Ever feel like your credit score is a rollercoaster ride with no brakes? You’re not alone. Banks, debt collectors, and credit reporting agencies can make some serious mistakes, and if they do, you’ve got a right to fight back.

This guide is your playbook for taking on these financial giants and winning. We’ll break down the Fair Credit Reporting Act (FCRA) and show you how to spot violations, gather evidence, and even take them to court. It’s time to level the playing field and reclaim your credit power.

Think of the FCRA as your secret weapon. It’s the law that protects you from inaccurate or unfair credit reporting. But knowing your rights isn’t enough. You need to know how to use them. We’ll guide you through the legal process, step by step, so you can fight for fair credit and get back on track.

Understanding the Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is a federal law that protects consumers’ rights regarding their credit information. It’s like the superhero of your credit report, ensuring that the information used to assess your creditworthiness is accurate, fair, and used responsibly.

You know how sometimes you feel like you’re stuck in a credit score nightmare, with banks and debt collectors throwing shade? Well, “THE FIGHT FOR FAIR CREDIT THE ULTIMATE GUIDE TO SUING BANKS DEBT COLLECTORS AND REPORTING AGENCIES UNDER THE FAIR CREDIT REPORTING ACT” is like your secret weapon, a guide to fighting back! It’s all about knowing your rights and taking action.

It’s a little like the “Recovering Out Loud” podcast, Recovering Out Loud , where they talk about getting your life back on track. This guide gives you the tools to fight back against unfair credit practices and get your financial life back on track!

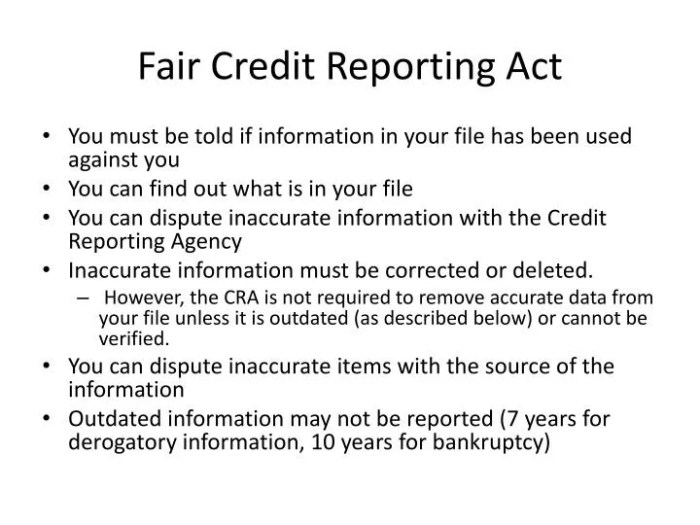

Purpose and Key Provisions of the FCRA

The FCRA’s main goal is to ensure that credit reporting agencies, lenders, and debt collectors use your credit information accurately and responsibly. It also provides consumers with rights to access, correct, and dispute inaccurate information in their credit reports. Think of it as a set of rules for how your credit history is handled.

- Accurate and Fair Reporting:The FCRA mandates that credit reporting agencies must use reasonable procedures to ensure that the information in your credit report is accurate and complete. They’re supposed to investigate and correct any errors they find.

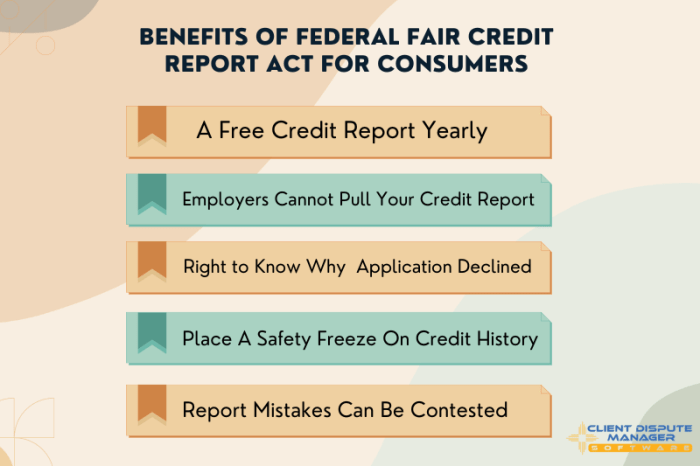

- Access to Your Credit Report:The FCRA gives you the right to obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months. This allows you to review the information and identify any potential errors.

