Think you’re too “newbie” for options trading? Think again! This ain’t your grandma’s stock market – it’s a whole new ball game, and you’re about to get schooled in the moves that can turn your portfolio into a money-making machine.

We’re talking calls, puts, premiums, strike prices – all the lingo you need to know to navigate this exciting (and potentially lucrative) world of options trading.

This crash course is your ultimate guide to understanding the basics, mastering common strategies, and learning practical tips to make sure you’re playing the game smart. We’ll break down everything from risk management to choosing the right options contracts, so you can confidently take your first steps in this dynamic market.

Understanding the Basics of Options Trading

Options trading can seem like a complex and confusing world, especially for beginners. But fear not, because this crash course will break down the fundamentals of options trading and give you a solid foundation for exploring this exciting market.

Understanding Options Contracts

Options contracts are agreements that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price (strike price) on or before a certain date (expiration date). Options are essentially contracts that give you the right to buy or sell something at a set price, and they’re a powerful tool for managing risk and generating profit.

Yo, wanna learn how to make some serious dough in the stock market? Options trading can be your ticket to the big time, but you gotta be smart about it. Check out “The Final Me” The Final Me for a wild ride about a dude who learns the hard way about making the right choices.

Then, get back to the basics with a beginner’s guide to options trading – it’s all about finding those sweet, sweet profits!

Types of Options

There are two main types of options:

- Calls:Call options give the buyer the right to buy the underlying asset at the strike price. Think of it as a ticket to buy the asset at a specific price, even if the market price goes up.

- Puts:Put options give the buyer the right to sell the underlying asset at the strike price.

Imagine it as a ticket to sell the asset at a specific price, even if the market price goes down.

The Importance of Premiums

The price you pay for an options contract is called the premium. The premium reflects the market’s perception of the likelihood that the option will be exercised. A higher premium suggests a greater probability of the option being exercised.

Strike Prices and Expiration Dates

The strike price is the price at which you can buy or sell the underlying asset if you exercise the option. The expiration date is the last day you can exercise the option.

Underlying Assets

Options can be traded on a wide variety of underlying assets, including stocks, ETFs, indices, and commodities. The underlying asset is what the option gives you the right to buy or sell.

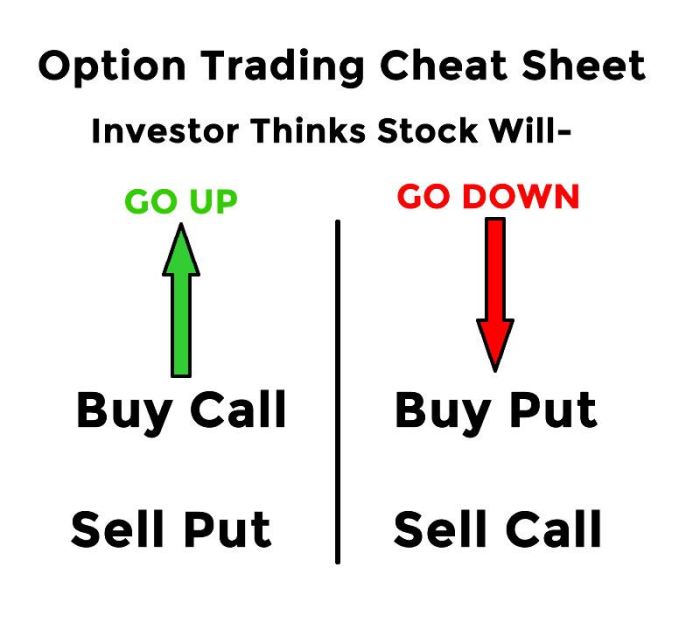

Buying vs. Selling Options

- Buying Options:When you buy an option, you pay a premium for the right to buy or sell the underlying asset at the strike price. You are bullish if you buy a call and bearish if you buy a put.

- Selling Options:When you sell an option, you receive a premium for giving someone else the right to buy or sell the underlying asset at the strike price. You are bearish if you sell a call and bullish if you sell a put.

Risks and Rewards

Options trading offers potential for both significant gains and losses. Here’s a breakdown of the potential risks and rewards:

- Buying Options:

- Potential for high returns:If the underlying asset moves in your favor, you can potentially make a lot of money.

- Limited risk:Your maximum loss is limited to the premium you paid.

- Selling Options:

- Limited profit:Your maximum profit is limited to the premium you received.

- Unlimited risk:If the underlying asset moves against you, your losses could be unlimited.

Real-World Scenarios

- Hedging:Options can be used to protect against potential losses on an existing investment. For example, if you own shares of a company and you’re worried about a potential price drop, you could buy a put option to protect your investment.

- Generating Income:Selling options can generate income, but it’s important to understand the risks involved.

- Speculating:Options can be used to speculate on the future direction of an asset. For example, you could buy a call option if you believe the price of a stock will rise.

Common Options Trading Strategies

Alright, buckle up, buttercup, because we’re about to dive into the world of options trading strategies. Think of it like choosing your weapon in a financial battle. Each strategy has its own strengths and weaknesses, and knowing which one to use when is key to winning the game.

