Ever wondered who the mastermind behind Bitcoin really is? It’s like trying to track down a ghost in the digital world! Satoshi Nakamoto, the anonymous creator of Bitcoin, has become a legendary figure in the world of crypto.

Their identity is shrouded in mystery, leaving everyone from tech enthusiasts to conspiracy theorists scratching their heads. But behind the enigma lies a revolutionary idea that changed the way we think about money.

Join us as we dive deep into the rabbit hole of Satoshi’s legacy, exploring the genesis of Bitcoin, the evolution of its technology, and the impact it’s had on the world. Get ready for a wild ride through the history of crypto, uncovering the secrets behind the most influential digital currency in history.

The Mystery of Satoshi Nakamoto

Satoshi Nakamoto, the enigmatic creator of Bitcoin, remains a shrouded figure, a phantom in the digital realm. Their identity, a mystery that has captivated the crypto community, continues to spark debates and intrigue. The fact that Satoshi chose to remain anonymous has had a profound impact on Bitcoin’s history and its future.

Satoshi’s Anonymity and its Significance

Satoshi’s decision to remain anonymous is arguably one of the most intriguing aspects of Bitcoin’s genesis. This deliberate choice has fostered a sense of mystery around the project, contributing to its early adoption and the development of a passionate community.

Deciphering the mysteries of Satoshi Nakamoto, the creator of Bitcoin, is like cracking a secret code. It’s a mind-bending journey into the world of crypto, filled with hidden clues and cryptic messages. But when the pressure gets to you, maybe it’s time to unwind with a little creative therapy.

The Black Background Flower Coloring Book (Coloring Books for Adults) offers a calming escape from the complex world of Bitcoin, allowing you to explore a world of vibrant colors and intricate designs. Once you’ve calmed your nerves, you can dive back into the fascinating world of Satoshi and the digital revolution he ignited.

The anonymity, while creating a sense of mystique, has also raised concerns about trust and security.

Theories Surrounding Satoshi’s Identity

The identity of Satoshi Nakamoto has been the subject of intense speculation and numerous theories.

- The Dorian Satoshi Nakamoto Theory:This theory, based on a 2014 article in Newsweek, suggested that a Japanese-American man named Dorian Satoshi Nakamoto was the true identity of Satoshi. However, Nakamoto denied the allegations, stating that he had never heard of Bitcoin.

- The Craig Wright Theory:Australian computer scientist Craig Wright has claimed to be Satoshi Nakamoto, presenting evidence to support his claim. However, his claims have been met with skepticism and controversy within the Bitcoin community.

- The Group of Developers Theory:This theory suggests that Satoshi was not a single individual but rather a group of developers who worked together on the Bitcoin project. The decentralized nature of Bitcoin lends credence to this idea, as it aligns with the principles of anonymity and collective effort.

Satoshi’s Timeline of Involvement

Satoshi’s involvement in Bitcoin’s development can be traced through a series of key events:

- 2008:Satoshi Nakamoto published the Bitcoin whitepaper, outlining the concept of a decentralized digital currency.

- 2009:The Bitcoin network was launched, with Satoshi mining the first block, known as the genesis block.

- 2010:Satoshi handed over control of the Bitcoin project to other developers, stepping back from active involvement.

- 2011:Satoshi’s last known public communication was a message on the Bitcoin forum.

Impact of Revealing Satoshi’s Identity

The question of whether revealing Satoshi’s identity would be beneficial or detrimental to Bitcoin is a complex one.

- Potential Benefits:Revealing Satoshi’s identity could provide valuable insights into the early development of Bitcoin, shed light on their motivations, and potentially boost the project’s legitimacy.

- Potential Detriments:Revealing Satoshi’s identity could lead to legal issues, security risks, and potentially damage Bitcoin’s reputation if the individual is found to have a controversial past.

Bitcoin’s Genesis

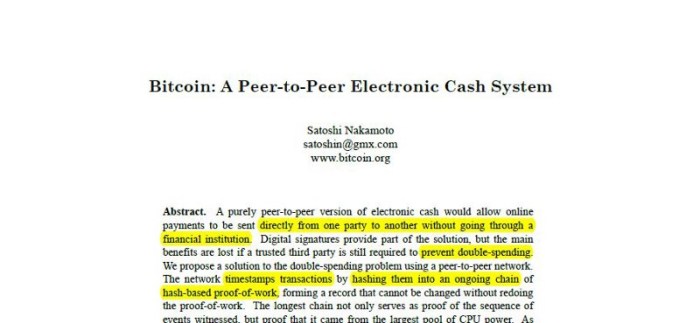

The Bitcoin white paper, published by Satoshi Nakamoto in 2008, laid the groundwork for a revolutionary digital currency. It introduced a decentralized system, a revolutionary approach to financial transactions, and a new way of thinking about money.

