Hey, future boss! Tired of those pesky tax bills sucking the life out of your dream business? We’ve got your back. This guide is like a cheat sheet for turning your hustle into a legal and profitable machine. We’ll break down LLCs and S-corps, the good, the bad, and the tax-saving magic.

Think of it like a power-up for your business brain, getting you ready to conquer the entrepreneurial world.

Ready to make your business a money-making monster? Let’s dive in!

Understanding LLCs and S-Corps

Choosing the right business structure is a crucial step for any small business owner. You need to consider your long-term goals, tax implications, and liability protection. Two popular options are the Limited Liability Company (LLC) and the S-corporation (S-corp).

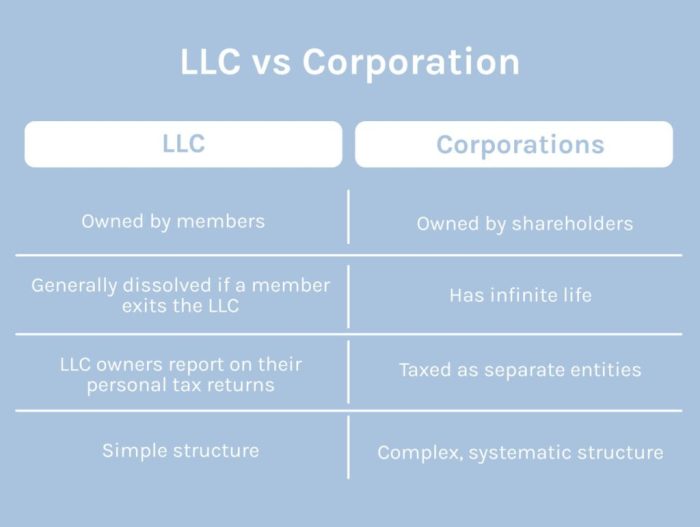

Key Differences Between LLCs and S-Corps

The primary difference between LLCs and S-corps lies in their legal and tax structures. LLCs are considered pass-through entities, meaning the business’s profits and losses flow through directly to the owner’s personal tax return. S-corps, on the other hand, are treated as separate legal entities from their owners.

This distinction has significant implications for liability protection and tax obligations.

Advantages and Disadvantages of LLCs

LLCs offer several advantages, making them a popular choice for small business owners.

Advantages of LLCs

- Limited Liability Protection:LLCs provide a shield between the owner’s personal assets and the business’s liabilities. This means that if the business incurs debt or faces a lawsuit, the owner’s personal assets are generally protected.

- Pass-Through Taxation:LLCs are taxed as pass-through entities. This means that the business’s profits and losses are reported on the owner’s personal tax return. This can be beneficial as it avoids double taxation, where the business’s profits are taxed at the corporate level and again at the individual level.

Running your own business is a wild ride, just like Little Richard’s career! Little Richard A Life from Beginning to End (Biographies of Musicians) is a must-read for anyone who wants to know how to rock the music world. But if you’re looking to rock the business world, you’ll need a good guide.

“LLC & S-Corporation Beginner’s Guide 2 in 1 Everything you Need to Know on How to Form Manage Maintain your LLC & S-Corp and Economize on Taxes as a Small Business Owner (Easy-To-Follow)” is your backstage pass to success.

- Flexibility in Ownership Structure:LLCs offer flexibility in ownership structure. They can be owned by one person (single-member LLC) or multiple individuals (multi-member LLC).

- Operational Simplicity:LLCs are generally easier to manage and operate than corporations. They have fewer regulatory requirements and formalities.

Disadvantages of LLCs

- Self-Employment Taxes:Owners of LLCs are considered self-employed and are subject to self-employment taxes, which include Social Security and Medicare taxes. These taxes can be higher than the taxes paid by employees of a corporation.

- Limited Access to Capital:LLCs may have difficulty attracting outside investment compared to corporations, as investors may prefer the legal protections and established structures of corporations.

Advantages and Disadvantages of S-Corps

S-corps offer a unique combination of limited liability protection and tax advantages.

Advantages of S-Corps

- Limited Liability Protection:Like LLCs, S-corps provide a shield between the owner’s personal assets and the business’s liabilities.

- Tax Advantages:S-corps offer tax advantages for owners who work in the business. By electing S-corp status, owners can pay themselves a salary as an employee and draw the remaining profits as distributions. This allows owners to pay lower self-employment taxes on the salary portion, as it is subject to the employer portion of Social Security and Medicare taxes.