Covered Calls

Covered calls are a popular strategy for investors who are bullish on a stock but want to generate some extra income. This strategy involves selling a call option on a stock you already own.

- Mechanics: You sell a call option on a stock you own, giving the buyer the right, but not the obligation, to buy your shares at a certain price (the strike price) before a certain date (the expiration date).

- Profit and Loss Scenarios: If the stock price stays below the strike price at expiration, the call option will expire worthless, and you keep the premium you received for selling it.

If the stock price goes above the strike price, you’ll be obligated to sell your shares at the strike price, limiting your potential upside.

- Risk-Reward Profile: Covered calls are a relatively low-risk strategy because your potential losses are limited to the difference between the stock price and the strike price, plus the premium you received.

However, you also limit your potential upside.

- Real-World Example: Imagine you own 100 shares of Apple (AAPL) at $175 per share. You believe the stock will continue to rise, but you also want to generate some income. You decide to sell a covered call option with a strike price of $180 and an expiration date of January 2024.

Options trading can be a rollercoaster ride, especially for beginners. The ups and downs can get pretty intense, so it’s important to find ways to chill out and keep your cool. Maybe grab a copy of Trace and Escape A Relaxing Tracing Book Whimsical Tracing For Stress and Anxiety Relief to de-stress before diving back into the world of calls, puts, and strikes.

After all, a clear mind is the best tool for making those savvy options trades.

If the stock price stays below $180, you’ll keep the premium you received for selling the call option. If the stock price goes above $180, you’ll be obligated to sell your 100 shares at $180 per share, even if the stock is trading at a higher price.

So you wanna dive into the world of options trading? It’s like playing with fire, but with money! You gotta learn the ropes, like how to spot a good deal, and when to hold ’em or fold ’em. But sometimes, you need a break from the high-stakes action, and that’s where the Black Beauties Fantasy Coloring Book comes in.

It’s like a chill session for your mind, filled with gorgeous portraits of Black and Brown women in nature. Then, you can jump back into the options game, with a clear head and a fresh perspective.

Cash-Secured Puts

Cash-secured puts are a strategy for investors who are bearish on a stock but want to generate some income. This strategy involves selling a put option on a stock you don’t own.

- Mechanics: You sell a put option on a stock you don’t own, giving the buyer the right, but not the obligation, to sell you shares at a certain price (the strike price) before a certain date (the expiration date).

- Profit and Loss Scenarios: If the stock price stays above the strike price at expiration, the put option will expire worthless, and you keep the premium you received for selling it. If the stock price falls below the strike price, you’ll be obligated to buy the shares at the strike price.

- Risk-Reward Profile: Cash-secured puts are a relatively high-risk strategy because your potential losses are unlimited if the stock price falls significantly. However, you also have the potential to earn a significant profit if the stock price stays above the strike price.

- Real-World Example: You think Tesla (TSLA) is overvalued and expect the stock to decline. You decide to sell a cash-secured put option with a strike price of $200 and an expiration date of January 2024. If the stock price stays above $200, you’ll keep the premium you received for selling the put option.

If the stock price falls below $200, you’ll be obligated to buy 100 shares of Tesla at $200 per share, even if the stock is trading at a lower price.

Protective Puts

Protective puts are a strategy for investors who want to protect their portfolio from potential losses. This strategy involves buying a put option on a stock you own.

- Mechanics: You buy a put option on a stock you own, giving you the right, but not the obligation, to sell your shares at a certain price (the strike price) before a certain date (the expiration date).

- Profit and Loss Scenarios: If the stock price stays above the strike price at expiration, the put option will expire worthless, and you’ll lose the premium you paid for it.

If the stock price falls below the strike price, you can exercise the put option and sell your shares at the strike price, limiting your potential losses.

- Risk-Reward Profile: Protective puts are a relatively low-risk strategy because they limit your potential losses.

However, you also limit your potential upside.

- Real-World Example: You own 100 shares of Amazon (AMZN) at $150 per share. You’re concerned about the stock’s recent volatility and want to protect your investment. You decide to buy a protective put option with a strike price of $140 and an expiration date of January 2024.

If the stock price stays above $140, the put option will expire worthless, and you’ll lose the premium you paid for it. If the stock price falls below $140, you can exercise the put option and sell your 100 shares at $140 per share, limiting your losses.

Practical Tips for Successful Options Trading

Options trading, while potentially lucrative, can also be a high-risk endeavor. Mastering the art of risk management is crucial to navigating the volatile world of options and ensuring your trading journey remains profitable. By understanding and implementing effective strategies, you can minimize potential losses and maximize your chances of success.

Risk Management Strategies

Effective risk management is the cornerstone of successful options trading. It’s not about avoiding risk altogether, but rather about understanding and controlling it. Here are some strategies for mitigating potential losses:

- Set Stop-Loss Orders:Stop-loss orders are your safety net. They automatically sell your options contract when the price reaches a predetermined level, limiting your potential losses. For example, if you buy a call option for $1, you might set a stop-loss at $0.50.

