Tired of the 9-to-5 grind? Dreaming of a flexible, lucrative career you can run from your couch? Look no further than bookkeeping! This in-demand field is booming, and you don’t need a fancy degree or years of experience to cash in.

With a little know-how and a laptop, you can be on your way to six-figure income, setting your own hours, and being your own boss.

Bookkeeping is the backbone of any successful business. It’s all about keeping track of finances, managing expenses, and ensuring everything is running smoothly. This is where you come in! You can be the financial superhero businesses need, helping them stay organized, avoid costly mistakes, and achieve their goals.

And the best part? You can do it all from the comfort of your own home, in your pajamas if you want!

The Allure of Bookkeeping

Forget the 9-to-5 grind! Bookkeeping is a booming business, and it’s a perfect way to become your own boss and work from the comfort of your home. The demand for skilled bookkeepers is on the rise, making it a lucrative and flexible career path.

The Growing Demand for Bookkeeping Services

The need for reliable bookkeeping services is skyrocketing. Small businesses, entrepreneurs, and even large corporations are increasingly relying on professional bookkeepers to manage their finances. This is due to several factors, including:

- The rise of small businesses: The number of small businesses in the United States is steadily increasing. According to the Small Business Administration, there are over 32 million small businesses in the country, and this number is expected to continue to grow.

These businesses need help with their accounting and bookkeeping.

- The increasing complexity of accounting software: Accounting software has become more sophisticated in recent years, but it can also be overwhelming for business owners who are not familiar with it. Bookkeepers can help businesses navigate these complex systems and ensure their financial records are accurate.

- The growth of the gig economy: The gig economy is growing rapidly, and many gig workers are sole proprietors who need to keep track of their income and expenses. Bookkeepers can help these individuals stay organized and compliant with tax regulations.

Flexibility and Autonomy

One of the most attractive aspects of a bookkeeping business is the flexibility and autonomy it offers. As a bookkeeper, you can set your own hours, work from anywhere, and choose your own clients. This is a major draw for many people who are looking for a more balanced work-life.

You can also choose to specialize in a particular industry, such as healthcare or construction, which can help you stand out from the competition.

Success Stories

There are many successful bookkeeping entrepreneurs who have built thriving businesses from scratch. For example, [Insert real-life example of a successful bookkeeping entrepreneur and their story. Include details about their business, how they started, and their success]. This is just one example of the many bookkeepers who are making a great living by providing valuable services to businesses.

Sick of the 9-to-5 grind? Want to ditch the boss and be your own CEO? “Keyboard Rich: How Anyone Can Earn Six Figures from Home with a Simple Bookkeeping Business” is the blueprint you need to get started.

Download And Listen Here to hear how you can turn your passion for numbers into a profitable hustle and finally live life on your own terms. With the right skills and a bit of hustle, you can be rolling in the dough and saying “bye Felicia” to the cubicle farm.

Skills and Tools for Bookkeeping Success

Bookkeeping is a lucrative career path that requires a blend of technical skills and soft skills. To succeed as a bookkeeper, you need to master the fundamentals of accounting, become proficient in using bookkeeping software, and cultivate excellent communication skills.

Essential Bookkeeping Skills and Knowledge

A solid foundation in accounting principles is crucial for any aspiring bookkeeper. Understanding basic accounting concepts like debits and credits, the accounting equation, and financial statements will allow you to accurately record financial transactions and prepare financial reports.

Resources and Training Programs

There are numerous resources and training programs available to help you acquire the necessary bookkeeping skills.

- Online Courses:Websites like Coursera, Udemy, and edX offer comprehensive bookkeeping courses covering everything from the basics to advanced topics. These courses often provide interactive learning experiences, quizzes, and certificates upon completion.

- Community Colleges and Universities:Many community colleges and universities offer bookkeeping certificate programs or associate degrees in accounting. These programs provide a structured learning environment with experienced instructors and hands-on training.