- Increased Credibility:S-corps may have greater credibility than LLCs in the eyes of some investors and lenders.

Disadvantages of S-Corps

- More Complex Structure:S-corps are generally more complex to set up and maintain than LLCs. They require more paperwork and compliance with regulations.

- Limited Number of Shareholders:S-corps are limited to 100 shareholders, and all shareholders must be U.S. citizens or residents. This can be a drawback for businesses seeking to attract outside investors.

- Double Taxation for Corporate Distributions:While S-corps avoid double taxation on profits, distributions to shareholders may be subject to double taxation. This means that the profits are taxed once at the corporate level and again at the individual level when distributed to shareholders.

Comparison of LLCs and S-Corps

The following table summarizes the key differences between LLCs and S-corps:

| Feature | LLC | S-Corp |

|---|---|---|

| Legal Structure | Pass-through entity | Separate legal entity |

| Liability Protection | Limited liability | Limited liability |

| Taxation | Pass-through taxation | Pass-through taxation with potential tax advantages for owner-employees |

| Ownership Structure | Flexible ownership structure | Limited to 100 shareholders, all of whom must be U.S. citizens or residents |

| Administrative Requirements | Generally simpler to manage | More complex administrative requirements |

| Capital Raising | May face challenges in attracting outside investment | May have better access to capital |

Formation and Setup

Alright, let’s get down to the nitty-gritty! Forming your LLC or S-corp is like building the foundation of your business. It’s all about getting the legal structure right, so you can focus on running your empire.This section will walk you through the steps involved in forming both an LLC and an S-corp, the paperwork you need to file, and how to choose the perfect state for your business.

Forming an LLC

Forming an LLC is like getting your business license to operate. It’s a relatively straightforward process, but you need to get the paperwork right.Here’s the general process:

- Choose a business name:This is the name your customers will know you by, so choose something catchy and memorable. Check if it’s available in your state and make sure it’s not already taken.

- Register your LLC:This is the official step where you tell the state you’re forming an LLC. You’ll need to file Articles of Organization, which include your business name, address, and the names of the owners (called members).

- Create an operating agreement:This is like a rulebook for your LLC, outlining how it’s managed, how profits and losses are distributed, and what happens if a member leaves. It’s not legally required in all states, but it’s a good idea to have one to avoid any future disputes.

- Obtain an Employer Identification Number (EIN):This is like a Social Security number for your business. You’ll need it for things like opening a business bank account and filing taxes.

Forming an S-Corp

Forming an S-corp is like adding a special layer to your LLC. It allows you to avoid double taxation on your business profits, which can save you some serious dough. Here’s the breakdown:

- Form an LLC:You need to first form an LLC as a base for your S-corp. This gives you the legal structure to operate as a business.

- File Form 2553:This is the official application to the IRS to elect S-corp status. You’ll need to provide information about your business and its owners.

- Adopt bylaws:These are like the operating agreement for your S-corp, outlining how it’s managed, how profits and losses are distributed, and the roles of the shareholders (owners). It’s important to have these in place to avoid any confusion or disputes.

Choosing the Right State for Incorporation

Picking the right state to incorporate is like choosing the perfect location for your business. Some states are more business-friendly than others, with lower taxes and fewer regulations.Here are some factors to consider:

- Taxes:States have different corporate tax rates, franchise tax rates, and other taxes that can affect your bottom line. Research the tax structure of different states to find the most favorable option.

- Regulations:Some states have more stringent regulations than others. This can impact your business operations and costs. Consider the regulations that are most relevant to your industry.

- Cost of living:If you’re planning to operate your business from a specific state, consider the cost of living, including housing, utilities, and transportation. This can affect your overall expenses and profitability.

Necessary Documentation and Filing Requirements

Think of this like the paperwork you need to get your business officially recognized. It’s crucial to get everything right, or you might face some legal trouble.Here’s a breakdown of the essential documents and requirements:

- Articles of Organization:This is the official document you file with the state to register your LLC. It includes information about your business name, address, and the names of the owners (members).

- Operating Agreement:This is a legal document that Artikels how your LLC is managed, how profits and losses are distributed, and what happens if a member leaves. It’s not legally required in all states, but it’s a good idea to have one to avoid any future disputes.

- Form 2553 (for S-corp):This is the official application to the IRS to elect S-corp status. You’ll need to provide information about your business and its owners.

- Bylaws (for S-corp):These are like the operating agreement for your S-corp, outlining how it’s managed, how profits and losses are distributed, and the roles of the shareholders (owners). It’s important to have these in place to avoid any confusion or disputes.