Yo, if you’re tired of those shady credit reporting agencies messing with your financial life, then you need to check out “THE FIGHT FOR FAIR CREDIT THE ULTIMATE GUIDE TO SUING BANKS DEBT COLLECTORS AND REPORTING AGENCIES UNDER THE FAIR CREDIT REPORTING ACT.” It’s like your own personal cheat code for taking back control of your credit score.

Download And Listen Here to learn how to fight back against those bad credit reporting practices and get your financial mojo back! You deserve to be in charge of your own credit, so get informed and get ready to fight for what’s yours!

- Dispute Resolution:If you find inaccuracies in your credit report, you have the right to dispute them with the credit reporting agency. They’re required to investigate your dispute and correct any errors they find. This is your chance to fight back against inaccurate information.

- Limited Use of Credit Information:The FCRA restricts the use of credit information by certain entities, such as employers, landlords, and insurance companies. This helps prevent discrimination based on your credit history.

- Privacy Protections:The FCRA also includes provisions to protect the confidentiality of your credit information. It restricts who can access your credit report and for what purposes.

Common FCRA Violations

While the FCRA is designed to protect you, unfortunately, violations can occur. Banks, debt collectors, and credit reporting agencies might break the rules, leading to potential harm to your credit score and financial well-being.

- Inaccurate or Incomplete Information:Credit reporting agencies sometimes include inaccurate or incomplete information in your credit report, such as incorrect balances, late payments, or closed accounts. This can negatively impact your credit score and make it harder to get loans or credit cards.

Yo, listen up! If you’re dealing with shady credit reporting agencies or those debt collectors who just won’t quit, you need to check out “THE FIGHT FOR FAIR CREDIT THE ULTIMATE GUIDE TO SUING BANKS DEBT COLLECTORS AND REPORTING AGENCIES UNDER THE FAIR CREDIT REPORTING ACT.” It’s like a cheat code for getting your financial life back on track.

And trust me, I know a thing or two about dealing with messed up situations, just check out Frankly Speaking Stories From My Life , it’s all about real life struggles and how to overcome them. Anyway, back to credit, this guide is your ultimate weapon to fight back against those who are messing with your credit score.

It’s time to take control and get the justice you deserve!

- Failure to Investigate Disputes:Credit reporting agencies may fail to properly investigate your disputes, leaving inaccurate information on your credit report. This can further damage your credit score and make it difficult to access credit.

- Unauthorized Access:Banks, debt collectors, and credit reporting agencies may access your credit report without your consent, violating your privacy rights. This could be used for fraudulent purposes or to unfairly discriminate against you.

- Failure to Provide You with Your Credit Report:Credit reporting agencies may fail to provide you with a copy of your credit report within the required timeframe, delaying your ability to identify and correct errors.

- Improper Reporting of Debt Collections:Debt collectors may report inaccurate information about your debt to credit reporting agencies, such as incorrect balances or dates of delinquency. This can lead to a lower credit score and make it harder to secure loans or credit cards.

Consumer Rights and Remedies Under the FCRA

The FCRA empowers consumers to take action against FCRA violations. It provides you with several rights and remedies to address inaccuracies, protect your privacy, and hold violators accountable.

- Right to Dispute:You have the right to dispute any inaccurate information in your credit report. This is your first line of defense against errors that can damage your credit score.

- Right to a Free Credit Report:You are entitled to a free copy of your credit report from each of the three major credit bureaus once every 12 months. This allows you to review your credit history and identify any potential issues.

- Right to Sue:If you believe that a credit reporting agency, bank, or debt collector has violated the FCRA, you have the right to sue them in court. You can seek damages, including compensation for any financial harm caused by the violation.

- Right to a Summary of Your Credit File:You have the right to receive a summary of your credit file, which includes a list of all the information reported about you to the credit reporting agency.

- Right to Limit Access to Your Credit Report:You have the right to limit access to your credit report for certain purposes, such as marketing or prescreening for credit offers. This helps protect your privacy and prevent unwanted solicitations.