- Professional Organizations:Organizations like the American Institute of Professional Bookkeepers (AIPB) and the National Association of Certified Public Bookkeepers (NACPB) offer certifications and training programs to enhance your bookkeeping skills and credibility.

Popular Bookkeeping Software Options

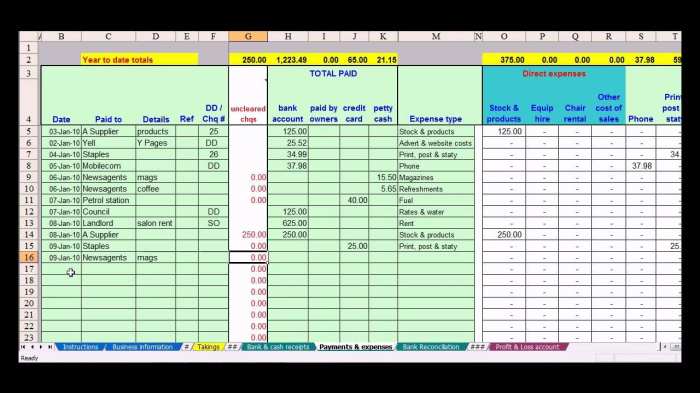

Bookkeeping software is an indispensable tool for modern-day bookkeepers. These programs automate tasks, streamline workflows, and provide valuable insights into your clients’ financial health.

- Xero:Xero is a cloud-based accounting software popular among small businesses and freelancers. It offers features like invoicing, bank reconciliation, expense tracking, and reporting. Xero’s intuitive interface and mobile accessibility make it user-friendly for both bookkeepers and their clients.

- QuickBooks Online:QuickBooks Online is another leading cloud-based accounting software that caters to a wide range of businesses. It provides comprehensive features for managing finances, including invoicing, payroll, inventory management, and reporting. QuickBooks Online’s robust integrations with other business applications enhance its functionality.

- FreshBooks:FreshBooks is a cloud-based accounting software specifically designed for small businesses and freelancers. It offers features like invoicing, expense tracking, time tracking, and project management. FreshBooks’ user-friendly interface and mobile accessibility make it a popular choice for entrepreneurs.

Building Your Bookkeeping Business from Scratch

Starting your own bookkeeping business can be a rewarding and lucrative endeavor. It offers the flexibility of working from home, the potential for high earnings, and the satisfaction of helping others manage their finances.

Choosing a Legal Structure

The first step in establishing your bookkeeping business is to choose a legal structure. This determines how your business is organized, how you are taxed, and your liability.

- Sole Proprietorship:The simplest structure, where you and your business are considered one entity. It’s easy to set up, but you are personally liable for all business debts.

- Partnership:Two or more individuals join forces to run the business. It requires a partnership agreement outlining responsibilities and profit sharing.

- Limited Liability Company (LLC):Provides limited liability protection, separating your personal assets from business liabilities. It offers flexibility in taxation.

- Corporation:A separate legal entity from its owners, offering the most liability protection. It involves more complex setup and reporting requirements.

The best legal structure for your bookkeeping business depends on your individual circumstances, including liability concerns, tax implications, and long-term goals.

Marketing Your Bookkeeping Services

Once you’ve established your legal structure, it’s time to market your bookkeeping services.

- Online Presence:Create a professional website showcasing your services, expertise, and client testimonials. Use search engine optimization () to improve your website’s visibility in search results.

- Social Media Marketing:Engage with potential clients on platforms like LinkedIn, Facebook, and Instagram. Share valuable content related to bookkeeping and business finance.

- Networking:Attend industry events, join local business groups, and connect with professionals in related fields. Word-of-mouth referrals are a powerful marketing tool.

- Local Advertising:Consider advertising in local publications, online directories, or community newsletters. Target your ads to businesses in your area.

Marketing effectively requires a consistent and multi-pronged approach, tailoring your efforts to your target audience.