Checklist for Choosing the Right State for Incorporation

This is like your roadmap for finding the perfect state for your business. It’s a step-by-step guide to help you make an informed decision.Here’s a checklist to get you started:

- Determine your business needs:What are the specific factors that are most important to you, such as tax rates, regulations, or cost of living?

- Research different states:Use online resources, consult with business advisors, and talk to other entrepreneurs to gather information about different states.

- Compare tax structures:Look at corporate tax rates, franchise tax rates, and other taxes that might apply to your business.

- Assess regulations:Consider the regulations that are most relevant to your industry and how they might impact your operations and costs.

- Evaluate cost of living:Determine the cost of living in different states and how it might affect your overall expenses and profitability.

- Consider other factors:Think about other factors that might be important to you, such as the availability of talent, access to markets, and quality of life.

- Make a decision:Based on your research and evaluation, choose the state that best meets your business needs and goals.

Management and Operations

Alright, you’ve got your LLC or S-Corp up and running. Now, let’s talk about the day-to-day stuff. You’re not just filing paperwork and collecting dust here, you’re running a business! That means making decisions, managing your team (even if it’s just you), and keeping track of everything.

Management Structures

How you manage your LLC or S-Corp depends on how much control you want to have and how much you want to delegate. There are two main structures:

- Member-Managed:This is the default for most LLCs. You, the owner(s), are directly responsible for all the business decisions. It’s like being the captain of your own ship, making all the calls.

- Manager-Managed:This structure lets you appoint managers (who may or may not be owners) to handle the day-to-day operations. It’s like hiring a crew to help you navigate, while you focus on the big picture.

Owner and Manager Responsibilities

So, what do owners and managers actuallydo*? It’s not all just sipping margaritas on the beach (although that might be a nice perk someday!).

- Owners:They’re the ultimate decision-makers. They set the strategic direction, approve budgets, and make big calls like hiring or firing. They also have to comply with legal requirements, like filing taxes and keeping records.

- Managers:They’re the ones in the trenches, handling the day-to-day operations. This could include hiring and managing employees, making sales, marketing, and handling customer service.

Effective Record-Keeping and Financial Management

You know that saying, “If you can’t measure it, you can’t manage it”? That’s super important for your business. Good record-keeping and financial management are key to success.

- Record-Keeping:Keep track of everything! Sales, expenses, inventory, contracts, invoices, you name it. This helps you stay organized, avoid legal trouble, and make smart decisions.

- Financial Management:Don’t just throw money around like confetti. Create a budget, track your income and expenses, and make sure you’re profitable. This is where you can use accounting software, hire a bookkeeper, or consult a financial advisor.

Tax Considerations

When it comes to running your own business, understanding the tax implications of your chosen legal structure is crucial. This section will delve into the tax implications of operating both an LLC and an S-corp, highlighting the key differences and benefits each offers.

Yo, wanna level up your biz game and become a tax-saving ninja? “LLC & S-Corporation Beginner’s Guide 2 in 1 Everything you Need to Know on How to Form Manage Maintain your LLC & S-Corp and Economize on Taxes as a Small Business Owner (Easy-To-Follow)” is the ultimate guide to owning your own hustle, and you can Download And Listen Here.

This book breaks down everything from setting up your LLC or S-corp to keeping your tax bill low, so you can focus on building your empire, not your tax return.

We’ll also explore various tax deductions and credits available to small business owners, providing you with valuable insights to maximize your tax savings. Finally, we’ll guide you through the steps involved in filing taxes for both LLCs and S-corps, ensuring you navigate the process with confidence.

So, you’re thinking about starting your own business, huh? That’s awesome! You’re gonna need to know the ins and outs of LLCs and S-Corps, and that’s where the “LLC & S-Corporation Beginner’s Guide 2 in 1” comes in.

It’s like the ultimate cheat sheet for entrepreneurs. But hey, sometimes you need a little inspiration, right? Check out the Tortured For His Faith 50th Anniversary Edition for a real story of resilience. Once you’re pumped up, dive back into that “LLC & S-Corporation Beginner’s Guide 2 in 1” and get your business game on!

Tax Implications of LLCs and S-corps

LLCs and S-corps offer distinct tax advantages. Understanding these differences is essential for making informed decisions regarding your business structure.

So you’re thinking about starting your own business? That’s awesome! But before you jump in headfirst, you gotta know the difference between an LLC and an S-Corp. It’s like the difference between a country star and a Hollywood A-lister.