This ensures that if the price falls below your stop-loss level, your position will be automatically closed, limiting your loss to $0.50 per share.

- Diversify Your Portfolio:Don’t put all your eggs in one basket. Diversifying your options portfolio across different underlying assets, expiration dates, and strike prices reduces your exposure to any single risk.

- Use Option Strategies with Limited Risk:Certain options strategies, like covered calls and cash-secured puts, offer limited risk profiles. These strategies involve selling options, generating premium income, and limiting potential losses to the underlying asset’s price.

- Monitor Your Positions Regularly:Keep a close eye on your options positions and be prepared to adjust your strategy if the market moves against you. Don’t hesitate to exit a trade if your risk tolerance is exceeded.

Choosing the Right Options Contracts

Selecting the right options contracts is crucial for achieving your investment goals and managing risk effectively. Your choice should align with your risk tolerance and market outlook.

Wanna ditch the 9-to-5 and become a Wall Street whiz? Options trading can be your ticket to financial freedom, but it ain’t all sunshine and roses. Ready to dive into the world of puts and calls? Download And Listen Here to learn the secrets of profitable strategies, and you’ll be rolling in dough before you know it! So, what are you waiting for?

Get that hustle on and start learning the ropes of options trading.

- Consider Your Investment Goals:Are you looking to generate income, speculate on price movements, or hedge your existing portfolio? Different options strategies cater to different goals.

- Evaluate Your Risk Tolerance:Options trading involves a high degree of risk. Determine your comfort level with potential losses before entering any trade.

- Analyze the Underlying Asset:Thoroughly research the underlying asset you’re considering. Understand its fundamentals, industry trends, and potential catalysts for price movements.

- Choose the Right Expiration Date:The expiration date determines the contract’s time value. Short-term options have higher time decay, while long-term options have lower time decay. Consider your time horizon and market outlook when selecting an expiration date.

- Select the Appropriate Strike Price:The strike price determines the price at which you can buy or sell the underlying asset. Choose a strike price that aligns with your market outlook and risk tolerance.

Understanding Market Volatility

Market volatility is a key factor influencing options pricing. Volatility refers to the degree of price fluctuations in an underlying asset. Higher volatility generally leads to higher options premiums, while lower volatility results in lower premiums.

The higher the volatility, the more expensive the option.

- Volatility Impacts Option Premiums:Volatility is a key driver of option premiums. When volatility is high, investors are willing to pay more for options contracts because they are willing to pay a premium for the potential for greater price movements.

- Measure Volatility Using Implied Volatility:Implied volatility is a measure of the market’s expectation of future volatility. It is often expressed as an annualized percentage.

- Monitor Volatility Changes:Keep an eye on volatility changes and their impact on your options positions. Volatility can fluctuate significantly, affecting the value of your options contracts.

Book Review

This book review delves into a popular options trading book for beginners, exploring its key concepts, strategies, and suitability for new traders. We’ll compare its approach to other popular resources, offering insights and recommendations.

Key Concepts and Strategies

The book emphasizes understanding the basics of options contracts, including their payoff profiles, intrinsic and extrinsic value, and the various types of options. It then dives into fundamental strategies like covered calls, cash-secured puts, and protective puts, explaining their risk and reward profiles.

The book also touches on more advanced strategies like straddles and strangles, but focuses on building a solid foundation in core strategies before venturing into more complex concepts.

Comparison with Other Resources

Compared to other beginner-friendly resources, this book stands out with its clear and concise explanations, avoiding overwhelming jargon. It uses real-life examples and scenarios to illustrate concepts, making them relatable and easier to grasp. The book’s focus on risk management is commendable, as it emphasizes the importance of defining your risk tolerance and using appropriate strategies to mitigate potential losses.

Suitability for Beginners

This book is highly recommended for individuals new to options trading. Its step-by-step approach and practical examples make it an excellent starting point for learning the fundamentals. However, it’s important to note that options trading involves inherent risks, and this book should be used as a stepping stone for further learning and practice.

The book provides a solid foundation, but real-world experience and ongoing education are crucial for success.

Concluding Remarks

So, you’ve got the basics down, you’ve learned some killer strategies, and you’re ready to take on the options trading world. Remember, patience, discipline, and a little bit of research go a long way. This isn’t about getting rich quick – it’s about making smart decisions, managing risk, and maximizing your potential.

So, buckle up, grab your coffee (or your favorite energy drink), and get ready to dive in!

Common Queries

What’s the best way to learn about options trading?

Start with the basics, then practice with a demo account before risking real money. There are also tons of online resources, courses, and books to help you learn.

How much money do I need to start options trading?

It depends on the strategy you choose. Some strategies require a small investment, while others can be more expensive. It’s important to start small and gradually increase your investment as you gain experience.

Is options trading risky?

Yes, options trading can be risky, but it can also be very rewarding. It’s important to understand the risks involved and manage your risk carefully.

Can I make a lot of money with options trading?

It’s possible to make a lot of money with options trading, but it’s also possible to lose a lot of money. The key is to learn the strategies, manage your risk, and invest wisely.