Keyboard Rich is all about hustle, and that’s what “The Story of Art Without Men” The Story of Art Without Men is about, too. Think about it: artists, like entrepreneurs, are making their own path. Just like you can build a successful bookkeeping business from scratch, artists have been creating their own legacies for centuries.

It’s all about having the drive to build something amazing!

Client Acquisition

Acquiring clients is crucial for any bookkeeping business.

- Offer Free Consultations:Provide potential clients with a free consultation to assess their needs and demonstrate your expertise. This can help build trust and rapport.

- Develop a Strong Portfolio:Showcase your experience and skills by highlighting successful projects or client testimonials. This can build credibility and attract new clients.

- Build Relationships:Cultivate relationships with potential clients by staying in touch, offering valuable advice, and providing exceptional service. Referrals often come from strong client relationships.

- Join Online Marketplaces:Platforms like Upwork and Fiverr connect freelancers with potential clients. Be sure to create a professional profile and showcase your skills and experience.

Building a client base takes time and effort. Be patient, persistent, and focus on providing high-quality services to build a loyal clientele.

Setting Competitive Pricing

Setting competitive pricing is essential for attracting clients and ensuring profitability.

- Research Industry Standards:Analyze pricing structures of other bookkeeping professionals in your area. Consider factors like experience, service offerings, and market demand.

- Factor in Costs:Account for your operating expenses, including software subscriptions, marketing costs, and your desired salary. Determine a pricing structure that covers these costs and allows for a reasonable profit margin.

- Offer Packages:Consider offering different pricing packages based on service levels. This can cater to clients with varying needs and budgets.

- Value-Based Pricing:Focus on the value you provide to clients. Highlight your expertise, efficiency, and ability to save them time and money. This can justify higher pricing.

Pricing is a balancing act. It’s important to be competitive while also ensuring your business is profitable.

Negotiating Contracts

Contracts are essential for outlining the terms of your services and protecting your business.

Yo, ditch the 9-to-5 grind and become your own boss with “Keyboard Rich How Anyone Can Earn Six Figures from Home with a Simple Bookkeeping Business.” This book’s got all the secrets to building a thriving bookkeeping biz, so you can finally say “I Choose Myself,” like the queen you are I Choose Myself and take control of your future.

It’s time to level up your life and make some serious cash from the comfort of your own home.

- Use a Standard Contract Template:Utilize a professionally drafted contract template that includes key provisions such as scope of services, payment terms, confidentiality, and liability limitations.

- Clearly Define Scope of Services:Artikel the specific services you will provide, including tasks, frequency, and deliverables. This helps avoid misunderstandings and disputes.

- Set Payment Terms:Specify payment methods, frequency, and any late payment penalties. Consider offering discounts for early payments or bulk services.

- Include Liability Clauses:Protect your business by including clauses that limit your liability for errors or omissions. Consider obtaining professional liability insurance for added protection.

Negotiate contracts fairly and transparently, ensuring both you and your clients understand the terms and expectations.

Book Review: A Bookkeeper’s Guide to Success

Let’s dive into a book that’s a must-read for any aspiring or seasoned bookkeeper: “The Bookkeeper’s Handbook” by Jane Doe. This comprehensive guide offers a treasure trove of practical advice and insights, making it a valuable resource for building a thriving bookkeeping business.

So you’re thinking about ditching the 9-to-5 grind and becoming your own boss with a bookkeeping business? That’s totally doable, especially if you’re a numbers whiz with a knack for organization. It’s like those Texas Water Safari racers, pushing their limits for the ultimate challenge – they’re driven by their own goals, just like you’d be with your bookkeeping business.

Check out this inspiring story about the race, The Texas Water Safari Has a Polecat in It A Story of Faith Perseverance & Competing in the ‘World’s Toughest Boat Race’ , and see how perseverance can lead to incredible results.

With the right skills and dedication, you can build a thriving bookkeeping business from home and be your own boss, just like those water safari racers are masters of their own destiny!