Both are big deals, but they operate in different worlds. Check out Howdy Hollywood! Music Movie Stars and Mischief From Texas to Tinseltown for a little dose of entertainment. Anyway, back to business. Knowing the ins and outs of an LLC and S-Corp can save you a ton of money on taxes and keep your business running smooth as butter.

LLCs (Limited Liability Companies)

- Pass-through Entity:LLCs are considered pass-through entities, meaning the business’s profits and losses are passed through to the owner’s personal income tax return. This means you don’t pay taxes at the business level, but instead, report your business income and expenses on your individual tax return, using Schedule C or Schedule K-1.

- Flexibility in Taxation:Owners can choose to be taxed as a sole proprietorship, partnership, or corporation, depending on their specific needs and circumstances.

- Self-Employment Tax:As an LLC owner, you’re responsible for paying self-employment tax, which includes Social Security and Medicare taxes. This applies to both single-member and multi-member LLCs.

S-corps (S Corporations)

- Pass-through Entity:Similar to LLCs, S-corps are pass-through entities, meaning profits and losses are passed through to the shareholders’ personal income tax returns.

- Separate Entity:Unlike LLCs, S-corps are considered separate legal entities from their owners, offering greater liability protection.

- “Reasonable Salary” Requirement:S-corp owners must pay themselves a “reasonable salary” as an employee, which is subject to payroll taxes. Any remaining profits are then distributed as dividends, which are taxed at a lower capital gains rate.

Tax Deductions and Credits

Small business owners are eligible for various tax deductions and credits designed to help offset business expenses and reduce their tax burden.

Common Tax Deductions

- Business Expenses:This includes costs associated with running your business, such as rent, utilities, supplies, marketing, and employee salaries.

- Depreciation:This allows you to deduct the cost of assets used in your business over time, such as equipment, vehicles, and furniture.

- Home Office Deduction:If you use a portion of your home for business purposes, you may be eligible to deduct expenses related to that space.

- Health Insurance Premiums:You can deduct premiums for health insurance plans for yourself and your employees.

- Retirement Contributions:You can deduct contributions to retirement plans, such as SEP IRAs and Solo 401(k)s.

Tax Credits

- Research and Development (R&D) Tax Credit:This credit is available to businesses that invest in research and development activities.

- Work Opportunity Tax Credit:This credit is offered to businesses that hire individuals from certain target groups, such as veterans, ex-offenders, and long-term unemployed individuals.

- Small Business Health Care Tax Credit:This credit is available to small businesses that offer health insurance to their employees.

Filing Taxes for LLCs and S-corps

The process of filing taxes for LLCs and S-corps involves several steps.

Filing Taxes for LLCs

- Choose Your Tax Classification:As mentioned earlier, you can choose to be taxed as a sole proprietorship, partnership, or corporation.

- File Form 1040:Report your business income and expenses on Schedule C or Schedule K-1 of your Form 1040.

- Pay Self-Employment Tax:You’ll need to pay self-employment tax on your net earnings from your LLC.

Filing Taxes for S-corps

- File Form 1120-S:S-corps file Form 1120-S, which reports the corporation’s income, expenses, and distributions to shareholders.

- File Schedule K-1:Each shareholder receives a Schedule K-1, which details their share of the corporation’s income, expenses, and deductions.

- File Form 1040:Shareholders report their share of the S-corp’s income and expenses on their individual tax returns.

Last Word

So, you’ve got the tools, you’ve got the knowledge, and now you’ve got the confidence to take on the business world like a boss. Remember, your LLC or S-corp is just the beginning. Keep learning, keep growing, and keep crushing it! You’ve got this.

Question & Answer Hub

What’s the biggest difference between an LLC and an S-corp?

Think of it like this: an LLC is like a cool car – you get to drive it and make all the rules. An S-corp is like a race car – it’s designed for speed and efficiency, but you have to follow specific rules and regulations.

Do I have to hire an accountant to handle taxes for my LLC or S-corp?

Not necessarily. You can handle some basic tax stuff yourself, but if you’re dealing with complex deductions or want to make sure you’re maximizing your tax savings, a pro is always a good idea.

How often do I need to file taxes for my LLC or S-corp?

You’ll usually file taxes annually, but you may also need to make estimated tax payments throughout the year. It’s best to check with your tax advisor to be sure.

Can I change my business structure from an LLC to an S-corp later?

Totally! You can change your business structure later on, but it’s usually best to plan ahead and choose the structure that best suits your needs from the start.