Dreaming of a life where money works for you, not the other way around? Then get ready to ditch the 9-to-5 grind and dive into the world of passive income! This guide is your ultimate cheat sheet to building a sustainable financial future, going beyond the hype of dropshipping and revealing a whole universe of possibilities.

We’ll break down the concept of passive income, busting common myths and showcasing real-life success stories that prove it’s not just a pipe dream. From e-commerce ventures to online courses and beyond, you’ll discover a diverse range of income streams that can fuel your financial freedom.

Get ready to level up your hustle and unlock a future where you can truly live life on your own terms.

The Ultimate Guide to Passive Income

Ever dreamed of earning money while you sleep? That’s the magic of passive income, and it’s not just a pipe dream. It’s a real possibility that can transform your financial life, offering freedom and security. But what exactly is passive income, and how can you tap into its potential?

Let’s dive in!

Yo, wanna hustle your way to some sweet passive income? Dropshipping is a total game-changer, and you can find a ton of awesome ideas in the “Passive Income Ideas Ultimate Guide.” But if you’re looking to take things to the next level and create your own products, check out Mastering Fusion 360 28 Step-By-Step Projects for Beginners in 3D Printing Prototyping and Making.

It’s like a crash course in 3D printing, and you can use those skills to design and sell your own dope creations online. That’s how you really build an empire, my friend!

Passive Income Explained

Passive income refers to earnings generated without active involvement. It’s like having a money-making machine working for you 24/7, even when you’re busy with other things. Think of it as a side hustle that runs itself, requiring minimal effort once set up.

Benefits of Passive Income

Passive income brings a whole bunch of perks:

- Financial Freedom:It can provide a steady stream of income, giving you more financial flexibility and independence.

- Time Freedom:It allows you to spend more time on things you love, without being tied to a 9-to-5 job.

- Security:It can act as a safety net, providing a backup income stream during unexpected life events.

- Long-Term Growth:Some passive income streams, like investments, can grow over time, building wealth for the future.

Challenges and Misconceptions

While passive income sounds amazing, it’s not always a walk in the park. There are challenges and common misconceptions to be aware of:

- Initial Investment:Most passive income streams require some upfront investment, whether it’s time, money, or both.

- Time and Effort:While passive income is about minimal ongoing effort, it often requires significant work to set up and maintain.

- No Overnight Success:Building a successful passive income stream takes time and patience. Don’t expect to become a millionaire overnight.

- “Get Rich Quick” Schemes:Be wary of promises of easy money. Legitimate passive income streams require effort and a realistic approach.

Real-Life Examples

The good news is that countless people have successfully built passive income streams. Here are a few real-life examples:

- The Blogger:A blogger who shares their expertise and builds a loyal audience can generate income through advertising, affiliate marketing, and selling digital products.

- The Online Course Creator:An expert in a specific field can create and sell online courses, providing valuable knowledge and earning a passive income stream.

- The Rental Property Owner:Owning rental properties can provide a consistent income stream, although it requires ongoing management.

Categories of Passive Income

Passive income opportunities are vast, but they can be categorized into several main areas:

- Online Businesses:This includes e-commerce, affiliate marketing, blogging, online courses, and more.

- Real Estate:Rental properties, REITs, and real estate crowdfunding are examples of passive income streams in this category.

- Investments:Stocks, bonds, dividends, and index funds offer potential passive income through capital appreciation and regular payouts.

- Content Creation:Creating and selling digital products like ebooks, music, or software can generate passive income.

- Other:Other passive income streams include royalties, licensing, and even owning vending machines or parking spaces.

Beyond Dropshipping

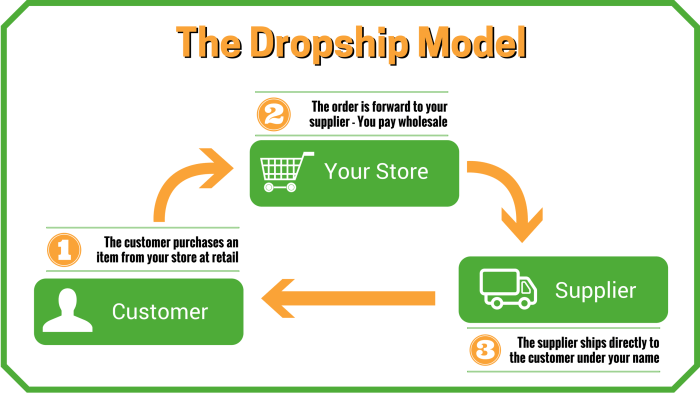

Dropshipping can be a great way to start an e-commerce business with minimal upfront investment. But like any business, it has its limitations and potential drawbacks. Let’s explore some of these challenges and dive into alternative passive income streams that can complement or even replace dropshipping, diversifying your passive income portfolio.