Identifying Potential FCRA Violations

Think of the Fair Credit Reporting Act (FCRA) as the superhero of your credit report, fighting for accuracy and fairness. But just like any superhero, it needs your help to identify potential villains – violations of your credit rights. This section will equip you with the tools to spot these violations, understand their consequences, and gather the evidence you need to fight back.

Common Red Flags Indicating Potential FCRA Violations

Knowing the warning signs can help you catch a violation before it impacts your credit score.

- Inaccurate Information:If your credit report contains incorrect information, such as wrong addresses, incorrect balances, or accounts you didn’t open, it’s a red flag. This could indicate a violation of the FCRA’s accuracy requirements.

- Unverified Information:If a credit reporting agency (CRA) fails to verify information before reporting it, it might be a violation of the FCRA’s accuracy and investigation requirements. This can happen if a debt collector or lender provides inaccurate information without proper verification.

- Outdated Information:The FCRA requires CRAs to remove certain information after a specific time period. If your credit report includes outdated information, such as a paid-off account that’s still listed as delinquent, it could be a violation. For example, information about bankruptcies can remain on your credit report for 10 years, while most other negative information falls off after 7 years.

- Unauthorized Information Sharing:The FCRA limits who can access your credit report. If you find that someone has accessed your report without your authorization, it could be a violation of the FCRA’s privacy provisions. For example, your credit report shouldn’t be accessed without your consent for employment purposes.

- Lack of Disclosure:The FCRA requires creditors and debt collectors to disclose specific information about their reporting practices. If you’re not receiving these disclosures, it could be a violation of the FCRA’s transparency requirements.

Types of FCRA Violations and Legal Remedies

Understanding the types of violations and the legal remedies available is crucial for taking action.

| Type of FCRA Violation | Legal Remedies |

|---|---|

| Failure to Investigate Disputes | You can sue the CRA for damages, including actual damages, statutory damages, and attorney fees. |

| Failure to Correct Inaccurate Information | You can sue the CRA for damages, including actual damages, statutory damages, and attorney fees. |

| Unauthorized Disclosure of Credit Information | You can sue the CRA or the entity that accessed your credit report without authorization for damages, including actual damages, statutory damages, and attorney fees. |

| Failure to Provide Proper Disclosures | You can sue the creditor or debt collector for damages, including actual damages, statutory damages, and attorney fees. |

Gathering Evidence of FCRA Violations

Evidence is key to proving your case.

- Documentation:Gather copies of your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion). Keep any communication with creditors, debt collectors, or CRAs, including letters, emails, and phone records. Keep copies of any documentation you have related to the account or the information in dispute.

- Communication Records:Keep detailed records of all communication with creditors, debt collectors, or CRAs. This includes the date, time, and content of the communication. Consider using a phone recording app to record phone calls.

Navigating the Legal Process

You’ve done your homework, identified potential FCRA violations, and you’re ready to fight back. But how do you actually take legal action? This section will walk you through the steps involved in filing a lawsuit under the FCRA, guide you on finding the right legal representation, and address the costs and risks associated with pursuing legal action.

Filing a Lawsuit Under the FCRA

Before you can sue, you need to understand the process. It’s a bit like a game of legal chess, but with a lot more paperwork. Here’s the general game plan:

- Demand Letter:First, you’ll send a formal “demand letter” to the offending party (the bank, debt collector, or credit reporting agency). This letter Artikels the specific FCRA violations and demands that they correct the errors or remove the inaccurate information. Think of it as a “heads up” before you unleash the legal beast.

- Time Limits:You’ll need to follow the FCRA’s strict time limits. For example, you generally have 30 days to file a dispute with a credit reporting agency after receiving a copy of your credit report. If you miss these deadlines, you might miss your chance to sue.

- Filing the Lawsuit:If the demand letter doesn’t get you the results you want, you can file a lawsuit in federal court. This is where it gets serious. You’ll need to prepare a complaint outlining the FCRA violations and the damages you’ve suffered.

- Discovery:Once the lawsuit is filed, you’ll enter a discovery phase. This involves gathering evidence and information from the other side. Think of it as a legal treasure hunt.

- Trial:If the case doesn’t settle, you’ll go to trial. This is where you’ll present your evidence and argue your case before a judge or jury.

