Ready to level up your mortgage game and become a certified loan origination pro? The NMLS SAFE Act is your ticket to the big leagues, and this study guide is your secret weapon! With over 420 practice questions, you’ll be acing that exam and closing deals like a boss in no time.

Forget boring textbooks, this guide’s got the inside scoop on the NMLS SAFE Act, and it’s gonna make your study sessions feel like a total blast.

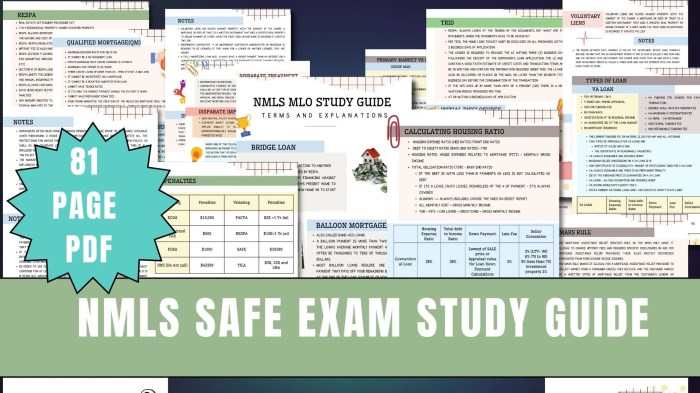

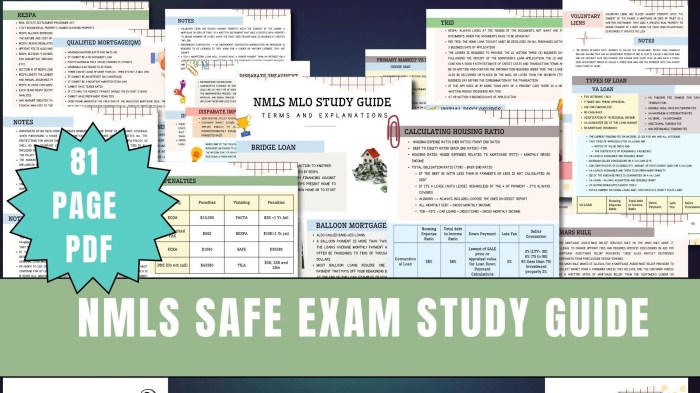

This guide breaks down the NMLS SAFE Act, explains its importance for mortgage loan originators, and gives you a comprehensive overview of the key components that shape the mortgage industry. Think of it as a cheat sheet for success, packed with insights, tips, and strategies to make sure you’re fully prepared for the exam.

We’re talking effective study techniques, a killer study plan, and tons of practice questions to help you conquer those tricky scenarios. This guide is like having your own personal tutor, ready to guide you through every step of the way.

NMLS SAFE Act Study Guide Overview

Yo, aspiring mortgage loan originators! Buckle up, because this study guide is your ticket to crushing the NMLS SAFE Act exam. This ain’t your average study guide; it’s packed with 420+ practice questions, all designed to help you ace the test and get your license, fast and easy.

So, you wanna crush that Mortgage Loan Originator test and get your NMLS license? No sweat, fam! This study guide’s got your back with 420+ practice questions, and you can Download And Listen Here to some killer tips and tricks.

You’ll be acing that exam and signing those loan docs like a boss in no time!

Importance of the NMLS SAFE Act

The NMLS SAFE Act, short for the Secure and Fair Enforcement for Mortgage Licensing Act, is the real deal for mortgage loan originators. It’s all about ensuring that everyone in the mortgage industry is legit and has the knowledge and skills to do their job right.

This means protecting consumers from shady practices and ensuring that the whole mortgage process is smooth sailing.

Key Components of the NMLS SAFE Act

This act is all about setting the standards for mortgage loan originators across the country. Here’s the lowdown on the key components:

- Licensing and Registration:The NMLS SAFE Act requires all mortgage loan originators to be licensed and registered with the Nationwide Mortgage Licensing System (NMLS). This creates a centralized database that tracks all originators, making it easier for regulators to keep an eye on things and for consumers to verify an originator’s credentials.

So, you’re ready to crush that Mortgage Loan Originator test, right? Get those study guides ready, ’cause the NMLS SAFE Act is no joke. But hey, if you’re feeling overwhelmed, maybe you need to check out Gasping for Air The Stranglehold of Narcissistic Abuse , it might give you some perspective on how to handle those tough situations.

Once you’ve got your head straight, those 420+ practice questions will be a breeze, and you’ll be on your way to becoming a mortgage loan superstar!

- Background Checks:The NMLS SAFE Act requires background checks on all mortgage loan originators. This helps ensure that only trustworthy individuals are working in the industry, which is a big win for consumer protection.