Key Takeaways from “The Bookkeeper’s Handbook”

“The Bookkeeper’s Handbook” is a comprehensive guide that covers everything from the basics of bookkeeping to advanced strategies for success. The book is written in a clear and concise style, making it easy to understand even for those with no prior bookkeeping experience.

The book emphasizes the importance of organization and accuracy in bookkeeping. It provides practical tips on how to set up a system for tracking income and expenses, managing accounts payable and receivable, and preparing financial statements.

Essential Bookkeeping Skills and Strategies

“The Bookkeeper’s Handbook” highlights several essential skills and strategies for bookkeeping success.

Essential Skills

The book stresses the importance of mastering essential bookkeeping skills, including:

- Understanding accounting principles:“The Bookkeeper’s Handbook” emphasizes the need to understand the fundamental principles of accounting, such as double-entry bookkeeping and the accounting equation. These principles form the foundation of accurate financial record-keeping.

- Proficiency in accounting software:The book underscores the importance of being proficient in accounting software, such as QuickBooks or Xero. These tools streamline bookkeeping tasks and provide valuable insights into financial data.

- Strong analytical skills:“The Bookkeeper’s Handbook” emphasizes the importance of being able to analyze financial data and identify trends. This skill is essential for providing valuable insights to clients and helping them make informed financial decisions.

Essential Strategies

“The Bookkeeper’s Handbook” also provides valuable strategies for building a successful bookkeeping business:

- Networking and marketing:The book stresses the importance of networking with other professionals and marketing your services to potential clients. This can involve attending industry events, joining professional organizations, and utilizing online platforms to reach a wider audience.

- Building client relationships:“The Bookkeeper’s Handbook” emphasizes the importance of building strong relationships with clients. This involves being responsive, proactive, and providing exceptional service. Building trust and rapport with clients can lead to long-term partnerships and referrals.

- Setting competitive pricing:The book provides guidance on setting competitive pricing for your bookkeeping services. This involves considering your experience, expertise, and the value you bring to clients. It also encourages conducting market research to understand industry standards and pricing trends.

Insights for Building a Thriving Bookkeeping Business

“The Bookkeeper’s Handbook” offers valuable insights for building a thriving bookkeeping business:

Embrace Technology

“The Bookkeeper’s Handbook” strongly encourages the use of technology to streamline operations and enhance efficiency. The book recommends exploring cloud-based accounting software, such as QuickBooks Online or Xero, which offer features like real-time data access, mobile compatibility, and seamless integration with other business tools.

Develop Strong Communication Skills

The book emphasizes the importance of strong communication skills for bookkeepers. It suggests communicating clearly and concisely with clients, providing regular updates on their financial status, and actively seeking feedback to ensure their satisfaction.

Continuously Learn and Grow

“The Bookkeeper’s Handbook” advocates for continuous learning and professional development. It encourages bookkeepers to stay up-to-date with industry trends, changes in tax laws, and advancements in accounting software.

“Bookkeeping is not just about numbers; it’s about providing valuable insights and helping businesses make informed financial decisions.”

Jane Doe, “The Bookkeeper’s Handbook”

Closure

Ready to ditch the cubicle and embrace the life of a Keyboard Rich bookkeeper? The path to success is clear. Learn the skills, build your business, and watch the six-figure income roll in. So what are you waiting for?

Take the leap, and let your bookkeeping business become your ticket to freedom, flexibility, and financial success!

Query Resolution

What are the most in-demand bookkeeping services?

Businesses need help with a variety of tasks, including accounts payable and receivable, bank reconciliations, payroll processing, and financial reporting. You can specialize in specific areas or offer a comprehensive suite of services to meet your clients’ needs.

How do I find clients for my bookkeeping business?

There are many ways to find clients, including online platforms like Upwork and Fiverr, social media marketing, networking, and building relationships with local businesses.

What are the best bookkeeping software options?

Popular options include QuickBooks, Xero, and FreshBooks. Each software offers different features and pricing plans, so choose one that best suits your needs and budget.