Finding the Right Attorney

You’re not alone in this fight. An experienced FCRA attorney can be your legal superhero. But finding the right one is key.

- Specialization:Look for attorneys who specialize in FCRA litigation. They’ll have the knowledge and experience to navigate the complex legal landscape.

- Reputation:Check the attorney’s reputation and track record. You want someone who’s won cases like yours.

- Communication:Make sure you feel comfortable communicating with the attorney. They should be able to explain the legal process clearly and answer your questions.

Costs and Risks

Let’s be real, legal battles can be expensive.

- Attorney Fees:Attorneys typically charge hourly fees or a contingency fee (a percentage of any settlement or judgment).

- Court Costs:You’ll also need to pay filing fees, service fees, and other court-related expenses.

- Risks:There’s no guarantee of success. You might lose the case and be responsible for the other side’s legal fees.

Book Review: “The Fair Credit Reporting Act: A Consumer’s Guide to Protecting Your Credit”

This book provides a comprehensive overview of the Fair Credit Reporting Act (FCRA) and its implications for consumers. It aims to empower individuals to understand their rights and navigate the complexities of the credit reporting system. While the book offers valuable insights, it does have certain limitations in its approach.

Strengths and Weaknesses of the Book

The book’s strengths lie in its clear and concise language, making it accessible to readers with varying levels of financial literacy. It effectively breaks down complex legal concepts into understandable terms, making the FCRA less daunting. However, the book could benefit from more detailed explanations of specific FCRA provisions and their practical applications.

Fighting for fair credit can be a real drag, man. It’s like a never-ending battle against the big banks and those pushy debt collectors. Sometimes you just need to chill out and find a way to de-stress. That’s where Mosaic Animals Color By Number for Adults (BLACK backgrounds) Activity Coloring Book for Adults Relaxation and Stress Relief comes in.

Coloring can be a real game-changer for your mental health. After a long day of fighting for your credit rights, grab a coloring book and let those creative juices flow. You’ll be ready to take on those banks again in no time.

For instance, while it mentions the right to dispute inaccurate information, it could provide more concrete examples of how to effectively file a dispute and what to expect in the process.

Understanding Consumer Rights and Remedies

“The Fair Credit Reporting Act: A Consumer’s Guide to Protecting Your Credit” is a valuable resource for consumers seeking to understand their rights under the FCRA. It provides a comprehensive overview of the law’s key provisions, including the right to access your credit report, the right to dispute inaccurate information, and the right to limit the sharing of your credit information.

The book also discusses remedies available to consumers who have been harmed by FCRA violations, such as the ability to sue for damages.

Key Takeaways and Actionable Insights

The book emphasizes the importance of regularly monitoring your credit report for inaccuracies. It encourages consumers to take proactive steps to protect their credit, such as disputing any errors and limiting the sharing of their credit information. It also highlights the significance of understanding your credit score and how it impacts your financial life.

“Consumers have the right to dispute inaccurate information in their credit reports, and credit reporting agencies are required to investigate and correct any errors.”

The book provides a step-by-step guide on how to file a dispute with a credit reporting agency, outlining the necessary documentation and procedures. It also explains the process of obtaining a copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion).

Final Thoughts

So, you’re ready to take control of your credit score? The FCRA is your ally. Don’t let inaccurate information or unfair practices hold you back. This guide gives you the tools and knowledge to fight for your rights and achieve financial freedom.

Remember, your credit score matters, and you deserve a fair shake. Go get ’em!

FAQ Explained

What are some common examples of FCRA violations?

Common violations include inaccurate information on your credit report, failure to investigate disputes, and unauthorized access to your credit report.

How long do I have to file a lawsuit under the FCRA?

You typically have two years from the date of the violation to file a lawsuit. It’s always best to consult with an attorney to confirm the specific time limit in your case.

Can I represent myself in an FCRA lawsuit?

While it’s possible to represent yourself, it’s highly recommended to hire an attorney experienced in FCRA litigation. They can help you navigate the complex legal process and increase your chances of success.

What are the potential costs and risks associated with pursuing legal action?

Legal fees, court filing fees, and other expenses are potential costs. There’s also the risk of losing the lawsuit, although the FCRA provides strong protections for consumers.