Limitations and Potential Drawbacks of Dropshipping

Dropshipping, while seemingly straightforward, presents its own set of challenges. Here are some key limitations to consider:

- Low Profit Margins:Competition in dropshipping is fierce, leading to price wars and shrinking profit margins. You’re often competing with numerous other sellers offering similar products, making it difficult to stand out and maintain a healthy profit.

- Limited Control Over Quality and Shipping:Since you don’t handle inventory directly, you rely on your suppliers for product quality and shipping times. This can lead to customer dissatisfaction if products arrive damaged or late, impacting your brand reputation.

- Dependence on Suppliers:Dropshipping relies heavily on your suppliers. If they experience issues with production, shipping, or even go out of business, it can disrupt your entire business, leaving you scrambling for alternative solutions.

- Scalability Challenges:Scaling a dropshipping business can be difficult, especially if you rely on a single supplier. As your business grows, you might face limitations in your supplier’s ability to handle increased order volumes, potentially impacting your ability to meet customer demand.

- Competition and Saturation:The dropshipping market is increasingly saturated, making it harder to find unique products and differentiate yourself from competitors. Many dropshippers offer similar products, leading to a constant battle for customers and sales.

Alternative Passive Income Streams

Diversifying your passive income portfolio beyond dropshipping can provide greater stability, reduce reliance on a single business model, and open up new opportunities for growth. Here are some alternative passive income streams that complement dropshipping and offer distinct advantages:

- Affiliate Marketing:Promote other companies’ products or services on your website, blog, or social media channels and earn a commission on each sale you generate. This is a low-cost, low-risk option with high potential for passive income, but requires building a strong audience and finding relevant affiliate programs.

- Online Courses and Digital Products:Share your knowledge and expertise by creating online courses, ebooks, or other digital products. This can be a highly profitable passive income stream, but requires upfront effort to create and market your products effectively.

- Real Estate Investing:Invest in rental properties, either directly or through real estate investment trusts (REITs). This can generate passive income through rental payments, but requires significant capital investment and ongoing management.

- Peer-to-Peer Lending:Lend money to borrowers through online platforms and earn interest payments. This offers the potential for higher returns than traditional savings accounts, but carries higher risk.

- Dividend Stocks:Invest in companies that pay dividends, generating passive income through regular payouts. This requires careful research and understanding of stock market dynamics.

- High-Yield Savings Accounts:Deposit your savings into high-yield savings accounts offered by online banks and earn higher interest rates than traditional banks. This is a low-risk option, but returns may be lower than other investments.

Comparing Passive Income Options

Here’s a table comparing the different passive income options based on factors such as investment, effort, and potential return:

| Passive Income Stream | Investment | Effort | Potential Return |

|---|---|---|---|

| Dropshipping | Low | Medium | Medium |

| Affiliate Marketing | Low | Medium | High |

| Online Courses and Digital Products | Medium | High | Very High |

| Real Estate Investing | High | Medium | Medium to High |

| Peer-to-Peer Lending | Medium | Low | Medium to High |

| Dividend Stocks | Medium to High | Medium | Medium to High |

| High-Yield Savings Accounts | Low | Low | Low |

Building a Sustainable Passive Income Empire

Building a passive income empire is like building a house. You need a solid foundation, a well-designed plan, and a commitment to consistent work. Just like a house, your passive income portfolio needs to be strong and resilient to withstand any storms that may come your way.

Yo, wanna build a side hustle that brings in the dough while you chill? Check out this Passive Income Ideas Ultimate Guide Dropshipping – E-commerce business and more than 20 different ways that you can generate passive income. It’s like a treasure map for finding your own financial freedom.

And hey, if you’re looking for some awesome gift ideas for your bestie who’s just entered the golden years, check out Retirement Gifts For Women 101 Empowering Activities for Women Embracing Retirement – Your Retirement Filled with Love Laughter and Fulfillment – it’s packed with inspiring ideas to make their retirement rock! Back to the hustle, let’s talk about building that passive income empire!

