking about the market. By understanding the principles behind this approach, you can gain an edge in the world of trading, leveling up your game and becoming a smarter, more confident trader.

Commonly Asked Questions

What does ICT stand for?

ICT stands for “Inner Circle Trader.” It’s a name given to a group of traders who have mastered specific trading techniques, including the Power of Three (PO3) concept.

Is the PO3 concept only for professional traders?

While the PO3 concept was initially used by institutional traders, it can be applied by anyone with a solid understanding of technical analysis and trading strategies. It’s all about learning and applying the principles.

Are there any books that explain the PO3 concept in detail?

Yes, there are several books available that delve into the intricacies of the PO3 concept and its application in institutional trading.

How can I learn more about the PO3 concept?

There are various resources available online, including courses, videos, and articles that explain the PO3 concept and its applications. You can also join online communities dedicated to trading strategies to learn from experienced traders.