- Education and Training:The NMLS SAFE Act mandates that all mortgage loan originators complete a certain amount of education and training. This ensures that they have the knowledge and skills to understand the complex world of mortgages and provide accurate and reliable information to borrowers.

- Continuing Education:To stay up-to-date with the ever-changing mortgage industry, the NMLS SAFE Act requires mortgage loan originators to complete continuing education courses on a regular basis. This helps ensure that they’re always on top of the latest rules, regulations, and best practices.

You’re totally crushing that mortgage loan originator test prep, right? But hey, sometimes life throws a curveball, and you gotta deal with it. That’s what the blog post NINE DAYS Living With My Soul Wide Open After Violent Trauma is all about – finding your strength after a tough situation.

So, yeah, get those practice questions down, ace that test, and remember, you got this!

Impact on the Mortgage Industry

The NMLS SAFE Act has had a huge impact on the mortgage industry, bringing about a whole new level of professionalism and accountability. Here’s the deal:

- Increased Consumer Protection:The NMLS SAFE Act has significantly improved consumer protection by ensuring that only qualified and trustworthy individuals are working as mortgage loan originators.

- Standardized Licensing and Regulation:The NMLS SAFE Act has created a nationwide system for licensing and regulating mortgage loan originators, eliminating the need for individual states to create their own systems. This simplifies the process for originators and ensures consistency across the country.

- Enhanced Transparency:The NMLS SAFE Act has made the mortgage industry more transparent by creating a centralized database that tracks all mortgage loan originators and their licensing information. This allows consumers to easily verify an originator’s credentials and check their history.

Study Guide Content

This study guide covers all the essential topics you need to know for the NMLS SAFE Act exam. The content is divided into different sections, each focusing on a specific area of the mortgage industry.

- Mortgage Loan Origination:This section covers the basics of mortgage loan origination, including the different types of loans, the mortgage application process, and the role of the mortgage loan originator.

- Mortgage Industry Regulations:This section dives into the legal and regulatory framework that governs the mortgage industry. It covers key laws, regulations, and compliance requirements that you need to be familiar with.

- Mortgage Loan Products:This section explores the various types of mortgage loan products available to borrowers, including conventional loans, government-insured loans, and private loans.

- Mortgage Loan Closing:This section covers the final stages of the mortgage loan process, including the closing process, settlement statements, and the role of the closing agent.

- Ethics and Fair Lending:This section emphasizes the importance of ethical conduct and fair lending practices in the mortgage industry. It covers topics such as discrimination, predatory lending, and the role of the Equal Credit Opportunity Act (ECOA).

Level of Difficulty

The NMLS SAFE Act exam is designed to test your knowledge and understanding of the mortgage industry. It’s not a walk in the park, but it’s not a complete nightmare either. With this study guide, you’ll have all the tools you need to conquer the exam and get your license.

- Practice Questions:The study guide includes over 420 practice questions that cover all the topics you need to know for the exam. These questions are designed to help you identify your strengths and weaknesses and to familiarize yourself with the exam format.

- Detailed Answers and Explanations:Each practice question comes with a detailed answer and explanation, providing you with a thorough understanding of the concepts tested.

- Tips and Strategies:The study guide also includes helpful tips and strategies for preparing for the exam, such as time management techniques and test-taking strategies.

Exam Preparation Strategies

Passing the NMLS SAFE Act exam is crucial for becoming a licensed mortgage loan originator. To conquer this challenge, you need a solid strategy that combines effective study techniques and dedicated practice. This section will guide you through the best practices for preparing for the exam.

Effective Study Techniques

Effective study techniques are key to mastering the vast amount of information required for the NMLS SAFE Act exam. You can maximize your learning by employing these strategies:

- Active Recall:Instead of simply reading the material, actively recall key concepts and definitions. This could involve using flashcards, creating summaries, or teaching the material to someone else.

- Spaced Repetition:Review material at increasing intervals to strengthen memory retention. This method helps you retain information over the long term.

- Focus on High-Yield Topics:Identify the most frequently tested areas and prioritize your study time accordingly. You can find this information in the NMLS exam blueprint or through practice questions.

- Utilize Different Learning Styles:Everyone learns differently. Experiment with various methods like reading, listening to podcasts, watching videos, or taking practice quizzes to find what works best for you.

Benefits of Practice Questions

Practice questions are invaluable tools for preparing for the NMLS SAFE Act exam. They provide a realistic simulation of the actual exam experience and help you:

- Identify Knowledge Gaps:Practice questions expose areas where you need further study. This allows you to focus your efforts on the topics you need the most help with.

- Become Familiar with Exam Format:Practice questions help you get accustomed to the types of questions, answer formats, and time constraints you’ll encounter on the real exam.