This section will guide you through proven strategies for building a successful passive income portfolio, provide actionable tips for optimizing each passive income stream, and discuss the importance of diversification and risk management. You’ll also find resources and tools that can help you generate passive income.

Strategies for Building a Successful Passive Income Portfolio

A strong passive income portfolio requires a well-defined plan. This plan should be tailored to your individual goals, risk tolerance, and resources. Here are some proven strategies to consider:

- Diversification:The old adage “Don’t put all your eggs in one basket” applies here. Diversifying your income streams reduces your risk and increases your chances of success. Consider a mix of passive income streams, such as real estate, affiliate marketing, and online courses.

Yo, wanna ditch the 9-to-5 grind and build a passive income empire? This “Passive Income Ideas Ultimate Guide: Dropshipping – E-commerce business and more than 20 different ways that you can generate passive income” is your cheat sheet to making money while you sleep.

Check out this killer guide, Download And Listen Here , and learn how to make your dreams of financial freedom a reality! With over 20 passive income ideas, you’ll be swimming in cash in no time.

- Automation:The goal of passive income is to generate income without actively working. Automation is key to achieving this. Look for ways to automate your processes, such as using software tools to manage your online businesses or setting up recurring revenue streams.

- Scaling:Once you’ve established a passive income stream, focus on scaling it. This means finding ways to increase your revenue without significantly increasing your workload. For example, you might create an online course and then market it to a wider audience.

Optimizing Passive Income Streams

Once you’ve established a few passive income streams, it’s important to optimize them for maximum efficiency. Here are some tips:

- Regular Monitoring:Keep a close eye on your passive income streams to identify any areas that need improvement. Analyze your data and make adjustments as needed.

- Continuous Improvement:The world of passive income is constantly evolving. Stay up-to-date on the latest trends and strategies to ensure your streams remain competitive.

- Reinvestment:Use your passive income to fuel further growth. Invest in your businesses, upgrade your technology, or explore new opportunities. This is how you build a sustainable passive income empire.

Diversification and Risk Management

Diversification is a crucial element of building a sustainable passive income portfolio. By spreading your investments across multiple streams, you reduce your risk. If one stream falters, the others can compensate.

So you’re thinking about building a passive income empire, huh? Dropshipping, e-commerce, the whole shebang! That’s awesome! But let’s be real, sometimes you need a break from the hustle. Why not unwind with a little creative coloring?

Check out this Kawaii Bubble Tea Delight Coloring Book , it’s seriously cute and way more chill than spreadsheets. Once you’ve got your zen on, you’ll be ready to tackle those passive income ideas with a fresh perspective!

Consider these risk management strategies:

- Emergency Fund:Set aside an emergency fund to cover unexpected expenses. This will help you weather any storms that may come your way.

- Risk Assessment:Before investing in any passive income stream, carefully assess the risks involved. Consider the potential for loss and how you might mitigate those risks.

- Professional Advice:If you’re unsure about your risk tolerance or how to manage your portfolio, seek advice from a financial advisor.

Resources and Tools

There are many resources and tools available to help you generate passive income. Here are a few examples:

- Online Courses:Platforms like Udemy, Coursera, and Skillshare offer a wide range of courses on topics related to passive income generation.

- Books and Articles:There are numerous books and articles available that provide valuable insights into building a passive income portfolio.

- Online Communities:Join online communities dedicated to passive income to connect with other entrepreneurs and learn from their experiences.

Ending Remarks

So, are you ready to take control of your finances and build a life of freedom and abundance? The journey to passive income might not always be smooth sailing, but with the right knowledge, strategies, and a little bit of hustle, you can achieve financial independence and create a future that truly inspires you.

It’s time to ditch the daily grind and embrace the power of passive income. The possibilities are endless, and the only limit is your imagination.

Question Bank

Is passive income really possible?

Absolutely! While “passive” doesn’t mean completely hands-off, it does mean you can build systems that generate income without requiring your constant attention. Think of it as setting up a money-making machine that keeps running even when you’re not actively working on it.

How much money can I make with passive income?

The earning potential is unlimited! The amount you make depends on the type of passive income you pursue, the effort you invest, and the scale of your operation. Some people generate a few hundred dollars per month, while others build multi-million dollar empires.

Do I need a lot of money to start generating passive income?

Not necessarily. There are many passive income opportunities that require minimal investment, like starting a blog or creating an online course. However, some ventures might require a larger initial investment, such as buying rental properties or launching a subscription box business.