Yo, wanna crack the code on Bitcoin? The Secrets of Satoshi is your ultimate guide to understanding this digital gold rush. Dive deep into the mystery behind the creator, the tech behind the currency, and the future of finance.

Download And Listen Here to unlock the secrets of Satoshi and become a crypto king!

Key Concepts and Principles

Satoshi’s white paper Artikeld a series of key concepts and principles that defined Bitcoin’s structure and operation. These principles are the foundation upon which the Bitcoin network operates.

Unraveling the mysteries of Satoshi Nakamoto, the mastermind behind Bitcoin, is like trying to crack the code to a hidden treasure chest. It’s a puzzle that keeps us on the edge of our seats, just like listening to the smooth melodies of George Winston’s piano music, found in the George Winston Piano Music Book A Collection Of 15 Songs For Easy Piano.

Maybe one day, we’ll finally understand the genius behind Bitcoin, just like we appreciate the timeless beauty of Winston’s piano compositions.

- Decentralization:Bitcoin is a decentralized system, meaning it operates without a central authority. This ensures that no single entity controls the network, fostering transparency and security.

- Peer-to-peer Transactions:Bitcoin transactions occur directly between users, eliminating the need for intermediaries like banks. This enables faster and more efficient transactions.

- Cryptographic Security:Bitcoin relies on cryptography to secure transactions and prevent fraud. This involves complex mathematical algorithms to ensure the integrity of the network.

- Blockchain Technology:The Bitcoin blockchain is a public ledger that records all transactions, making them transparent and auditable. This ensures the immutability and integrity of the network.

- Limited Supply:Bitcoin has a fixed supply of 21 million coins, preventing inflation and ensuring its long-term value.

Technical Challenges

Satoshi faced significant technical challenges in creating the Bitcoin blockchain. These challenges were related to designing a secure and efficient system that could handle the demands of a global network.

- Double-Spending Prevention:One of the biggest challenges was preventing double-spending, where a user could spend the same Bitcoin multiple times. Satoshi addressed this by implementing a consensus mechanism known as proof-of-work.

- Scalability and Transaction Speed:Bitcoin’s early design faced scalability challenges, as the network could only process a limited number of transactions per second. Satoshi’s solution was to create a decentralized network with a distributed ledger, ensuring that transactions are verified and confirmed by multiple nodes.

- Security and Trust:Satoshi needed to create a system that was secure and trustworthy, as it was handling real-world value. This was achieved through cryptographic hashing, ensuring the integrity of transactions and preventing manipulation.

Early Adoption and Growth

Bitcoin’s early adoption was driven by a community of tech-savvy individuals and enthusiasts who recognized its potential. The community played a crucial role in testing, developing, and promoting the Bitcoin network.

- Early Adopters:The first Bitcoin users were primarily programmers, cryptographers, and libertarians who saw Bitcoin as a potential alternative to traditional financial systems.

- Open Source Development:Bitcoin’s open-source nature allowed for community contributions and development, fostering innovation and rapid improvements.

- Online Forums and Communities:Online forums and communities, such as Bitcointalk, played a crucial role in fostering discussion, collaboration, and the growth of the Bitcoin ecosystem.

Initial Use Cases and Applications

In its early stages, Bitcoin was primarily used as a digital currency for online transactions, particularly in the dark web and for peer-to-peer payments.

- Online Transactions:Bitcoin’s early use cases involved online purchases, especially for goods and services that were not easily purchased with traditional payment methods.

- Peer-to-Peer Payments:Bitcoin enabled individuals to send and receive payments directly without intermediaries, fostering financial independence and reducing transaction fees.

- Micropayments:Bitcoin’s ability to handle small transactions made it suitable for micropayments, facilitating the exchange of digital content and services.

The Evolution of Bitcoin

Bitcoin, the first decentralized digital currency, has undergone a remarkable evolution since its inception in 2008. From its humble beginnings as a niche technology, Bitcoin has grown into a global phenomenon, attracting millions of users and influencing the financial landscape.

This journey has been marked by significant milestones, technical innovations, and impactful events that have shaped Bitcoin into the digital asset it is today.

Key Milestones in Bitcoin’s Development

The development of Bitcoin has been a gradual process, with various milestones marking its progress. Here’s a chronological timeline of some of the most important events:

- 2008:Satoshi Nakamoto publishes the Bitcoin whitepaper, outlining the concept of a decentralized digital currency.