- Develop Test-Taking Strategies:Practice questions allow you to experiment with different test-taking strategies, such as time management, eliminating incorrect answers, and pacing yourself.

- Boost Confidence:Successfully answering practice questions builds confidence and reduces test anxiety. This can lead to a more positive and focused exam experience.

Comprehensive Study Plan

A comprehensive study plan is essential for ensuring that you cover all the necessary material and have enough time to practice. Here’s a step-by-step approach:

- Determine Your Study Time:Estimate how much time you can realistically dedicate to studying each week. Be honest with yourself about your commitments and schedule.

- Break Down the Material:Divide the NMLS SAFE Act exam syllabus into smaller, manageable sections. This will make the learning process feel less overwhelming.

- Create a Study Schedule:Allocate specific days and times for studying each section. Be sure to include breaks to avoid burnout.

- Gather Learning Resources:Utilize a variety of study materials, including textbooks, practice questions, online courses, and videos. Choose resources that align with your learning style.

- Schedule Practice Sessions:Regularly take practice exams to simulate the real exam environment. This will help you identify areas for improvement and build confidence.

- Review and Revise:After each study session or practice exam, review the material and address any weaknesses. This continuous feedback loop is essential for effective learning.

Book Review

This NMLS SAFE Act Study Guide is a comprehensive resource designed to help aspiring mortgage loan originators ace the exam and secure their license. It covers a wide range of topics, including federal regulations, ethics, and lending practices. But does it deliver on its promise of a “fast and easy” path to success?

Let’s dive into the details.

Strengths

The study guide’s primary strength lies in its extensive question bank. With over 420 practice questions, it provides ample opportunity for students to test their knowledge and identify areas needing further review. These questions are designed to mirror the actual exam format and difficulty level, making the guide an effective tool for familiarizing oneself with the exam’s structure and content.The guide’s structure is another key advantage.

It’s organized into clear and concise sections, allowing students to navigate the material efficiently. Each section focuses on a specific topic, providing a detailed explanation and relevant examples. This format ensures that students can easily locate the information they need and build a solid understanding of each concept.

So you’re ready to crush that Mortgage Loan Originator Test, right? No sweat! Get yourself the NMLS SAFE Act Study Guide 2023-2024 – it’s got 420+ practice questions and answers, so you’ll be ready to rock. And if you need some extra motivation, check out the inspiring memoir, Ol’ Buddy Marty With Average Ability and Supreme Effort All Things Are Possible; A Memoir Sprinkled with Wit Wisdom and Inspiration , which shows that with a little effort, anything is possible.

You got this, champ! Get that study guide and ace that test!

Weaknesses

While the guide offers a comprehensive overview of the NMLS SAFE Act exam content, it might not be the best fit for all learning styles. Some students may find the sheer volume of information overwhelming, particularly those who prefer more interactive or visual learning methods.

The guide’s reliance on text-based explanations might not engage all learners effectively.Another potential weakness is the lack of detailed explanations for each practice question. While the guide provides correct answers, it doesn’t always offer in-depth analysis or rationale behind the choices.

This could leave students feeling uncertain about their understanding and unable to fully grasp the nuances of the material.

Comparison with Other Resources

Compared to other available resources, this study guide stands out for its extensive question bank and comprehensive coverage of the NMLS SAFE Act exam content. However, it lacks the interactive features and visual aids found in some online courses or study platforms.

These resources may be more engaging for visual learners or those who prefer a more dynamic learning experience.

Recommendation

This NMLS SAFE Act Study Guide is a valuable resource for students who prefer a traditional study approach and appreciate the benefit of extensive practice questions. It’s particularly well-suited for individuals who are comfortable with self-directed learning and prefer a structured, comprehensive guide.

However, if you are seeking a more interactive or visually stimulating learning experience, you might consider exploring other resources like online courses or study platforms that offer a wider range of learning methods.

End of Discussion

So, are you ready to join the ranks of mortgage loan origination superstars? This NMLS SAFE Act study guide is your ultimate guide to success. With its engaging approach, comprehensive coverage, and killer practice questions, you’ll be equipped to crush that exam and launch your career to new heights.

Don’t just dream about becoming a mortgage loan originator, make it happen! This guide is your key to unlocking your potential and taking your career to the next level.

Clarifying Questions

What if I’m not a fast learner?

No worries! This study guide is designed for all learning styles, with clear explanations, practice questions, and tips to help you master the material at your own pace.

Is this guide current?

Absolutely! This study guide is updated regularly to reflect the latest NMLS SAFE Act regulations and exam requirements, ensuring you have the most relevant and up-to-date information.

What are some other resources that might be helpful?

The NMLS website is a great resource for official information and updates, and there are also online forums and communities where you can connect with other mortgage loan originators and share tips.