- 2009:The Bitcoin network is launched, with the first block, known as the genesis block, being mined.

- 2010:The first Bitcoin transaction occurs, with programmer Laszlo Hanyecz purchasing two pizzas for 10,000 BTC.

- 2011:Bitcoin’s price begins to rise significantly, attracting more attention and investment.

- 2013:Bitcoin’s price reaches an all-time high of over $1,000, leading to widespread media coverage and public interest.

- 2014:The Mt. Gox exchange, then the largest Bitcoin exchange, is hacked, resulting in the loss of millions of dollars worth of Bitcoin.

- 2017:Bitcoin’s price experiences another surge, reaching an all-time high of nearly $20,000.

- 2021:Bitcoin’s price surpasses $60,000, highlighting its growing mainstream adoption and institutional interest.

Evolution of Bitcoin’s Technical Features

Bitcoin’s technical features have evolved over time, incorporating new functionalities and improvements. Here are some key changes:

- Block Size Increase:The original Bitcoin protocol had a block size limit of 1MB, which limited transaction throughput. In 2017, the Bitcoin Cash fork implemented a larger block size, increasing the network’s capacity.

- SegWit (Segregated Witness):This upgrade, implemented in 2017, separated transaction signatures from transaction data, increasing the block size effectively without compromising security.

- Lightning Network:Introduced in 2018, the Lightning Network is a layer-two scaling solution that allows for faster and cheaper transactions off-chain, complementing the main Bitcoin blockchain.

- Taproot:This upgrade, implemented in 2021, improves privacy and efficiency by simplifying transaction scripts and enabling more complex smart contracts.

Impact of Key Events

Certain events have significantly impacted Bitcoin’s development and its perception in the world.

Cracking the code of Bitcoin’s creator, Satoshi Nakamoto, is like trying to find a lost treasure map in a dusty old bar. You never know what you’ll find, but the journey itself is pretty wild. Maybe you’ll stumble upon a forgotten story like A Boyhood at Red’s Growing Up in My Dad’s Neighborhood Bar , a tale of good times and maybe a few shady deals.

Just like in that story, understanding Bitcoin is about piecing together clues, finding the connections, and ultimately, figuring out the big picture.

Mt. Gox Hack

The Mt. Gox hack in 2014 was a major setback for Bitcoin, highlighting security vulnerabilities in early exchanges. This event led to increased scrutiny of Bitcoin’s security and prompted the development of more robust security measures for exchanges and wallets.

Rise of Altcoins

The emergence of altcoins, alternative cryptocurrencies, has provided competition and innovation within the blockchain space. Altcoins have explored different approaches to blockchain technology, challenging Bitcoin’s dominance and fostering the development of new functionalities.

Bitcoin Today vs. Early Version

Bitcoin today is vastly different from its early version, both in terms of its technical features and its role in the global financial landscape. Here are some key differences:

- Price and Market Cap:Bitcoin’s price has skyrocketed from a few cents in its early days to tens of thousands of dollars today. Its market capitalization has grown significantly, making it one of the most valuable assets in the world.

- Adoption:Bitcoin has gained widespread adoption, with millions of users and businesses accepting it as a form of payment.

- Regulation:Bitcoin is now subject to increasing regulation from governments worldwide, with varying degrees of acceptance and oversight.

- Competition:Bitcoin faces competition from other cryptocurrencies and blockchain technologies, which have emerged as alternatives or complements to Bitcoin’s functionality.

Concluding Remarks

Unveiling the secrets of Satoshi Nakamoto is like cracking a code that unlocks the future of finance. From the humble beginnings of a white paper to the global phenomenon Bitcoin has become, it’s a story of innovation, resilience, and the power of ideas.

Whether you’re a seasoned crypto investor or just curious about the digital revolution, understanding Satoshi’s vision is key to navigating the exciting world of blockchain technology.

Essential FAQs

Is Bitcoin really anonymous?

While Bitcoin transactions are pseudonymous, meaning they don’t directly link to your real identity, they are traceable on the blockchain. It’s not completely anonymous, but it offers a higher level of privacy compared to traditional banking systems.

What’s the deal with the Mt. Gox hack?

The Mt. Gox hack in 2014 was a major blow to the Bitcoin community, as it exposed vulnerabilities in early exchanges. It highlighted the importance of security measures and led to significant improvements in the industry.

Is Bitcoin really the future of money?

That’s a hot debate! Bitcoin has the potential to disrupt traditional finance, but it faces challenges like volatility, scalability, and regulatory uncertainty. Only time will tell how it truly shapes the future of money.